Yearly, the TPG Awards honor excellence in bank cards, loyalty packages and journey. Please click on right here to learn extra about our winner choice course of and methodology for the 2024 TPG Awards.

Chase has snagged the award for Greatest Journey Rewards Credit score Card for the seventh yr in a row.

A consensus favourite amongst TPG staffers, the Chase Sapphire Most popular® Card (see charges and charges) is once more taking dwelling the title of Greatest Journey Rewards Credit score Card. That is due to its low annual charge, potential to earn Chase Final Rewards factors, a wonderful roster of switch companions, ease of use and beneficiant journey advantages and protections.

The Sapphire Most popular was my first journey rewards bank card, getting me into the world of factors and miles. This card is nice for inexperienced persons and consultants alike and can proceed to be in my pockets for years to come back.

Let’s discover why the Chase Sapphire Most popular is known as the highest journey rewards card yr after yr.

Nice for inexperienced persons

The Chase Sapphire Most popular is the little sibling of the Chase Sapphire Reserve® (see charges and charges), a premium journey rewards card with a $550 annual charge. The Sapphire Reserve has extra advantages and perks than the Sapphire Most popular, however the Sapphire Most popular wins on simplicity and ease of use.

Moreover, for those who’re new to the world of factors and miles, the welcome supply on the Chase Sapphire Most popular can jump-start your journey with a pleasant stash of what we take into account essentially the most precious rewards forex (together with Bilt Rewards Factors).

For a restricted time, new candidates can obtain the highest-ever welcome supply of 100,000 bonus factors after spending $5,000 throughout the first three months of account opening. Primarily based on TPG’s April 2025 valuations, this welcome supply is value $2,050.

Associated: Chase Sapphire Most popular vs. Sapphire Reserve: Must you go mid-tier or premium?

Day by day E-newsletter

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Low annual charge

The Chase Sapphire Most popular has a modest $95 annual charge that’s akin to that of its mid-tier journey rewards card rivals.

When you will not get perks like lounge entry or journey assertion credit, you’re going to get a strong card with glorious earnings charges and helpful perks. This annual charge is far more affordable for these simply moving into the world of bank cards with annual charges or these seeking to improve from a no-annual-fee card to a mid-tier card.

The cardboard additionally comes with an easy annual $50 assertion credit score for any lodge booked by Chase Journey℠ . In case you make the most of this credit score, the efficient annual charge drops to solely $45.

Associated: The whole information to bank card annual charges

Precious bonus classes

Whereas many journey rewards playing cards have a number of bonus classes, the Sapphire Most popular outshines most. That is as a result of the bonus classes are broad, there aren’t any spending caps and purchases made overseas are eligible for bonus factors. The cardboard earns versatile rewards within the type of Chase Final Rewards factors.

The Sapphire Most popular earns:

- 5 factors per greenback spent on journey booked by Chase Journey

- 5 factors per greenback spent on Lyft rides (by Sept. 2027)

- 5 factors per greenback spent on Peloton tools and accent purchases of $150 or extra (with a restrict of 25,000 bonus factors by Dec. 2027)

- 3 factors per greenback spent on eating, choose streaming companies and on-line grocery retailer purchases (excludes Goal, Walmart and wholesale golf equipment)

- 2 factors per greenback spent on all different journey not booked by the Chase Journey portal (journey is broadly outlined by Chase and contains issues resembling parking, tolls, ferries and campgrounds)

- 1 level per greenback spent on the whole lot else

These are a few of the greatest earnings charges available on the market. Whereas there are a number of different playing cards with increased earnings charges in sure classes, these playing cards often carry increased annual charges or are restricted by spending caps in choose bonus classes.

Whether or not you are a newbie or an knowledgeable, these bonus classes may also help you maximize your earnings and get you nearer to your subsequent journey.

Associated: 6 the reason why the Chase Sapphire Most popular is the right card for the typical traveler

Versatile redemptions and transfers

The Chase Sapphire Most popular earns Final Rewards factors that may be redeemed in a number of methods.

Factors might be redeemed for journey booked by the Chase Journey portal at 1.25 cents per level, an announcement credit score at 1 cent per level (at occasions increased for those who use Chase’s Pay Your self Again function) or reward playing cards at 1 cent per level.

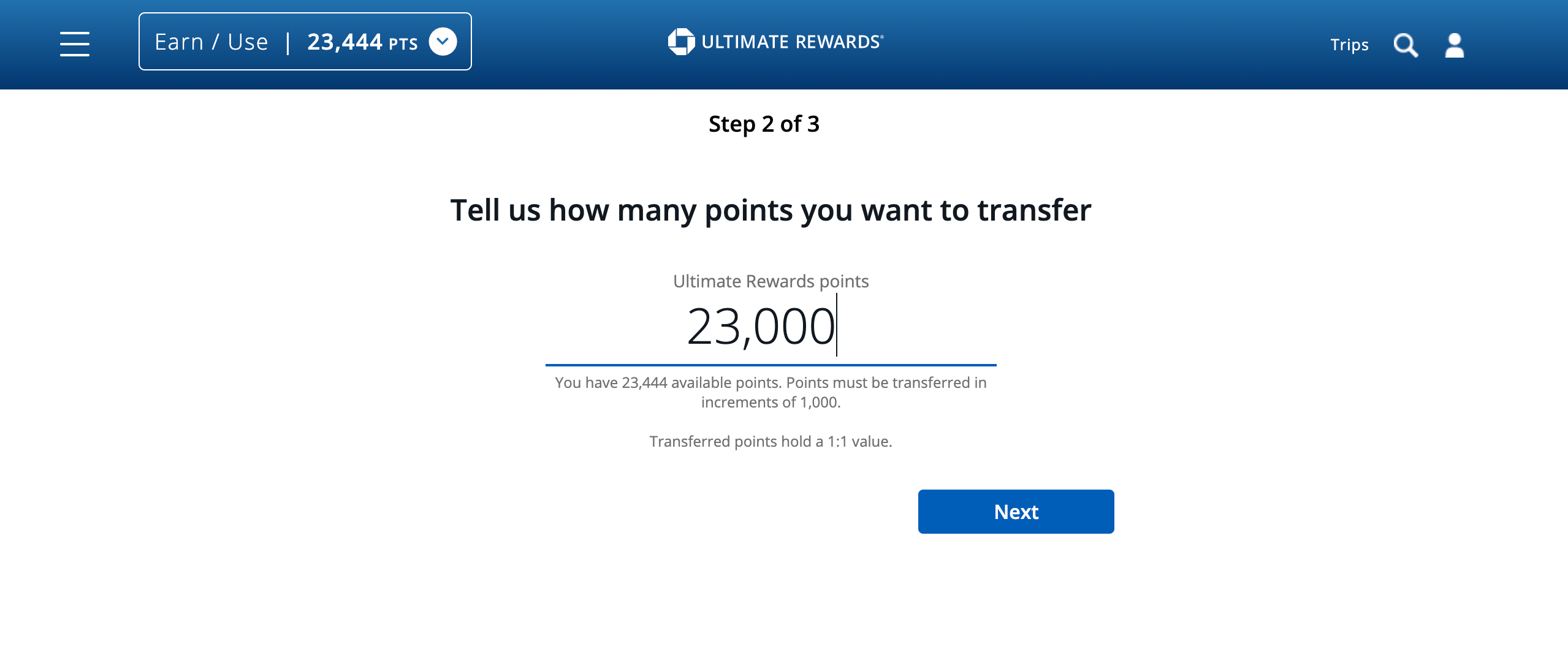

It’s also possible to redeem factors by transferring them to companions, our favourite redemption possibility. Primarily based on TPG’s April 2025 valuations, Final Rewards factors are value 2.05 cents every by this redemption route.

Chase has a roster of 14 switch companions, together with 11 airline and three lodge companions. Transferring and redeeming factors is comparatively simple, making this convenient for inexperienced persons. Many switch companions have unbelievable candy spot redemptions the place you will get outsize worth to your factors.

My three favourite Chase switch companions are Air Canada Aeroplan, Southwest Speedy Rewards and World of Hyatt. The latter has gotten me excellent lodge redemptions worldwide at properties just like the Grand Hyatt Barcelona, the place I routinely rise up to 4 cents per level in worth.

Associated: When and the best way to switch Chase Final Rewards factors to World of Hyatt

Journey protections and perks

The Chase Sapphire Most popular is loaded with varied journey protections and insurances that alone might assist justify the annual charge. These embody:

- Baggage delay insurance coverage

- Misplaced baggage reimbursement

- Main rental automotive protection

- Buy safety and prolonged guarantee safety

- Journey cancellation insurance coverage

- Journey delay insurance coverage

Even for those who journey solely a few times a yr, these protections can add peace of thoughts your journey plans go awry. Moreover, the acquisition and prolonged guarantee safety might be useful for giant purchases.

Backside line

It is clear why TPG staffers (each inexperienced persons and consultants ourselves) usually suggest the Chase Sapphire Most popular. With its precious earnings charges, helpful protections and advantages, entry to switch companions and low annual charge, the Sapphire Most popular is worthy of taking the crown dwelling once more because the Greatest Journey Rewards Credit score Card.

To be taught extra concerning the card, learn our full evaluation of the Chase Sapphire Most popular.

Apply right here: Chase Sapphire Most popular