After I determined to purchase a sofa, I knew I would must pay the associated fee off over time. In any case, furnishings is a big-ticket merchandise.

The simplest and (to me) most blatant reply was a 0% APR card. Most 0% APR playing cards allow you to repay a cost over 12 to 18 months, however some playing cards have an introductory 0% APR interval that lasts for so long as 21 months. This could give me greater than sufficient time to repay my sofa with out feeling monetary pressure.

Sadly, my plans for a 0% APR card led to a rejection.

Since issuers usually frown on making use of for one more card proper after getting rejected, I did not need to apply for a special card instantly. Insert Chase Pay Over Time.

Here is why I plan on checking Pay Over Time for all of my future massive purchases — and why you must, too.

What’s Chase Pay Over Time?

Some issuers provide cardholders particular fee plans for big purchases. These plans could have a particular annual share fee (APR) or a month-to-month charge in alternate for no curiosity. The latter is how Chase Pay Over Time works.

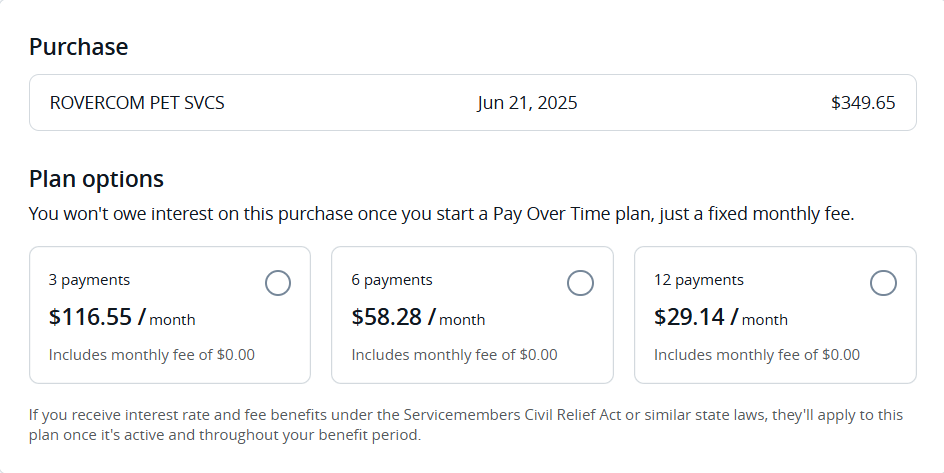

Whenever you make a purchase order of $100 or extra, you might even see the choice to place the cost on a Pay Over Time plan.

Chase provides you with just a few totally different choices to select from, permitting you some flexibility in how massive your month-to-month funds might be and the way lengthy you need to repay all the cost.

Chase usually costs a month-to-month charge, however you will not pay any curiosity so long as you pay the cost off by the top of your plan.

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Nevertheless, as I discovered in my latest expertise, generally you will get fortunate and obtain a proposal for a no-fee plan.

Why I selected Pay Over Time

As I discussed earlier, I wanted a sofa for my condominium. Anybody who’s furnished a house is aware of that furnishings is pricey, so it is a good suggestion to attempt to discover a strategy to pay these costs off over time.

I initially tried to use for the Wells Fargo Mirror® Card (see charges and costs). Wells Fargo rejected me for having too many new accounts prior to now 24 months, echoing the frustrations that factors and miles lovers usually encounter with Chase and their 5/24 rule.

I used to be relying on this card for my new sofa, because the Wells Fargo Mirror affords a 0% introductory APR for 21 months on purchases and qualifying steadiness switch (then a variable APR of 17.24%, 23.74% or 28.99%). Whereas I do not anticipate it to take me that lengthy to repay my sofa, having the security internet is at all times good in case additional surprising bills come up.

I assumed I would need to postpone my sofa buy, however then I remembered Pay Over Time. I hadn’t used it earlier than, so I wasn’t sure if I might get a no-fee plan like some Reddit customers mentioned they’d obtained. However I used to be prepared to take the chance.

Worst case situation, I would need to pay slightly additional in charges, however I would have a chunk of furnishings I wanted.

My expertise with Pay Over Time

I’ve 4 playing cards from Chase which might be eligible for Pay Over Time:

The knowledge for the Chase Freedom Flex has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

I selected my United Explorer since it is the Chase card I take advantage of the least proper now. It is simpler for me to get a fast glimpse of what I’ve left to pay if my sofa is without doubt one of the solely (or the one) costs on my assertion.

I might’ve used my Freedom Limitless for 1.5% money again on my buy, however I haven’t got a excessive credit score restrict on that card. Placing my buy on my Freedom Limitless would’ve held over 30% of my credit score line hostage whereas I labored to pay it off. I take advantage of that card for lots of purchases, in order that was a no-go.

Most of Chase’s playing cards provide Pay Over Time, so you do not have to open certainly one of these playing cards to reap the benefits of this profit.

As soon as the cost went by means of, I chosen Pay Over Time to see my choices. Second of fact: Would I luck out with a no-fee plan?

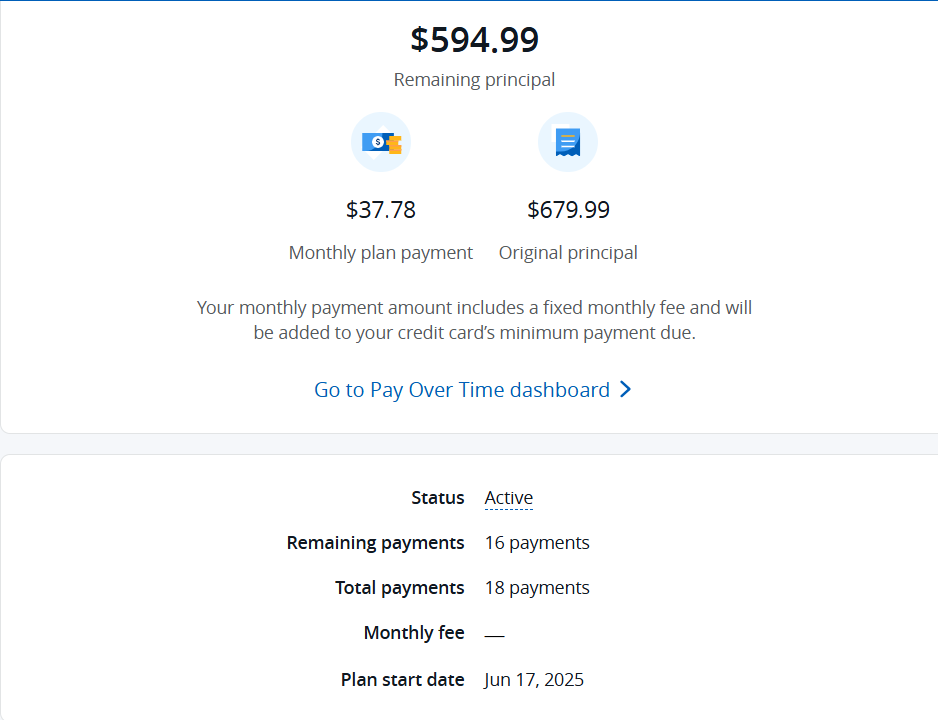

Luckily, that is precisely what I bought. I had just a few choices for a way lengthy I needed my Pay Over Time plan to be. I selected the 18-month plan; like I mentioned earlier, I like longer plans as a result of they offer me larger peace of thoughts.

Even when extra bills come up, I do know I can make the minimal fee every month. And if they do not, I can repay my sofa ahead of 18 months.

Chase Pay Over Time vs. Paying in Full

Chase Pay Over Time is a good instrument for purchases you want, however cannot afford to pay for abruptly. I goal to observe TPG’s golden rule of solely charging what I can afford to pay, however each on occasion, instances like this come up the place that is not doable.

However what about if you realize for sure you possibly can repay a big buy in a single go? Is Pay Over Time nonetheless price contemplating?

I imagine it’s. In the event you’re supplied a plan with no charge, it could be price parking the cash you will have available in a high-yield financial savings account. Then, you possibly can both repay the month-to-month cost with different revenue or pay it off slowly from the cash you’ve got stashed away.

No matter which technique you select, as soon as your financial savings have generated some curiosity, you possibly can at all times decide to pay your plan off early, penalty-free.

Backside line

I am very grateful that I used to be in a position to safe a no-fee Pay Over Time plan.

It allowed me to get my sofa regardless of not being permitted for a 0% introductory APR card. I plan on checking it extra repeatedly going ahead, particularly for any emergency bills that come up.

Given that you simply aren’t assured to get a no-fee Pay Over Time plan, I nonetheless suggest attempting to open a 0% introductory APR card first for any bills that you do not have the flexibility to cowl solely.

However when you get rejected or aren’t ready to open a brand new card, it is a nice different.

Associated: How I earned nearly 30,000 Amex Membership Rewards factors with assist from Rakuten