To latest grads: Congratulations! Graduating from school is a big milestone, and your arduous work and efforts must be celebrated.

Whether or not you are leaping into your first job or embarking on a post-grad journey, it could possibly really feel overwhelming to launch into maturity.

Do not fret — there are instruments to make this transition simpler. A big step into maturity is opening your first bank card. Maybe you are forward of the sport and have been a proud proprietor of a pupil card all through your 4 years as an undergrad. Or you might be buying round in your first “grownup” bank card.

Both method, we firmly consider the Chase Sapphire Most well-liked® Card (see charges and costs) must be each graduate’s first bank card.

Here is why.

Excessive welcome bonus

For a card with a (affordable) $95 annual price, you are 100,000 Final Rewards factors after you spend $5,000 on purchases within the first three months of account opening. TPG’s April 2025 valuations put Final Rewards factors at 2.05 cents every, that means this welcome bonus is value $2,050.

However earlier than you get too excited, guarantee you may handle the spending requirement to get the bonus. It really works out to about $1,667 in month-to-month spending in your first three months, which you’ll be able to simply hit when you’re about to spend a stable chunk on transferring bills and an expert wardrobe in your launch into maturity.

Nonetheless, ensure you do not cost greater than you may afford to repay, irrespective of how good the bonus is.

Associated: Who’s eligible for the Chase Sapphire Most well-liked’s bonus?

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Introduction to factors and miles

If you wish to study in regards to the world of factors and miles, you’ve got come to the precise place. Right here at TPG, we have now a plethora of assets to get you began, together with our novices information and our listing of the greatest first bank cards.

One of many stuff you’ll see in these guides is that Chase Sapphire Most well-liked is at all times on the high of the listing. It is a beginner-friendly card that may ease you into “journey hacking” or studying tips on how to use your bank card rewards to unlock free flights or lodge stays.

There are various redemption choices with this card, however you will discover probably the most worth as a journey rewards card by utilizing your factors for journey.

To interrupt it down in easy phrases, you could have two choices for reserving journey with this card.

First, you may e-book by Chase Journey℠ at a 25% factors bonus or a price of 1.25 cents every. For instance, 10,000 factors interprets to a $125 worth in journey. You may e-book a wide range of journey on this portal, together with flights, accommodations, automotive leases and cruises.

When you get comfy reserving journey by the portal, you may dip your toes into transferring your factors to loyalty packages.

Chase enables you to transfer your factors at a 1:1 price to its airline and lodge companions, so your 100,000 Final Rewards factors can equal 100,000 factors within the loyalty program of your selection.

In fact, some companions are higher than others, however a few of our high-value favorites embody Air Canada Aeroplan and World of Hyatt. With these companions, getting rather more than 1.25 cents of worth per level is feasible. We have even gotten as much as 4.5 cents in worth with a business-class ticket on Air France earlier than, so the sky is the restrict on the subject of Chase’s switch companions.

Associated: New to journey rewards? Here is the right newbie card combo

Worthwhile card advantages

The Chase Sapphire Most well-liked is a well-liked card, particularly amongst Gen Z, because it comes with many helpful accomplice advantages that may show you how to get monetary savings and reward you on the similar time.

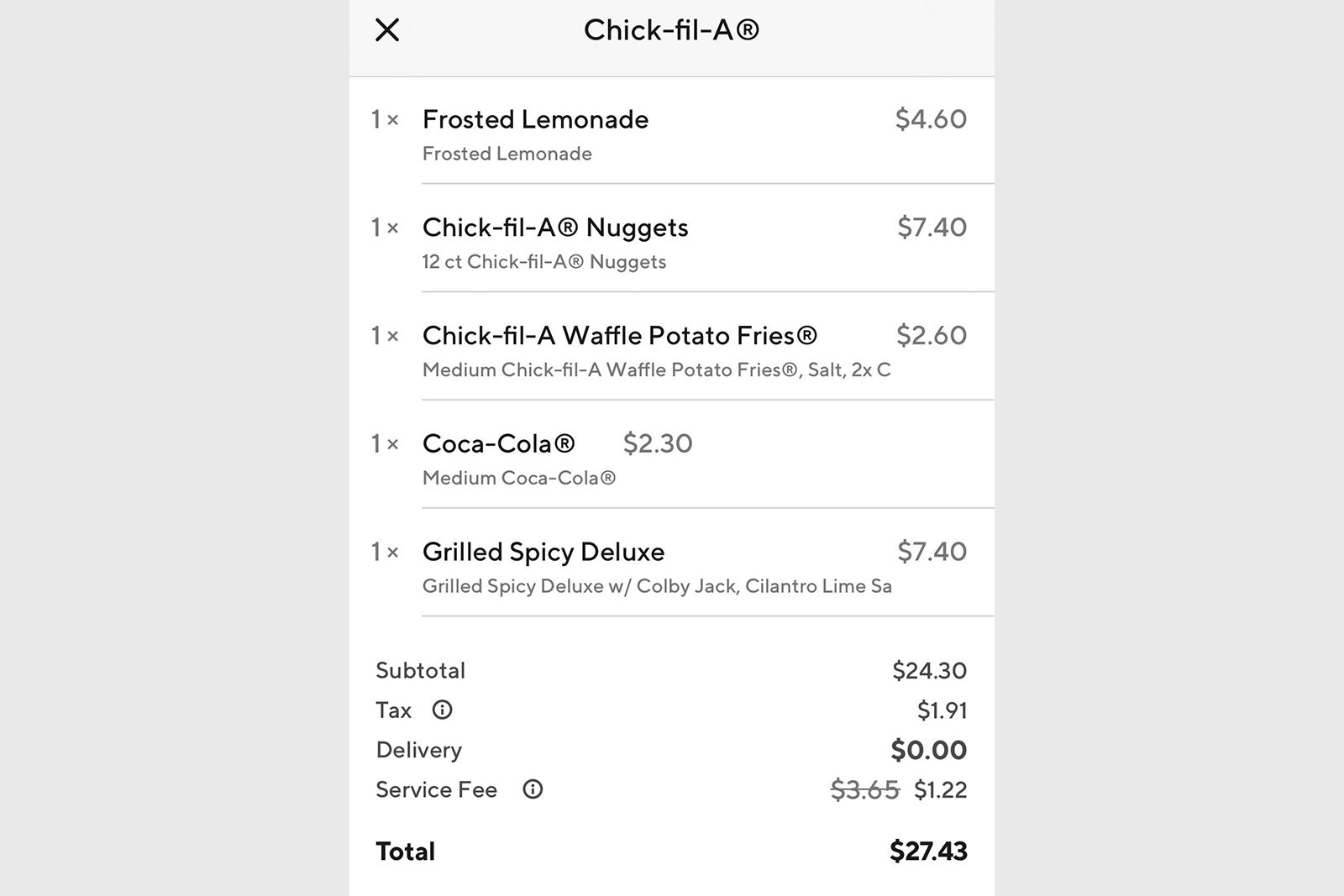

Some of the precious perks is a complimentary one-year membership to DoorDash DashPass (activate by Dec. 31, 2027). This membership will get you free supply charges and lowered service charges on eligible orders of $12 or extra. This subscription service normally prices $9.99 month-to-month, so this profit is effective sufficient to justify the cardboard’s $95 annual price.

You may additionally take pleasure in 5 factors per greenback on Lyft rides (by Sept. 30, 2027). Relying on how typically you utilize Lyft, this can be a unbelievable strategy to earn bonus factors on this rideshare service.

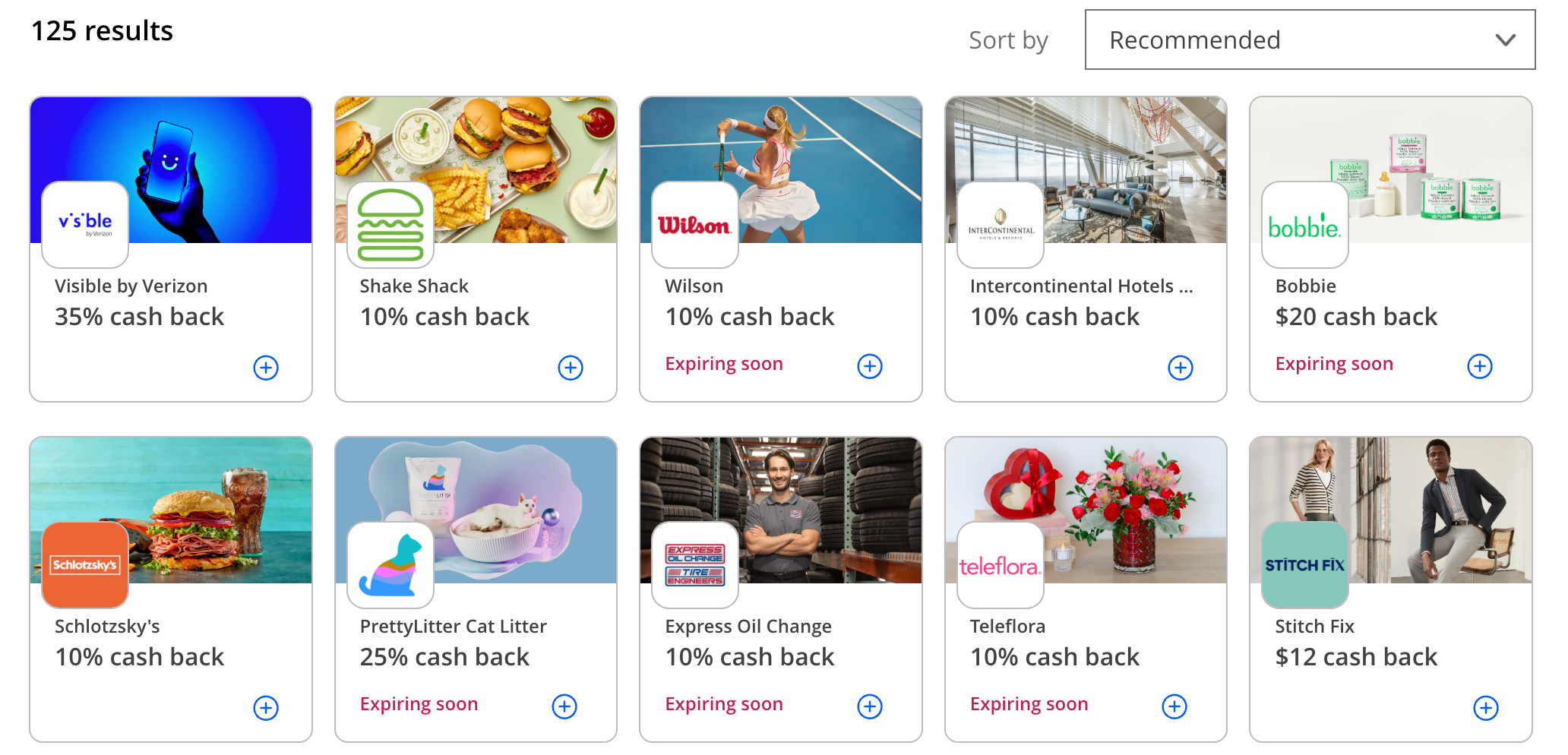

Lastly, it is value checking the Chase Provides in your card. They will replace each week or so.

All of those accomplice provides will help you get monetary savings in your on a regular basis purchases.

Associated: 8 lesser-known methods your bank card can prevent cash

Journey and buy protections

Another reason you will love the Sapphire Most well-liked: No different card with a $95 annual price comes with as many journey and buying protections.

Hopefully, you by no means have to make use of any of those advantages, however these coverages will provide you with peace of thoughts and prevent cash if an emergency arises:

- Journey cancellation and interruption insurance coverage: Reimburses you as much as $10,000 per individual (or $20,000 per journey) in your pre-paid, nonrefundable journey bills resulting from coated causes, corresponding to illness, extreme climate and extra.

- Misplaced baggage reimbursement: Covers loss or harm to your baggage by a typical provider (corresponding to an airline) for as much as $3,000 per passenger.

- Journey delay reimbursement: Reimburses you as much as $500 per ticket to buy meals or lodging for journey delays of 12 hours or extra (or requiring an in a single day keep).

- Buy safety: Covers harm or theft on new purchases, as much as $500 per declare and as much as $50,000 per account.

- Baggage delay insurance coverage: Reimburses you as much as $100 per day (for as much as 5 days) for bags delays greater than six hours to cowl the acquisition of important objects.

- Prolonged guarantee safety: Extends a U.S. producer’s guarantee by an extra 12 months on warranties of three years or much less.

- Main automotive rental protection: Covers theft and harm as much as the precise money worth of the rental automotive on bookings of lower than 31 consecutive days. Notice that almost all bank cards solely supply secondary protection.

- Journey and emergency help: Obtain emergency help and referrals when you encounter issues whereas touring.

For any of those to use, you should pay in your buy along with your Chase Sapphire Most well-liked. You may file a declare by chasecardbenefits.com.

Associated: How my Chase Sapphire Most well-liked saved me practically $250 on a canceled journey

Backside line

In case you’ve simply graduated, do your self a favor and add the Chase Sapphire Most well-liked to your pockets.

With its unbelievable welcome bonus, long-term incomes potential and helpful perks, you will love having this card alongside in your journey into the grownup world.

Apply right here: Chase Sapphire Most well-liked with 100,000 Final Rewards factors after you spend $5,000 on purchases within the first three months of account opening.