If issues go awry when you’re touring, you will be glad that you just booked your journey — and its associated bills — with a card that options journey protections. Fortunately, many rewards bank cards provide complimentary protections so long as you pay for pay as you go, nonrefundable journey bills with the cardboard.

For instance, the Chase Sapphire Most well-liked® Card is a well-liked journey rewards card with an inexpensive $95 annual charge. Amongst its nice journey advantages are journey cancellation and interruption insurance coverage and journey delay reimbursement.

These protections provide a considerable degree of protection which will forestall the necessity for buying separate journey insurance coverage. With the Sapphire Most well-liked, in case your journey is delayed 12 hours or extra — or requires you to ebook in a single day lodging — you are coated for associated bills, as much as $500 per ticket.

Let’s look at the protection you get with journey rewards playing cards, utilizing the Sapphire Most well-liked’s advantages as our major instance. Do not forget that safety and protection range from card to card, so fastidiously overview the advantageous print for the particular playing cards you maintain (or plan to use for) earlier than reserving your subsequent journey.

Journey cancellation and interruption insurance coverage

First, let’s rapidly go over journey cancellation and interruption insurance coverage on the Sapphire Most well-liked, as outlined by Chase:

“In case your journey is canceled or lower brief by illness, extreme climate and different coated conditions, you could be reimbursed as much as $10,000 per particular person and $20,000 per journey on your pre-paid, non-refundable journey bills, together with passenger fares, excursions and resorts.”

If the airline, lodge or tour operator doesn’t refund you on your pay as you go journey bills, that is when you possibly can file a declare beneath journey cancellation and interruption insurance coverage to get reimbursed for these prices.

Word that you just will not get reimbursed for any new journey lodging made due to the cancellation or interruption.

Associated: The perfect journey insurance coverage insurance policies and suppliers

Journey delay reimbursement

The phrases are related for journey delay reimbursement on the Sapphire Most well-liked:

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

“In case your frequent provider journey is delayed greater than 12 hours or requires an in a single day keep, you and your loved ones are coated for unreimbursed bills, reminiscent of meals and lodging, as much as $500 per ticket.”

As with the journey cancellation and interruption insurance coverage, the journey delay coverage solely gives reimbursement for particular bills, that are outlined as “affordable further bills incurred for meals, lodging, toiletries, medicine and different private use objects as a result of coated delay.”

Due to this fact, you possibly can anticipate to get reimbursement for important objects that you need to buy on account of the delay. Nonetheless, this doesn’t imply you possibly can reserve a brand new flight on a unique provider and nonetheless get reimbursed.

Bear in mind to maintain the $500 per ticket restrict in thoughts.

Associated: Flight canceled or delayed? Here is what to do subsequent

Will journey insurance coverage cowl the price of my new flight?

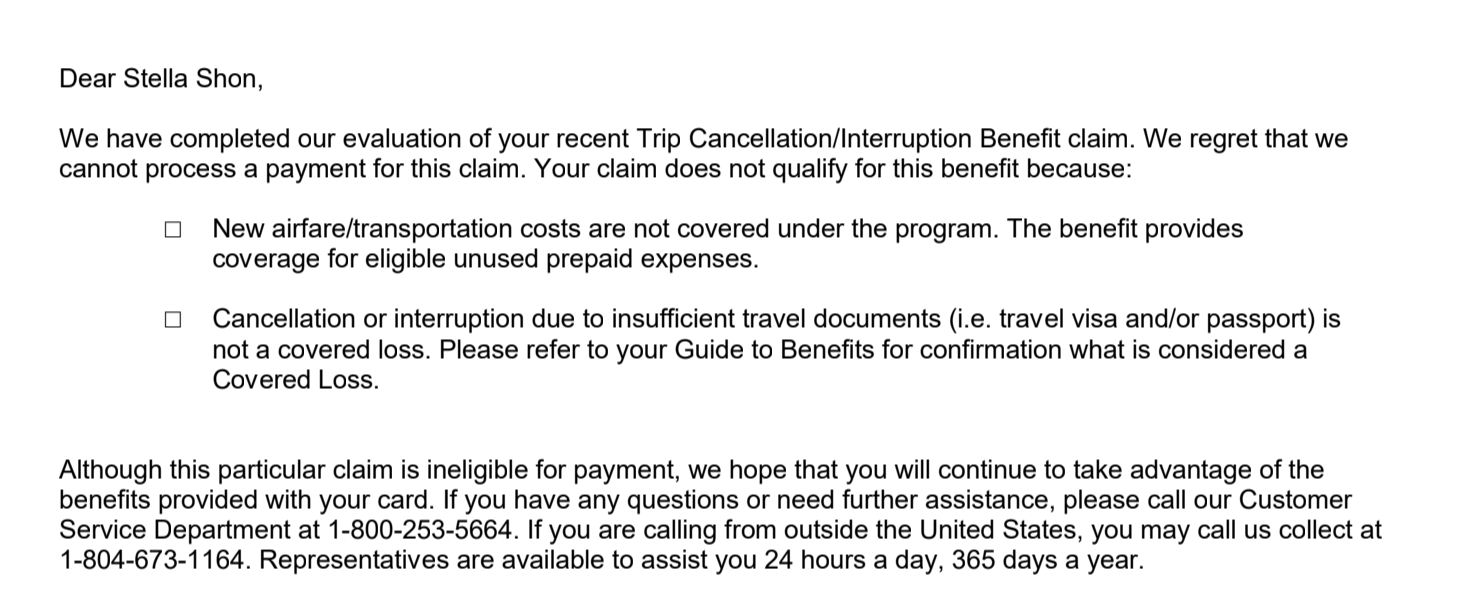

In brief, the reply is not any. Whether or not you file a declare beneath journey cancellation and interruption insurance coverage or journey delay reimbursement, you’ll not get reimbursed for brand new airfare.

Which means should you purchase a $100 United flight that will get canceled (or delayed) and you find yourself buying one other $300 flight on Delta as an alternative, the price of the brand new Delta airfare won’t be coated for reimbursement.

I realized this the laborious manner on a solo journey to Europe when my flight from Italy to Greece was canceled. I rebooked and thus rerouted myself by means of an airport two hours away.

After shopping for a brand new flight, hopping on a bus and ready patiently within the terminal for the subsequent flight, I attempted submitting a declare with my Chase Sapphire Most well-liked.

This may increasingly appear irritating, however journey cancellation and interruption insurance coverage will nonetheless reimburse you for pay as you go, nonrefundable bills.

Associated: The right way to attain airline customer support rapidly

Backside line

It is nice that many journey bank cards include advantages like journey cancellation and interruption insurance coverage and journey delay reimbursement, however it’s essential to learn the phrases and circumstances to know what precisely these advantages do and don’t cowl.

Whereas these protections could also be enough for many vacationers, those that need greater protection ought to severely contemplate shopping for journey insurance coverage that gives extra safety or “cancel for any motive” protection.

Associated: New airline guidelines are in impact — here is what it’s best to know