The Chase Sapphire Most well-liked® Card (see charges and costs) is without doubt one of the finest journey playing cards in the marketplace. With a average $95 annual price, it is a best choice for each frequent and informal vacationers — particularly these new to incomes journey rewards.

In case you’ve been eyeing the Chase Sapphire Most well-liked, now is a good time to use, as Chase is providing a stellar welcome bonus of 100,000 Final Rewards factors after you spend $5,000 on purchases within the first three months of account opening.

This is without doubt one of the largest welcome bonuses we have seen for this card lately.

In case you’re contemplating filling out an software, you is perhaps questioning: What credit score rating do that you must be authorised for the Sapphire Most well-liked? Whereas there isn’t any set quantity that ensures approval, understanding the Chase Sapphire Most well-liked necessities will help you gauge your possibilities.

At TPG, we dedicate plenty of time to discussing how credit score scores work, how credit score scores affect bank card approvals and what elements issuers contemplate past your rating.

Let’s look at the Chase Sapphire Most well-liked credit score rating necessities and enhance your probabilities of getting authorised.

Associated: Acquired glorious credit score? These are the perfect bank cards for you

Chase Sapphire Most well-liked overview

The Chase Sapphire Most well-liked is a longtime favourite amongst superior factors and miles collectors. In case you’re contemplating including it to your pockets, now is a good time to take action.

The Sapphire Most well-liked earns invaluable Chase Final Rewards factors that may be transferred to this system’s resort and airline companions. It additionally consists of perks like an annual $50 resort credit score for reservations made by way of Chase Journey℠ and a 10% factors bonus in your cardmember anniversary.

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Take a look at our full Chase Sapphire Most well-liked bank card overview for extra data.

Credit score rating wanted for the Chase Sapphire Most well-liked

Credit score scores within the mid-700s and above will sometimes be sufficient to get you authorised for many journey bank cards. Nevertheless, having a decrease rating does not essentially imply you’ll be able to’t add considered one of these playing cards to your pockets.

The Chase Sapphire Most well-liked is named among the finest starter journey bank cards in the marketplace, and newbies can nonetheless be authorised for it.

Whilst you probably will not want an distinctive credit score rating to be authorised, we advocate that you’ve got a credit score rating of a minimum of 700 to extend your probabilities of approval. This rating falls in the midst of the “good” credit score rating class, which ranges from 670-739.

The credit score rating ranges utilizing the FICO scoring mannequin are:

- Distinctive: 800-850

- Superb: 740-799

- Good: 670-739

- Honest: 580-669

- Poor: 579 and beneath

Simply word that though your credit score rating is an effective indicator of your approval odds, it isn’t an absolute science. Chase would possibly nonetheless deny you even for those who meet the “required” credit score rating — and would possibly nonetheless approve you even for those who’re beneath it.

The Chase Sapphire Most well-liked is taken into account an incredible newbie card, however you may not get authorised if in case you have little credit score historical past or just one bank card to your title.

If you’re brand-new to bank cards, we advocate first making use of for one of many finest first bank cards or a starter card to assist construct your credit score.

Many different elements go into qualification past your credit score rating, similar to your revenue and the common age of your credit score accounts. Chase doesn’t publicly disclose revenue or credit score utilization necessities, however a better revenue and decrease credit score utilization will improve your probabilities of being authorised.

One other vital issue that is typically neglected is your relationship with the financial institution. In case you’ve been a longtime Chase buyer and have giant balances in your financial institution accounts with them, you will have higher approval odds (particularly for those who apply in a department).

Lastly, even for those who’re eyeing a extra premium Chase card, such because the Chase Sapphire Reserve® (see charges and costs), it’s possible you’ll need to apply for the Chase Sapphire Most well-liked first. In spite of everything, getting authorised for the Sapphire Most well-liked is usually simpler than the Sapphire Reserve.

Then, when you’re able to graduate to a extra premium product or if you would like entry to the perks on the Sapphire Reserve at a later date, you’ll be able to request a card improve.

Associated: Card Comparability: Chase Sapphire Most well-liked vs. Sapphire Reserve

The right way to examine your credit score rating

By no means do you have to pay to examine your credit score rating. Many bank cards include a free FICO rating calculator. And even when yours does not, there are numerous different methods to examine your credit score rating free of charge.

Many free websites will help you retain higher observe of your rating and its elements. You possibly can even use these companies to dispute any data in your rating that is not correct or seems to be fraudulent. If you’d like much more credit score companies, you may additionally contemplate paying for a credit score monitoring service like myFICO.

Elements that have an effect on your credit score rating

Earlier than you begin making use of for any bank cards, it is important to grasp the elements that make up your credit score rating. In spite of everything, the mere act of making use of for a brand new line of credit score will change your rating.

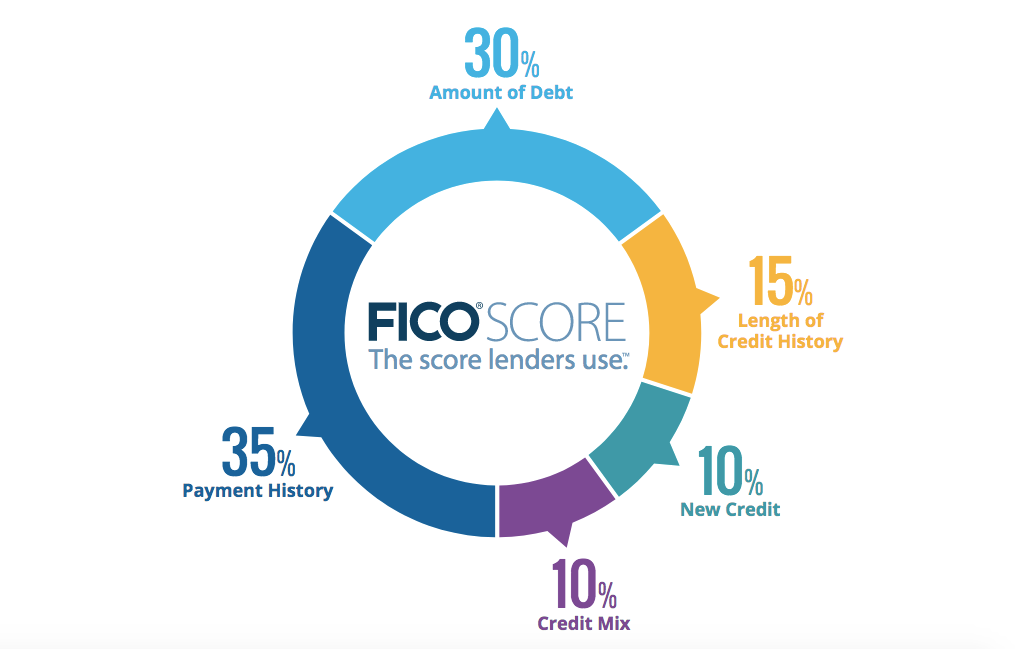

Whereas the precise method for calculating your credit score rating is not public, FICO is clear concerning the elements they assess and the weightings they use:

- Cost historical past: 35% of a FICO rating represents your cost historical past. So, for those who get behind in making mortgage funds, this a part of your credit score rating will endure. Additionally, the extra prolonged and more moderen the delinquency, the extra vital the destructive impact.

- Quantities owed (credit score utilization): 30% of your FICO rating consists of the relative dimension of your present debt. Particularly, your debt-to-credit ratio is the full of your money owed divided by the full quantity of credit score obtainable throughout all of your accounts. Many individuals declare having a debt-to-credit ratio beneath 20% is finest, nevertheless it’s not a magic quantity.

- Size of credit score historical past: 15% of your rating represents the common size of all accounts in your credit score historical past. The typical size of your accounts is usually a vital issue if in case you have a restricted credit score historical past. It may also be an element for individuals who open and shut accounts rapidly.

- New credit score: Your most up-to-date accounts decide 10% of your credit score rating. So, this a part of your credit score rating will endure for those who’ve just lately opened too many accounts. In spite of everything, acquiring plenty of new credit score is one signal of monetary misery.

- Credit score combine: 10% of your rating is expounded to what number of totally different credit score accounts you’ve gotten, similar to mortgages, automotive loans, credit score loans and retailer bank cards. Whereas having a mixture of mortgage varieties is healthier than having only one kind, we do not advocate taking out pointless loans solely to enhance your credit score rating.

With regard to the Sapphire Most well-liked, one essential issue to think about is your common age of accounts. Whereas a lengthier credit score historical past will enhance your rating, many issuers deal with the one-year cutoff. That signifies that having a median age of accounts of greater than a yr can go a good distance towards growing your odds of approval. Nevertheless, you might need bother getting authorised with 11 months of credit score historical past — even when your numerical credit score rating is great.

You probably have any delinquencies or bankruptcies in your credit score report, Chase would possibly hesitate to approve you for a brand new line of credit score. It is essential to do not forget that your credit score profile is greater than only a quantity. Certainly, your credit score profile is a set of data given to the issuer to research your creditworthiness.

Because of this, there isn’t a hard-and-fast rule a couple of particular credit score rating that may mechanically get you authorised (or denied) for the Sapphire Most well-liked.

Associated: 7 issues to grasp about credit score earlier than making use of for a brand new card

Chase Sapphire Most well-liked software necessities

After you’ve got checked your credit score rating, there are a couple of Chase-related elements to think about earlier than you apply for the Chase Sapphire Most well-liked.

‘1 Sapphire card’ rule

Chase limits cardholders to having just one Sapphire card, so if you have already got one, your software will probably be mechanically rejected. This consists of all of Chase’s Sapphire merchandise, such because the Chase Sapphire Reserve and the no-annual-fee Chase Sapphire® Card, the latter of which is not accepting new candidates.

The data for the Chase Sapphire card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

5/24 Rule

As with most Chase playing cards, the Sapphire Most well-liked is topic to Chase’s 5/24 rule, which states that Chase will mechanically reject your software for those who’ve opened 5 or extra private bank cards (with any issuer) within the final 24 months.

The 5/24 rule is hard-coded into Chase’s system, so brokers typically cannot manually override it. As such, for those who’re over 5/24, your solely possibility for getting the Chase Sapphire Most well-liked is to attend till you are beneath 5/24 once more.

Associated: The right way to calculate your 5/24 standing

Earlier Sapphire card welcome bonus

One other issue to think about when making use of for the Chase Sapphire Most well-liked is welcome bonuses. In case you’ve obtained a welcome bonus from any Sapphire card within the final 48 months, your software will probably be mechanically rejected.

Associated: The present finest bank card welcome bonuses

What to do in case your software is rejected

If Chase rejects your bank card software, do not quit. In case you obtain a rejection letter, you must first look at the explanations to your rejection. By regulation, card issuers should ship you a written or digital communication explaining what elements prevented you from being authorised.

As soon as you’ve got discovered why Chase rejected you, you’ll be able to name the reconsideration line.

Inform the individual on the telephone that you simply just lately utilized for a Chase bank card, had been stunned to see Chase rejected your software and wish to converse to somebody about getting that call reconsidered.

From there, it is as much as you to construct a case and persuade the agent why Chase ought to approve you for the cardboard.

For instance, if Chase rejected you for having a brief credit score historical past, you’ll be able to level to your stellar document of on-time funds. Or, if Chase rejected you for missed funds, you could possibly clarify that these had been a very long time in the past and your latest historical past has been excellent.

Chase can be recognized to restrict a buyer’s whole credit score line throughout all playing cards. You will have success overcoming a rejection by providing to shift unused credit score from an current card to a brand new one.

There is not any assure that your name will work, nevertheless it’s price spending quarter-hour on the telephone if it’d aid you get the cardboard you need.

Associated: Your information to calling a bank card reconsideration line

Backside line

The Chase Sapphire Most well-liked Card is a good possibility for these simply getting began on this planet of factors and miles, particularly with the present welcome bonus. Hopefully, you will not have bother getting authorised, however needless to say Chase will probably mechanically reject you if any of the next apply to you:

- Have already got a Sapphire card (together with the Chase Sapphire Reserve and the no-annual-fee Sapphire card —which is not accepting new candidates)

- Acquired a welcome bonus from any Sapphire card within the final 48 months

- Opened 5 or extra playing cards throughout all issuers within the final 24 months

Apply right here: Chase Sapphire Most well-liked Card