After I was first authorised for the Chase Sapphire Most well-liked® Card (see charges and costs), the profitable welcome bonus and beneficial switch companions have been what excited me most concerning the card.

The Sapphire Most well-liked contains a host of helpful advantages past accumulating Chase Final Rewards factors at a terrific incomes price. However, if you happen to’re like me, you are most likely spending much less time researching journey cancellation and interruption insurance coverage and extra time daydreaming about how you are going to redeem 100,000 Final Rewards factors.

For a restricted time, the Sapphire Most well-liked is providing 100,000 bonus factors after spending $5,000 on purchases inside the first three months of account opening. That is the best supply we have ever seen on this card, making now a strong time to use.

However that does not imply you must overlook the Sapphire Most well-liked’s journey insurance coverage perks. I am definitely glad I remembered journey cancellation insurance coverage once I unexpectedly missed a New Yr’s Eve celebration.

I made a mistake that just about price me $250, however I used journey insurance coverage on my Sapphire Most well-liked to get reimbursed for a lodge I by no means visited. Here is what I did so precisely what to do if you happen to’re ever in an analogous scenario.

How I used Chase Sapphire Most well-liked journey cancellation insurance coverage

In December, I booked a two-night keep at a Hyatt Place in Charlotte to go to some associates for New Yr’s Eve. The entire price was $245, which I pay as you go on-line.

Three days earlier than I used to be able to hit the street, I caught a horrible bout of the flu. So as a substitute of toasting Champagne and having fun with hors d’oeuvres, I took ibuprofen and napped away my sickness.

That $245 Hyatt cost hit my Sapphire Most well-liked account the day I used to be purported to verify in. As an alternative of preparing for New Yr’s celebrations, I used to be mendacity on the sofa.

After I felt higher a few week later, I remembered that I had booked the lodge stick with my Sapphire Most well-liked, which gives journey insurance coverage. Since I might file a declare, I tried to get my a reimbursement. Here is how that went down for me.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: Your information to Chase’s journey insurance coverage protection

How I filed a declare

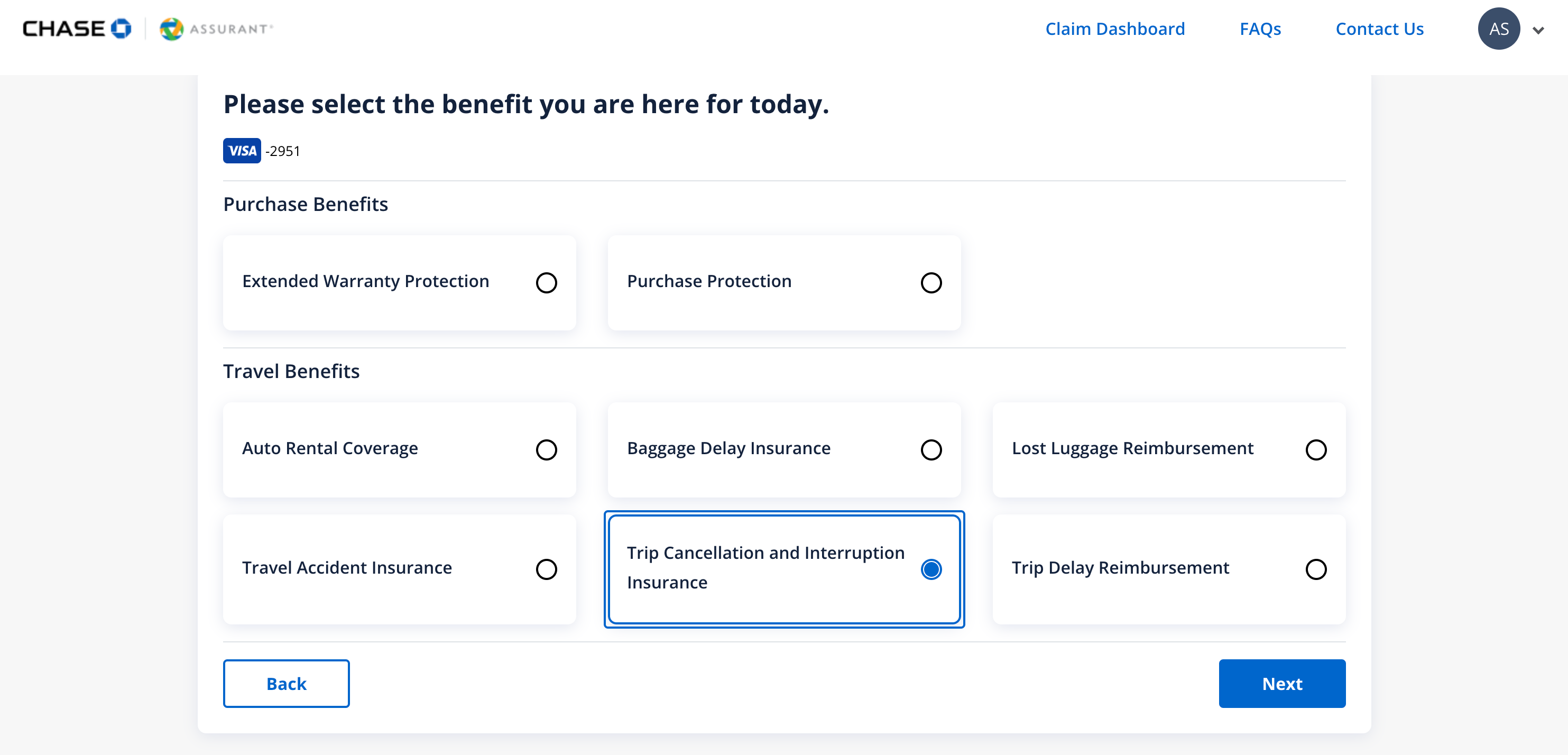

I went to chasecardbenefits.com and registered with my card info. Then, I used to be taken to my declare dashboard, the place I chosen “File a Declare.”

On the following web page, I selected my Sapphire Most well-liked. I used to be delivered to a display screen the place I might choose the particular buy or journey profit I used to be trying to make the most of.

I clicked on “Journey Cancellation and Interruption Insurance coverage” since this was the profit that utilized to my scenario.

Subsequent, I crammed within the buy date of my “ticket/itinerary” and the date of cancellation/interruption.

Afterward, I used to be given a immediate to decide on the kind of loss from an inventory of 16 choices:

- Unintended bodily harm

- Burglarized residence

- Broken residence

- Illness/sickness

- Hospitalization

- Jury responsibility/subpoena

- Lack of life

- Army order

- Named storm

- Quarantine

- Extreme climate

- Transportation strike

- Journey warning

- Terrorist incident

- Uninhabitable residence/lodging

- Different

I chosen “illness/sickness” since I had a medical observe proving my prognosis days earlier than I used to be purported to journey.

Documentation I submitted

The following a part of the method required an additional elevate.

I used to be requested to offer documentation to substantiate my declare. What you’ll want to submit will differ relying on which sort of loss you choose.

Chase’s advantages information notes that, relying on the character of your declare, it’s possible you’ll want to offer extra particulars.

Usually, nevertheless, this is what you may have to spherical up:

- Journey itinerary

- Paperwork that affirm the explanation for journey cancellation or interruption, resembling medical data or a demise certificates

- Your card assertion exhibiting the final 4 digits of your account quantity and the cost you made along with your eligible card

- Cancellation or refund insurance policies of the supplier concerned

- Proof of coated journey bills incurred on account of a visit interruption

- Any unused vouchers, tickets or coupons

- Every other doc requested to substantiate the declare

In my case of the flu versus a Hyatt reservation, I initially submitted:

- An e mail affirmation of my Hyatt Place reserving with dates

- A physician’s observe confirming my flu prognosis with a date

- Proof of the Hyatt transaction from my Chase on-line portal

Simply over every week later, I used to be despatched a follow-up e mail asking for a couple of extra particulars.

The e-mail acknowledged that I wanted to submit “affirmation that the journey preparations have been canceled with the journey provider,” plus the “card account assertion (exhibiting the final 4 (4) digits of the account quantity) demonstrating the cost for the journey was made in your Lined Card and/or with redeemable Rewards [and] any unused vouchers, tickets, or coupons from the frequent service (resembling planes, trains and cruise ships).”

For the reason that preliminary transaction was a few weeks in the past at this level, I used to be in a position to submit my month-to-month card assertion. I additionally uploaded a lodge invoice I retrieved from Hyatt’s web site.

The place I assumed I made a mistake

One other week handed, and I acquired a second e mail asking for extra documentation. This time, the letter repeated a necessity for “affirmation that the journey preparations have been canceled with the journey provider.”

At this level, I spotted I’ll have made a mistake.

I did not have official affirmation of the cancellation. In my flu-related daze, I might utterly forgotten to formally cancel my reservation. So, as a substitute of this being a “journey cancellation” challenge, I used to be primarily a no-show.

Embarrassed, I left my declare behind. Then, I wrote about it for TPG’s Day by day E-newsletter, hoping to assist others keep away from making my mistake by remembering to really cancel reservations for journeys they should miss.

The outcome

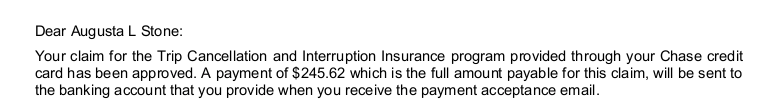

This e mail change occurred in late January, so you may think about my shock once I woke as much as an e mail in March that my declare had been authorised.

I will observe that there is by no means a assure your particular declare might be authorised. So, if you happen to do not really cancel your reservations, you is probably not refunded.

As soon as I used to be authorised, receiving my refund was simple. I acquired a same-day e mail from Virginia Surety Firm, which works with Assurant, Chase’s insurance coverage supplier. I submitted my financial institution info by means of a safe channel, and the cash was in my account by the following morning.

My declare was successful — and I did not even count on it.

Backside line

With journey cancellation insurance coverage on the Chase Sapphire Most well-liked, you may typically be reimbursed for nonrefundable, pay as you go journey bills charged by a provider, together with lodge stays just like the one I booked.

Every Chase card comes with a Information to Advantages explaining its insurance coverage advantages. When you maintain a card with journey cancellation and interruption protection, keep in mind to cancel your reservations forward of time and file a declare within the unlucky occasion you miss a visit.

When you’re on the lookout for a card with this protection, I like to recommend the Sapphire Most well-liked. Along with this surprisingly simple course of, the cardboard itself provides beneficial Chase Final Rewards factors, glorious incomes charges and nice switch companions. Whenever you add within the consolation of journey protections, it would not get a lot sweeter for a $95 annual price.

Apply right here: Chase Sapphire Most well-liked Card

Associated: Is the Chase Sapphire Most well-liked definitely worth the annual price? I say sure