Relating to your monetary persona, there are few metrics extra essential than your credit score rating. This quantity can affect not solely your potential to get accepted for high journey bank cards but in addition the rate of interest you pay on a mortgage, your potential to acquire an auto mortgage and a number of different features of your life.

When you’ve made a New Yr’s decision to enhance your credit score rating in 2025, listed below are some methods to efficiently just do that.

Perceive credit score rating fundamentals

Earlier than moving into the following tips, let’s begin with a fast overview of simply what constitutes your credit score rating. Proper off the bat, it is essential to notice that there are two fundamental credit score scoring fashions: VantageScore and FICO.

Whereas there are just a few minor variations between the 2, they each try and numerically measure the identical factor: your trustworthiness as a borrower.

A decrease rating signifies a better threat of defaulting on a mortgage, thus reducing the sum of money or credit score a monetary establishment is prepared to lend you (or reducing the possibilities of you being accepted for a mortgage in any respect).

The next rating, however, signifies that you just’re much less prone to default and thus capable of deal with bigger mortgage quantities and smaller charges.

Each scores fall on the identical scale (300-850) and use the identical common standards:

- Fee historical past: What number of funds you’ve got missed or made late throughout your credit score historical past.

- Quantities owed: Ceaselessly known as your credit score utilization ratio, it measures how a lot of your obtainable credit score is at the moment getting used.

- Size of credit score historical past: The common age of your accounts throughout lenders.

- New credit score: How a lot new credit score you’ve got lately gained entry to, together with the variety of onerous inquiries.

- Credit score combine: The various kinds of accounts you’ve got had (bank cards, auto loans, mortgages and so forth.).

By paying shut consideration to those 5 gadgets — particularly the primary two — you may be effectively in your strategy to enhancing your credit score rating.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: Your subsequent bank card approval is within the arms of those three companies

Evaluate your credit score report for inaccuracies

Some of the essential issues it is best to do is evaluate your credit score report for inaccurate info.

In keeping with a research carried out by Shopper Studies, a few third of shoppers discovered an error on their credit score reviews. In lots of circumstances, these errors aren’t malicious (e.g., identification theft) however quite inaccuracies associated to comparable names or different easy mix-ups.

Luckily, there is a federally documented course of for eradicating these errors. This text from the Federal Commerce Fee supplies full particulars of those steps, together with request your free credit score report each week.

As soon as you’ve got recognized an error, submit a dispute letter immediately with the credit score reporting firm; you should use the FTC’s pattern for inspiration. The bureau should examine the criticism, sometimes involving going to the group that offered the disputed info.

If this does not assist, the subsequent step is to contact the data supplier immediately along with your criticism; once more, the FTC supplies a pattern dispute letter for this function. Be detailed however concise, and embody copies of any documentation that helps your dispute.

Whereas this course of may be time-consuming, cleansing up your credit score report back to be away from all inaccuracies is a vital step you possibly can take to right away enhance your rating — or, on the very least, forestall any future drops in your rating associated to errors.

Associated: Tips on how to examine your credit score rating at no cost

Prolong your obtainable credit score

One other strategy to enhance your credit score rating within the new yr is to broaden the credit score line to which you have got entry. This may increasingly appear counterintuitive: absolutely extra credit score means extra money to spend and, due to this fact, extra threat, proper?

Whereas that is true on the floor, keep in mind that your credit score utilization ratio makes up nearly a 3rd of your FICO rating (and can also be a key a part of your VantageScore). That is why getting access to further credit score can enhance your credit score rating.

There are two alternative ways to perform this:

- Request credit score line will increase on current accounts: Some issuers make it very straightforward to request will increase on-line, which usually will not end in a tough inquiry in your credit score report.

- Apply for a brand new bank card: Regardless that it will end in a tough inquiry and briefly drop your rating, it could nonetheless provide you with a brand new line of credit score (to not point out unlock a doubtlessly beneficial welcome bonus). This may increasingly outweigh the short-term drop within the brief run and can nearly actually assist in the long term.

This is an instance of how this may work. As an example you have got a single bank card with a restrict of $5,000. Regardless that you pay it off in full each month, the cardboard nonetheless has a median stability of roughly $2,500, as you utilize it as your major bank card and can proceed charging purchases to it as your cost due date approaches.

The overall rule of thumb is to maintain your utilization underneath 30%, so on this instance, you are effectively above that (50%).

Now, as an instance you request —and are granted — a rise of $5,000. Or perhaps you apply for a brand new card and are given a $5,000 line. With this one motion, you’ve got simply boosted your obtainable credit score to $10,000. So long as your stability stays within the $2,500 vary, your utilization drops to 25%, which ought to end in a noticeable improve in your rating over time.

Nonetheless, this solely works if you don’t use the brand new credit score line to spend past your means. So long as your spending stays constant, you are merely spreading that quantity out over a bigger credit score restrict, dropping your utilization and growing your rating. Bank cards should not essentially a surefire strategy to get into debt; be sure you hold your purchases consistent with your revenue.

Associated: What’s the distinction between a tough and mushy pull in your credit score report?

Arrange automated funds

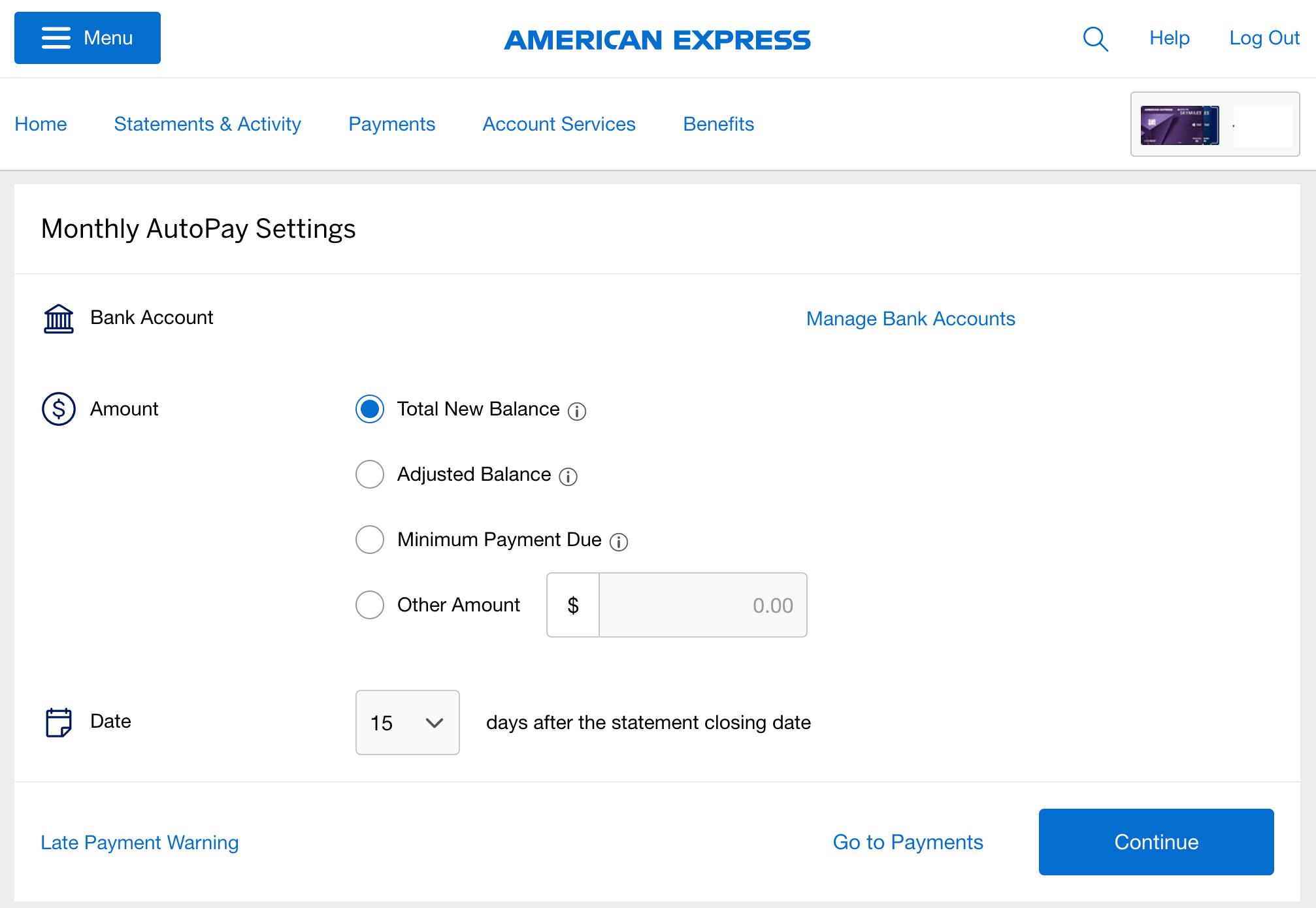

When you’re liable to lacking a deadline right here or there, it is best to no less than have calendar reminders in your bank card cost due dates and, at greatest, have automated funds enabled in your accounts.

As famous above, your cost historical past is crucial think about figuring out your credit score rating, and even a single late cost can dramatically scale back your rating, because it signifies that you could be be struggling to repay your stability.

By organising reminders or enabling automated funds out of your checking account, you make sure that each cost shall be processed on or earlier than your assertion due date.

In fact, this comes with the caveat that you should keep sufficient cash in your checking account to cowl the stability that shall be paid robotically. In any other case, the overdraft payment might eat away at your earnings and nonetheless end in a late cost.

Associated: Tips on how to arrange autopay for all of your bank cards

Price range to pay down excellent balances

Our No. 1 commandment for journey rewards bank cards right here at TPG is: Thou shalt pay thy stability in full.

When you carry a bank card stability from month to month, the curiosity prices that accrue will simply cancel out the worth of the factors or miles you are incomes on the cardboard — after which some.

Nonetheless, you’ll have an previous debt out of your freewheeling days as a university scholar, or perhaps you elected to finance a big buy with an introductory 0% annual share fee bank card or deferred curiosity provide on a retailer bank card.

Don’t let these balances go unpaid. If you have not already achieved so, sit down and create a funds for a way you will pay these balances off to keep away from (or decrease) your curiosity publicity.

Associated: Tips on how to consolidate and pay down bank card debt

Join credit score monitoring

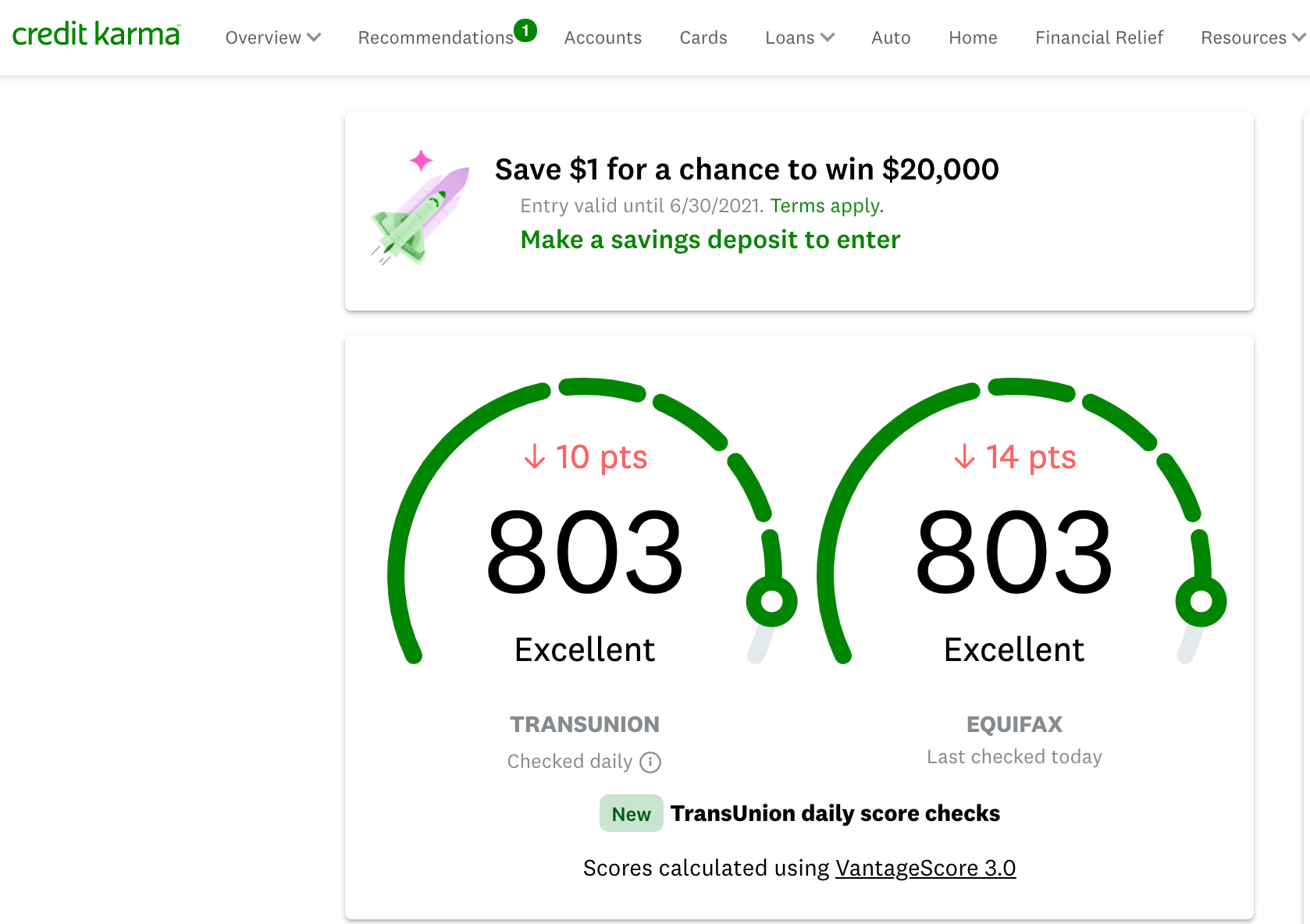

This last suggestion will not essentially end in a right away improve in your credit score rating. Nonetheless, it is a greatest observe to maintain tabs in your rating and rapidly determine any points which will come up: Join a service that displays your credit score profile and notifies you of any adjustments.

We like to make use of Credit score Karma, a free service that tracks your TransUnion and Equifax scores and permits you to view your credit score report any time you need. You too can set alerts for numerous issues, comparable to adjustments to your report.

Backside line

Whether or not you are new to the factors and miles interest or have been round for some time, preserving your credit score rating excessive is without doubt one of the most essential issues you are able to do. It will improve your approval odds for high journey rewards bank cards, broaden your entry to installment loans and even decrease the rates of interest and costs you’d pay to lenders.

When you’ve made a decision to spice up your scores in 2025, we hope this information has given you some concrete steps to enhance your credit score well being within the coming weeks and months.

Associated: 3 actual methods to spice up your credit score rating in 30 days