Jacob Njagi’s new child son may barely breathe when he arrived in an ambulance on the emergency ward of an Avenue Group hospital in Nairobi, Kenya, within the early hours of the morning. It was June 2022 — COVID-19 circumstances have been surging — and Njagi and his household had spent hours looking for an obtainable mattress. Once they lastly pulled as much as the hospital in Parklands — a leafy neighborhood that felt 1,000,000 miles away from the poverty round their dwelling on the sting of town — Njagi was exhausted. His toddler, Jason, was in peril, his lungs clogged.

However Njagi stated that directors on the hospital — which is backed by the Worldwide Finance Corp. (IFC), a member of the World Financial institution Group that works to alleviate poverty — demanded a deposit. “We needed to beg them to at the very least give us oxygen, as a result of the oxygen within the ambulance was virtually out,” Njagi just lately instructed the Worldwide Consortium of Investigative Journalists (ICIJ).

Admission, he realized, required a deposit of 100,000 Kenyan shillings (about $850 on the time) — greater than a month’s earnings from the wholesale meals enterprise he’d constructed. Njagi scrambled for funds, begging his sister for help. Her buddies helped scrape collectively sufficient to cowl a deposit for the child, he stated.

Practically per week later, Jason was effectively sufficient to go dwelling, however he had spent three days on a ventilator within the neonatal intensive care unit and wanted additional therapy, the medical doctors warned. Njagi, who’s 34, was involved that he may by no means pay the invoice — already greater than 400,000 shillings (about $3,600) — so he requested for his son to be discharged. Jason’s care had come at an virtually insufferable value: the monetary stability Njagi had constructed for his household.

In Kenya, the place solely a few quarter of the inhabitants was insured in 2023, well being care is scarce and infrequently ruinously costly. However the IFC-backed hospital that handled Njagi’s son was purported to be totally different.

Certainly one of 5 establishments that make up the World Financial institution Group, the IFC’s mission is to struggle poverty in creating nations by investing within the non-public sector, a job supported with funds from its greater than 180 member nations. Its funding in Avenue Group, the corporate that runs the hospital the place Njagi’s son was handled, was supposed to advance the World Financial institution Group’s well being care technique, which incorporates serving to households within the creating world keep away from “poverty resulting from sickness.”

As an alternative, IFC-backed, for-profit hospitals like these run by Avenue Group have destabilized the funds of households throughout East Africa, a year-long investigation by ICIJ has discovered. Avenue Group’s operator, the Evercare Group, stated that its hospitals and clinics present “entry to high quality care for a lot of poor and decrease earnings Kenyans” and that it doesn’t make emergency care contingent on a affected person’s skill to pay upfront.

Since 2009, the IFC has partnered with at the very least 4 non-public fairness corporations which have invested its cash in for-profit hospitals in Kenya and Uganda. Whereas the IFC has made public guarantees to enhance well being care for everybody, its financing for personal hospitals in East Africa has as a substitute deepened inequality. It has additionally contributed to the tens of hundreds of thousands of {dollars} in administration charges and monetary efficiency bonuses paid to non-public fairness corporations for his or her work managing investments in hospitals on behalf of the IFC and others.

In over 70 interviews, former and present medical doctors, nurses and executives from IFC-backed amenities in Kenya and Uganda and from the non-public fairness corporations managing them described how pressures to enhance returns for buyers contributed to elevated therapy prices and lowered accessibility. This saddled some sufferers with crushing debt and diverted assets initially supposed to assist the poor towards making medical amenities extra worthwhile. These accounts are supported by court docket data, inside company communications and paperwork, and affected person data reviewed by ICIJ.

To gather unpaid payments, among the hospitals unlawfully detained sufferers as much as months at a time, ICIJ discovered. A few of these incidents have been broadly reported within the media and have been the topic of high-profile court docket circumstances and authorities inquiries. However the IFC failed to forestall problematic practices from persevering with at hospitals it helped finance. And the group has continued backing non-public hospitals even because it has remained unclear whether or not the investments enhance accessibility or affordability for the poor in any significant means.

The mannequin was “revenue earlier than life. It was revenue earlier than well being care. It was revenue first,” based on one former govt who requested anonymity to debate his expertise main a hospital in East Africa managed by an IFC-backed firm. Care at among the hospitals was so costly that their very own medical doctors and nurses couldn’t afford it, ICIJ realized. In interviews about greater than a dozen sufferers at these hospitals, their relations and buddies described how they solicited cash for medical care from church buildings, mosques, workplaces and even their dwelling villages, successfully draining wealth from whole communities.

It was revenue earlier than well being care. It was revenue first.

— former govt at an IFC-backed hospital in East Africa

The IFC didn’t reply detailed questions from ICIJ about allegations of affected person mistreatment or aggressive efforts to gather funds on the hospitals it funds. It stated that the IFC “advocates for improved monetary safety for residents,” including that its consumer hospitals attempt to assist low-income sufferers however folks nonetheless wrestle as a result of many nations’ public well being care techniques aren’t sufficiently funded. The group additionally stated that it expects the hospitals to tell the IFC and different related authorities of credible allegations of wrongdoing, and that when needed the hospitals ought to strengthen inside controls.

“We will and should do higher in our oversight and supervision,” the IFC stated in its assertion, including that, going ahead, it “won’t work with new purchasers who don’t decide to — and observe — our requirements, and moral rules and practices for affected person care.” Bloomberg Information and the anti-poverty group Oxfam have each additionally just lately reported on the excessive value of care and problematic practices at IFC-financed hospitals.

Evercare, Avenue Group’s operator, additionally stated that “it isn’t our coverage to detain sufferers for non-payment.” It famous the “strong monetary counselling packages” and “versatile fee options” it supplies to sufferers and likewise stated it has launched care protocols that embody an specific prohibition on detentions.

However the considerations shared with ICIJ concerning the IFC’s investments can’t be lowered to particular person acts of wrongdoing; they go to the very core of the group’s method to investing in well being care — one primarily based on belief in non-public fairness corporations and for-profit firms to guard essentially the most susceptible. Since 1999, the IFC has put greater than $9 billion into backing non-public well being care firms in nations reminiscent of Kenya and Uganda, kicking off a surge in financing from taxpayer-funded growth establishments into non-public hospitals throughout the creating world. It has set the bar for different gamers investing in worldwide growth, promising that its well being care investments will work towards “emphasizing strong well being techniques and guaranteeing accessible, inexpensive high quality providers for all.”

The IFC has delivered on a part of that promise: Its financing has helped underwrite the development or acquisition of hospitals and outpatient clinics in Africa, Asia, Latin America and the Center East. And it has, amongst different issues, helped suppliers safe loans to purchase gear and arrange working theaters that allow hospitals to supply life-saving care.

For some, nevertheless, these providers have come at an virtually insufferable value. Njagi is grateful to the IFC-backed Avenue Group hospital that saved his son, however the invoice put him in a monetary spiral, he stated. His household was homeless at one level and has at occasions lived with relations, he stated, including that the pressure practically ended his marriage.

Earlier than his encounter with Avenue Group, Njagi’s funds have been “steady,” and he was “in a position to present,” he stated. However now, he works as a day laborer within the rice fields close to his dwelling — a single room with a communal bathroom. Financially, he stated, “I’ve nothing left.”

The enterprise of well being in Africa

Based in 1956 and headquartered in Washington, D.C., the Worldwide Finance Corp. is tasked with selling non-public enterprise within the creating world and with serving to to create world prosperity. However in its first 4 many years, it largely stayed away from well being care, an space that many at its mum or dad group, the World Financial institution Group, believed was higher left to governments.

Within the Nineties, nevertheless, as a wave of enthusiasm for the privatization of presidency providers swept the Western world, the World Financial institution Group reevaluated the non-public sector’s position in offering well being care. In 1997, it launched a complete well being technique that pledged to make use of its huge assets and affect to enhance well being outcomes for the poor and shield them from “the impoverishing results of sickness.” Responding to the decision, the IFC started pouring cash into the well being care sector, and by 2001 it had authorised dozens of initiatives.

Nonetheless, some on the IFC weren’t positive that financing non-public hospitals would advance its anti-poverty mandate. They anxious about how sufferers would afford the care at these new amenities: Non-public hospitals “are much less open to poor folks until there are some monetary mechanisms,” reminiscent of common well being protection, to pay the prices of their care, Man Ellena, the IFC’s then-director of well being and training, instructed a 2002 assembly of its board.

By 2007, nevertheless, such considerations had light. In a report titled “The Enterprise of Well being in Africa,” the IFC described how buyers may, by means of methods like rising affected person quantity, revenue from hospitals tending to the continent’s poor.

Looking for to set an instance for different buyers, the IFC introduced plans to launch the Africa Well being Fund — a $100 million funding automobile for “serving to low-income Africans acquire entry to inexpensive, high-quality well being providers.”

To handle the endeavor, the IFC and several other co-investors chosen Aureos Capital, a personal fairness agency targeted on small-scale investments within the creating world. In a 2008 fund proposal obtained by ICIJ, Aureos instructed potential shareholders that it noticed “no battle within the objectives of enhancing Africans’ livelihoods by means of higher healthcare provision, and producing 15-20% gross annual returns to buyers.”

Aureos would gather an trade normal 2.5% administration payment, based on an appointment letter from the IFC. And the agency would earn hundreds of thousands extra if it met the fund’s purpose of serving the “backside of the pyramid” — folks incomes lower than $3,000 per 12 months. Extra rewards would kick in if the investments reached these making underneath $1,000. (Practically 40% of Kenyans dwell on lower than 8,006 Kenyan shillings a month, equal to about $730 a 12 months, based on the latest authorities survey.)

For its first funding, Aureos chosen an organization that appeared like an ideal match for the fund’s targets: a personal hospital in Nairobi based by Sam Thenya, a charismatic, younger physician who used his earnings to subsidize charitable work.

Thenya based Nairobi Girls’s Hospital in 2001, pushed by his anger after directors at his earlier job insisted {that a} sexual assault survivor pay for emergency care out of pocket. The hospital tended to Nairobi’s center class and poor whereas providing free care to survivors of sexual and home violence.

“I instructed the [Nairobi Women’s Hospital] board that we had to supply free providers regardless that we have been struggling financially,” Thenya stated in a 2014 interview. When the board instructed him that the work was unaffordable, he refused to hear: “I instructed them, ‘Over my useless physique!’ ”

Thenya’s story was compelling for IFC’s fund supervisor Aureos, and by early 2010 it had acquired over 20% of Nairobi Girls’s for $2.7 million; two Aureos employees members joined the corporate’s board of administrators.

Discovering different investments that fulfilled the IFC’s formidable objectives was a gradual job. Greater than a 12 months later, Aureos invested in two extra non-public well being care suppliers. One was Avenue Group, which ran the hospital that may someday deal with Jacob Njagi’s toddler son.

Quickly the Africa Well being Fund attracted companions from around the globe, together with the event finance establishments of France, Norway and South Africa. However there have been already considerations that the cash was failing to succeed in these it was supposed to serve.

In 2012, an impartial advisory agency employed by the IFC and its companions to judge their well being initiative in Africa famous that non-public investments targeted on serving to the underserved “might not be viable on a industrial scale.”

That didn’t appear to discourage Abraaj Capital, a Dubai, United Arab Emirates-based non-public fairness agency targeted on rising economies. The agency acquired Aureos later that 12 months, taking on administration of the IFC-backed Africa Well being Fund.

The fund’s portfolio of firms epitomized the sort of “influence investing” that Abraaj’s founder, Arif Naqvi, had championed in settings just like the billionaire-studded World Financial Discussion board in Davos, Switzerland: companies that promised to make giant earnings whereas enhancing lives within the creating world.

With the Aureos deal, Abraaj gained management of round $7.5 billion price of investments in quite a lot of industries worldwide. That very same 12 months, an trade publication ranked Abraaj the biggest non-public fairness agency specializing in rising markets. Abraaj had beforehand invested in hospitals and different well being care companies within the Center East and Asia, and it shortly elevated the Africa Well being Fund’s stake in Nairobi Girls’s.

With the fund as a backer, the chain had quickly expanded its operations, opening new hospitals and clinics. Avenue Group had additionally grown shortly — doubling its clinics and including a hospital. Bolstered by this obvious success, Abraaj started approaching buyers a few new fund: a billion-dollar “ecosystem” of well being companies serving creating nations.

The IFC determined to speculate $150 million within the challenge. The group’s involvement signaled to different potential backers that their cash could be effectively spent, a portfolio supervisor on the pension fund of the United Church of Christ, a socially liberal Protestant denomination, stated throughout a 2017 discussion board co-hosted by Abraaj. For these thinking about social change, he stated, the facility of the IFC’s imprimatur “actually can’t be overstated.”

Altogether, buyers piled $850 million into the brand new fund, permitting Abraaj to make main acquisitions in India, Pakistan, and elsewhere. The fund additionally dramatically elevated its presence in Kenya: It took controlling stakes in Nairobi Girls’s and two different hospitals and bought Avenue Group.

In a disclosure, the IFC stated the brand new fund would contribute to its anti-poverty mission by concentrating on “enchancment in entry, high quality and affordability of healthcare for low-income and middle-income populations in Africa” and elsewhere.

Throughout conferences at a public hospital in Kenya, nevertheless, Khawar Mann, the pinnacle of Abraaj’s well being investments, supplied a much less optimistic evaluation to a medical scholar who questioned how the fund would assist the poor.

“We will’t go to that a part of the inhabitants,” Mann replied, based on a description of the encounter in The New York Instances. “The enterprise is simply not sustainable.”

‘Like prisoners’

By the third quarter of 2017, Abraaj had collected $37.6 million in administration charges from the brand new well being care fund — sufficient to cowl the price of a routine start for over 77,000 girls at an Avenue Group hospital.

In the meantime, directors at IFC-backed hospitals required uninsured sufferers — greater than 75% of the inhabitants in Kenya and practically everybody in Uganda lacks insurance coverage — to pay giant upfront deposits for admission, often inflicting delays in crucial care, based on interviews with present and former hospital employees and sufferers’ households. (Evercare denied making emergency care contingent on a affected person’s skill to pay upfront.)

As soon as admitted, sufferers with out the power to pay their invoice could possibly be caught indefinitely. Even switch to a less expensive facility may depend upon a affected person’s monetary assets: One man interviewed by ICIJ was hit by a automotive in late 2024 and lay in Avenue Group’s Parklands hospital in Nairobi for per week with two damaged legs and a damaged jaw whereas household and buddies solicited donations for his therapy. His household requested for a switch after a health care provider estimated it could value 700,000 Kenyan shillings ($5,400 on the time) to repair only one leg, based on a supporter and medical payments reviewed by ICIJ. Administration agreed to maneuver him, a good friend stated, however solely after the household paid the invoice for his ICU care and different providers, which by then had risen to greater than 1.3 million Kenyan shillings ($10,263). When he finally went to a public hospital, therapy prices have been a fraction of what Avenue charged.

Hospital directors, together with at Avenue Group, typically requested sufferers in arrears to show over the deed to their land or their automotive as collateral, based on medical doctors, nurses, employees, and sufferers interviewed by ICIJ, in addition to a authorized settlement and inside paperwork from Avenue.

These with out property to show over typically confronted a bleaker state of affairs: remaining within the hospital whereas they — or their family and friends — collected funds. Private and non-private hospitals all through the area have been infamous for the follow of holding sufferers till they settled their invoice, typically generally known as “discharge-in.” This most frequently occurred to uninsured individuals who had are available for a severe emergency.

The issue was significantly acute at Nairobi Girls’s. The hospital group, which had obtained its first IFC-backed investments by early 2010, had been underneath scrutiny by the information media and native authorities for holding sufferers and even our bodies over unpaid payments since at the very least 2014, the 12 months a person reportedly sued the group for allegedly refusing to switch his ailing spouse to a different facility due to an impressive invoice.

Thenya, the hospital group’s founder and present CEO, freely admitted to the follow. In a 2016 interview, he instructed the Kenyan newspaper Enterprise Each day that his “largest drawback” was “politicians calling for launch of sufferers who haven’t paid their payments.”

Because the years glided by, examples of abuses at Nairobi Girls’s piled up: Affected person “detentions” have been famous in court docket circumstances and chronicled in newspaper articles and two tv exposés in 2017 and 2019 that discovered 16 folks being held on the firm’s hospitals. One girl had been there for practically 230 days.

“We simply turned sick like some other particular person can get sick,” one of many sufferers instructed a reporter in 2017 — as Abraaj piled up its administration charges. “And now we’ve been detained in right here like prisoners.”

In an interview with a tv reporter concerning the detentions, Thenya stated that “Low cost doesn’t exist in well being care.” Nairobi Girls’s was owed over 430 million Kenyan shillings ($4.2 million) in excellent payments, the report famous, however didn’t clarify why.

Following a information report, a Kenyan parliamentary committee ordered an investigation into the months-long detention of the physique of a younger girl whose kidneys had failed after she obtained therapy at a Nairobi Girls’s hospital. Earlier than she died, her household had requested a switch to a less expensive, public facility. However Nairobi Girls’s moved her as a substitute to a unique department, the place she died a number of weeks later, the committee discovered, including that the household consent type that the hospital shared with the committee “gave the impression to be a forgery.” The directors’ actions, the committee famous, appeared to have been “motivated by the necessity to preserve the affected person within the hospital’s custody to make sure fee of the invoice already incurred” — practically 2.6 million Kenyan shillings (about $25,000).

The board of Nairobi Girls’s, which on the time included at the very least one consultant from Abraaj, had met to debate the case, the hospital group’s chief working officer instructed the committee, including that the board was empowered to forgive money owed after 12 months. But it surely was solely after the committee started its investigation that the hospital agreed to launch the lady’s physique and waive the invoice. The committee took no additional motion, and detentions at Nairobi Girls’s hospitals continued: Two years later, in 2019, the Kenya Ministry of Well being reportedly discovered 15 our bodies and 12 discharged sufferers being held there.

Even rulings from Kenya’s Excessive Court docket, which heard at the very least three civil fits by sufferers detained unlawfully at Nairobi Girls’s, did little to cease the follow. In 2016, a decide ordered the corporate to pay 1,000,000 Kenyan shillings ($9,600) to a girl it had held for greater than three months over an impressive invoice of 173,000 Kenyan shillings ($1,700). Two years later, the court docket ordered Nairobi Girls’s to launch a person it had held for months after a site visitors accident. And in 2021, it awarded damages to a younger mother, Emmah Njeri, whom Nairobi Girls’s had held for greater than 5 months in 2018 over unpaid payments exceeding 2.7 million Kenyan shillings (about $27,000).

When Njeri lastly went dwelling, her 9-month-old son not acknowledged her, she instructed ICIJ: “The bond has by no means been as earlier than.”

In an announcement to ICIJ, Thenya wrote that the follow of “delayed discharges” was by no means meant to be punitive. Moderately, they have been merely “a mirrored image of systemic challenges in healthcare financing.”

The board, he wrote, had been conscious that Nairobi Girls’s was holding sufferers over unpaid payments, and — after the primary Excessive Court docket ruling — the corporate took steps to finish the follow. Nonetheless, the hospital “continues to face difficulties” with uninsured sufferers, “which typically complicates discharge logistics,” Thenya added. “Nonetheless, we stay dedicated to affected person dignity and authorized compliance.”

It’s unclear what the IFC knew concerning the detentions at Nairobi Girls’s and different hospitals, and it has not been named in any of the publicly obtainable court docket paperwork involving former sufferers reviewed by ICIJ. However representatives from a number of IFC-backed non-public fairness funds — not simply Abraaj — knew of detentions, based on interviews with 5 folks acquainted with the state of affairs.

‘Priorities have modified’

By the top of 2017, buyers had begun elevating questions on Abraaj and its world well being fund. In keeping with allegations in court docket filings by the U.S. Securities and Alternate Fee, a whole lot of hundreds of thousands of {dollars} earmarked for well being care investments had been flowing into the agency’s different accounts “to cowl money shortfalls.” The next 12 months, Abraaj returned a part of the IFC-backed fund’s capital underneath strain from its buyers, who quickly started a seek for a brand new agency to take over its property.

It had been a decade for the reason that IFC had begun its non-public well being care push into Africa, however a report by the World Financial institution’s impartial analysis group discovered there was nonetheless “restricted proof” that the IFC’s well being care investments had benefited the poor.

In the meantime, employees at Avenue Group hospitals have been more and more involved about their employers’ route since their buy by Abraaj. Dissatisfaction with wages and circumstances had led nurses and different employees to unionize. A petition reportedly signed by greater than 100 staff decried Avenue’s concentrate on revenue over affected person care: “Priorities have modified from provision of top of the range well being take care of an inexpensive value to 1 during which employees have been inspired to over take a look at, over prescribe and customarily overcharge our worthwhile sufferers to extend earnings.”

In April 2019, Abraaj’s founder, Arif Naqvi, was arrested in the UK on fraud expenses, together with the alleged misappropriation of roughly $100 million of the well being fund’s property. Shortly after, TPG, one of many world’s largest non-public fairness funds, took over Abraaj’s well being portfolio, together with its IFC-backed investments in Kenya, renamed it the Evercare Well being Fund, and wrapped it into its personal influence funding portfolio, the Rise Fund. (Naqvi is presently awaiting extradition to the USA to face trial. Naqvi has denied wrongdoing and couldn’t be reached for remark.)

On its new web site, in an echo of the Abraaj fund’s founding logic, Evercare said that its mission was “to construct a legacy of accessible, top quality, secure non-public healthcare for low and middle-income sufferers in rising markets.”

However by the top of 2020, the reference to low- and middle-income sufferers had disappeared. (In an announcement to ICIJ, the corporate stated that it “continues to concentrate on entry to top quality take care of sufferers throughout the socio-economic spectrum, significantly in underserved markets.”)

That very same 12 months, native media reported on leaked messages from a WhatsApp group made up of Nairobi Girls’s staff. The messages, from earlier than TPG took over, confirmed the CEO of Nairobi Girls’s on the time, Felix Wanjala, pushing medical doctors to fulfill each day admissions targets and apparently urging them to increase sufferers’ hospital stays. Progress updates posted to the group included a class for “discharge-ins.”

In an e mail to the hospital group’s board after the leak, Wanjala denied accusations that he was attempting to boost income unfairly. However he wrote that, underneath TPG, the necessity to enhance returns was solely rising extra pressing: Income have been the “primary challenge that all of our administrators keep watch over,” he wrote, including, “we hardly ever focus on affected person care in our conferences — [it’s] a aspect challenge.” TPG, he stated, “desires EBITDA X3 in three years,” utilizing an abbreviation for a standard measure of profitability.

Two days later, Nairobi Girls’s introduced that Wanjala would step other than his publish. As an alternative, a three-person committee from TPG’s Evercare would lead the hospital group and report back to the board.

The Kenya Medical Practitioners and Dentists Council subsequently admonished the corporate’s administration for overruling medical doctors’ selections to medically discharge sufferers. However, the council famous, it had seen no proof of overcharging for providers. In response to questions from ICIJ, Evercare wrote that after the leak, the board of Nairobi Girls’s employed an outdoor agency to suggest methods to enhance affected person care and established higher reporting and monitoring of admissions and discharges.

Chatting with ICIJ, Wanjala stated that the WhatsApp messages have been taken out of context and that there was no proof that sufferers had been overcharged. Moreover, he stated that in his time as CEO, Nairobi Girls’s by no means obtained particular revenue targets from buyers and that his e mail was solely with regard to preliminary conversations he had had with TPG.

For some executives at Evercare and Avenue Group, the scandal confirmed long-held suspicions about Nairobi Girls’s. For years, fund managers had seen it as essentially the most profitable of the IFC-backed hospital companies in Kenya, an instance for the others to emulate, based on 4 former executives at Avenue Group and Evercare.

However few buyers questioned how the enterprise achieved its outcomes. The concentrate on “financials and nothing else” had stopped buyers from seeing what was occurring proper in entrance of their eyes, a former Avenue Group govt stated. When a hospital is overly targeted on producing substantial returns, which means “there’s a affected person who’s struggling. There’s a affected person who’s dropping by way of both dropping high quality of life [or] high quality of care.”

In 2023, Evercare offered Nairobi Girls’s again to its founder, ending IFC’s involvement with the chain. However Nairobi Girls’s by no means absolutely recovered from the WhatsApp leak about affected person discharges. Its Rongai department closed in October 2024, and staff throughout the corporate stop because it fell months behind on paychecks.

In a Fb publish addressing the state of affairs, Thenya, the Nairobi Girls’s founder, attributed the shortfall to delayed funds from government-run medical insurance plans. Nairobi Girls’s efficiency is enhancing, he instructed ICIJ.

New scandals — and a brand new route

In summer time of 2020 after the WhatsApp leak, as COVID-19 unfold, the IFC launched an initiative to advertise moral rules within the non-public well being sector.

A information to the initiative supplied examples of unethical practices, together with “incarcerating sufferers for non-payment,” in what gave the impression to be the primary public acknowledgement by an IFC-affiliated group of the widespread follow of holding sufferers with unpaid payments.

The IFC inspired non-public well being care buyers and suppliers to decide to a set of 10 moral rules, together with one calling on hospitals to deal “humanely” with sufferers unable to pay their payments. However there was no built-in enforcement: Organizations that pledged their dedication to those requirements wouldn’t be held accountable to them.

As an example: One of many ethics initiative’s founding signatories, Hospital Holdings Funding (HHI), managed a Ugandan hospital that in 2021 drew nationwide condemnation after it reportedly refused to launch the physique of a health care provider who had died of COVID-19. In 2019, the IFC had supplied $27 million in financing to the enterprise — together with a $22 million fairness funding that made it one of many firm’s largest shareholders — pledging to “make sure that the Firm adheres to excessive environmental, security and social requirements.” A 2018 proposal for the enterprise instructed potential buyers that they might anticipate a “minimal” 25% return over a five-year interval, based on paperwork reviewed by ICIJ.

In an announcement to ICIJ, the Funding Fund for Well being in Africa (IFHA), the non-public fairness fund managing HHI, wrote that the case of the detained physician’s physique occurred on the peak of the pandemic when well being care suppliers globally have been strained, that it has since strengthened care and that it “has insurance policies in place to keep away from detention of sufferers or corpses over unpaid medical payments.” It additionally stated that ICIJ’s e mail asking about IFHA’s operations contained “a number of statements that are incorrect and brought out of context,” however didn’t present examples.

Evercare signed on to the ethics pledge in September 2021. However at some hospitals in its portfolio, strain from administration to extend income in ways in which may run afoul of that pledge was nonetheless current, based on folks acquainted with the state of affairs and paperwork reviewed by ICIJ. In a gathering with representatives from TPG in early 2021, Avenue Group’s chief working officer accused the medical group’s then CEO of instructing medical doctors “to contravene medical coverage and ethics by referring sufferers for admission to therapy who don’t match that medical standards,” based on a witness assertion submitted to the Kenyan Excessive Court docket in relation to a labor dispute.

The witness additionally claimed that employees repeatedly raised considerations by means of an employer-provided whistleblower platform. Avenue Group’s board, Evercare and TPG ignored them and even took disciplinary actions in opposition to “those that oppose unethical or unlawful directions,” the particular person wrote within the assertion.

Evercare instructed ICIJ that it had carried out an intensive investigation in response to the allegations and located “no proof or indications of misconduct.”

In early 2024, managers at Avenue Group’s hospital in Parklands instructed medical officers that they might be evaluated partly on their skill to “enhance income.” Targets included assembly a median “ticket value” per affected person, performing lab work on 78% of sufferers, and sending 85% of sufferers to radiology, based on a doc reviewed by ICIJ.

In its assertion, Evercare stated that the medical doctors “should not evaluated primarily based on income technology or industrial targets however solely on high quality affected person care, medical security, and adherence to internationally accepted evidence-based medication tips.”

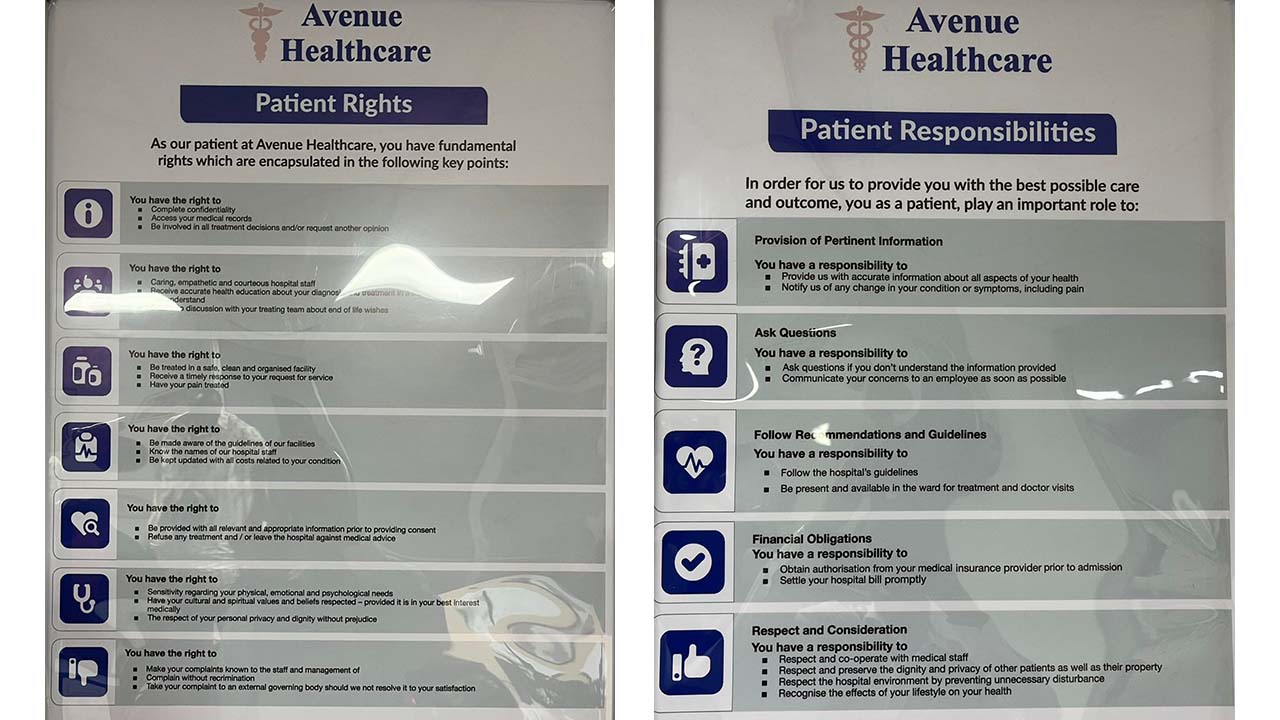

At the moment, Avenue’s hospitals show indicators telling sufferers that they’re free to depart in opposition to medical recommendation, but in addition that they’ve an obligation to settle money owed: Discharge and monetary consent insurance policies, final up to date in September 2024, don’t point out detention or how employees ought to deal with sufferers who can not pay their payments.

Former and present Avenue Group employees interviewed by ICIJ proceed to query its route. Whereas there was large settlement that well being care assets had benefited from the investments by the IFC, virtually all felt sufferers had been ill-served by the basic misalignment between the objectives of personal fairness and the objectives of well being care suppliers. The hospitals present high-quality care, one former govt instructed ICIJ. However, he added, if receiving therapy means “you’re in debt for the remainder of your life, what’s the purpose?”

Left with ‘lower than nothing’

Lately, regardless of court docket circumstances and information protection, IFC-backed hospitals have continued to place sufferers in monetary misery. (A brand new nationwide medical insurance program launched final 12 months in Kenya has aimed to make well being care extra accessible.) ICIJ discovered dozens of posts on social media and the fundraising website GoFundMe, printed from 2020 to 2025, pleading for buddies, household and group members to contribute cash towards payments at Avenue Group and different IFC-backed hospitals. ICIJ spoke with 12 individuals who, since 2020, have obtained therapy at Avenue Group hospitals for themselves or members of the family solely to return underneath extreme monetary pressure.

Amongst them was Siamah Shabaan, who in March 2024 fell in poor health whereas pregnant and was taken to a public hospital in Kisumu. However medical doctors at authorities amenities nationwide have been on strike, so she was moved to an Avenue Group hospital. The hospital admitted her with no deposit, however her child died shortly after start. The household quickly took out a personal mortgage to pay a part of the child’s invoice.

Shabaan solely wanted a couple of days to get better from her sickness, she stated, however she remained within the hospital for nearly two weeks as her mom, Asha Salim, begged the village chief and native imam to every ship the hospital a letter explaining that the household had no cash. She hand-delivered them to the hospital to ask for leniency.

Not lengthy after, Shabaan returned to her dwelling in Muhoroni, the place she lives along with her mom in a shack with a tin roof and no electrical energy. When Shabaan was discharged, there have been two payments: round $1,200 for her and round $600 for her child, excess of she may pay. Even earlier than Shabaan was handled at an Avenue Group hospital, she and her household had practically nothing. Now they’ve much less, Shabaan stated. The hospital recurrently calls her mom, urging her to make funds towards the debt. The household says they’ve been instructed to pay any quantity, whilst little as 1,000 Kenyan shillings ($7.68). However her mom has no job, and the household can’t afford to.

Shabaan isn’t bitter concerning the state of affairs — she is grateful to the hospital for saving her life. She hopes to sometime have the assets to pay the invoice. She’s simply undecided how that may ever occur.

Within the meantime, the collectors that Shabaan’s mom turned to when her daughter was hospitalized have threatened to have her arrested, Shabaan stated throughout a go to with an ICIJ reporter. The ladies have been sitting on a pair of previous wood chairs, the one decorations of their practically empty dwelling. The chairs had belonged to her grandfather, Shabaan stated. Only a few days earlier than, the collectors had come to take them.

The household needed to plead with them to not, she stated. However she doesn’t understand how for much longer they are going to wait.

Contributors: Denise Ajiri, Jelena Cosic, Miguel Fiandor Gutiérrez, Karrie Kehoe, Delphine Reuter, David Rowell, Annys Shin, Joanna Robin, Kathleen Cahill, Davi Sherman (ICIJ), Hannah Levintova (Mom Jones), Frederic Musisi (Each day Monitor)

This story was printed in partnership with Mom Jones.