Whenever you share your factors and miles redemptions along with your family and friends, they’re going to doubtless ask to your recommendation on which bank card they need to get subsequent. In the event that they take your recommendation, you could possibly profit by sending them your referral hyperlink and incomes a bonus.

However what in case your pal or member of the family needs a enterprise card, and also you solely have private playing cards?

Nice information: You should still be capable to refer them. Nonetheless, since every issuer has its personal method of rewarding referrals, a number of various factors will decide whether or not you can earn a bonus.

Here is what that you must learn about incomes referral bonuses on each private and enterprise bank cards.

American Categorical

American Categorical is essentially the most versatile issuer for incomes referral bonuses from completely different playing cards. You possibly can earn a referral bonus when somebody will get a enterprise card out of your private referral hyperlink or vice versa.

Nonetheless, you and the individual you are referring have to take a number of steps to get the referral bonus with a distinct card.

First, log into your Amex account, click on “Rewards & Advantages” from the menu within the high left-hand nook, then choose “Refer a Buddy.”

You possibly can ship an e mail on to your pal or member of the family or copy and paste a referral hyperlink. Then, when your recipient opens the hyperlink, the pop-up window will point out the cardboard you used to refer them.

For instance, I might create a referral hyperlink for my Hilton Honors American Categorical Aspire Card. My pal would see the choice to use for any of the three Hilton Honors private playing cards.

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

They might click on “Enterprise Playing cards” on the left-hand aspect to see a referral supply for the enterprise model.

For cobranded playing cards just like the Hilton ones, you’ll be able to typically solely refer inside that card household.

Nonetheless, once I referred my pal utilizing my American Categorical® Gold Card hyperlink, they’d cobranded playing cards, cash-back and Membership Rewards playing cards to select from. If in case you have a card that earns Membership Rewards factors, utilizing its referral hyperlink will doubtless give your pal or member of the family essentially the most card choices.

The knowledge for the Hilton Aspire Amex card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Chase

Typically, Chase solely allows you to earn a referral bonus if you refer somebody to a card throughout the similar household because the one you have got.

For instance, when you have the Chase Freedom Flex®, you’ll be able to refer somebody for the Chase Freedom Limitless®. That you must be an Ink cardholder to refer somebody for one of many Ink Enterprise playing cards.

If in case you have a private cobranded card, just like the IHG One Rewards Traveler Credit score Card, you’ll be able to refer somebody to get any card inside that household. On this case, you’ll be able to refer somebody to the IHG One Rewards Premier Enterprise Credit score Card even in the event you solely have a private IHG card.

Associated: The very best Chase bank cards

Capital One

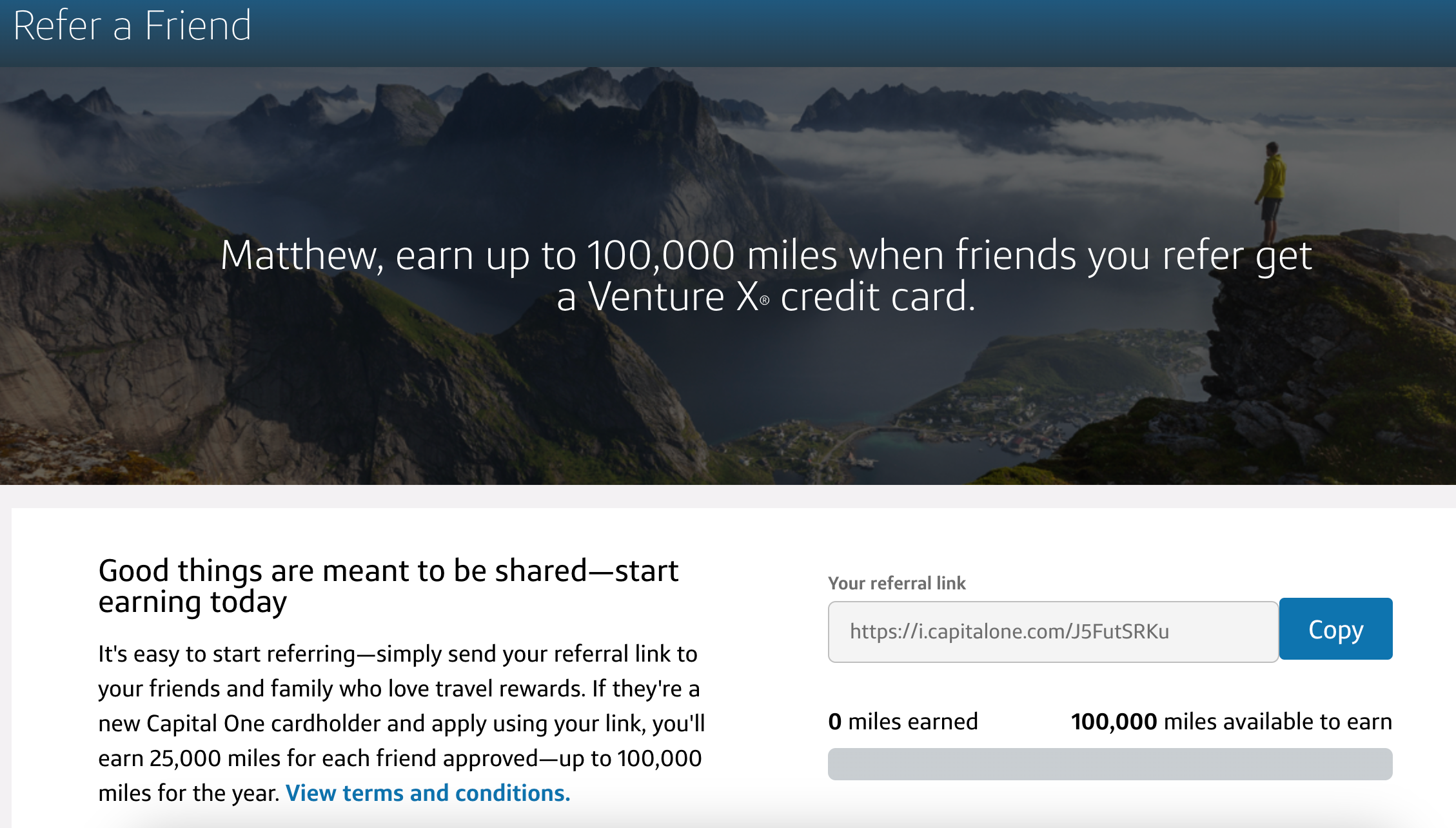

Capital One referral bonuses are extra restricted. They’re focused as a substitute of extensively obtainable, so you may have to test your account to see when you have a referral hyperlink you’ll be able to ship to a pal. If in case you have a hyperlink, your pal might want to navigate by means of it to see which playing cards can be found to them in your referral.

The constant limitation for Capital One referrals is that private bank card holders will solely be capable to refer private playing cards. It’s essential to have a Capital One enterprise account to refer somebody to a Capital One enterprise card.

Associated: Capital One Refer a Buddy: What that you must learn about this beneficiant program

Citi

Citi is way extra stingy with its referral presents than the opposite issuers listed right here. It presents referral bonuses, however they’re particularly focused. So, you are removed from assured to earn a referral bonus when you have a pal who needs a Citi card.

Backside line

Referring buddies or members of the family to one in all your favourite bank cards is a good way to share the world of factors and miles. Incomes a referral bonus makes sharing that data even sweeter.

Test your referral hyperlinks earlier than your pal or liked one applies for a brand new card. Should you can share one, it is a win for you each.

Associated: Refer companies to Capital One and earn as much as $1,500 per referral