Charles and Linda Stricker made 4 widespread however disastrous journey insurance coverage errors earlier than, throughout and after their final trip. These simply avoidable errors put almost $3,000 of the couple’s money in peril.

The Strickers’ issues started after they bought a complete journey insurance coverage coverage however uncared for to learn it. That oversight brought about a cascade of extra missteps after Linda was injured on the primary day of their journey, culminating in a whole denial of her journey insurance coverage declare.

Six months later, Charles was nonetheless indignant over the state of affairs. His spouse’s expertise had left him with the misunderstanding that journey insurance coverage is a waste of cash. He felt duped. So he shared his story with TPG and requested that we warn readers of “the travesty known as journey insurance coverage.”

Sadly, his skewed view of journey insurance coverage is not unusual. Nevertheless, most vacationers holding that opinion, together with Charles, have formulated it primarily based on unfavourable experiences created by their journey insurance coverage misunderstandings.

In the end, we could not grant Charles’s preliminary want, however we may do one thing significantly better. I will get to the excellent news in a second. However first, this is what it’s best to know in regards to the journey insurance coverage errors this couple made so you do not do the identical.

Journey insurance coverage mistake No. 1: Not studying or understanding the coverage

The Strickers started planning their Globus tour of Croatia almost one 12 months upfront, and so they bought a complete journey insurance coverage coverage from Tin Leg to guard themselves.

With airfare included, the price of the 10-night journey was just below $12,000. The Tin Leg Gold journey insurance coverage coverage value the couple an extra $1,024.

Tin Leg Gold features a free 14-day lookover interval.

Clients are inspired to make use of that point to rigorously overview the journey insurance coverage coverage to make sure they perceive it. It’s essential to notice what the coverage does and does not cowl and the best way to entry the advantages. If the shopper determines the coverage does not meet their wants earlier than the tip of the lookover interval, it’s absolutely refundable.

Reward your inbox with the TPG Each day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Sadly, the Strickers, like many vacationers, did not learn via their journey insurance coverage coverage through the lookover interval. Months after Tin Leg denied Linda’s declare, the Strickers had been nonetheless unfamiliar with many facets of their coverage.

“After I bought Tin Leg Gold, I used to be assured that we had full safety for our journey,” Charles advised me. “I additionally did not suppose we might even want it.”

He was right on the primary level. The Tin Leg Gold coverage is a complete plan that gives as much as $500,000 in medical and evacuation protection, amongst different advantages.

However the couple did not get far on this journey earlier than Charles was confirmed very fallacious on his second level. Linda would want that journey insurance coverage coverage.

Journey insurance coverage mistake No. 2: Not calling Tin Leg for steering

Just a few days earlier than the land portion of their Globus tour started, the couple flew from Phoenix to Zagreb, Croatia.

Sadly, the Strickers confronted issues virtually instantly.

“There have been a number of delays after which an additional leg was added to our itinerary en route,” Charles recalled. “On the third a part of our journey, Linda collapsed as she got here out of the toilet.”

Charles scooped up his spouse and guided her again to her seat. Once they landed in Zagreb, they headed to an emergency care facility.

Within the translated medical notes that Charles shared with me, the physician who examined Linda noticed that she was experiencing intense again ache. He prescribed muscle relaxants and suggested mattress relaxation. He additionally really useful that if the ache endured or worsened, she ought to go to an emergency orthopedic physician.

The Strickers obtained a duplicate of the physician’s notes and a receipt and returned to their resort.

The following day, the couple had a call to make. The bus tour of Croatia was about to start, and Linda’s ache had not subsided.

“The very last thing she wished to do was sit for hours on a bus,” Charles defined. “We determined she ought to fly residence to see our physician.”

They made that call with out involving Tin Leg. That was a mistake.

Journey insurance coverage mistake No. 3: Not asking for coated bills or advantages

Like most journey insurance coverage suppliers, Tin Leg presents an simply reachable 24-hour helpline for patrons needing help. When a traveler must return residence due to an harm or sickness, Tin Leg brokers could make flight preparations and even embody a medical escort, if a physician deems it vital.

Sadly for Linda, the couple did not name Tin Leg or contain the corporate of their decision-making. That made her journey residence unnecessarily sophisticated, uncomfortable and costly.

Nevertheless, as a result of the Strickers had by no means learn their coverage, they had been unaware of the 24-hour helpline and the advantages out there to Linda.

Journey insurance coverage mistake No. 4: Asking for issues the coverage does not cowl

Linda flew residence from Zagreb independently, arranging for a wheelchair at every cease. Charles continued with the tour of Croatia.

“As a physician, I used to be assured that when Linda acquired residence, she would get competent therapy,” Charles advised me. “I continued with the journey to attenuate our loss.”

When Linda lastly arrived again in Arizona, she headed to Pressing Care. The physician despatched her residence with suggestions much like these she had obtained in Zagreb. After a couple of week of mattress relaxation, Linda was again to regular, and Charles quickly returned.

Collectively, they gathered all of the documentation they wanted to file their journey insurance coverage declare.

The couple requested for all the pieces they assumed could be coated by their journey insurance coverage coverage, together with:

- Gratuities for Linda’s wheelchair attendants at every airport

- Reimbursement for the missed Croatian tour

- Reimbursement for her medical analysis in Arizona

However inside weeks, the couple obtained the unhealthy information. Apart from a pay as you go Viator tour that the couple missed when Linda was on the emergency care facility in Zagreb, Tin Leg utterly denied her declare.

Within the denial, the adjuster defined that private suggestions or items made voluntarily to service suppliers would by no means be reimbursed by journey insurance coverage. Moreover, journey insurance coverage covers medical therapy throughout your journey, not after you arrive residence. As quickly as Linda left her tour and landed again in Arizona, her medical protection from Tin Leg terminated.

Nevertheless, the worst a part of the rejected declare was the $2,999 reimbursement request for the missed Croatian tour. That was denied as a result of nowhere within the medical report did the doctor particularly advocate that Linda not proceed on the tour.

Had the couple learn their coverage, they might have identified that earlier than Linda may press the eject button on the journey and qualify for reimbursement via Tin Leg, she wanted an official be aware from a medical physician deeming her unable to journey.

“So I paid $1,058 for a journey insurance coverage plan that supplied nothing,” Charles stated. “I had no concept that the doctor needed to advise her to discontinue the journey, as I’m positive this was hidden within the fantastic print of the various pages of the coverage.”

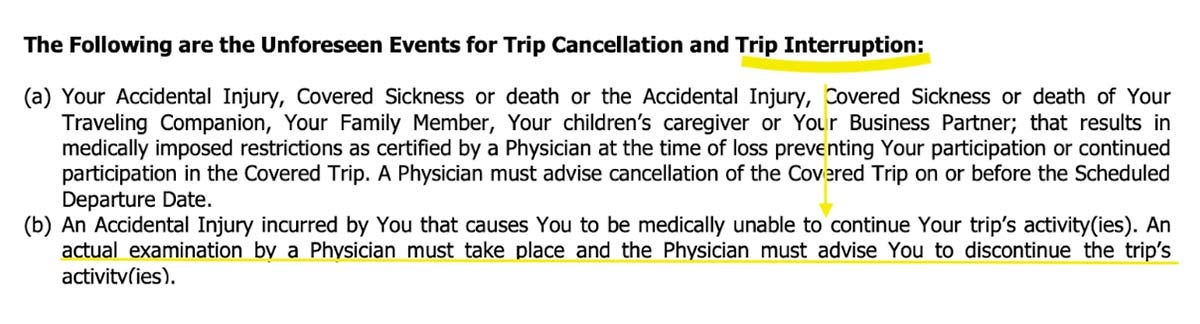

I defined to Charles that the clause isn’t hidden or in fantastic print. It’s a main a part of the Journey Interruption part. Each journey insurance coverage coverage lists the occasions coated (named perils) and beneath what circumstances these occasions are coated.

Right here is the clause within the Strickers’ coverage that they wanted to familiarize themselves with earlier than Linda returned to the U.S.

Charles predicted that the physician in Croatia would not have given this advice even when they’d requested it. Nevertheless, I think he would have carried out simply that if Linda returned the subsequent day with the identical painful signs. It appeared that the physician had already implied that Linda wasn’t appropriate for touring when he really useful mattress relaxation.

The excellent news

Though Charles had solely contacted TPG to boost consciousness of his spouse’s terrible expertise and warn others, I hoped we may do one thing completely different for the couple.

The physician in Croatia did primarily advocate that Linda not proceed her travels. In any case, it is robust to take part in a strolling and bus tour when your physician says try to be in mattress resting and taking heavy treatment.

So, six months after Linda and Charles obtained their journey insurance coverage denial from Tin Leg, I contacted Squaremouth, its mum or dad firm, with my concept.

The excellent news for the Strickers is that not all journey insurance coverage errors are irreversible. Even when a traveler does not ask for steering from TPG, there are different choices to pursue:

In the end, Squaremouth and the underwriter of the couple’s Tin Leg coverage, Starr Indemnity Insurance coverage Firm, agreed with my concept. The Strickers’ declare was reevaluated and accredited for the tour reimbursement: $2,999.

The couple is thrilled, and one factor is for positive: They may go over their subsequent journey insurance coverage coverage with a fine-tooth comb. Charles recommends you do the identical.

Backside line

Vacationers should at all times overview their journey insurance coverage insurance policies rigorously. A complete journey insurance coverage coverage can present many advantages, however in the event you do not acquaint your self together with your coverage, you will not know. Be sure you perceive:

- What is roofed (named perils)

- What is not coated (exclusions)

- The protection limits (financial)

- Underneath what circumstances are you coated

- The steps you need to take to efficiently file a declare (take cautious be aware of the submitting deadline)

Journey insurance coverage is barely a “travesty” in the event you do not take the time to learn via your coverage and be sure you perceive it.

When you have an issue together with your journey insurance coverage firm and also you’re unable to succeed in a good decision regardless of your greatest efforts, ship your request for assist to ombudsman@thepointsguy.com, and I will be completely happy to overview your case and assist you, too, if I can.