The annual “iPhone day” has come and gone.

Apple on Friday launched the most recent era of its hottest gadgets: the iPhone 16 household, Watch Sequence 10 and AirPods. The brand new fashions hit retailer cabinets Sept. 20, and because it at all times appears to do, the tech big introduced a lot of hype to the launch.

At its Fifth Avenue flagship retailer in New York, Apple’s high brass, together with CEO Tim Prepare dinner, greeted excited clients, lots of whom waited hours in line to be the primary to get their fingers on these new gadgets.

One govt, Deirdre O’Brien, Apple’s senior vice chairman of retail, was particularly excited on Friday.

“We stay for at present, we actually do. And you’ll simply really feel the power, and it is arduous to sleep the evening earlier than,” she instructed TPG in an unique interview on launch day. (She slept about 4 hours on Thursday evening, she instructed TPG.)

Preorders for the brand new gadgets started Friday, Sept. 13, only a few days after the corporate’s particular keynote occasion, throughout which the tech big unveiled its newest merchandise, together with a brand-new mannequin of AirPods.

From upgrades to the cameras, battery and sturdiness to noise cancellation within the entry-level AirPods, the most recent gadgets will possible attraction to many shoppers, particularly those that are at all times on the street.

And when you’re occupied with splurging for some new tech, O’Brien shared some ideas for maximizing the expense. This is every little thing it’s essential to know.

Making the acquisition

When it is time to purchase a brand new Apple system, O’Brien says no retailer is healthier outfitted than Apple’s proprietary retail shops.

Every day Publication

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Apple workers know all of the ins and outs of the brand new merchandise, and it is that “connection” and “capability to teach our clients” that makes the shopping for expertise higher, she mentioned. O’Brien highlighted that the shops provide an end-to-end expertise that she believes is healthier than what’s supplied by third-party resellers.

Apple retailer workers (or specialists, as they’re known as) will reply questions, arrange your system (together with activating your cell service) and even provide useful ideas and methods at what the corporate manufacturers “At the moment at Apple” classes.

Since iPhone demand often appears to outstrip provide when a brand new product rolls out, O’Brien suggests clients can tip the chances of their favor by monitoring on-line availability for his or her most popular gadgets after which place an in-store pickup to order the system they need.

After all, many different shops promote Apple tech; as an illustration, you may decide up an iPhone from the provider of your alternative (AT&T, Verizon or T-Cell) or by third-party distributors corresponding to Finest Purchase and Walmart.

Generally, shopping for an iPhone by a 3rd celebration generally is a higher deal than going immediately by Apple, particularly throughout limited-time promotions, so you will need to examine your choices earlier than pulling the set off.

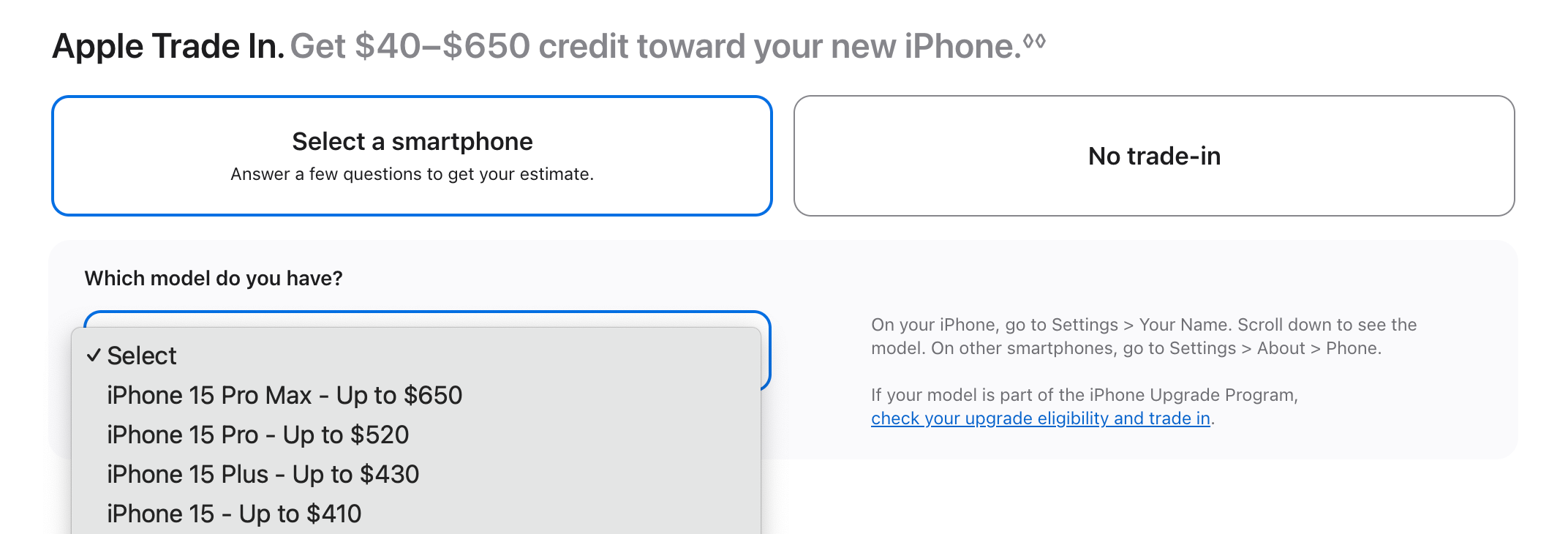

Commerce-in choices

The brand new iPhones definitely aren’t low-cost, and O’Brien’s high tip for making the acquisition way more reasonably priced is to commerce in your present system.

“Primary, you’ve got bought that worth,” O’Brien mentioned of the Apple Commerce-In program, which recycles used telephones. “Quantity two, it is nice for the setting, and the setting is such a key worth of ours at Apple.”

You probably have any spare gadgets mendacity round, Apple will give you credit score (or a present card) towards the acquisition of a brand new cellphone. Credit vary from $40 for the iPhone 7 Plus (2016) to as a lot as $650 when you hand over final 12 months’s iPhone 15 Professional Max.

You will have to make your buy immediately by Apple to benefit from this explicit trade-in provide, although some third-party sellers have related promotions out there.

After all, you will at all times need to learn the phrases and situations of any trade-in presents.

Buying portal bonuses

Whereas O’Brien shared some ideas, there are different issues to think about when shopping for new gadgets to maximise your worth.

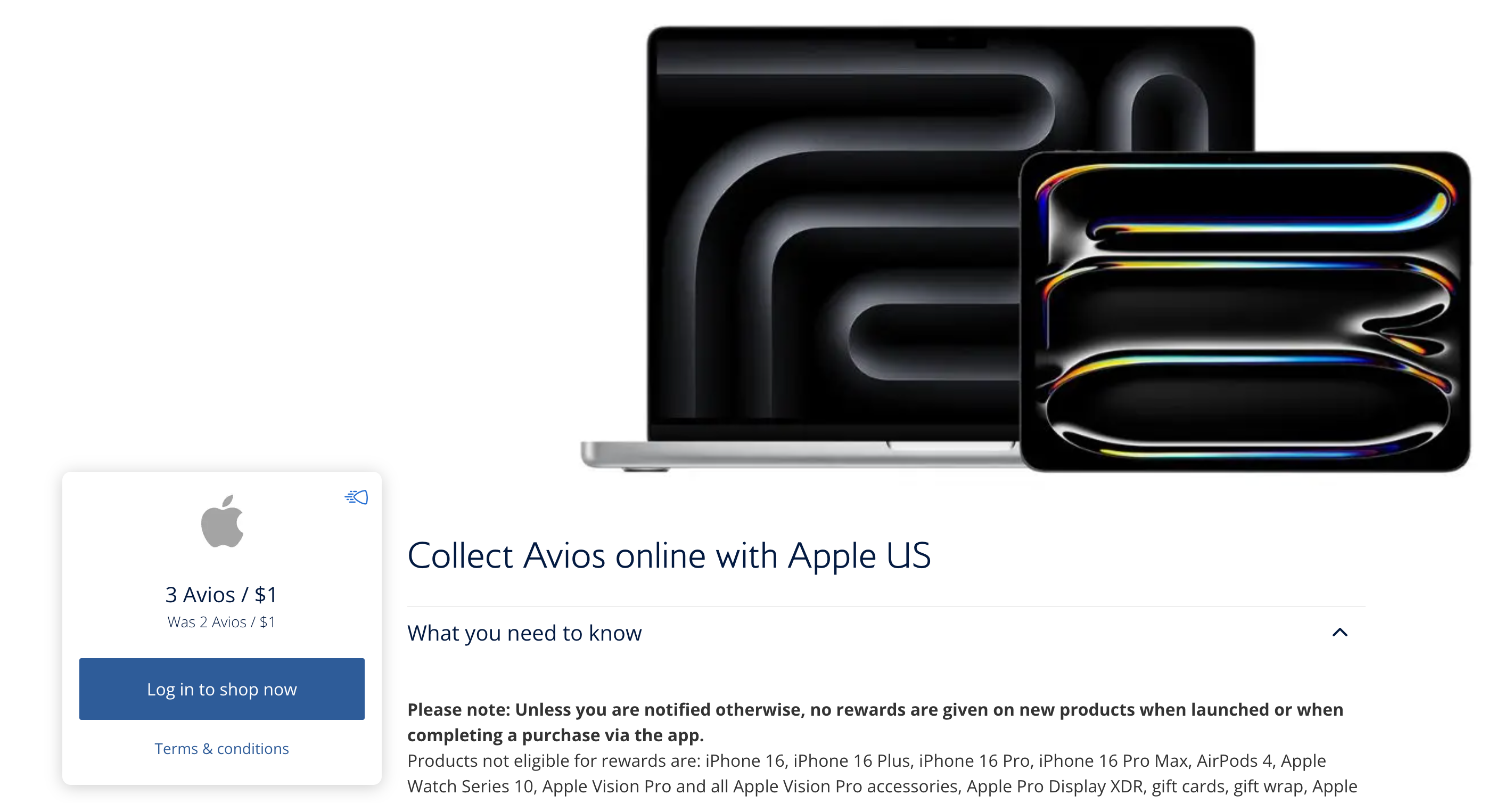

For one, examine for procuring portal bonuses. Should you begin your procuring journey at one among these portals, you will nonetheless be redirected to purchase the system immediately from Apple, however you will earn extra factors or miles. Some gadgets are restricted from portal bonuses proper after launch, although that is definitely one thing to search for when you determine to make your buy at a later date.

I would suggest utilizing a procuring portal aggregator like Cashback Monitor to simply determine the most important return.

Which playing cards to make use of

The subsequent huge query is which bank card to make use of in your buy.

In O’Brien’s thoughts, that is the Apple Card.

“You possibly can at all times use an Apple Card, and there is a lot of nice options that include the cardboard,” she mentioned.

The Apple Card is not the worst choice since you may benefit from an interest-free month-to-month installment plan and earn 3% again if you are going to buy immediately by Apple. The data for the Apple Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Nevertheless it’s not essentially your finest decide to maximise rewards and prolonged guarantee protection.

Traditionally, I’ve made my Apple purchases with The Platinum Card® from American Categorical. Although you will earn simply 1 American Categorical Membership Rewards level (which is value 2 cents, in response to TPG’s September 2024 valuations) per greenback spent, the cardboard’s included buy safety is a superb insurance coverage coverage if I find yourself breaking or shedding my iPhone.

Plus, Amex presents ongoing cellphone safety with the Platinum Card, making this card my high decide for iPhone purchases.

In the end, given the excessive price of Apple’s newest gadgets, I would concentrate on playing cards that provide buy safety and prolonged guarantee advantages relatively than people who provide the best return. Different high purchase-protection picks embody:

| Card | Most protection quantity (per merchandise or declare) |

Most protection quantity (per card or account) | Protection period (days) | Incomes charge on Apple purchases | Annual payment |

|---|---|---|---|---|---|

| American Categorical® Gold Card* | $10,000 per merchandise (or $500 per occasion for pure disasters) | $50,000 per card, per calendar 12 months | 90 | 1 Membership Rewards level per greenback | $325 (see charges and charges) |

| Capital One Enterprise X Rewards Credit score Card | $10,000 per declare | $50,000 per account | 90 | 2 Capital One miles per greenback | $395 |

| Ink Enterprise Money® Credit score Card | $10,000 per declare | $50,000 per account | 120 | 1% money again | $0 |

| Blue Money On a regular basis® Card from American Categorical* | $1,000 per merchandise (or $500 per occasion for pure disasters) | $50,000 per card, per 12 months | 90 | 3% money again on U.S. on-line retail purchases, on as much as $6,000 in purchases per 12 months (then 1%) | $0 annual payment (see charges and charges). |

| Chase Freedom Flex® | $500 per declare | $50,000 per account | 120 | 1% money again | $0 |

* Eligibility and profit ranges fluctuate by card. Phrases, situations, and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Defend your funding

Apple and different third-party retailers promote AppleCare+ and different proprietary warranties. These may very well be value contemplating, particularly for unintentional injury on non-iPhone gadgets, however savvy spenders who’ve the suitable bank card could also be lined for injury to their iPhones.

As of late, a few of our high really helpful bank cards additionally provide ongoing cellphone safety, so long as you pay your provider invoice with an eligible card that gives loss and injury safety. That in and of itself may cowl an annual payment if you find yourself damaging your system.

Personally, I would suggest utilizing both the Amex Platinum, the Chase Freedom Flex or the Capital One Enterprise X, all of which supply each buy safety and cellphone safety advantages.

| Card | Protection/deductible | Notable exclusions | Incomes charge on cellphone invoice | Annual payment |

|---|---|---|---|---|

| Ink Enterprise Most well-liked® Credit score Card | As much as $1,000 per declare, with a most of three claims per 12-month interval (with a $100 deductible per declare) | Beauty injury that does not have an effect on the cellphone’s capability to operate; misplaced telephones | 3 Chase Final Rewards factors per greenback* | $95 |

| The Platinum Card from American Categorical** | As much as $800 per declare, with a most of two claims per 12-month interval (with a $50 deductible) | Beauty injury that does not have an effect on the cellphone’s capability to operate; misplaced telephones | 1 Amex Membership Rewards level per greenback | $695 (see charges and charges) |

| Chase Freedom Flex | As much as $800 per declare, with a most of two claims value $1,000 per 12-month interval (with a $50 deductible) | Beauty injury that does not have an effect on the cellphone’s capability to operate; misplaced telephones | 1 Chase Final Rewards level per greenback | $0 |

| Capital One Enterprise X Rewards Credit score Card | As much as $800 per declare, with a most of two claims value $1,600 per 12-month interval (with $50 deductible) | Beauty injury that does not have an effect on the cellphone’s capability to operate; misplaced telephones | 2 Capital One miles per greenback | $395 |

*Earn 3 Final Rewards factors per greenback on the primary $150,000 in mixed purchases every account anniversary 12 months within the classes of journey, transport purchases, web, cable and cellphone companies, and promoting purchases with social media websites and engines like google.

**Eligibility and profit ranges fluctuate by card. Phrases, situations and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by New Hampshire Insurance coverage Firm, an AIG Firm.

Assembly minimal spending

Lastly, one other consideration could be to time your splurge with the opening of a brand new card. This manner, you would be a lot nearer to assembly the minimal spending requirement to earn a big sign-up bonus. One in every of our high picks in the intervening time is the Chase Sapphire Most well-liked® Card, which is providing 60,000 bonus factors after you spend $4,000 on purchases within the first three months of account opening.

You will discover a full checklist of high presents right here. Simply observe that not all of those playing cards embody buy safety and prolonged guarantee perks, so when you’re seeking to prioritize protection over factors, check with the chart above.

Associated studying:

For charges and charges for the Amex Platinum Card, click on right here

For charges and charges for the Amex Gold Card, click on right here

For charges and charges for the Blue Money On a regular basis, click on right here