Since including switch companions to its journey rewards playing cards in 2018, Capital One has blossomed into a top quality transferable rewards program with greater than 15 airline and lodge companions. With the addition of extra switch companions and improved switch ratios, Capital One is an excellent worthwhile program.

On this information, we are going to share learn how to maximize the miles you have earned by redeeming your miles for flights or lodge stays by way of Capital One’s switch companions.

Associated: Do you have to switch Capital One miles to companions or redeem instantly for journey?

Learn how to earn Capital One miles

You may earn Capital One miles on 5 bank cards:

| Capital One Enterprise Rewards Credit score Card | $95 | Earn 75,000 bonus miles after spending $4,000 on purchases inside the first three months from account opening, plus a $250 Capital One Journey credit score to make use of within the first cardholder 12 months. | 2 miles per greenback spent on purchases, no overseas transaction charges and a International Entry/TSA PreCheck software charge credit score (as much as $120) |

|---|---|---|---|

| Capital One Enterprise X Rewards Credit score Card | $395 | 75,000 bonus miles after spending $4,000 on purchases inside the first three months from account opening. | 2 miles per greenback spent on purchases, $300 in annual credit towards bookings made by way of Capital One Journey, a International Entry/TSA PreCheck software charge credit score (as much as $120), no overseas transaction charges, prolonged guarantee safety, Capital One Lounge entry and 10,000 annual bonus miles |

| Capital One VentureOne Rewards Credit score Card | $0 | 20,000 bonus miles after spending $500 inside the first three months from account opening. | 1.25 miles per greenback spent on all purchases and no overseas transaction charges |

| Capital One Spark Miles for Enterprise | $0 introductory annual charge the primary 12 months, then $95 | 50,000 bonus miles after spending $4,500 on purchases inside the first three months of account opening | 2 miles per greenback spent on all purchases |

| Capital One Spark Miles Choose for Enterprise | $0 | 50,000 miles after you spend $4,500 on purchases inside the first three months of account opening | 1.5 miles per greenback spent on all purchases and free worker playing cards |

The data for the Capital One Spark Miles Choose for Enterprise has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Do you have to switch capital one miles to airline and lodge companions?

You have got two choices for redeeming your Capital One miles: for a set worth at 1 cent every or by transferring them to airline and lodge companions.

In case you aren’t within the temper to seek for award availability, you have discovered an awesome deal on money airfare or you’ll be able to’t use airline miles in your journey bills, redeem your Capital One miles at a set worth. The method is comparatively simple and would not require leaping by way of any hoops. Here is a step-by-step information to redeeming Capital One miles at a set worth.

Alternatively, transferring miles and redeeming them for associate redemptions can get you a greater worth than 1 cent apiece. That is very true if you switch to a associate that has retained fastened award charts, and you’ll pretty simply redeem 50,000 miles (for instance) for one thing price excess of $500.

In case you’re all for exploring this route, this is learn how to switch your Capital One miles to companions and e-book airline and lodge awards.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Associated: Learn how to determine when to make use of money or miles for getting airline tickets

Learn how to switch Capital One miles to airline and lodge companions

You will get extra worth out of your Capital One miles if you happen to use the issuer’s switch companions. Fortunately, the method of doing so is easy.

The Capital One Journey portal might be accessed instantly from the principle web page of your account by clicking the “View Rewards” button.

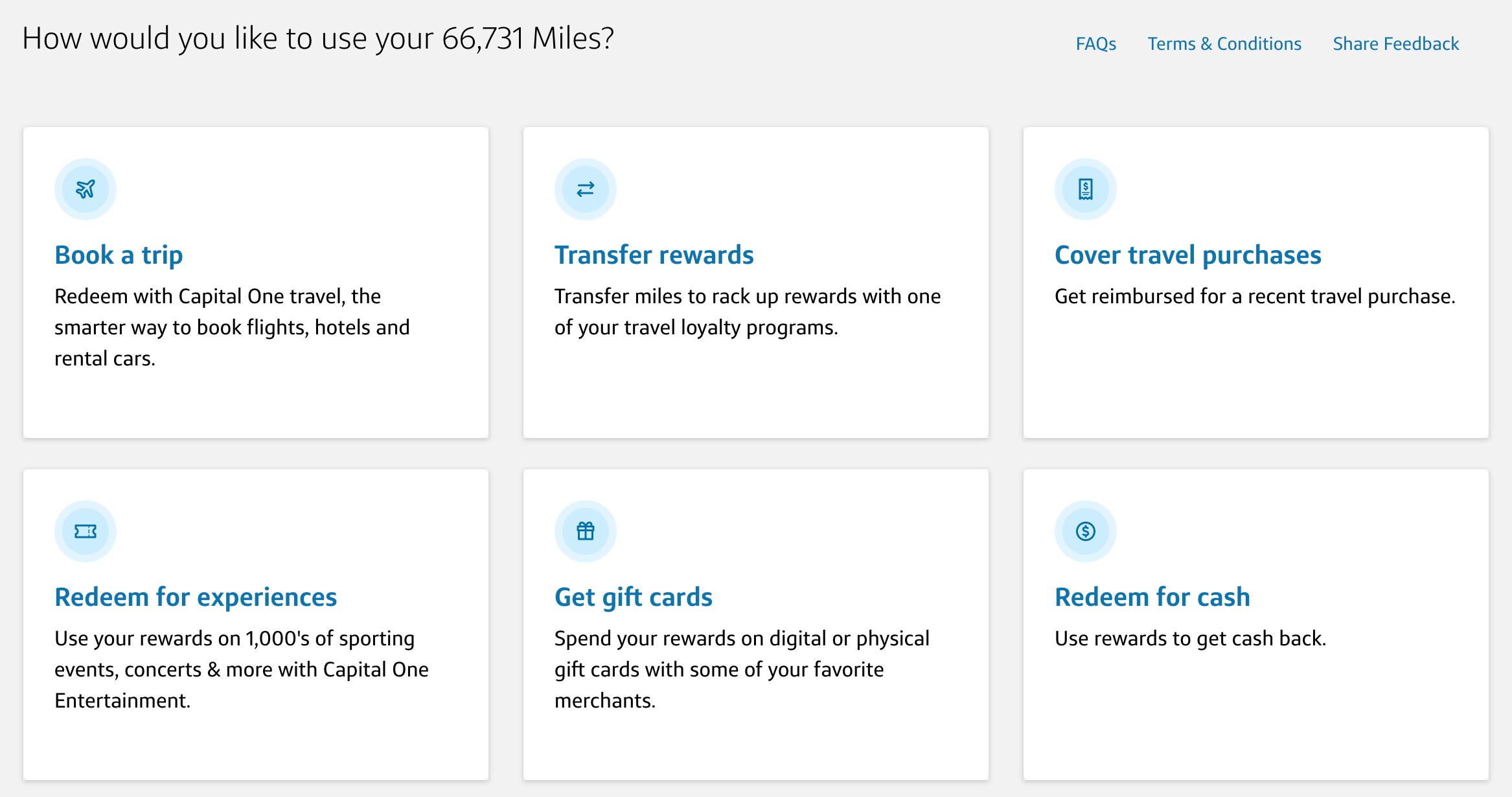

From there, discover the “Switch Rewards” part.

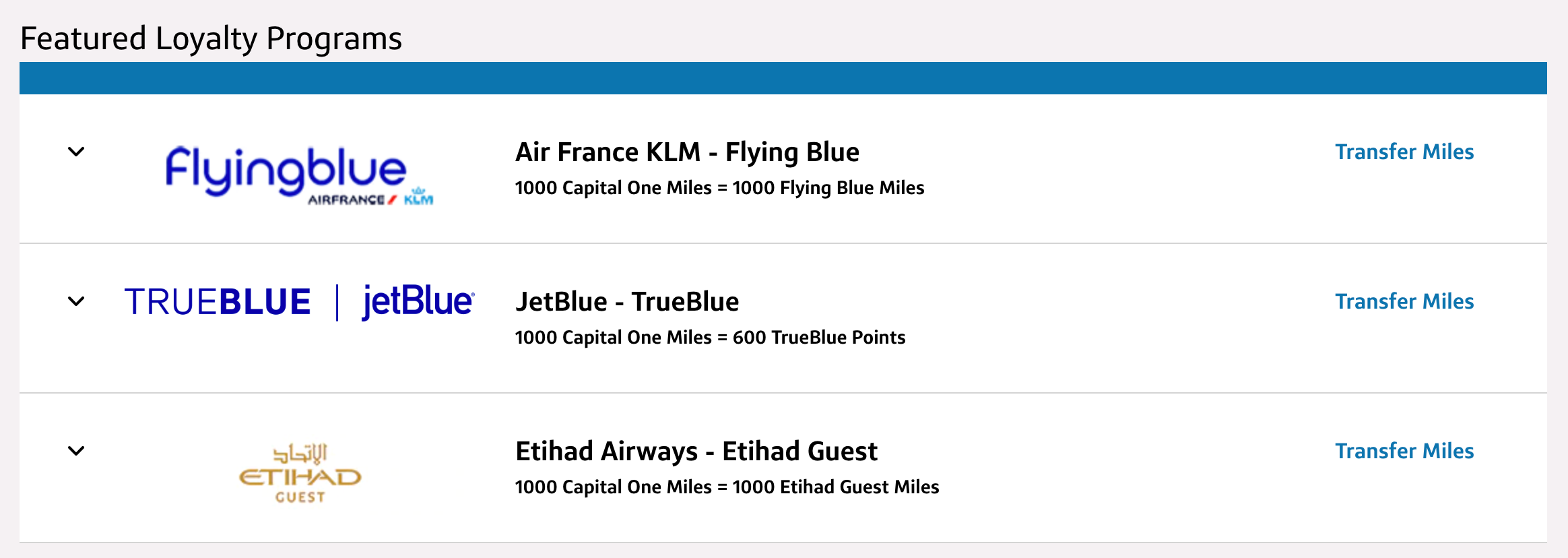

On the next web page, you will see Capital One’s airline and lodge companions. Any switch bonuses will seem within the “Featured Loyalty Packages” part on the high. Nonetheless, not all featured packages provide a bonus, as you’ll be able to see beneath.

Capital One at present has greater than 15 airline and lodge companions:

- Aeromexico Rewards

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Accor Dwell Limitless

- Avianca LifeMiles

- British Airways Government Membership

- Cathay Pacific Asia Miles

- Alternative Privileges

- Emirates Skywards

- Etihad Visitor

- EVA Airways Infinity MileageLands

- Finnair Plus

- JetBlue TrueBlue

- Miles&Smiles (Turkish Airways)

- Qantas Frequent Flyer

- Singapore Airways KrisFlyer

- TAP Miles&Go

- Virgin Crimson

- Wyndham Rewards

To begin the switch course of, click on “Switch Miles” to the suitable of your required airline or lodge associate. You may then be prompted to enter your loyalty quantity for that program and conform to the phrases earlier than selecting what number of miles you wish to switch.

As soon as the switch is full, you will see a “Success!” pop-up message with a affirmation code it can save you and/or print. That is useful, particularly since a couple of companions might not immediately switch.

Associated: Capital One re-adds JetBlue as switch associate

Issues to know earlier than you switch Capital One miles

Transfers are irreversible as quickly as they’re full, so make sure to enter the precise variety of miles you wish to switch.

The minimal variety of miles you’ll be able to switch is 1,000; from there, you’ll be able to improve the quantity in increments of 100. This can be a good characteristic that differs from different transferable currencies. For instance, transfers from Chase Final Rewards should be in increments of 1,000 factors. Capital One can thus be particularly helpful if it is advisable high off your account, although make sure to take note of the switch ratios.

Whereas Capital One miles switch to most companions at a 1:1 ratio, a couple of companions — Accor, EVA Airways and JetBlue — have a much less fascinating ratio. Happily, you will see this data through the switch course of, so you will know what number of factors or miles you will obtain in alternate for the designated variety of Capital One miles.

Here is a fast overview of switch ratios and occasions for every associate.

| Program | Switch ratio |

|---|---|

| Aeromexico Rewards | 1:1 (1,000 miles equals 1,000 Aeromexico Rewards factors) |

| Air Canada Aeroplan | 1:1 (1,000 miles equals 1,000 Aeroplan factors) |

| Air France-KLM Flying Blue | 1:1 (1,000 miles equals 1,000 Flying Blue miles) |

| Avianca LifeMiles | 1:1 (1,000 miles equals 1,000 LifeMiles) |

| Accor Dwell Limitless | 2:1 (1,000 miles equals 500 ALL factors) |

| British Airways Government Membership | 1:1 (1,000 miles equals 1,000 Avios) |

| Cathay Pacific Asia Miles | 1:1 (1,000 miles equals 1,000 Asia Miles) |

| Alternative Privileges | 1:1 (1,000 miles equals 1,000 Alternative Privileges factors) |

| Emirates Skywards | 1:1 (1,000 miles equals 1,000 Skywards miles) |

| Etihad Visitor | 1:1 (1,000 miles equals 1,000 Etihad Visitor miles) |

| EVA Airways Infinity MileageLands | 2:1.5 (1,000 miles equals 750 Infinity MileageLands miles) |

| Finnair Plus | 1:1 (1,000 miles equals 1,000 Finnair Plus Avios) |

| JetBlue TrueBlue | 5:3 (1,000 miles equals 600 JetBlue TrueBlue factors) |

| Miles&Smiles (Turkish Airways) | 1:1 (1,000 miles equals 1,000 Miles&Smiles miles) |

| Qantas Frequent Flyer | 1:1 (1,000 miles equals 1,000 Qantas Frequent Flyer factors) |

| Singapore Airways KrisFlyer | 1:1 (1,000 miles equals 1,000 KrisFlyer miles) |

| TAP Miles&Go | 1:1 (1,000 miles equals 1,000 Miles&Go miles) |

| Virgin Crimson | 1:1 (1,000 miles equals 1,000 Virgin factors; Virgin Crimson factors may also be redeemed by way of Virgin Atlantic Flying Membership) |

| Wyndham Rewards | 1:1 (1,000 miles equals 1,000 Wyndham Rewards factors) |

Be aware: Switch occasions might differ. Some TPG workers members have reported switch occasions of as much as two weeks for Accor.

Remember that the identify in your associate loyalty account should precisely match the identify in your Capital One account — in any other case, you could not be capable to switch miles. You may first have to replace your identify on one facet, which might decelerate the switch course of. Having a brand-new loyalty account also can decelerate the method, which is why we advocate registering for loyalty packages earlier than you determine to make a switch.

Transferring to companions can unlock quite a lot of worthwhile redemptions by way of the above airways and motels. Nonetheless, simply because you’ll be able to switch Capital One miles to companions doesn’t essentially imply it’s best to. We have collected some suggestions and methods to get most worth out of your Capital One miles that ought to enable you perceive the nice and dangerous redemptions.

Keep in mind, too, that we at all times recommend researching flight and lodge availability earlier than transferring your miles. As soon as the switch is full, you can not reverse it.

Associated: The very best time to use for these common Capital One bank cards based mostly on provide historical past

Backside line

The power to switch Capital One miles to many worthwhile associate packages paired with the always-available possibility to make use of your rewards instantly makes for a stable lineup of Capital One bank cards. That is why we worth Capital One miles at 1.85 cents apiece per our March 2025 valuations.

The truth that each the Enterprise and Enterprise X playing cards characteristic beneficiant welcome bonuses proper now will help you shortly amass these worthwhile miles in your subsequent journey.

For Capital One merchandise listed on this web page, a number of the advantages could also be offered by Visa® or Mastercard® and should differ by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.