A godson of King Charles labored intently with an American financier accused by the U.S. authorities of evading taxes on greater than $350 million in army contract earnings, in line with company paperwork.

Lord Charles Tryon held positions at numerous corporations tied to Douglas Edelman, a former protection contractor who was charged in Could on 30 counts of tax evasion, conspiracy, and offering false data to U.S. authorities. Tryon denied any involvement in Edelman’s alleged tax evasion, and prosecutors haven’t alleged wrongdoing on his half.

The Tryon household has been near King Charles for the reason that Seventies. The king as soon as described Lord Tryon’s mom, Australian-born Woman Dale “Kanga” Tryon, who died in 1997, as “the one lady who ever understood me.”

As an toddler, Charles Tryon, now a 48-year-old financier, appeared in a well-known picture of the king holding him at his christening. He turned the 4th Lord Tryon in 2018.

Edelman made a fortune from greater than $7 billion value of contracts with the U.S. army to provide forces in Afghanistan and the Center East with jet gasoline throughout the post-9/11 battle on terror, in line with the indictment.

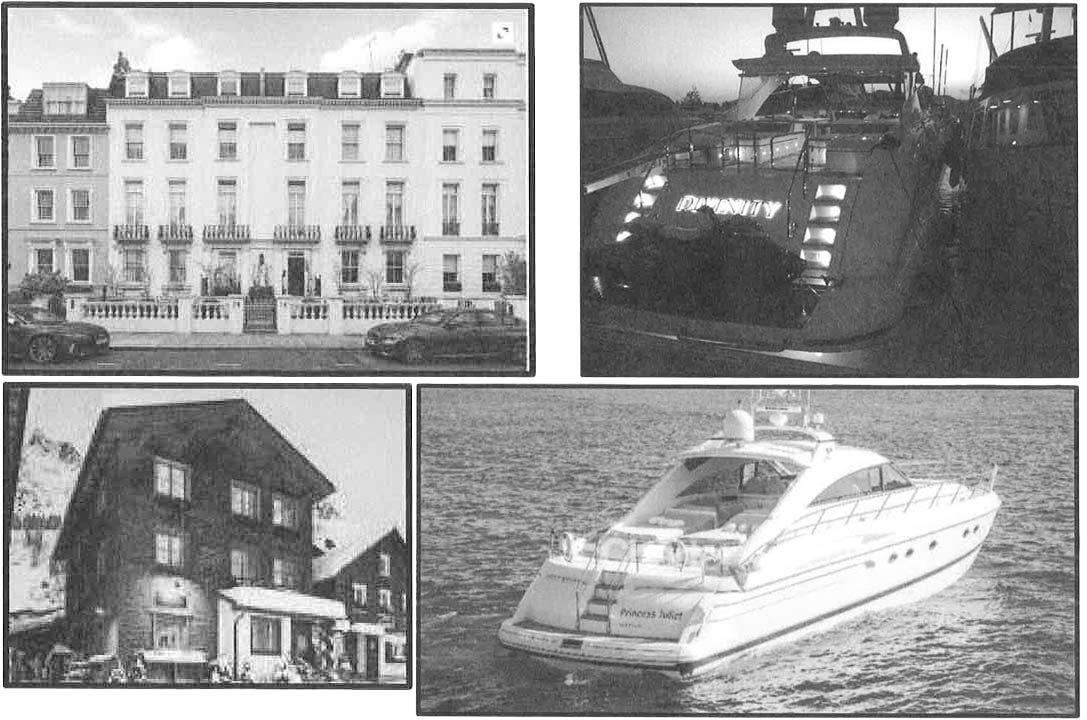

Prosecutors allege that Edelman used a number of offshore corporations as a part of an elaborate scheme to put property in his French spouse’s identify and thus evade tens of millions in U.S taxes. They declare that Edelman opened abroad financial institution accounts within the names of those corporations, which he used to buy a $43 million mansion within the upscale London neighborhood of Kensington, an Austrian ski chalet and a number of yachts. Edelman has pleaded not responsible to the fees.

Information obtained by the Worldwide Consortium of Investigative Journalists (ICIJ) from the Pandora Papers listing Tryon as a director of a type of corporations from 2009 to 2011 and as having energy of lawyer in reference to one other entity in 2009. One other enterprise that Tryon launched was, till 2014, registered to a London handle linked to Edelman’s companies; Tryon asserted that his agency took over the lease from Edelman’s corporations. Edelman additionally invested in a enterprise based by Tryon in South Sudan till 2017.

In response to questions on his involvement with Edelman, Tryon wrote that he labored in companies linked to the American financier from 2003 till mid-2008, and cut up from Edelman “on considerably acrimonious phrases” in early 2009. He strongly denied that he had any involvement in or data of Edelman’s alleged tax evasion, which the indictment alleges occurred from 2003 to 2020.

The information reviewed by ICIJ present Tryon’s involvement in Edelman’s corporations, however don’t element his actions on their behalf. Tryon will not be talked about within the indictment, and wrote that he has not been contacted by prosecutors in relation to the continuing case.

Edelman was arrested in Spain in July and extradited to the USA in September to face trial. Sen. Ron Wyden (D-OR), the chair of the Senate Finance Committee, has written that the fees in opposition to him “characterize one of many largest particular person tax evasion schemes in American historical past.”

Edelman declined to remark for this story.

Tryon is presently CEO of the Mauritius-based Maris Restricted, which he describes as an “Africa frontier market targeted enterprise capital fund.”

Maris Restricted’s web site stories that the corporate holds property of over $125 million, and that its investments embrace a equipment dealership in Angola, mining companies in Zimbabwe and a forestry enterprise in South Sudan.

Leaked paperwork reviewed by ICIJ present that, from 2009 to 2011, Tryon was a director of a British Virgin Islands-based firm known as Satellite tv for pc Assist Companies Restricted, which the U.S. indictment alleges was used to hide Edelman’s earnings. The indictment claims Edelman opened financial institution accounts in Singapore and the United Arab Emirates within the identify of the corporate, and in 2014 and 2015 used it to buy two yachts, “Divinity” and “Princess Juliet.”

Tryon initially wrote in an e mail that he didn’t function a director for Edelman’s companies, and subsequently wrote that he was stunned to study that he had been a director of Satellite tv for pc Assist Companies. He wrote that he couldn’t perceive why he had been made a director in April 2009, after he mentioned he cut up with Edelman, and served in that position till September 2011.

Paperwork additionally present Tryon as having been issued an influence of lawyer in October 2009 in reference to the Aspen Wind Company, one other entity the U.S. indictment alleges was a part of Edelman’s tax evasion scheme. Prosecutors declare that Edelman held a checking account at Credit score Suisse within the identify of the corporate, and that Edelman shifted its property to Singapore after the Swiss financial institution informed him in November 2008 that he would both must disclose the account to U.S. authorities or shut it. The property have been transferred earlier than Tryon held energy of lawyer on the firm.

Aspen Wind was described on information web site EurasiaNet as an “umbrella” group that held a variety of Afghanistan-based companies, together with an organization that bought Web providers in Afghanistan of which Tryon was CEO.

Tryon first wrote that he remembered being granted an influence of lawyer for Aspen Wind in order that he might signal an settlement with the Web providers supplier. He subsequently wrote that he didn’t know why he would have been granted an influence of lawyer a number of months after ending his enterprise relationship with Edelman.

Satellite tv for pc Assist Companies and Aspen Wind shared a London mailing handle with a U.Okay.-registered firm of which Tryon served as director, Maris Capital Advisors. Tryon wrote that Maris Capital Advisors took over the lease from Edelman’s companies at 20 Conduit Road, however that it was utterly unconnected to Edelman. Information reviewed by ICIJ present that Edelman’s companies used the constructing as their mailing handle till 2011, and U.Okay. company information present that Tryon’s Maris Capital Advisors listed 20 Conduit Road as its official handle till 2014.

Information reviewed by ICIJ present {that a} Panamanian legislation agency which supplied company providers to Edelman listed a equally named firm, Maris Capital Restricted, as a part of Edelman’s offshore company community. Tryon mentioned that this agency had been integrated by one in all his colleagues at his present enterprise, and that the formation agent unintentionally related it with Edelman’s companies. He mentioned the corporate didn’t conduct any enterprise and was faraway from the BVI company listing in 2021.

In a 2010 article he wrote for The Every day Telegraph, Tryon described working for a “small, extremely specialised enterprise capital firm” in Afghanistan.

He wrote: “Given our successes there and the worsening political and safety state of affairs, I used to be given a remit to look additional afield to Africa, which offered a brand new universe of alternatives.”

After Tryon left Edelman’s employment to launch his personal enterprise, they co-invested in two ventures in South Sudan. Tryon and Edelman’s corporations each held possession stakes in a billboard promoting firm, and a agency that managed cellular phone infrastructure within the nation.

Tryon wrote that these companies have been his personal initiatives and that neither Edelman nor his representatives have been concerned of their day-to-day operations. He wrote that he determined to shut the telecommunications agency in 2015 and that the billboard promoting firm was bought in 2017.

The Edelman case is the results of a serious worldwide collaboration involving the British tax authority and the IRS’s Joint Chiefs of World Tax Enforcement (J5), known as Operation Jetsetter.

The London property bought by Edelman, 14 Cottesmore Gardens, has a storied historical past. It was beforehand owned by each disgraced press baron Lord Conrad Black and the jailed Australian magnate Alan Bond.