Whether or not buying on-line or over the cellphone, you need to present your bank card info to course of the transaction. Aside from getting into a card quantity and an expiration date, you most likely should enter a safety code — a function on each bank card meant to assist confirm the cardboard is in your possession.

These three- or four-digit numbers present an extra layer of safety. Here’s what you want to find out about bank card safety codes and the best way to discover them by issuer.

What’s a bank card safety code?

A bank card safety code is a gaggle of digits that is distinctive to your card. Once you present your safety code to a retailer, alongside along with your bank card quantity and expiration date, the data is immediately despatched to the cardboard issuer for authentication. As soon as that’s accepted, your transaction will undergo. This whole course of takes just a few seconds.

Bank card safety codes additionally go by just a few different names:

- CVV: card verification worth

- CVV2: card verification worth 2 (Visa)

- CVC: card verification code (Mastercard)

- CVC2: card verification code 2 (Mastercard)

- CVD: card verification information (Uncover)

- CID: card identification (Uncover and American Specific)

- CSC: card safety code (American Specific)

The bank card safety code is a safeguard towards potential fraud and theft. If somebody have been capable of come up with your bank card quantity through skimming or different means, they’d be out of luck, as most web sites require a safety code to make a purchase order. Primarily, the code is designed to point the cardboard is in your possession on the time of buy.

Associated: 5 methods to guard your self from bank card skimmers

The place to search out the safety code by issuer

The size and placement of every bank card safety code rely in your issuer. Here’s a snapshot:

| Issuer | Safety Code Size | The place to Discover the Code | Frequent Names for Safety Codes |

|---|---|---|---|

| Visa | Three numbers | Again of the cardboard | CVV2 |

| Mastercard | Three numbers | Again of the cardboard | CVC and CVC2 |

| American Specific | 4 numbers | Entrance of the cardboard | CID quantity and CSC |

| Uncover | Three numbers | Again of the cardboard | CVD and CID quantity |

The safety code is three digits lengthy for Visa, Mastercard and Uncover playing cards. These issuers have the safety code on the again of your card, to the proper of the signature panel. Earlier than the code, you would possibly see half or your whole bank card account quantity.

Every day E-newsletter

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

For American Specific playing cards, the safety code is 4 digits in size. It seems on the entrance of your card, often to the higher proper of your card account quantity.

Associated: determine and stop bank card fraud

Why safety codes are vital

Past safety towards theft, card safety codes present one other operate: information breach safety. With so many breaches and hacks occurring lately, this can be a notably delicate matter.

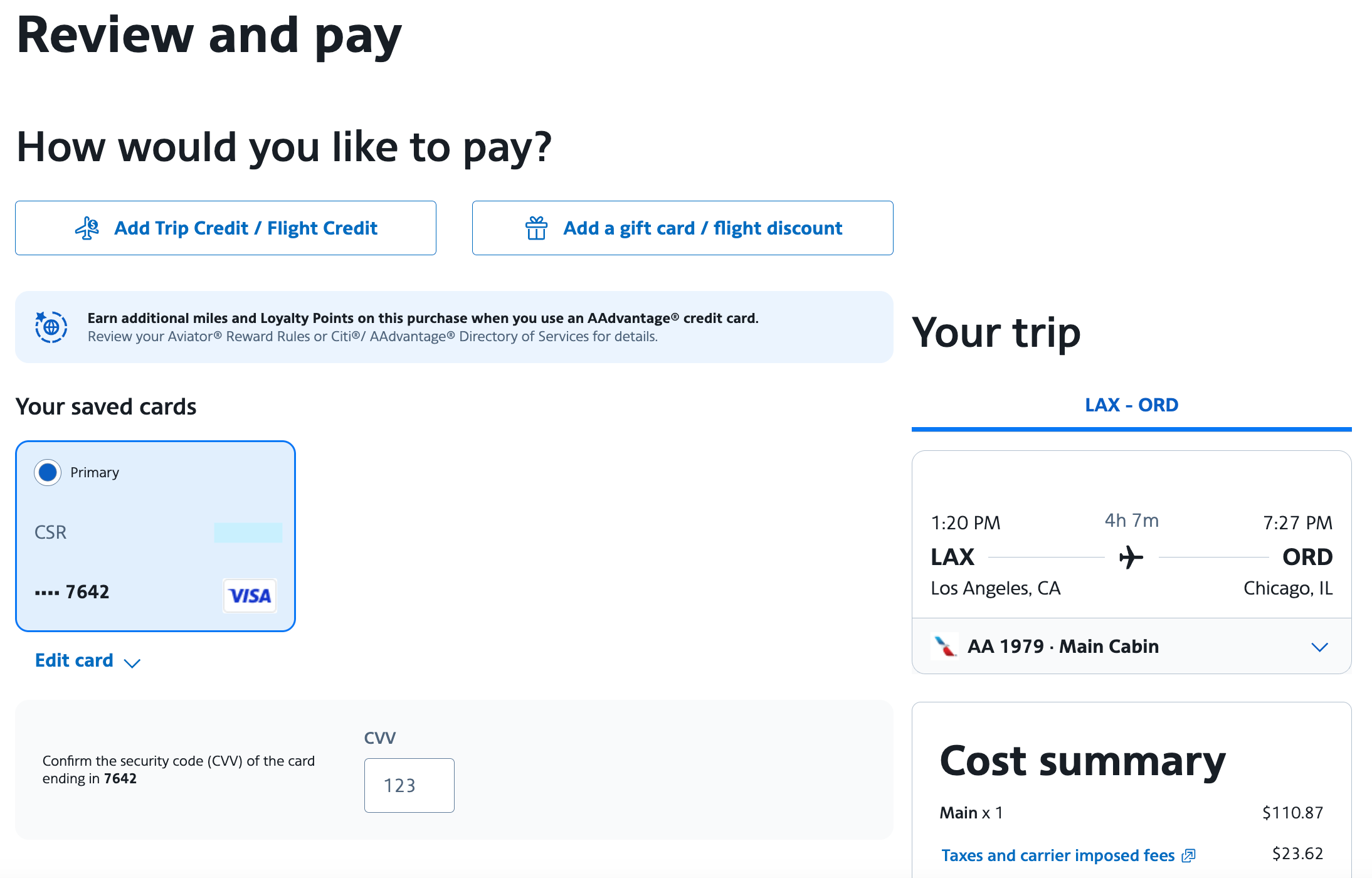

Whereas corporations might save your bank card quantity, business laws forestall them from storing your CVV code, which implies would-be hackers can not seize that information. That can also be why even in the event you request that an organization save your fee info for future purchases, you will have to enter your safety code at checkout every time.

These days, web browsers on our computer systems and telephones may also retailer bank card info, however while you do go to autofill your info for a purchase order, they, too, will ask for the CVV code for verification.

defend your safety code

Defending your bank card safety code is just like defending some other monetary or private info. A financial institution or different monetary establishment will nearly by no means ask you to your CVV code by e mail or over the cellphone. Delicate monetary info ought to be ideally despatched by means of safe channels solely. Which means you should not click on on hyperlinks or reply to emails that immediately ask you to confirm your account quantity and CVV code, as these are possible phishing scams.

Equally, a retailer might require you to offer a bank card safety code when making a purchase order. When buying on-line, enter your safety code on web sites you belief by searching for “https” within the handle bar or the safety lock image.

One of the best ways to identify bank card fraud is to observe your card account continuously for unfamiliar costs. It is best to test all through the month so you possibly can catch any unfamiliar costs rapidly. At a naked minimal, it is best to assessment the costs in your billing assertion each month earlier than paying your steadiness.

Backside line

Although bank cards have loads of safety safety, together with safety codes, it is vital to be aware of the place you are buying objects and to test your statements periodically. Safety codes are a safeguard for customers, and it is useful to know what and the place they’re if you want to share them.

Associated: How to decide on one of the best bank card for you