Chandigarh, August 22, 2024: A disturbing case has surfaced within the banking sector, as an officer from Indian Financial institution’s Sector 17B department in Chandigarh has been arrested for his alleged involvement in a cash laundering scheme. The officer, Mr. Avinash Kumar, who was liable for selling the opening of financial savings accounts by Tab Banking for migrant laborers, has been in judicial custody since August 13, 2024.

The police have reported that Mr. Kumar opened an account that was later utilized by fraudsters for illicit actions. Throughout their investigation, the arrested fraudsters revealed that that they had bribed Mr. Kumar to realize entry to account particulars, together with ATM playing cards, which had been subsequently used for cash laundering functions.

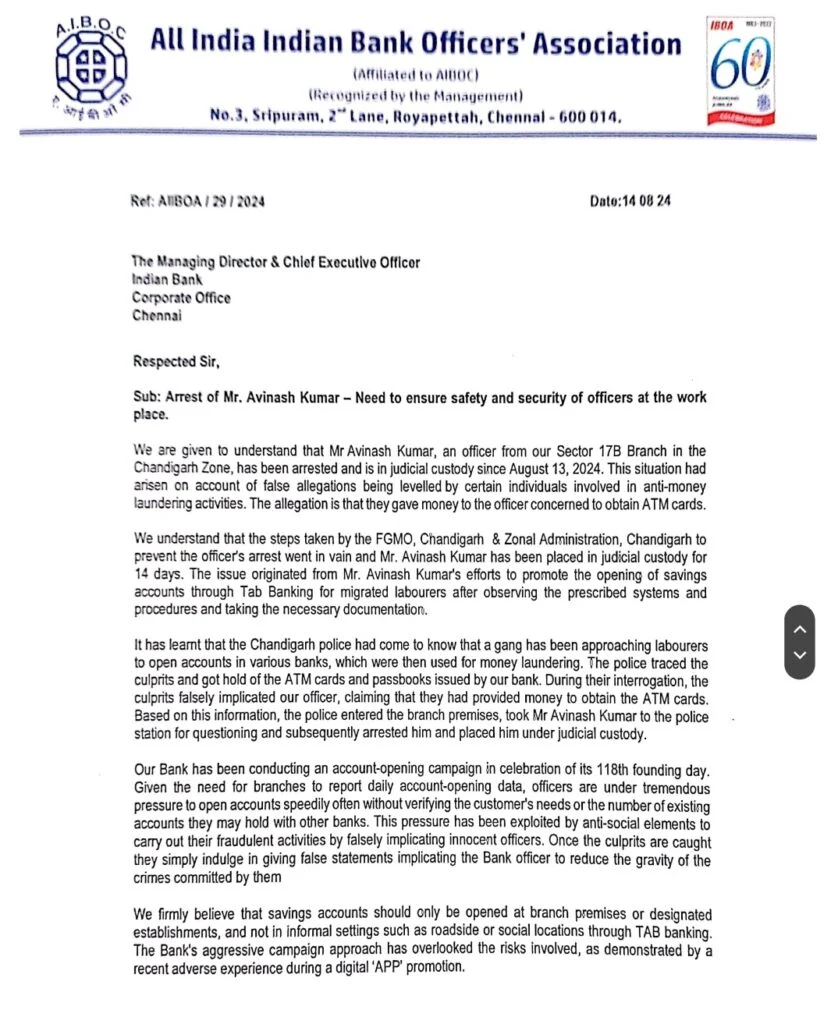

Mr. Avinash Kumar has been underneath judicial custody for the previous 14 days, and there was no help from the financial institution or different authorities. His colleagues and the All India Indian Financial institution Officers’ Affiliation (AIBOA) imagine that Mr. Kumar has been falsely implicated and that he was merely performing his duties as a financial institution officer. The AIBOA has urged the financial institution’s Managing Director & CEO to intervene within the matter and supply a decision that clears Mr. Kumar’s title.

Rising Menace of Cash Laundering By means of Banking Channels

This incident highlights a rising pattern the place financial institution workers are being unknowingly or forcefully dragged into fraudulent actions. The convenience of account opening by Tab Banking, significantly for marginalized communities, has opened up new vulnerabilities that fraudsters are more and more exploiting.

The involvement of third events, similar to gangs approaching laborers to open accounts, additional complicates the scenario, making it troublesome for financial institution officers to tell apart between real and malicious intents.

Safeguards for Bankers: Steps to Mitigate Dangers in Account Opening

With the growing frequency of such instances, it’s crucial for banks and their officers to undertake stricter measures when opening accounts. Listed below are some safeguards that may assist stop misuse of banking providers:

- Enhanced Due Diligence: Bankers ought to conduct thorough background checks, together with verifying the supply of earnings and the genuineness of the applicant’s deal with, earlier than opening any account.

- Multi-Layered Verification: Implement a multi-step verification course of that requires approval from larger authorities, particularly when coping with accounts opened by third-party brokers.

- Worker Coaching: Common coaching classes must be performed to coach financial institution workers about rising fraud methods and how one can determine pink flags.

- Strict Monitoring: Common audits and monitoring of newly opened accounts, significantly these opened underneath particular schemes like Tab Banking, may help in figuring out any suspicious exercise early on.

- Collaboration with Regulation Enforcement: Banks ought to keep shut coordination with legislation enforcement companies to make sure any suspicious actions are reported and acted upon promptly.

Whereas Mr. Avinash Kumar’s case might appear to be a results of a scientific failure, it underscores the significance of vigilance at each stage of banking operations. Defending the integrity of the banking system isn’t just the accountability of financial institution officers but in addition requires help from the administration, legislation enforcement, and the group.

Bankpediaa.com will proceed to comply with this case and supply updates as extra info turns into accessible.