Amid a number of modifications to the Chase Sapphire Reserve® (see charges and charges) in its current refresh, a marquee profit remained unchanged: its $300 annual journey credit score.

In contrast to related perks on competing playing cards, this credit score is extremely straightforward to make use of for all types of journey.

The Chase Sapphire Reserve costs a $795 annual charge. However if you happen to spend a minimum of $300 per 12 months on journey, the efficient annual charge turns into extra palatable.

This annual credit score is along with different Sapphire Reserve perks, similar to Chase Sapphire Lounge entry and a Precedence Move membership, a biannual credit score to make use of towards The Edit (minimal two-night keep required), Chase’s premium assortment of greater than 1,000 properties bookable by way of Chase Journey℠, and a number of way of life credit, all of which assist offset the excessive annual charge.

So, how precisely do you utilize the Sapphire Reserve’s journey credit score? Fortunately, it is actually, very easy. The (kind of) dangerous information? It is so easy and computerized that you could be use the credit score earlier than you even understand it.

When do you earn the $300 Chase Sapphire Reserve journey credit score?

The Sapphire Reserve‘s annual $300 journey credit score is awarded annually that you’ve the cardboard and is able to use as quickly as you open your new account.

Normally, when this credit score resets, it’s tied to the cardmember 12 months, not the calendar 12 months. Meaning whenever you first open the cardboard will normally decide the date you get a contemporary $300 journey credit score annually.

The exception is those that opened a Sapphire Reserve earlier than Could 21, 2017, who’re awarded the annual journey credit score primarily based on a calendar 12 months. In that case, the credit score is awarded after the final assertion closure date in December, no matter when through the 12 months the account was opened.

This contrasts American Categorical’ airline charge credit on playing cards similar to The Platinum Card® from American Categorical, as these are all the time awarded on a calendar-year foundation (as much as $200 assertion credit score; enrollment is required; phrases apply).

Each day Publication

Reward your inbox with the TPG Each day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: Chase Sapphire Reserve vs. the Amex Platinum

What counts towards the Sapphire Reserve’s journey credit score?

An ideal component of the Chase Sapphire Reserve‘s journey credit score is that it covers a variety of costs.

You possibly can usually use the annual journey credit score on something that codes as journey in your Sapphire Reserve. Though you may solely earn bonus factors on Chase Journey purchases (8 factors per greenback) and flights and accommodations booked direct along with your card (4 factors per greenback), your journey credit score can cowl a wider vary of journey bills. (Nonetheless, know that you do not earn factors on the journey costs offset by the $300 journey credit score.)

Some examples of kinds of purchases that rely for the Sapphire Reserve’s journey credit score embrace:

- Airways

- Buses

- Campgrounds

- Automotive rental companies

- Cruise traces

- Low cost journey websites

- Ferries

- Resorts

- Limousines

- Motels

- Parking heaps and garages

- Passenger trains

- Taxis

- Timeshares

- Toll bridges and highways

- Journey companies

As a result of airline costs typically code as journey, you need to use the credit score on purchases similar to airline tickets, taxes on award tickets, upgrades, seat task charges, checked bag charges, onboard snacks, change charges and lap toddler charges.

Your cruise deposits and funds must also rely, as do lodge bookings and deposits. If you must pay for parking, taxis or street tolls in your regular life, you may even use the journey credit score towards these on a regular basis costs.

What doesn’t rely towards the Sapphire Reserve journey credit score?

After all, not all purchases it’s possible you’ll consider within the journey house are thought-about journey costs. If a purchase order would not code as a journey cost, you will not be capable of use the Sapphire Reserve‘s $300 journey credit score for it.

Gadgets that code as journey fluctuate and can even change at any time. Some issues that will not be coded as journey embrace theme park tickets purchased straight from theme parks, ski carry tickets, Factors.com purchases, some airline or journey reward card purchases, inflight purchases which are processed by a 3rd celebration and a few meals eaten at a lodge however not charged to a room.

(Professional tip: If you need Disney tickets to code as a journey cost, e-book them by way of a third-party journey website similar to Get Away At the moment or Undercover Vacationer.)

How do you utilize the Sapphire Reserve journey credit score?

Utilizing your Sapphire Reserve journey credit score may be very easy: simply use your card to pay for eligible journey purchases — that is it. There’s nothing to activate, no codes to make use of or particular websites to e-book by.

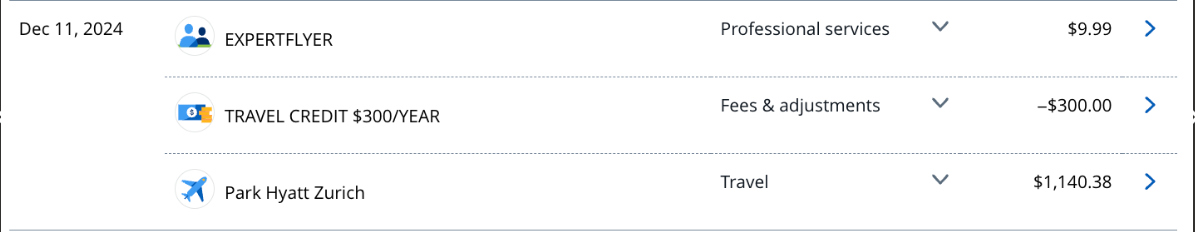

The offsetting assertion credit will normally robotically seem in your account inside a few days, and this may proceed till you have used the 12 months’s journey credit score in full.

Associated: The very best journey bank cards

How one can see if you happen to’ve used your Sapphire Reserve journey credit score

For those who’ve misplaced observe of whether or not you have used up your Sapphire Reserve annual journey credit score, you may simply determine it out by logging into Chase Journey, deciding on your Chase Sapphire Reserve card and scrolling down the house web page.

This part will let you know the month when the subsequent 12 months’s credit score will change into obtainable, so you realize to make use of up this 12 months’s credit score earlier than then.

Backside line

It is nice when bank cards provide you with annual journey credit which are straightforward to make use of, and the $300 journey credit score on the Chase Sapphire Reserve is about so simple as it comes. Yearly, you may robotically get $300 in assertion credit every time your card is used on an eligible journey buy.

After all, if you happen to aren’t taking advantage of the Sapphire Reserve’s advantages, you possibly can additionally discuss to Chase about doubtlessly downgrading to the Chase Sapphire Most well-liked® Card (see charges and charges) and even the no-annual-fee Chase Freedom Limitless® (see charges and charges).

To study extra concerning the card, learn our full evaluate of the Chase Sapphire Reserve.

Apply right here: Chase Sapphire Reserve