The Chase Sapphire Most well-liked® Card (see charges and charges) was my first journey bank card. Since I signed up for it in 2016, I’ve flown to locations like London, Istanbul, Mexico Metropolis and Tbilisi, Georgia — all on factors. It is protected to say that my first welcome bonus is lengthy gone.

Once I not too long ago transferred my final 36,000 Chase Final Rewards factors out of my account to e-book two nights on the Hyatt Regency Vancouver earlier than an Alaska cruise this summer time, I felt moderately points-poor.

It could take some time to construct my steadiness again to “enterprise class to Europe” ranges — even with beneficiant incomes classes like 5 factors per greenback spent on all journey bought by way of Chase Journey℠, 2 factors per greenback spent on all different journey, 3 factors per greenback spent on eating, choose streaming, on-line groceries and 1 level per greenback on all different purchases.

However then Chase introduced it was elevating the bonus on this card to a record-high 100,000 factors after spending $5,000 on purchases within the first three months of account opening.

I knew I needed to take motion.

Associated: Do not cancel: Easy methods to downgrade a Chase bank card

my first step

I had already thought-about signing up for the no-annual price Chase Freedom Limitless® (see charges and charges) since I’ve a number of excessive spending classes (vet payments, ugh) that do not match into any bonus classes for the present playing cards in my pockets.

Along with incomes 3% money again on drugstore purchases and restaurant eating in addition to 5% money again on journey bought by way of Chase Journey, the Chase Freedom Limitless provides 1.5% money again on all different purchases.

Once I heard in regards to the 100,000 bonus, I downgraded my present Chase Sapphire Most well-liked to the Freedom Limitless as a substitute of signing up for a brand new card. That manner, I might be eligible for a brand new Chase Sapphire Most well-liked and will earn this historic bonus; in contrast to Amex playing cards, it’s doable to earn a bonus greater than as soon as on Chase Sapphire playing cards.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Needless to say downgrading to the no-annual-fee Chase Sapphire Card (not open to new functions) would nonetheless disqualify you.

You may have to observe just a few essential guidelines. This is the step-by-step course of I adopted to downgrade my Chase Sapphire Most well-liked and join a brand new one for the prospect to earn 100,000 bonus factors.

The data for the Chase Sapphire Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: Playing cards providing welcome bonuses of 100,000 factors or extra

Test which month your earlier bonus hit

In keeping with Chase’s 48-month rule, you possibly can’t earn a bonus on a Chase card in the event you presently maintain that card in your pockets or in the event you’ve earned a bonus on that card within the final 48 months. (It is also necessary to know that Chase will not allow you to downgrade a card if you have not held it for at the very least 12 months.)

For those who’re questioning, 48 months in the past was Could 2021, proper across the time I used to be getting the primary COVID-19 vaccine.

I’ve solely had one Chase Sapphire Most well-liked account — which I opened in 2016, lengthy earlier than the pandemic — so I knew I used to be nicely outdoors the 48-month rule.

However to double-check, you possibly can scroll again by way of your statements to see precisely which month your final bonus landed in your account.

Ensure you’re underneath the 5/24 rule

Subsequent up was the 5/24 rule: To ensure that Chase to approve me for a brand new card, I needed to examine that I hadn’t opened 5 or extra private bank cards throughout all banks within the final 24 months.

I used to be assured I used to be nicely underneath the 5/24 rule, however to double-check, I logged into my Experian account to examine my credit score historical past and ensure I had solely utilized for 2 new playing cards up to now two years.

Unfreeze your credit score if frozen

For those who’ve frozen your credit score to forestall anybody else from opening up new credit score traces in your identify, you need to unfreeze your credit score earlier than making use of for a brand new bank card.

Whereas in my Experian account, I rapidly unfroze my credit score in order that after I reapplied, Chase might entry my credit score file. (Chase sometimes makes use of Experian to drag credit score experiences, so I did not hassle additionally unfreezing my credit score experiences at TransUnion and Equifax, the opposite two credit score bureaus.)

Associated: Easy methods to freeze your credit score

Name a Chase agent to downgrade

As soon as I had checked the whole lot was so as, I referred to as the quantity on the again of my Chase card and requested the agent to downgrade my Chase Sapphire Most well-liked to the no-annual-fee Chase Freedom Limitless.

The primary time I referred to as round 7 p.m. on a weeknight, there was a 15-minute wait to speak to an agent. Once I referred to as again the following day round midday, an agent answered after just a few rings.

All the name took six minutes. Along with downgrading me to the Chase Freedom Limitless, the agent confirmed that my Chase Sapphire Most well-liked annual price, which I had simply paid in February, could be prorated. Inside a day or so, Chase credited $71.28 again to my account.

The ready sport

Inside moments, my Chase app confirmed the Chase Freedom Limitless card artwork subsequent to my authentic card quantity. Though the whole lot had transitioned and I not had a Chase Sapphire account throughout the app, I made a decision to attend till my new Chase Freedom Limitless card arrived to reapply for a brand new Chase Sapphire Most well-liked account.

Nonetheless, since it is a limited-time supply ending quickly, I might act on this as quickly as doable.

Signing up once more

On Friday, April 25, I made a decision I had waited lengthy sufficient and utilized for a brand new Chase Sapphire Most well-liked. After filling out the brand new card utility, Chase accepted me instantly, and my new card quantity immediately appeared in my Chase app.

Although my new card hasn’t arrived within the mail but, I used to be in a position so as to add it to my Apple Pockets so I might begin charging my subway rides to my new account ASAP and begin incomes 2 factors per greenback spent on journey purchases.

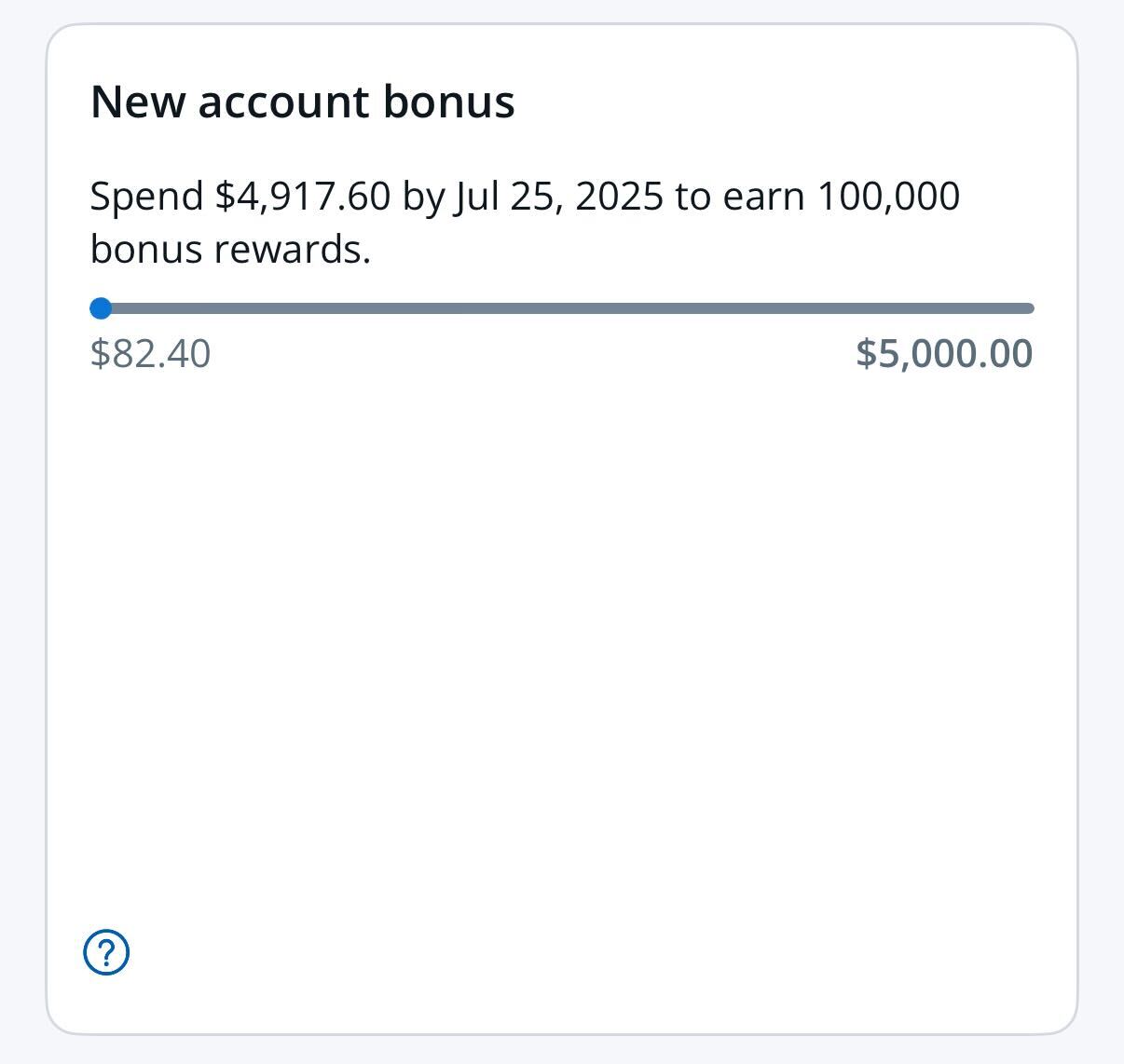

Due to the useful tracker Chase added to my account beneath my new Chase Sapphire Most well-liked, I can see what I’ve spent towards the $5,000 I have to earn the 100,000 level bonus by July 25.

Backside line

For those who’re desperate to replenish your Chase Final Rewards steadiness with one other 100,000 factors, it could possibly be price downgrading your Chase Sapphire Most well-liked to a no-annual-fee card just like the Chase Freedom Limitless so you possibly can reapply for a brand new Chase Sapphire Most well-liked account and earn the limited-time bonus.

Simply make certain you have not earned a Chase Sapphire Most well-liked bonus throughout the final 48 months and have signed up for fewer than 5 new bank cards with any financial institution within the final 24 months.

Associated:

Apply now: Chase Sapphire Most well-liked