Journey does not all the time go as anticipated. For instance, in case your airline loses your checked baggage, you find yourself within the hospital throughout your journey, or an in depth member of the family turns into unexpectedly ailing, coping with these conditions might be pricey. That is the place journey insurance coverage could assist.

You may already know that some journey rewards playing cards have embedded journey insurance coverage advantages once you use your card for purchases. We can’t focus on that sort of journey insurance coverage on this article; as an alternative, we’ll focus on a selected sort of journey insurance coverage you should buy on a trip-by-trip foundation.

American Specific® Journey Insurance coverage affords preset packages and the flexibility to pick out simply the protection choices you need. You need not use an Amex card and even be an American Specific cardmember to buy American Specific Journey Insurance coverage.

What’s American Specific Journey Insurance coverage?

American Specific Journey Insurance coverage could assist present protection for the surprising.

You’ll be able to choose a preset bundle, which is able to include set advantages and protection quantities — these choices let you get a bundle while not having to suppose by way of all the main points your self.

You even have the flexibility to buy precisely what you need on your journey. For instance, in the event you solely need to buy World Medical Safety, you are able to do that. This skill to buy solely the protection you need is comparatively distinctive among the many varieties of journey insurance coverage I’ve researched.

You should purchase American Specific Journey Insurance coverage with any debit or bank card, together with these not issued by American Specific. You do not should be an American Specific cardmember to buy American Specific Journey Insurance coverage as you need to use any debit or bank card to buy.

Not like different journey insurance coverage insurance policies that won’t cowl all of your journey companions, American Specific Journey Insurance coverage lets you enroll as much as 10 folks (together with your self), and likewise offers you the flexibility to cowl journey companions outdoors of your loved ones.

As a result of skill to select solely the protections you need or a preset bundle at a worth level that matches your wants, American Specific Journey Insurance coverage affords notably good choices for vacationers who’re price range aware or want the flexibility to customise protection.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Within the subsequent sections, we’ll focus on the varieties of preset packages and a la carte protection you should buy with American Specific Journey Insurance coverage. Then, we’ll focus on learn how to purchase this insurance coverage.

Associated: Must you get journey insurance coverage when you have bank card safety?

What varieties of American Specific Journey Insurance coverage can be found?

American Specific Journey Insurance coverage affords preset packages, however you may as well construct your personal protection and choose solely the protections you need. One of the best ways to see the choices for a selected journey is to click on the hyperlink within the earlier sentence and enter a couple of particulars about your journey, however here is a have a look at each varieties of merchandise.

Construct your personal protection

With the ability to choose solely the protections you need is comparatively distinctive, so here is a have a look at the varieties of protection that American Specific Journey Insurance coverage affords that I may choose as a Florida resident for a pattern journey:

- Journey Cancellation & Interruption: The sort of protection could present reimbursement for nonrefundable bills or extra prices if it is advisable to cancel your journey earlier than it begins. This protection might also present reimbursement for added prices in case your journey is interrupted. Nonetheless, this protection is not obtainable for the portion of your journey bought with journey award credit, factors or miles.

- World Medical Safety: The sort of protection could cowl emergency medical and dental bills on a visit that originates from the lined individual’s everlasting residence, is outdoors a 150-mile radius from the lined individual’s everlasting residence and happens inside the first consecutive 60 days of the journey. This protection additionally contains an emergency evacuation profit that can prepare and pay for evacuation to the closest satisfactory medical facility in the event you endure from a illness or maintain an unintended harm and require therapy whereas on a lined journey. You’ll be able to choose from three protection limits when buying this protection, though the dental protection most is $750 with all three choices.

- Journey Accident Safety: The sort of protection is payable if the lined individual suffers an unintended demise or dismemberment whereas boarding, touring in, or deplaning from a scheduled airline or widespread provider conveyance. When buying this protection, you may choose from two protection limits.

- World Baggage Safety: The sort of protection could reimburse for misplaced, broken or stolen baggage, whether or not checked or carried in your flight or in your resort or cruise property. This protection might also present reimbursement for important alternative gadgets in case your baggage is delayed. When buying this protection, you may choose from 4 protection limits.

- World Journey Delay: The sort of protection could reimburse lodging and different vital bills if a lined individual’s travels are delayed, together with in case your flight is overbooked and you might be involuntarily denied boarding, in the event you miss your flight connection, and in case your flight departure is delayed or canceled. When buying this protection, you may choose from three protection limits.

These a la carte protection choices embody entry to a 24-hour Journey Help Hotline which will supply journey assist anytime earlier than and through your journey.

Associated: What’s lined by bank card journey accident and emergency evacuation insurance coverage?

Preset packages

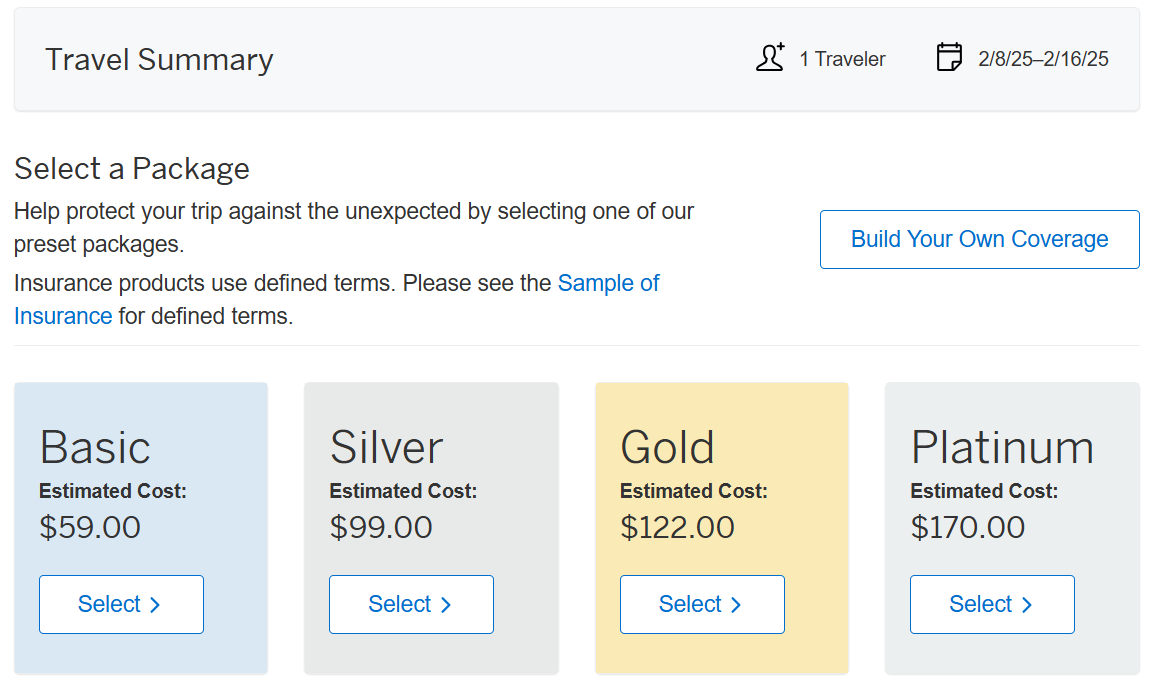

American Specific Journey Insurance coverage additionally affords 4 preset packages, every together with an assortment of varieties of protection. These packages present a straightforward manner to purchase protection for an upcoming journey with out making many choices.

The fundamental bundle contains Journey Cancellation & Interruption, World Medical Safety and World Baggage Safety, however doesn’t embody Journey Accident Safety or World Journey Delay.

The Silver, Gold and Platinum packages embody all of the varieties of protection you possibly can purchase however at differing ranges. The Silver bundle affords the bottom protection ranges, whereas the Platinum bundle affords the very best ones.

Associated: What your bank card’s journey safety covers — and what it does not

Easy methods to purchase American Specific Journey Insurance coverage

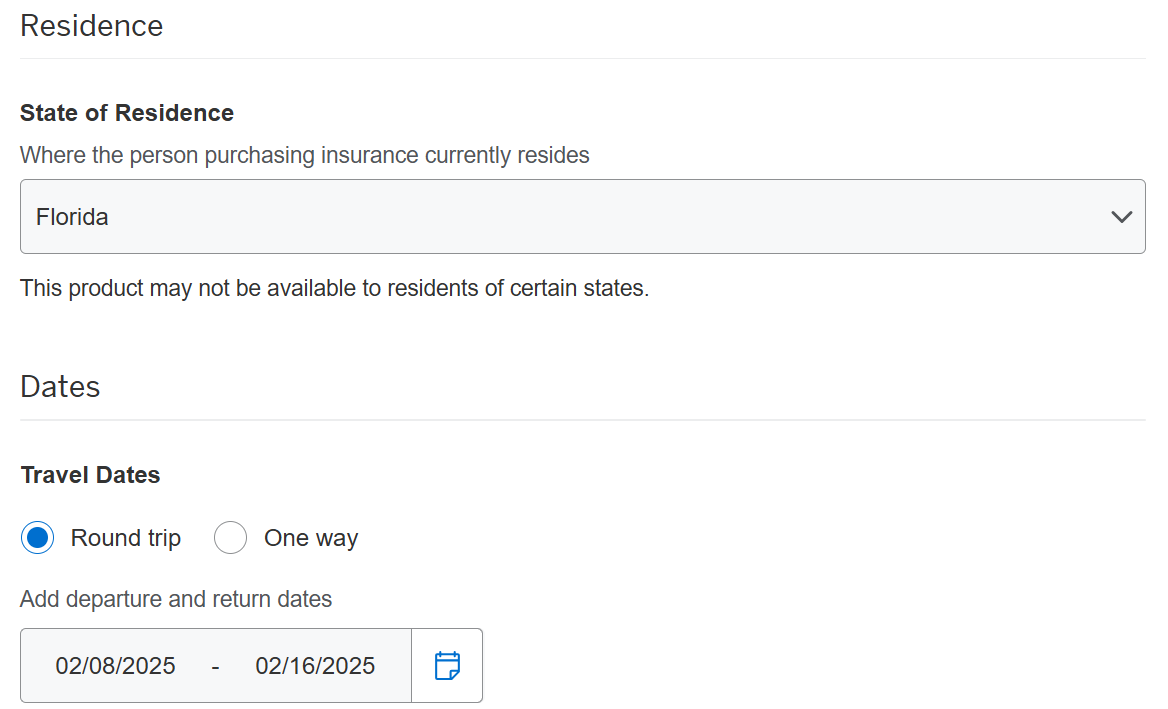

With American Specific Journey Insurance coverage, you may see your protection choices inside seconds. Click on the hyperlink within the earlier sentence and enter the main points of your journey. For instance, if I wished to buy American Specific Journey Insurance coverage for a winter ski journey, I might begin by getting into my state of residence and my journey dates.

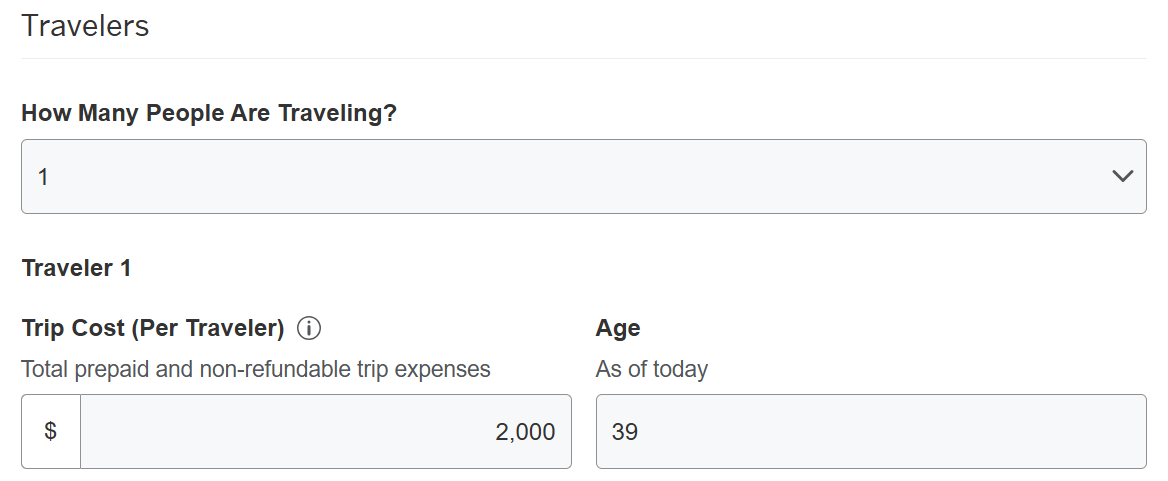

Then, I might have to enter the variety of vacationers and every traveler’s journey value and age.

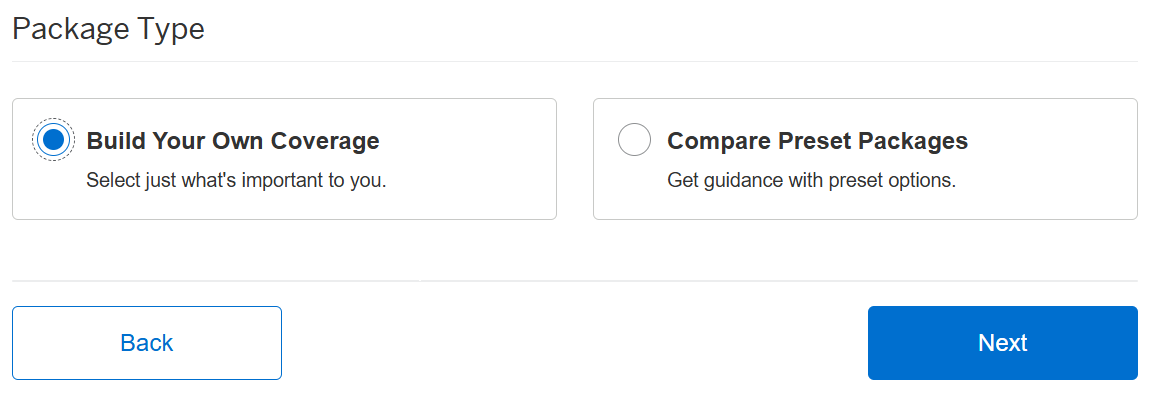

Subsequent, I can select the Construct Your Personal Protection choice or the one that permits you to examine preset packages. Nonetheless, this selection is not all that essential, as you may toggle between the alternatives on the following web page. For now, let’s assume I opted to construct my very own protection.

For this journey, here is a have a look at the build-your-own-coverage choices and pricing:

- World Journey Delay: No protection, $14 for as much as $150 of protection per day ($500 most per journey), $15 for as much as $200 of protection per day ($750 most per journey) or $20 for as much as $300 of protection per day ($1,000 most per journey)

- World Baggage Safety: No protection, $20 for as much as $500 of protection (as much as $300 of protection for a six-hour or longer delay), $35 for as much as $1,000 of protection (as much as $500 of protection for a six-hour or longer delay), $40 for as much as $1,500 of protection (as much as $500 of protection for a six-hour or longer delay) or $50 for as much as $2,500 of protection (as much as $500 of protection for a three-hour or longer delay)

- Journey Cancellation & Interruption: No protection or $80 for as much as 100% of the journey value

- World Medical Safety: No protection, $25 for as much as $25,000 of protection (dental protection of as much as $750), $30 for as much as $50,000 of protection (dental protection of as much as $750) or $32 for as much as $100,000 of protection (dental protection of as much as $750)

- Journey Accident Safety: No protection, $11 for as much as $250,000 of protection, $19 for as much as $500,000 of protection, $27 for as much as $1,000,000 of protection or $35 for as much as $1,500,000 of protection

Alternatively, I may choose one of many 4 preset packages. For my pattern journey, the Primary bundle would value $59, the Silver bundle would value $99, the Gold bundle would value $122 and the Platinum bundle would value $170.

No matter whether or not I choose to construct my very own protection or purchase a preset bundle, I might have to enter my full title, date of delivery, vacation spot nation and date of first journey fee earlier than reaching the fee display screen, the place I might have to enter my title, billing handle, telephone quantity, electronic mail and bank card info.

Costs and protection choices could differ on your journey. You’ll want to study the certificates of insurance coverage as soon as you buy protection to totally perceive your coverage. You normally have 14 days after you buy a coverage to look at the certificates of insurance coverage and void it if vital.

Backside line

American Specific Journey Insurance coverage affords build-your-own-coverage choices and preset packages. The build-your-own-coverage choices are notably interesting in the event you worth the flexibility to purchase solely the protection you need at a comparatively low value, particularly in the event you solely want one or two varieties of protection for an upcoming journey.

Journey with extra confidence and buy American Specific Journey Insurance coverage on your subsequent journey.

For full particulars and the total phrases and circumstances, please go to the American Specific Journey Insurance coverage web site right here.

American Specific Journey Insurance coverage (Coverage AX0126, or Coverage AETI-IND) is underwritten by AMEX Assurance Firm, Administrative Workplace, Phoenix AZ. Protection is set by the phrases, circumstances and exclusions of the respective insurance policies (see above) and is topic to alter with discover. This doc doesn’t complement or change the Coverage.

American Specific Journey Insurance coverage is obtainable by way of American Specific Journey Associated Companies Firm, Inc., California license quantity 0649234.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25842268/rev_1_C8D_FP_004r_High_Res_JPEG.jpeg?w=150&resize=150,150&ssl=1)