Holidays … aren’t they nice? There’s nothing like heading to an exquisite tropical island within the Caribbean, Florida or the Gulf Coast in the summertime or fall. Trip might be great — that’s, till a seasonal tropical climate occasion or hurricane hits your vacation spot. Then a trip can develop into an enormous headache or one thing even worse.

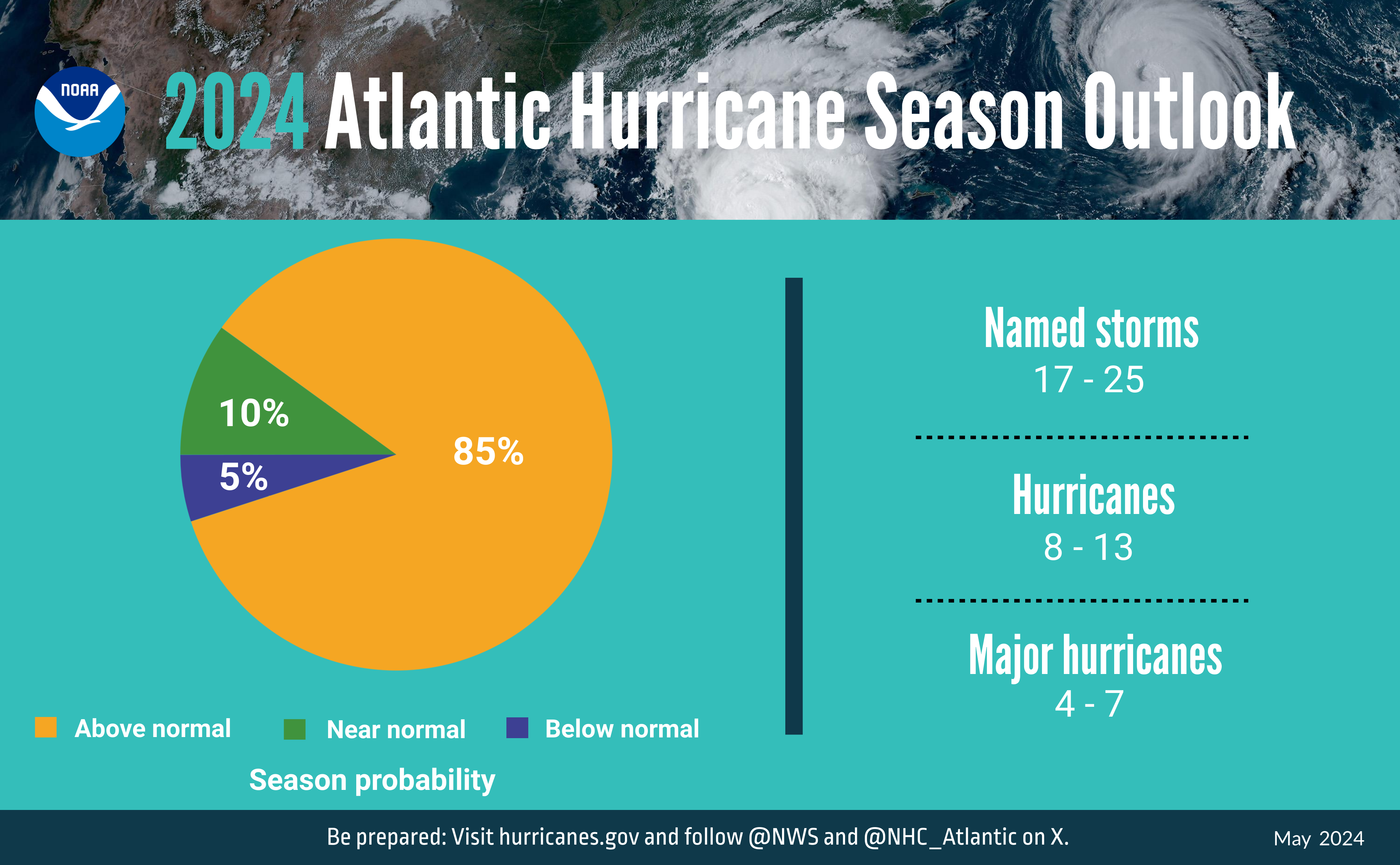

For the reason that 2024 hurricane season is predicted to be one of the energetic on document, it is essential to be ready to journey through the prime hurricane season. What’s one factor that may assist when a tropical climate occasion strikes? Journey insurance coverage.

“Journey insurance coverage has develop into an important a part of journey planning for vacationers vacationing within the Caribbean or Southeast seaboard through the Atlantic hurricane season [June through November],” says Stan Sandberg, co-founder of TravelInsurance.com.

Associated: Hurricane season is right here: TPG’s storm information for vacationers

However even in the event you’ve purchased protection or thought a bank card journey insurance coverage coverage lined you, quite a bit can nonetheless go incorrect.

Need to keep away from a hurricane headache? Learn on for the highest journey errors to keep away from throughout hurricane season.

Considering that hurricane season wraps up within the early fall

“Some folks do not realize that hurricane season is not confined to the summer season months,” says Beth Godlin, president of Aon Affinity Journey Follow.

In actuality, hurricane season runs via Nov. 30, based on Godlin. So, you will wish to regulate the climate and your journey insurance coverage right through to the beginning of December.

Not shopping for journey insurance coverage earlier than a storm is known as

If there’s one factor you must keep in mind about defending your trip funding throughout hurricane season, it is this: As soon as a storm is known as, it is too late to purchase journey insurance coverage.

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

There’s an essential cause behind this.

“Insurance coverage covers the sudden,” says Jenna Hummer, public relations director of Squaremouth (an organization that gives comparisons of journey insurance coverage from main U.S. suppliers, “so as soon as one thing is taken into account ‘foreseen’ — on this case, when a tropical storm or hurricane has been named — you’ll be able to now not get protection for that storm.”

Ready to buy journey insurance coverage throughout hurricane season

It is no shock, then, that each journey insurance coverage knowledgeable I interviewed had the identical recommendation in the event you’re planning to journey throughout a interval when hurricanes might happen. They advocate shopping for your protection as quickly as you ebook your journey.

In the event you’re seeing reviews {that a} hurricane is about to land in your vacation spot or could shut your own home airport, you have probably already missed the window to cowl your journey.

Considering you’ll be able to cancel your journey as a result of a hurricane occurred at your vacation spot

“A typical false impression is that if a hurricane happens close to your vacation spot, you’ll be able to cancel your trip and be lined,” Hummer says.

However the truth that a hurricane made land fall at your meant trip vacation spot earlier than you probably did doesn’t essentially imply which you could cancel and be reimbursed.

In line with Hummer, in case your resort is uninhabitable — that means it isn’t open or has no electrical energy or operating water — then you definately can be lined. Nonetheless, if the encircling space is coping with injury however the resort remains to be open, “You are on the hook to pay in your trip.”

Not figuring out what your journey insurance coverage will cowl

Most complete journey insurance policy will embody journey cancellation and interruption protection, journey delay protection and baggage loss and delay protection.

“Journey cancellation and journey interruption will reimburse misplaced or unused pay as you go, nonrefundable bills resulting from a hurricane making it not possible to get to your vacation spot,” Sandberg says. “Many plans can even present protection if there’s a obligatory evacuation on the vacation spot. Just a few plans will even present protection within the occasion there’s a NOAA hurricane warning at your vacation spot throughout your journey dates.”

Journey delay protection will reimburse you for sudden journey prices comparable to meals, transportation, web service and lodging when your flight is delayed for an prolonged time period.

“Take note, although, journey delays are usually not sometimes a lined cause for cancellation, and most insurance policies will not reimburse you in the event you select to cancel due to a visit delay,” Godlin says. “Nonetheless, your advantages could embody reimbursement for the a part of your journey you missed. For protection to kick in, some journey delay phrases require a minimal size of delay, which may vary wherever from 4 to 12 hours. Some phrases might also solely cowl delays brought on by specific-named perils, comparable to a hurricane that hits your vacation spot and forces early departure.”

Relying on bank card insurance policies to cowl you

In line with Hummer, this can be a tough one since many vacationers carry bank cards with journey perks, together with journey delay insurance coverage, and subsequently suppose they’re lined in case of a climate occasion like a hurricane.

“The issue with bank card protection is that the protection could be very low, like $5,000 for medical,” she says.

That is effectively beneath what you may want in a real emergency.

“Do not forget that your bank card will not cowl something not bought on that card,” Hummer says. “So, if you have not paid in your entire journey with that card or different folks in your group used one other cost technique, you will not be absolutely lined.”

Not shopping for a coverage with a 24-hour assist desk

If there is a coverage that prices much less however does not supply round the clock assist, skip it.

“Ensure you purchase a coverage with 24/7 help,” Hummer says.

She additionally added that in the event you’re in a state of affairs the place a hurricane has closed the airport, “Name your journey insurer first; they’ll pay for inns and meals whilst you’re ready on maintain with the airline.”

Not getting sufficient protection

Whereas you do not have to pay a premium for a journey insurance coverage package deal throughout hurricane season, you do have to have sufficient protection to get you residence and canopy any emergencies.

In line with Hummer, $50,000 in medical and $100,000 in medical evacuation are the minimums your package deal ought to embody.

Forgetting {that a} hurricane can occur at residence, too

Journey insurance coverage can nonetheless be helpful, even in the event you’re not going to a tropical space.

“For instance you reside in South Carolina, however you are taking an Alaskan cruise,” Godlin says. “As you are on the brink of embark in your dream trip, a hurricane hits the coast and decimates your own home. What are you able to do? In the event you bought journey safety and your own home is rendered uninhabitable, that may be a lined cause for journey cancellation.”

That is positively a worst-case state of affairs, however it’s reminder that hurricanes can occur at residence or whilst you’re away, relying in your origin and vacation spot.

Paying an excessive amount of for hurricane protection

“Purchase the most affordable coverage with the protection you want,” Hummer says.

Use a comparability engine, she suggests, and know that “simply since you’re paying extra does not imply you get extra protection.”

She explains that completely different journey insurance coverage businesses have completely different formulation and take a wide range of elements under consideration, like age and vacation spot — oftentimes, costs range whereas protection does not. As a substitute, be sure to’re getting the protection and help outlined above and select the choice that prices the least.

Associated studying: