Saving cash is on everybody’s to-do record. I imply, simply go searching at the price of issues. The excellent news is that if in case you have an American Categorical card, it is really simple to take action with a number of easy clicks.

From premium journey playing cards to cash-back playing cards and extra, Amex has a various lineup of client and enterprise choices. And there is one fixed factor you possibly can depend on throughout your entire American Categorical playing cards portfolio: Amex Gives.

Amex Gives is likely one of the greatest methods to save lots of money — or earn additional factors and miles — even if you’re not touring. There’s one small (however mighty) tip to get much more (and typically higher) affords to look in your card account. Let’s learn the way.

What are Amex Gives?

Amex Gives are buying, eating, journey or leisure promotions which might be tied to a selected card account. The precise supply is determined by the service provider, however lots require you to spend a specific amount by a selected date to earn a reduction or a haul of bonus factors. Others merely present a bonus over the common incomes charge — like this one:

As talked about, nearly all American Categorical playing cards have entry to Amex Gives — however the particular deal might fluctuate from card to card.

To search out these affords, log into your card account and navigate to “Amex Gives & Advantages” on the cardboard web page or on the “Gives” tab within the Amex app.

Associated: The last word information to saving cash with Amex Gives

get extra Amex Gives to look

Including present affords to your card

There are some ways to save cash by means of Amex Gives — they do not even have for use for journey. However first, you could enroll within the affords earlier than you should use them.

The important thing right here is scrolling by means of your “Amex Gives & Advantages” and including promotions that you just even probably could possibly use. There isn’t any hurt in including affords to your card even if you happen to do not use them. When a given supply expires, it will merely disappear out of your account. Gives can disappear, so add them to your card if you happen to suppose you would possibly use them. You are not obligated to buy at a service provider simply since you added a proposal to your Amex account.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Unlock much more affords

And there may be one other added bonus to putting affords onto your card: extra might grow to be accessible (and visual) in your account if you add present ones. That is proper — Amex caps the variety of affords which you can see at any given time to 100 affords per card.

An Amex spokesperson informed TPG that solely “the highest 100 affords accessible to a cardmember are displayed each on-line and within the American Categorical cell app.”

Nonetheless, word that there will not at all times be 100 affords at a given time for each card. For example, my Marriott Bonvoy Enterprise® American Categorical® Card solely exhibits 32 affords presently, so including extra will not unlock new ones. However Amex Membership Rewards-earning playing cards usually have extra affords than 100 which might be accessible — they’re simply not all seen.

Associated: Get monetary savings with these travel-related affords in your bank cards this month

An instance: The Platinum Card from American Categorical

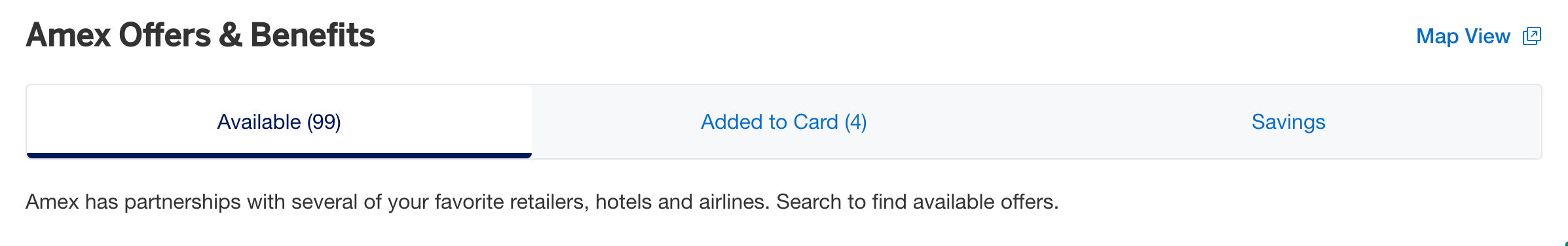

TPG bank cards author Danyal Ahmed had 4 affords added to his The Platinum Card® from American Categorical.

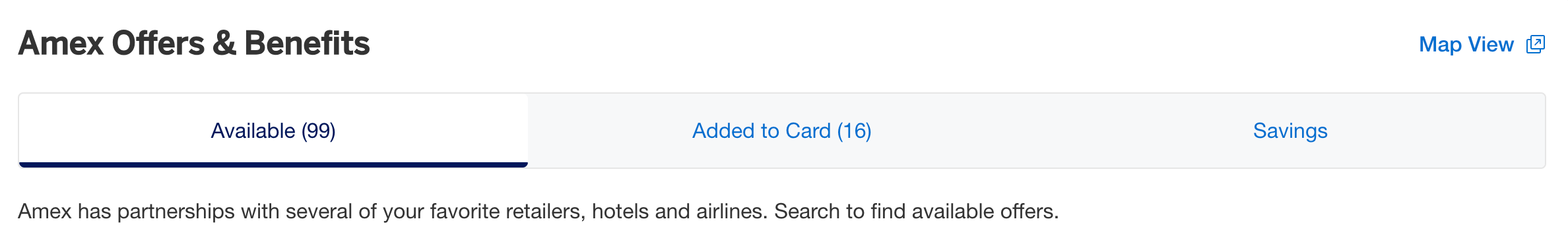

After including one other 12 affords, for a complete of 16 affords, he signed out of his account. A number of minutes later, he signed in once more and noticed that his record of obtainable affords was again as much as 99.

The 12 new affords added had expiration dates starting from a number of weeks to a number of months away. Some notable journey retailers that populated throughout the affords included Vacation spot by Hyatt, Huge Sky Resorts and Wyndham Motels & Resorts.

Clearly, if you happen to proceed including affords, there is a restrict to what number of Amex offers you sooner or later. Nonetheless, Amex may introduce new affords at any time, and by including present ones to the cardboard, try to be prepped for when new affords are launched. Subsequently, it is seemingly good apply so as to add affords to your account to “liberate” accessible area — and to verify for brand spanking new ones continuously.

One other potential technique: add affords which might be near expiring. Some cardholders might not need the “Added to Card” part cluttered with affords that they’ve little to no likelihood of utilizing. By including affords that expire quickly, that record will quickly swell however shortly drop all the way down to a extra manageable degree.

If including affords one after the other appears too sluggish, there’s a means so as to add them all of sudden. Should you add this bookmark to your browser, the method can go quicker.

Associated: An entire information to the Amex Gold eating credit score

Do not forget about different promotions

Amex Gives could be a nice deal on their very own, however you possibly can double- and even triple-dip to get a good higher return. These are greatest practices for any on-line buying that you just do — irrespective of the retailer.

At all times verify on-line buying portals to earn additional money again or bonus miles in your buy — Rakuten will even can help you earn bonus Amex factors at tons of of retailers. Moreover, you possibly can make the most of any gross sales at that specific service provider, together with bonus classes on a selected card.

Lastly, there are Amex-specific credit — like annual assertion credit at Saks Fifth Avenue (for The Platinum Card® from American Categorical, which affords as much as $100 in assertion credit yearly) and Dell (for The Enterprise Platinum Card® from American Categorical, which affords as much as $400 in assertion credit per 12 months). Enrollment is required for choose advantages.

Each of those shops have had Amex Gives over the previous 12 months, making an already helpful profit much more profitable.

Furthermore, you possibly can even use some buying portals when making purchases in particular person, including additional factors, miles or money again to your spending.

Associated: The last word information to saving cash with Amex Gives

Backside line

Other than elevated welcome affords, class bonuses and different month-to-month credit, Amex Gives are a surefire method to earn much more factors (or money again) on on a regular basis purchases.

I personally have saved tons of by means of Amex Gives throughout my 5 Amex playing cards, serving to to recoup a lot of the annual charges on these playing cards. Now, with this nugget of information, you may get entry to much more affords in your account — and preserve extra {dollars} in your pockets.

Associated: The ability of the Amex trifecta: Platinum, Gold and Blue Enterprise Plus