Redeeming airline factors and miles was once so easy.

When you had a vacation spot in thoughts, you checked the award chart of your favourite program to see what number of factors or miles this system charged. Supplied there was availability, you could possibly guide the flight for that mounted worth plus a small amount of money to cowl obligatory authorities taxes and airport charges.

Nevertheless, this worth proposition grew to become extra advanced over time. When world gasoline costs rose, some packages added gasoline surcharges to redemptions, arguing that offering these award seats was costly (gasoline often being an airline’s largest expense).

In concept, this was unwelcome however not unreasonable. The issue was that when gasoline costs dropped, the surcharges didn’t. Many packages have now renamed these gasoline surcharges “carrier-imposed surcharges,” as they bear no correlation with gasoline costs.

Nonetheless, many airways didn’t impose gasoline surcharges. You could possibly guide a long-haul flight for as little as $5 in charges and taxes plus the factors and miles, which was an ideal deal.

Then, the key U.S. airline packages began slowly however absolutely eradicating their award charts and switching to dynamic pricing. They reasoned that money costs fluctuate relying on demand, so redemption ranges ought to, too. Throughout off-peak intervals, members might nonetheless redeem their factors and miles on the lowest ranges, however when demand for seats elevated, so did the quantity of factors and miles required.

When you’ve got precious transferable bank card factors, you usually have to decide on between packages with mounted award charts however excessive surcharges and packages with low or no surcharges and dynamic pricing.

So, which is in the end the higher approach to go?

Associated: How a lot will your trip actually price? The scourge of dynamic pricing is spreading like wildfire

Every day Publication

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Enterprise class to Europe

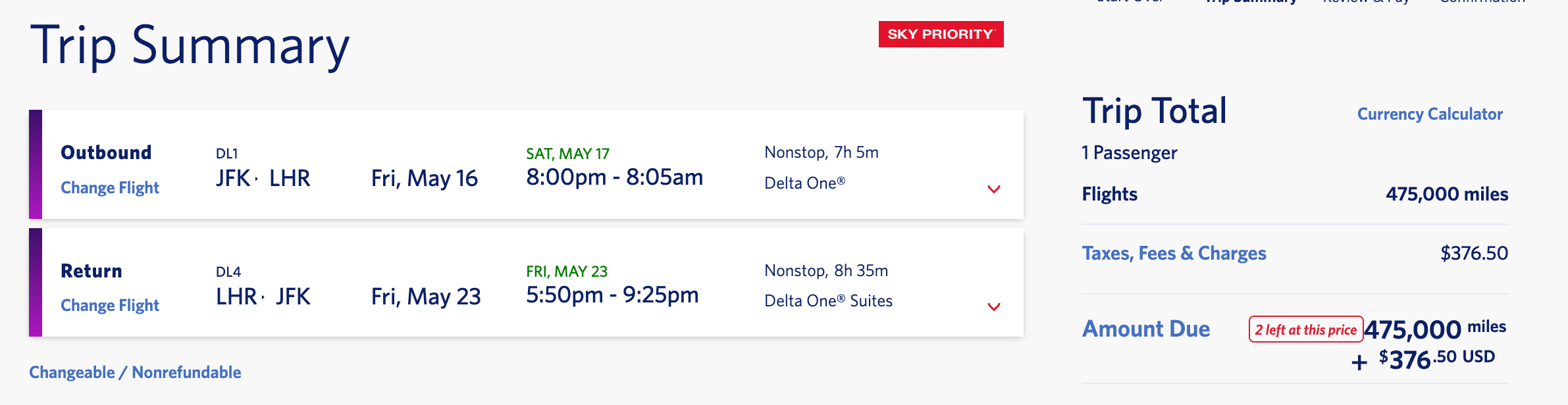

Let’s first have a look at your choices to guide business-class flights from New York to London in Could 2025. You could possibly switch your bank card factors to a program with dynamic pricing, like Delta SkyMiles, which does not cost gasoline surcharges. Gas surcharges to this vacation spot are greater due to the UK’s Air Passenger Obligation tax.

Whereas the money required is barely $376.60, you will want a whopping 475,000 SkyMiles per particular person round-trip.

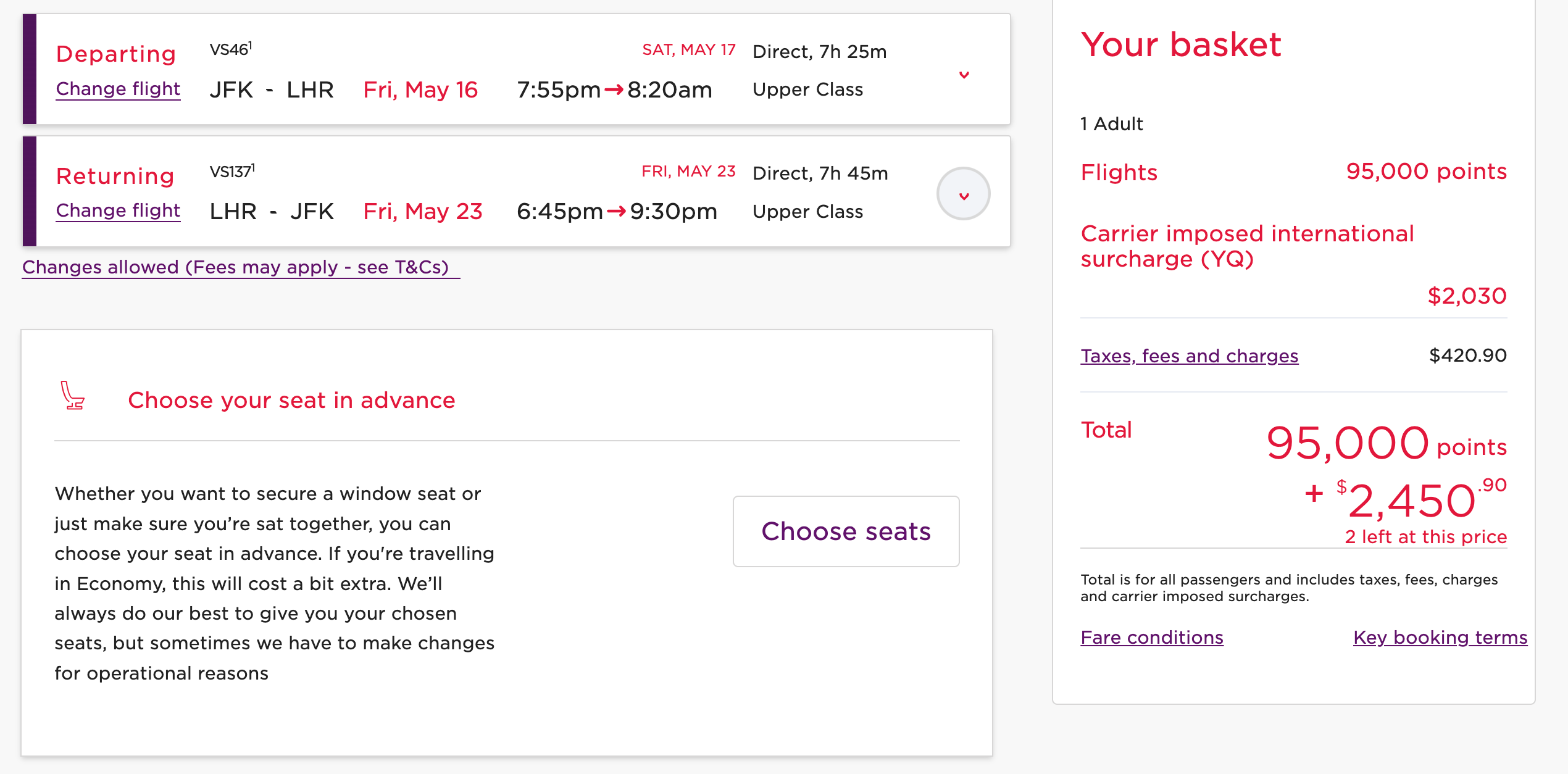

Alternatively, you could possibly switch your bank card factors to a program that has a hard and fast award chart however provides surcharges, reminiscent of Virgin Atlantic Flying Membership, this system for Delta Air Traces’ SkyTeam accomplice Virgin Atlantic.

Virgin Atlantic provides an eye-watering $2,000 as a carrier-imposed surcharge. Nevertheless, you will solely have to half with 95,000 Virgin Atlantic factors, in contrast with the greater than 475,000 SkyMiles possibility above on the identical round-trip New York-to-London possibility.

So, which is the higher possibility? Let’s estimate every price utilizing TPG’s September 2024 valuations.

- Redeeming Delta miles: 475,000 multiplied by 1.2 cents plus $376.50 equals $6,076.50

- Redeeming Virgin factors: 95,000 multiplied by 1.4 cents plus $2,450.90 equals $3,780.90

On this case, reserving with Virgin Atlantic Flying Membership would supply a lot better worth. Though an enormous surcharge is required, it requires a fraction of the factors.

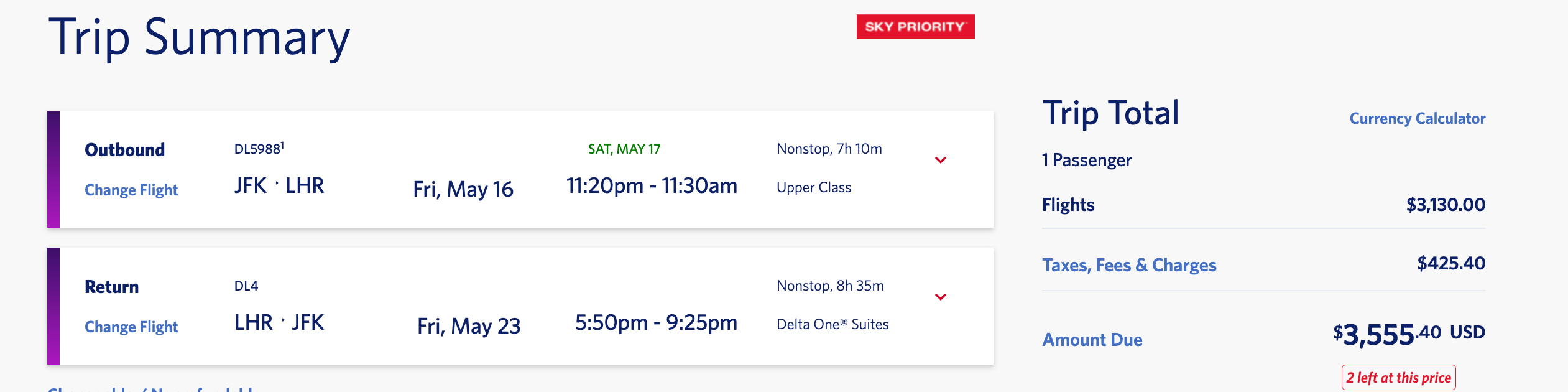

This redemption continues to be pricey, so it is value checking the money fares on the identical dates. With Delta providing nonstop business-class flights for $3,555.40 round-trip, paying money might make extra sense since additionally, you will earn SkyMiles for this money fare.

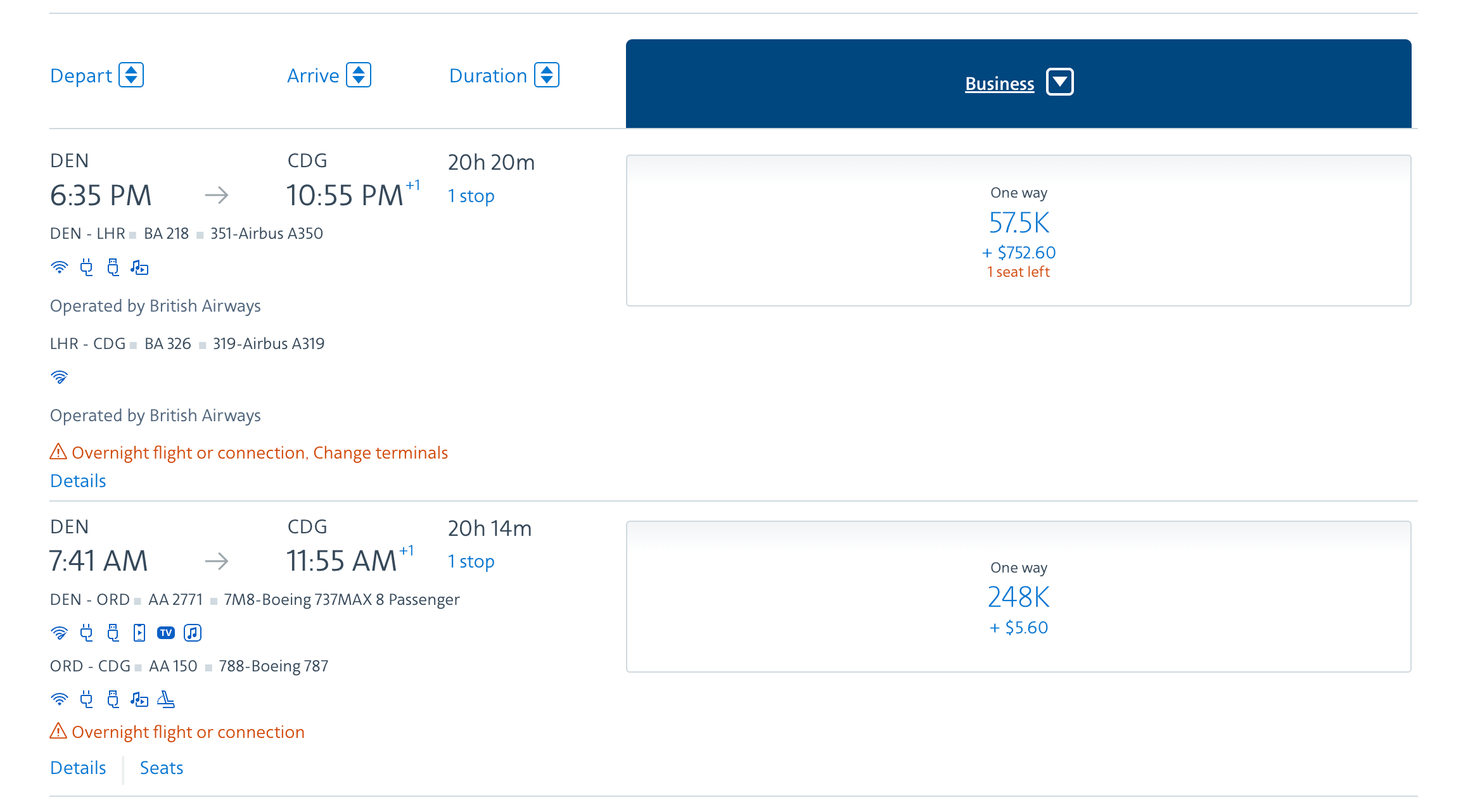

Let us take a look at one other instance. American Airways AAdvantage presently makes use of dynamic pricing for flights operated by American Airways however has retained an award chart for accomplice airways (passing on the surcharges the place the working provider would cost its members the surcharges).

Let us take a look at a one-way business-class redemption from Denver Worldwide Airport (DEN) to Paris-Charles de Gaulle Airport (CDG) in April 2025. As there aren’t any nonstop choices bookable via AAdvantage, you could possibly select to fly British Airways through London or American Airways through Dallas. The British Airways possibility is priced utilizing an award chart, so fewer miles are required, however the surcharges are larger; the American-operated possibility is priced dynamically however with out surcharges, so extra miles however much less money are required.

Right here is the price of every, utilizing TPG’s September 2024 valuations.

- Redeeming AAdvantage miles flying American Airways: 248,000 multiplied by 1.6 cents plus $5.60 equals $3,973.60

- Redeeming AAdvantage miles flying British Airways: 57,500 multiplied by 1.6 cents plus $752.60 equals $1,672.60

Once more, on this instance, it might be a a lot better deal to decide on the surcharges possibility, as you will not be utilizing almost as many miles. This might be a wonderful redemption, with one-way money fares ranging from $3,800 on the identical dates.

Premium financial system to Dubai

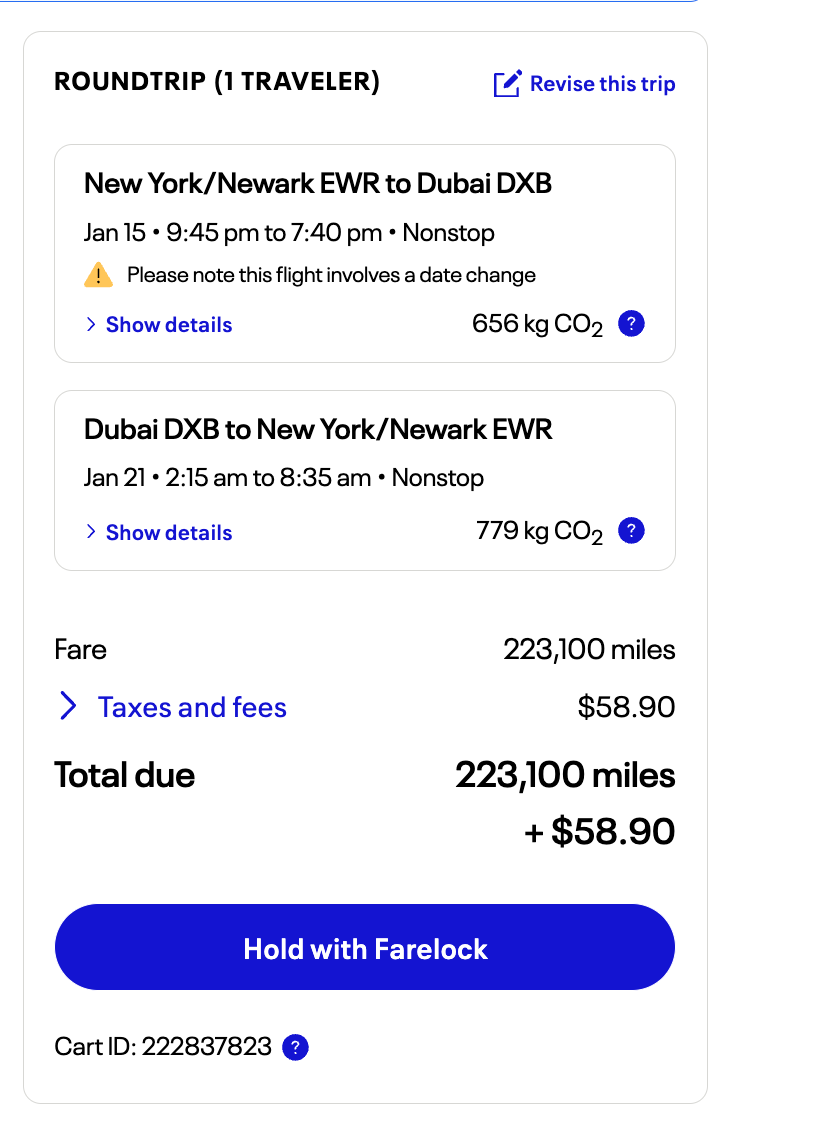

With United Airways’ nonstop service from Newark Liberty Worldwide Airport (EWR) to Dubai Worldwide Airport (DXB) now operational, let’s evaluate the price of flying the route in premium financial system in January 2025, a wonderful time to go to sunny Dubai. You could possibly guide via United MileagePlus for 233,100 miles plus a low $58.90 in charges and taxes, as United doesn’t cost surcharges.

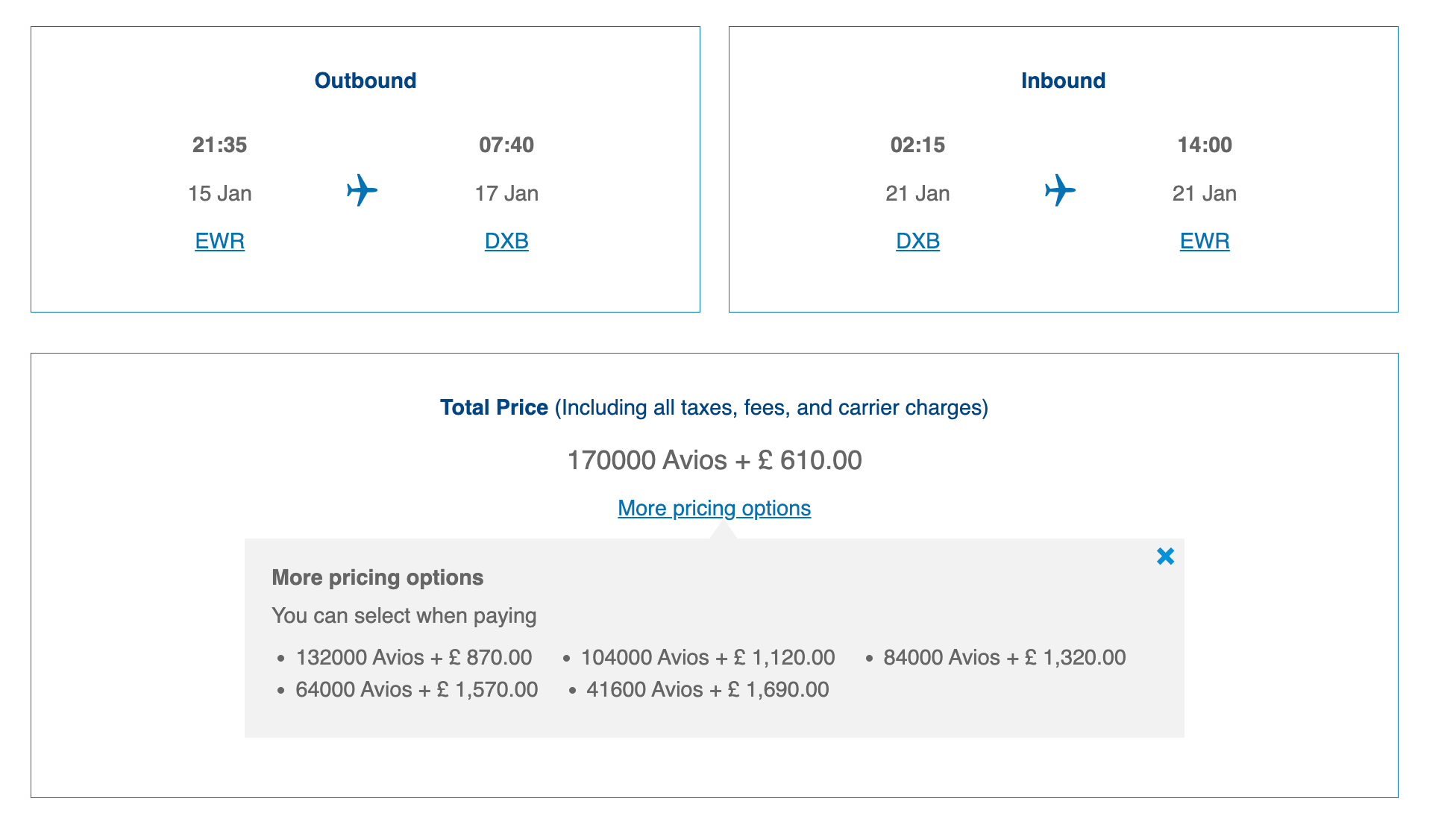

Alternatively, you could possibly guide via a program with a hard and fast award chart, like British Airways Government Membership. This program costs fewer Avios (170,000) however provides 610 British kilos ($854) in taxes, charges and surcharges for the same route that’s not direct.

Utilizing TPG’s September 2024 valuations once more, right here is the price between the 2 redemption choices:

- Redeeming United miles: 223,100 multiplied by 1.35 plus $58.90 equals $3,070.75

- Redeeming British Airways Avios: 170,000 multiplied by 1.4 plus $718 equals $3,098

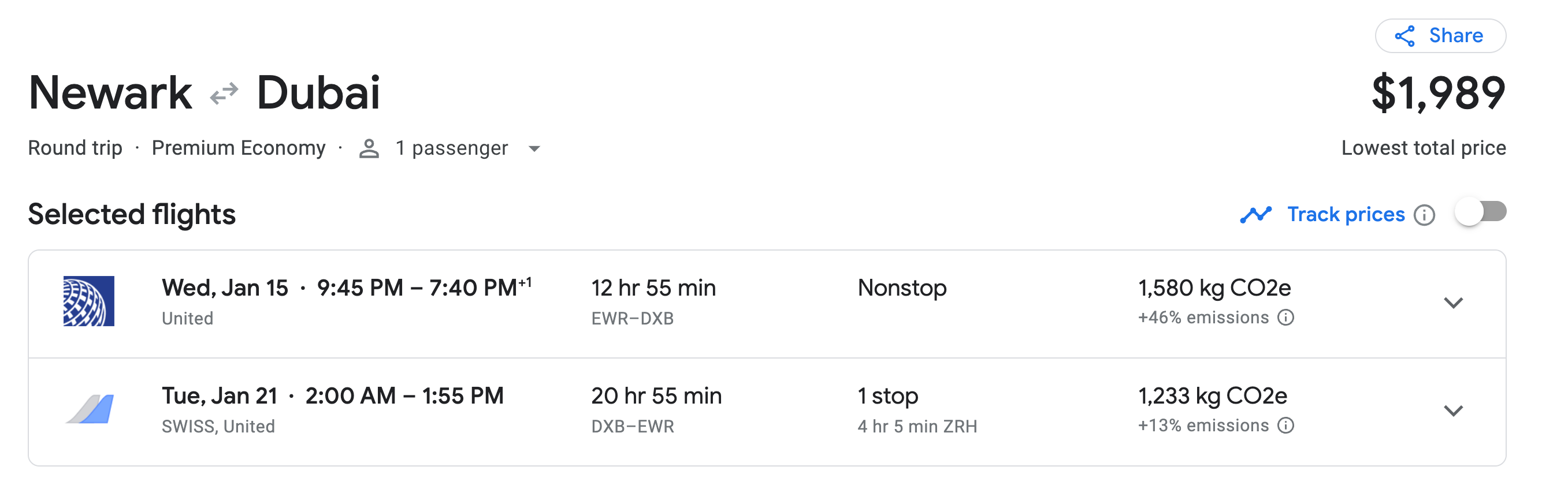

On this occasion, each choices are equal, noting that the United flight might be preferable, as it’s nonstop. However once more, examine the money fares, as there may be the choice of flying on the nonstop United flight in premium financial system and flying again on a mixture of Swiss and United through Zurich Airport (ZRH) for below $2,000 round-trip.

Learn how to earn transferable factors

Switch companions differ from card issuer to card issuer, however listed here are a few of our favourite playing cards providing sturdy welcome bonuses you may convert to some, if not all, of the packages mentioned above:

- American Categorical® Gold Card: Earn 60,000 bonus factors after spending $6,000 on purchases within the first six months of card membership. Plus, obtain 20% again in assertion credit on eligible restaurant purchases (as much as $100) throughout the first six months of card membership. Phrases apply.

- The Platinum Card® from American Categorical: Earn 80,000 Membership Rewards factors after you spend $8,000 on purchases throughout the first six months of card membership. Test to see in case you’re focused for a greater welcome supply via CardMatch (supply topic to vary at any time). Phrases apply.

- The Enterprise Platinum Card® from American Categorical: Earn 150,000 bonus factors after spending $20,000 on eligible purchases within the first three months of card membership.

- Capital One Enterprise Rewards Credit score Card: Earn 75,000 bonus miles when you spend $4,000 on purchases throughout the first three months from account opening.

- Capital One Enterprise X Rewards Credit score Card: Earn 75,000 bonus miles when you spend $4,000 on purchases throughout the first three months from account opening.

- Chase Sapphire Most well-liked® Card: Earn 60,000 bonus factors after spending $4,000 on purchases within the first three months from account opening.

- Ink Enterprise Most well-liked® Credit score Card: Earn 90,000 bonus factors after spending $8,000 on purchases within the first three months from account opening.

Associated: Why transferable factors are value greater than different rewards

Backside line

The good and horrible factor about dynamic pricing is that it wildly fluctuates each day. Should you journey in off-peak instances (reminiscent of to Europe in winter), these dynamic costs could also be near the outdated award chart costs. Mixed with low charges and taxes, this generally is a terrific approach to redeem your factors and miles.

If you wish to journey when demand is excessive, selecting a program with mounted award charts could be higher. This manner, you understand you’ll pay an inexpensive quantity of factors and miles, even when the surcharges are excessive. If doubtful, do the mathematics utilizing our valuation of factors and miles, as we did above.

As at all times, it’s a good suggestion to examine award availability earlier than transferring bank card factors to any program, because the transfers can’t be reversed in case you’re unable to seek out award availability via your chosen program. Additionally, examine money fares, as you might be able to discover a affordable money possibility as a substitute.