It is no shock that journey rewards bank cards get fairly a little bit of protection right here at TPG.

Making the most of high welcome bonuses and strategically utilizing your playing cards for on a regular basis purchases can unlock unbelievable redemptions, equivalent to premium cabin flights and luxurious lodge rooms. Nevertheless, there are a variety of misconceptions about bank cards.

Let’s debunk one notable fable to hopefully allow you to keep away from a credit score rating drop.

Associated: How do credit score scores work?

Fable: Closing a card I do not use will assist my credit score rating

There are numerous the reason why you might need a bank card that you just do not use anymore.

Possibly it was the very first one you opened as an grownup, however you could have since been changed with a extra precious card. Possibly your priorities have shifted, and a sure card now not suits into your technique. Or possibly you could have relocated to a brand new space of the nation and located that your go-to card has much less utility.

In these circumstances, chances are you’ll assume that it’s best to cancel an unused card simply sitting in your pockets (or sock drawer) to assist your credit score rating. Nevertheless, in actuality, chances are you’ll discover the precise reverse to be true. Canceling a card can truly drop your credit score rating.

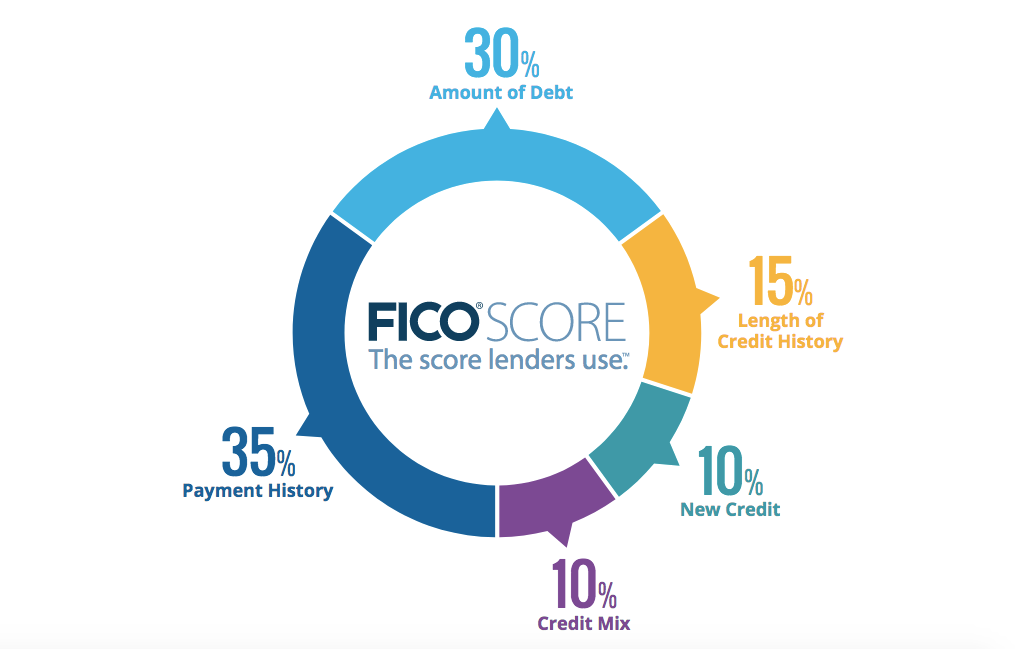

For this fable, it is important to know the various factors that contribute to your FICO rating, the metric most continuously used to find out your creditworthiness for any new line of credit score:

- Fee historical past

- Quantities owed

- Size of credit score historical past

- New credit score

- Sorts of credit score used

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Nevertheless, not all components are created equal. Within the graphic under, these 5 components are weighted based mostly on how essential they’re to your rating.

Relating to closing a card you now not use, there’s one major issue that may influence your rating in a detrimental approach: quantities owed.

Associated: How one can test your credit score rating

Quantities owed

The second most essential think about your FICO rating is your quantities owed — generally known as your credit score utilization fee. This appears to be like at how a lot of your credit score you’re truly utilizing, and it is usually expressed as a proportion. Here is the calculation: Complete stability in your account(s) divided by the entire restrict of account(s) equals utilization.

Holding this quantity low reveals issuers you can successfully handle your credit score strains and are not prone to overextending your self.

An instance

As an instance that you simply usually spend about $2,000 per 30 days in your major bank card with a $10,000 restrict, and also you at the moment have one other unused card, additionally with a $10,000 restrict. You thus have a utilization fee of 10% ($2,000 divided by $20,000).

Nevertheless, in the event you then cancel that unused card, the month-to-month spending is now unfold throughout a a lot decrease credit score line. By canceling the cardboard, your utilization jumps to twenty%. That quantity is not too regarding, however you should not take something that impacts your rating evenly.

In fact, that is to not say that it’s best to by no means cancel a bank card. When you’re now not utilizing a card that carries an annual payment, it might not make sense to maintain that card open until the advantages you are getting outweigh the payment. Simply you should definitely name the issuer and inquire a couple of retention bonus. The agent might even be keen to waive the annual payment.

Associated: How canceling a bank card impacts your FICO rating

Size of credit score historical past

Whereas the quantities owed are the first issue affected by canceling a card you now not use, it may possibly additionally influence your credit score historical past, which makes up 15% of your credit score rating.

If the unused card is your longest-tenured account, canceling it may possibly negatively have an effect on the typical age of your accounts. Nevertheless, this does not occur immediately, as closed accounts (in good standing) will usually keep in your credit score report for as much as 10 years.

However, canceling a card with no annual payment — particularly one you’ve got had for years — can in the end influence your rating.

This can be a key motive why I at all times suggest opening and holding no less than one card with no annual payment. Simply you should definitely make a least just a few purchases a 12 months on the cardboard to forestall the issuer from canceling it on account of inactivity. This will additionally assist stop your factors and miles from expiring.

Backside line

There are numerous myths about bank cards, and one widespread false impression is that it’s best to cancel a card that you do not use anymore to spice up your credit score rating.

In actuality, this could have a major detrimental influence in your credit score rating, as it would decrease your general credit score restrict and thus improve your utilization fee. Over time, this might (doubtlessly) lower your common age of accounts as nicely. Whereas there could also be authentic causes to cancel a card, do not do it with out first contemplating the way it will have an effect on your credit score rating.

Associated: TPG’s 10 commandments of bank card rewards