Many individuals use a most well-liked or chosen identify somewhat than their authorized identify or the identify on their start certificates. This may be so simple as somebody whose authorized identify is Elizabeth going by Liz or Beth of their each day life.

It additionally consists of transgender individuals. Within the largest examine ever performed on this subject (warning: PDF doc), practically 70% of transgender people stated they did not have any ID or banking paperwork matching their most well-liked identify.

Practically a 3rd of individuals whose paperwork do not match their present bodily presentation reported being denied providers, being requested to depart a enterprise and even being bodily assaulted when making an attempt to make use of these outdated paperwork.

Roughly 1 / 4 of those individuals stated they did not know methods to change to their most well-liked identify on their paperwork or believed it wasn’t doable. Nonetheless, some banks permit individuals to make use of their most well-liked or chosen identify on their credit score or debit playing cards — even when it does not match their authorized identify.

This permits individuals to have banking paperwork that match the id they current of their each day lives. Essentially the most widespread of those applications is Mastercard’s True Identify program, launched in 2019 and obtainable in North America and Europe.

Let’s study the positions of the foremost banks and bank card issuers within the U.S. on utilizing most well-liked names so you possibly can perceive your choices.

Perceive: The financial institution nonetheless wants your authorized identify

Earlier than we assessment financial institution and bank card issuer insurance policies, it is vital to grasp that some require you to open the account first after which submit a request for a brand new card together with your most well-liked identify on it (others help you do that through the account opening course of).

You need to use your authorized identify when making use of for any sort of financial institution or credit score account within the U.S. That is due to a provision (Part 326) within the USA Patriot Act; this rule went into impact in 2003.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

The rule requires banks, credit score unions and bank card issuers to determine a buyer identification program to adjust to authorities laws. This program requires you to supply your personally figuring out info so the financial institution can confirm that you’re who you say you’re. One requirement is offering your authorized identify.

The query is what comes after this. Can you alter the identify displayed in your credit score or debit card to a most well-liked identify somewhat than your authorized identify? Let’s take a look at your choices with a number of the main banks.

Associated: Are you able to get by means of airport safety with out ID?

American Specific

With just a few exceptions, American Specific has allowed customers to make use of a most well-liked identify on their bank cards for a number of a long time. Through the software course of for an American Specific card, customers can choose the identify they need displayed on their card.

If you wish to change or replace this later, you possibly can name the quantity on the again of your card. Amex permits cardmembers to make use of a most well-liked identify as long as it is not the identify of somebody well-known or profane, and a telephone consultant may also help you make this alteration.

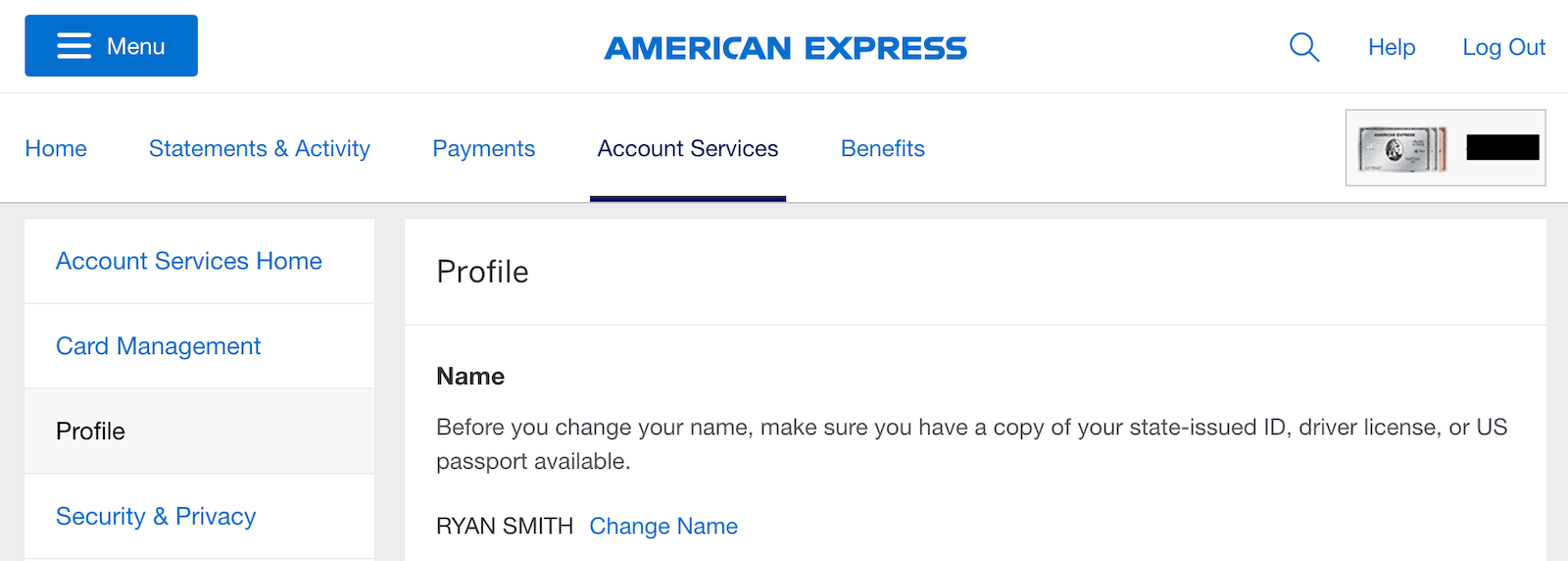

If the identify change coincides with a change in your authorized identify, you possibly can request this alteration by means of your person profile on the web site. After logging in, choose the cardboard you need to replace within the prime proper nook, then click on “Account Companies.” From right here, a brand new menu will seem on the left aspect; select “Profile.” Subsequent to your identify, you may see the choice for “Change Identify.”

The following web page will help you present your authorized identify after which a reputation to be displayed in your card.

After shifting ahead, it’s essential to submit paperwork to help your request. This on-line choice works greatest for many who have already efficiently modified their identify on their ID playing cards. In the event you request a most well-liked identify that does not match your authorized identify, a telephone name is your best choice.

Financial institution of America

Financial institution of America declined to supply info for this story.

Barclays

A spokesperson for Barclays confirmed that it is not doable to make use of a most well-liked identify on its bank cards presently, offering TPG with the next assertion:

“We try to satisfy the wants of all of our cardmembers, together with these within the LGTBQ+ neighborhood. Whereas we do not at present supply this characteristic, it is one thing now we have explored and wish to implement sooner or later.”

BMO Harris

BMO Harris operates a nationwide community of fee-free ATMs along with branches in eight states. Its True Identify initiative means that you can use your most well-liked identify on a credit score, debit or ATM card, together with enterprise playing cards.

In the event you financial institution with BMO Harris and need to request your most well-liked identify, name 888-340-2265 or go to a neighborhood department (places can be found right here).

Capital One

An replace to its coverage permits Capital One bank card holders to make use of most well-liked names, even when these aren’t a by-product of the individual’s authorized identify. When requesting the change, there is no such thing as a requirement to submit documentation associated to the popular identify you need in your card.

“At Capital One, our prospects are on the forefront of the whole lot we do, so we’re proud to share that prospects now have the flexibility to decide on to show their most well-liked identify on their bank card earlier than a authorized gender change or authorized identify change,” in keeping with a spokesperson for Capital One.

“Clients should not required to supply any documentation or justification for the identify they like to have seem on their bank card plastic.”

You may request a change to your most well-liked identify by calling the quantity on the again of your card.

Associated: Capital One Journey portal: What to learn about redeeming your miles for flights, inns and extra

Chase

With Chase, prospects should presently use their authorized identify on their credit score and debit playing cards. Nonetheless, this may occasionally change sooner or later. A spokesperson for Chase stated in 2022 that the financial institution is “engaged on giving our cardmembers the choice to make use of their most well-liked identify as an alternative.”

Citi

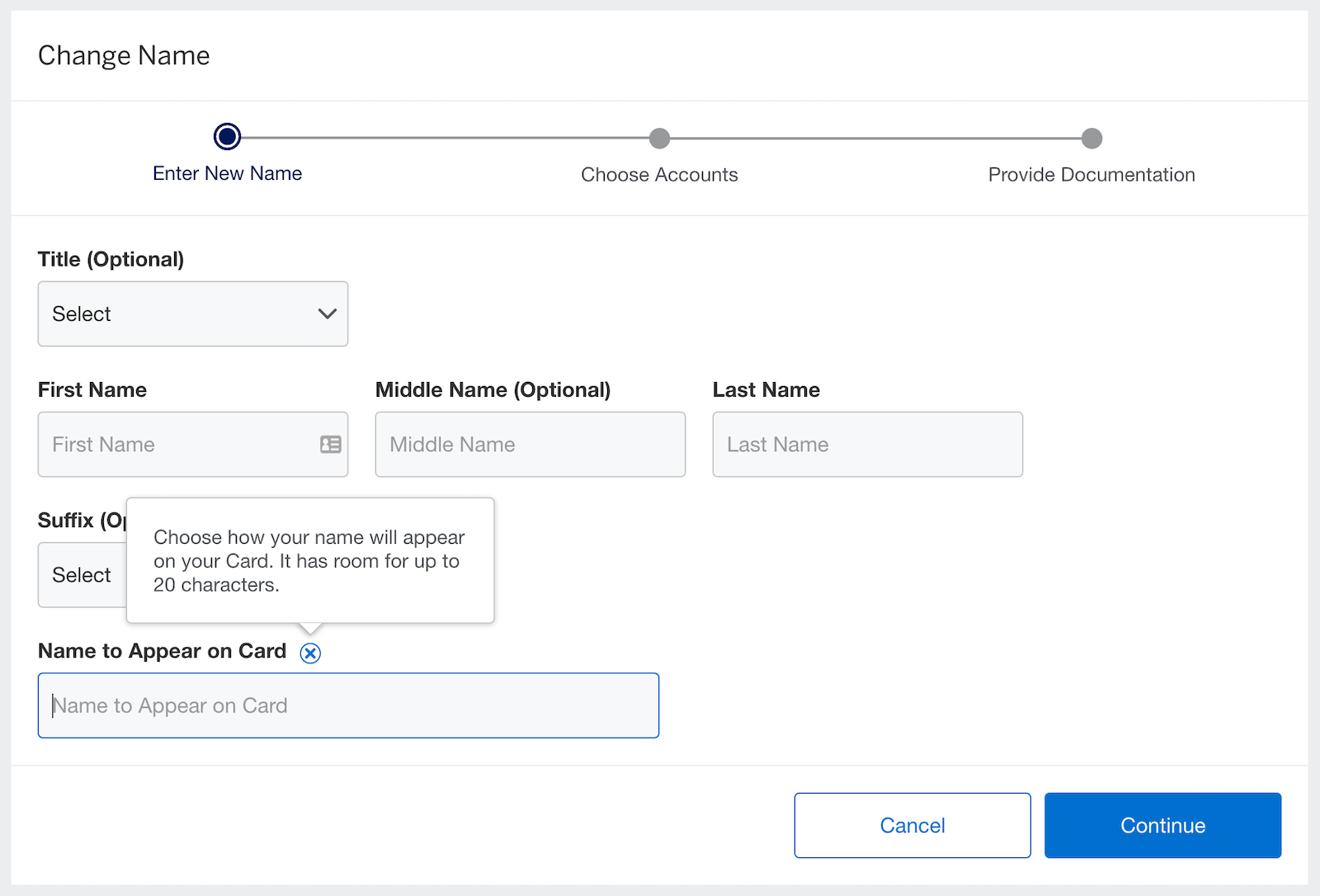

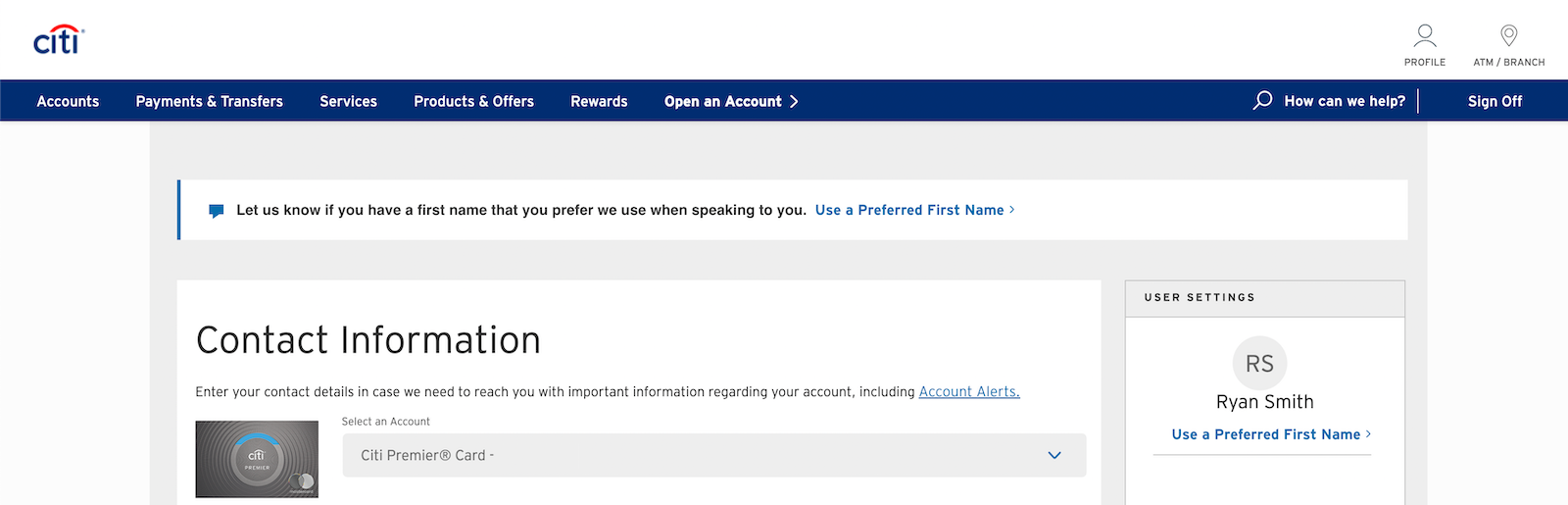

For years now, Citi bank card and debit card holders have been ready to make use of their chosen first names.

Clients can replace their names on debit playing cards by calling the quantity on the again of their card or by visiting a neighborhood Citi department (which you’ll find right here). Citi bank card holders can name the quantity on their card to request an replace for a number of playing cards directly or make this replace on-line (for only one account at a time) by logging in to their on-line accounts and clicking on “Profile” on the prime.

From right here, click on on “Contact Info.” You will note the choice to make use of a most well-liked first identify.

In line with a Citi spokesperson, a substitute card will arrive inside 4 to seven enterprise days after updating your most well-liked identify. You may observe the standing of your substitute card on-line.

Daylight

As a financial institution targeted on the LGTBQIA+ neighborhood, all communication is finished utilizing the popular identify supplied by prospects. After offering your authorized identify through the account software course of, each different communication level will use your most well-liked identify. This identify may even be proven in your debit card.

Uncover

Cardholders can’t use a most well-liked identify on debit or bank cards with Uncover. Nonetheless, a spokesperson added that the cardboard issuer is “dedicated to figuring out a course of for enabling strategies by which prospects can change their first identify on their fee card to their most well-liked/chosen identify.”

U.S. Financial institution

Presently, prospects can’t use a most well-liked identify on credit score or debit playing cards from U.S. Financial institution, in keeping with a financial institution spokesperson. The identical spokesperson supplied the next assertion:

Most popular names are an vital a part of particular person id, and we respect these preferences. Attributable to limitations on the id verification course of in place, we’re at present unable to accommodate using a reputation that doesn’t match with different authorized information. We’re repeatedly exploring course of enhancements to help all of our prospects. [H]owever, we do not have something agency to share presently.

Wells Fargo

Whereas utilizing a most well-liked identify could have been doable previously, it is not now with Wells Fargo. Those that beforehand used most well-liked names on Wells Fargo bank cards and debit playing cards have obtained letters stating they have to deliver their government-issued identification to a neighborhood department to obtain new playing cards with their authorized names.

Thus, solely the authorized identify on the account could be listed on these playing cards. Nonetheless, when requested about most well-liked names in 2022, a spokesperson for Wells Fargo stated the financial institution “proceed[s] to discover this selection.”

Backside line

As you possibly can see, a number of banks presently permit prospects to make use of their most well-liked identify on credit score and debit playing cards, together with enterprise accounts at a number of establishments. Others have dedicated to have a look at implementing using most well-liked names sooner or later. Superbia, a monetary establishment targeted on the LGBTQIA+ neighborhood, can be getting ready to launch and has assured using most well-liked names as a part of its core rules.

Whether or not you are trying to make use of a most well-liked identify associated to your authorized identify or one which is not, inclusion issues. Everybody ought to have the ability to use the identify they like of their each day lives — together with the subsequent time they pull out their credit score or debit card to make a purchase order.

Slightly than experiencing the ache and embarrassment that may come from pulling out a card that does not match your true self, banking with an issuer that means that you can use your most well-liked identify in your card could make you’re feeling acknowledged.

Nonetheless, it is vital to notice {that a} service provider should ask to see ID on some transactions, and having a card with a reputation that does not match your id paperwork may create a unique drawback. Nonetheless, the world of tap-to-pay transactions and cell wallets ought to make this easier.

Associated: Find out how to navigate an LGBTQ+ identify/gender change for travel-related documentation