One of many major components in making use of for a brand new bank card is to earn the sizable welcome bonus supplied. Regardless of the bonus supply is (and the cardboard’s different perks), it is usually well worth the onerous inquiry in your credit score report.

Chase presents a number of the finest journey rewards bank cards, with the highest two being the Chase Sapphire Most well-liked® Card (see charges and charges) and the Chase Sapphire Reserve® (see charges and charges).

Presently, the Sapphire Most well-liked is providing its highest-ever welcome supply of 100,000 bonus factors after spending $5,000 on purchases inside the first three months of account opening.

Nonetheless, think about the next state of affairs: You apply for a brand new bank card with a tremendous welcome supply, and your utility is denied, or you might be authorised however ineligible for the welcome supply.

Let’s undergo some situations to find out if you happen to’re eligible for a Sapphire card welcome bonus and methods to overcome any boundaries which will come up.

Chase’s 5/24 restrictions

The primary impediment to getting authorised for a Chase Sapphire card is the notorious 5/24 rule. In an try to cut back dangerous lending and sort out bank card churning, Chase enforces this on all candidates.

The rule states that your utility shall be mechanically rejected if you happen to’ve opened 5 or extra playing cards inside the final 24 months. Enterprise bank cards don’t rely towards this rule; nevertheless, being a certified person on another person’s account will rely towards 5/24.

If you’re over the 5/24 rule, don’t apply for both the Sapphire Most well-liked or the Sapphire Reserve since you seemingly will not qualify and you will nonetheless obtain a tough inquiry in your credit score report.

Resolution

You may must do some digging to find out if you happen to’re inside 5/24. Fortunately, it isn’t too tough. Calculate your 5/24 standing by your credit score report.

Each day Publication

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

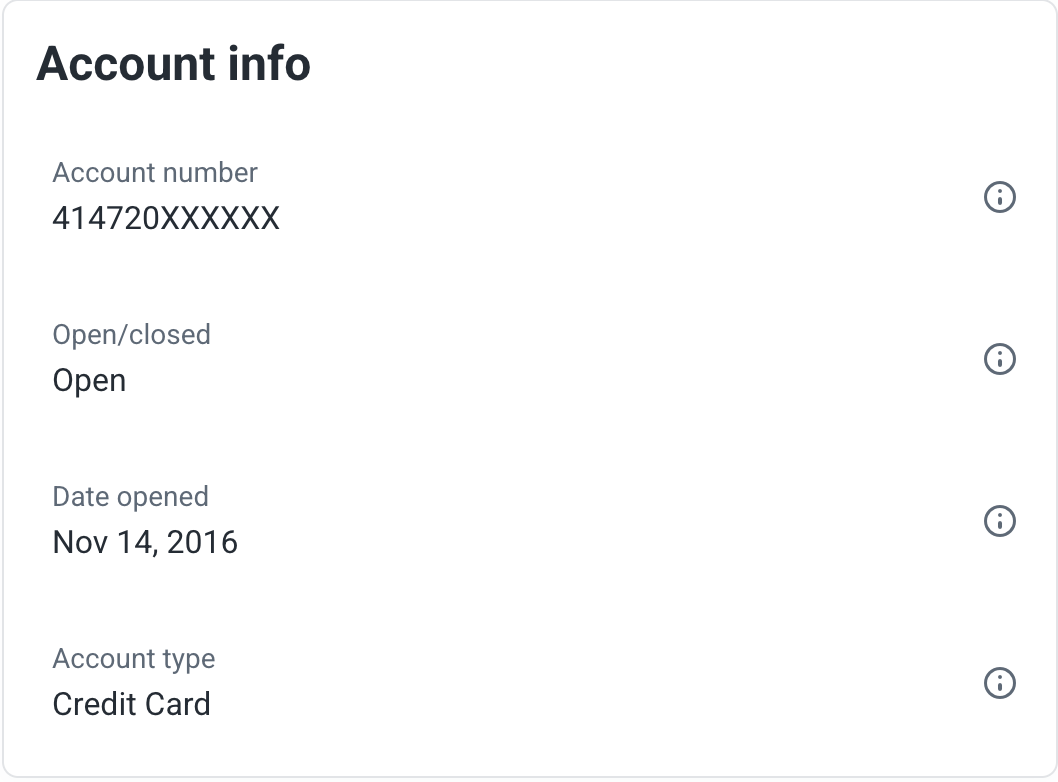

You may create a free account with Experian and, underneath “open accounts and closed accounts,” see which accounts are open and once they began reporting to the credit score bureau. You may as well request a free full credit score report from every of the three credit score bureaus each 12 months.

For instance, when trying up particular person bank cards on Experian, you’ll be able to see your present account standing and the precise date the bank card was opened.

For those who calculate your standing as 4 or fewer playing cards opened inside the final 24 months, you’ll be able to proceed to the subsequent step of confirming eligibility for the welcome bonus.

Associated: The very best methods to make use of your Chase 5/24 slots

Present Sapphire product cardholder

Now that you already know your utility for a Chase Sapphire card will not be mechanically denied as a result of 5/24, the subsequent step is to find out in case you are eligible based mostly on the playing cards in your pockets. Basically, you’ll not be authorised for a Chase Sapphire card if you happen to presently maintain one other Sapphire bank card.

For instance, as a present cardholder of the Chase Sapphire Reserve, I’m mechanically ineligible to earn the welcome bonus on the Chase Sapphire Most well-liked.

Resolution

To earn the present welcome bonus of 100,000 bonus factors on the Sapphire Most well-liked, you will need to shut any present Sapphire card or downgrade to a different Chase bank card.

For instance, you’ll be able to downgrade a present Sapphire card to the Chase Freedom Flex® (see charges and charges) by calling the quantity on the again of your Sapphire card and requesting a product change with the consultant. Nonetheless, to be eligible for the welcome bonus, you will need to meet one other set of standards.

Associated: When are you able to downgrade your bank card?

48-month rule

For those who’ve by no means held a Chase Sapphire bank card, proceed to use and relaxation assured you will not be denied for violating any of the beforehand acknowledged issuer restrictions. For those who’ve held a Sapphire bank card and have closed or downgraded it, you will must ensure you haven’t obtained a cardmember bonus inside the final 48 months.

For those who’ve earned a welcome bonus on both Sapphire card inside the final 48 months, even if you happen to’ve closed the cardboard and now not have it, you might be nonetheless ineligible.

Resolution

If I wished to capitalize on the Sapphire Most well-liked‘s 100,000 bonus factors supply, I must both shut my Sapphire Reserve or downgrade it to the Chase Freedom Limitless® (see charges and charges) or the Freedom Flex and wait a number of days to verify it has gone by means of. Take note, closing your card would impression your credit score rating, whereas downgrading your card wouldn’t.

I might then apply for the Sapphire Most well-liked. Assuming I get authorised, I would be eligible for the present welcome bonus since I earned the welcome bonus for my Sapphire Reserve in 2016.

Remember the fact that welcome bonuses are normally earned months after opening a Sapphire card, so make sure to calculate accordingly if you happen to’re slicing it shut.

This may be carried out by first verifying if you opened the account (you should utilize your credit score report for this) after which checking your month-to-month statements on-line from that time ahead to see when the bonus hit. Lastly, do some fast math to ensure you’re previous the 48-month mark.

Associated: The final word information to bank card utility restrictions

Credit score rating necessities

When going by means of the guidelines, chances are you’ll ask, “Am I eligible for the Chase Sapphire Most well-liked bonus?” After ensuring you meet the issuer’s necessities for welcome bonus eligibility for Sapphire bank cards, the ultimate step is to verify your present credit score rating and historical past are ok to land you an approval.

Primarily based on on-line crowdsourced information, each the Chase Sapphire Most well-liked and the Chase Sapphire Reserve have excessive approval requirements. As a Visa Infinite product, the Sapphire Reserve will probably be authorised for somebody who can meet the monetary necessities for a minimal credit score restrict of $10,000.

Components that decide this embrace a credit score rating of 740 or higher for the Sapphire Reserve or 670 or larger for the Sapphire Most well-liked. That is along with having a low debt-to-income ratio, good credit score historical past and low credit score utilization.

Resolution

You probably have no or restricted credit score historical past or a low credit score rating, it is higher to start out off with a extra entry-level bank card, such because the Chase Freedom Limitless or the Citi Double Money® Card (see charges and charges). Wait a 12 months or so after which apply for a Sapphire card, seemingly the mid-tier Chase Sapphire Most well-liked as a result of it being one of many finest newbie bank cards, thanks, partially, to its low annual payment of $95.

Inside that 12 months, make sure that to apply good habits corresponding to paying your stability on time and in full, avoiding late funds and retaining your credit score utilization underneath 30%. This can seemingly enhance your credit score rating, and though you will miss this limited-time welcome supply, likelihood is your approval odds shall be a lot larger.

Associated: 8 largest components that impression your credit score rating

Backside line

A number of roadblocks can exist when attempting to earn the welcome bonus on a Chase Sapphire bank card. Issuer-related restrictions, corresponding to Chase’s 5/24 or 48-month rule for earlier cardholders, may be averted by checking your credit score report or just ready till you fall outdoors of these restrictions.

In fact, there are additionally private limitations, together with a low credit score rating or weak credit score historical past. For those who’re involved in opening a Sapphire bank card, use this guidelines to verify your approval eligibility and talent to earn the welcome bonus.

To study extra, learn our full assessment of the Chase Sapphire Most well-liked.

To study extra, learn our full assessment of the Chase Sapphire Reserve.

Apply right here: Chase Sapphire Most well-liked Card

Apply right here: Chase Sapphire Reserve