The golden rule of bank cards and incomes rewards is that we must always try to pay our balances in full every month. The large rates of interest banks cost — particularly on journey rewards playing cards — will shortly strip away any worth chances are you’ll earn from factors and miles. Generally sudden bills can happen, otherwise you can not repay your steadiness attributable to monetary emergencies or poor planning.

Chase affords two financing choices for bank card costs: Chase Pay Over Time and My Chase Mortgage. Every comes with its personal charges or curiosity costs which can be normally decrease than your common annual proportion price (APR) and may help cardholders repay bigger purchases over a number of months.

On this information, we’ll go into the main points of Chase Pay Over Time and My Chase Mortgage that can assist you higher perceive what they’re and if these financing choices are best for you.

Chase Pay Over Time

Chase Pay Over Time is certainly one of two financing choices obtainable to most shopper Chase bank cards, such because the Chase Sapphire Reserve® (see charges and charges) and Chase Freedom Limitless® (see charges and charges).

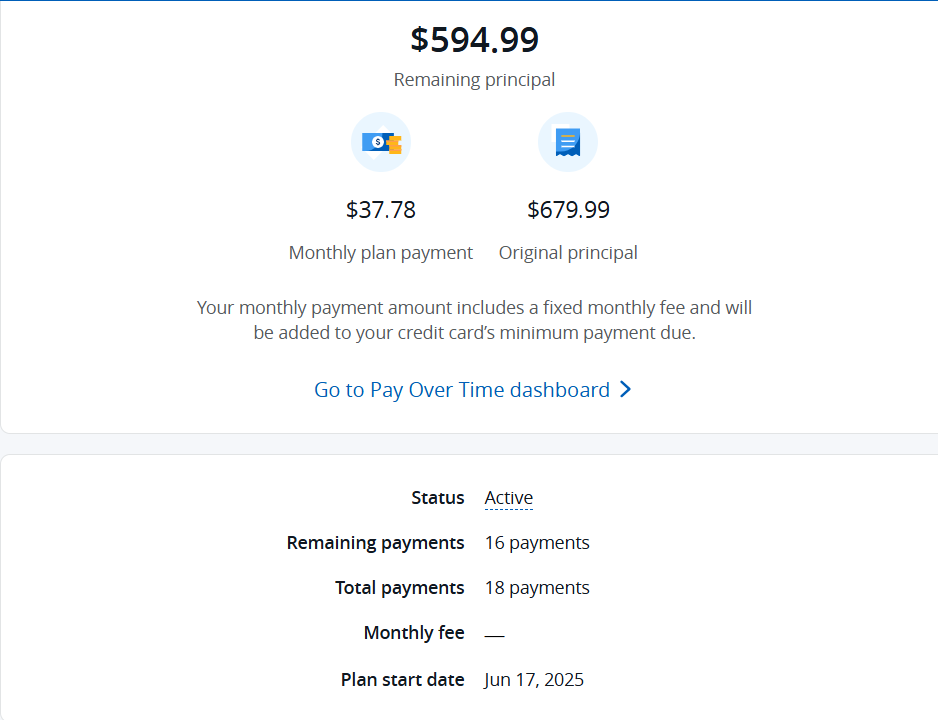

This was previously referred to as “My Chase Plan.”

What’s Chase Pay Over Time?

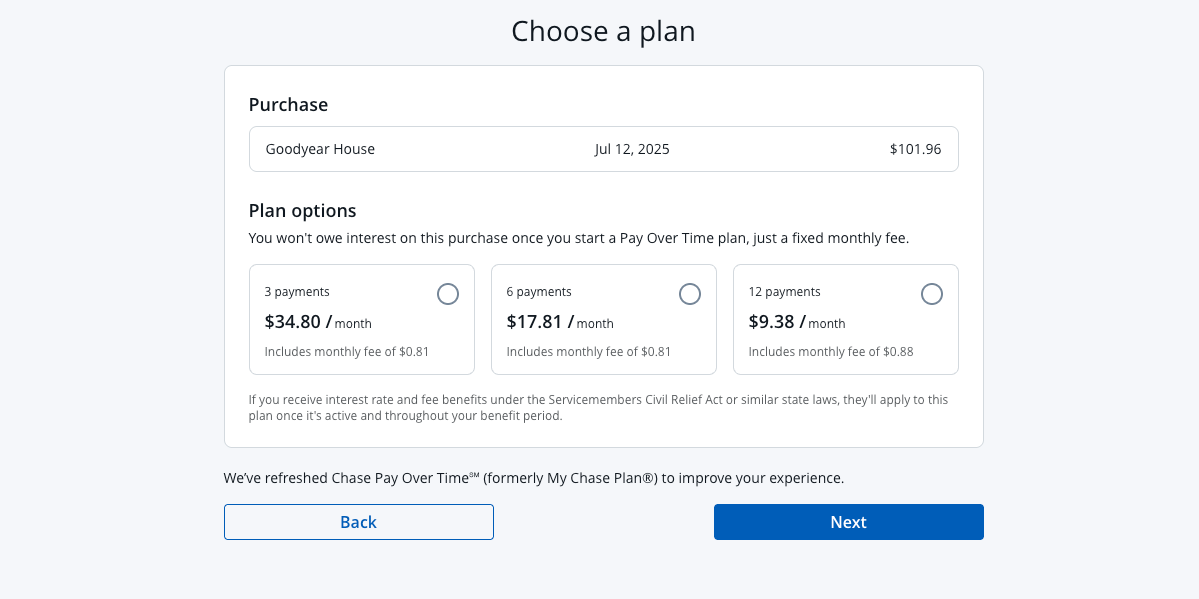

Chase Pay Over Time is much like the American Categorical Plan It® characteristic, the place Chase cardholders can repay purchases of $100 or extra over a particular variety of months with a month-to-month payment and no curiosity.

The Chase Pay Over Time month-to-month payment may be as much as 1.72% of every eligible transaction. This payment varies based mostly on elements reminiscent of the quantity being financed and the compensation plan period chosen, however it’s normally lower than any curiosity costs you’ll have accrued for those who had simply carried the steadiness.

Chase cardholders can have as much as 10 plans on their account at any time. Generally, Chase will supply a $0 month-to-month payment for a Pay Over Time plan; that is the perfect time to decide on Pay Over Time.

How does Chase Pay Over Time work?

Chase Pay Over Time permits cardholders to finance eligible purchases through the use of their present bank card and line of credit score with out transferring the steadiness to a steadiness switch card.

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Primarily based on the acquisition quantity, Chase can supply compensation phrases starting from three to 18 months. When choosing a Pay Over Time plan, cardholders are introduced with three compensation time period choices.

Though you’ll not be charged curiosity on the steadiness you carry month-to-month, Chase normally costs a month-to-month payment for enrolling a purchase order in Chase Pay Over Time. The month-to-month quantity of your plan is added to your minimal steadiness, so to make sure you’re paying off your buy, cardholders should pay a minimum of the minimal steadiness of their card every month.

Execs and cons of Chase Pay Over Time

| Execs | Cons |

|---|---|

|

|

TPG bank cards editor Olivia Mittak lately used Pay Over Time to purchase a sofa with an 18-month plan. She used her United℠ Explorer Card (see charges and charges), a cobranded Chase United card.

Amazon checkout

Chase cardholders may also elect to make use of Pay Over Time at checkout on Amazon.com on purchases of $50 or extra. When you choose your Chase card, you’ll be able to select “Financing affords obtainable” throughout checkout to see your choices.

You possibly can select your plan period and pay in your Amazon buy with a set APR that is the identical or decrease than your common APR.

Associated: Purchase now, pay later vs. bank card rewards: Which do you have to select?

My Chase Mortgage

My Chase Mortgage permits cardholders to borrow cash from their present line of credit score from their Chase playing cards, and is a greater solution to borrow cash than a money advance.

What’s My Chase Mortgage?

My Chase Mortgage enables you to use your line of credit score by depositing a mortgage into your checking account with out charges and with a comparatively low APR.

It is an efficient solution to borrow cash out of your present line of credit score with out the necessity to apply for a mortgage from one other financial institution, which might additionally earn you a tough inquiry in your credit score report.

How does My Chase Mortgage work?

You possibly can arrange My Chase Mortgage on-line at Chase.com or on the cell utility.

The minimal quantity you’ll be able to borrow is $500. The utmost mortgage quantity relies in your creditworthiness and different elements, together with account historical past.

Chase affords mortgage phrases from 12 months to 24 months; as soon as a plan is chosen, the funds are deposited into your account inside two enterprise days.

Every month, your minimal steadiness due can be reflective of your My Chase Mortgage month-to-month fee and the minimal fee due for purchases made within the earlier billing cycle. There isn’t any penalty for paying off your My Chase Mortgage early.

Execs and cons of My Chase Mortgage

| Execs | Cons |

|---|---|

|

|

Does Chase Pay Over Time or My Chase Mortgage have an effect on my credit score rating?

To place it merely, sure. Though there is no such thing as a credit score inquiry when using both Chase Pay Over Time or My Chase Mortgage, you might be nonetheless utilizing up your line of credit score and paying it off over time.

With bank cards, credit score utilization and quantities owed are two key elements in figuring out your credit score rating. When you’ve got a line of credit score of $20,000 and are using $10,000 as a My Chase Mortgage, then you definitely’re using 50% of that card’s total line of credit score.

The identical goes for Pay Over Time: regardless that you are not accruing curiosity, paying a card off slowly nonetheless reveals the credit score bureaus that you’ve debt month over month.

When you’ve got a My Chase Mortgage and a number of Pay Over Time plans activated in your account, your debt owed month to month can be much more, which can end in a drop in your credit score rating.

No matter drop in credit score rating chances are you’ll expertise with both financing play is short-term as a result of as you repay the debt, your total credit score utilization will lower and you may proceed displaying on-time funds.

Associated: Is 30% bank card utilization the magic quantity?

Are Chase Pay Over Time and My Chase Mortgage price it?

For those who can afford to repay a purchase order on time and in full and thus keep away from each curiosity funds and charges, that choice makes probably the most sense. Nonetheless, for giant purchases the place you recognize you will not be capable of repay the steadiness in full, Chase Pay Over Time and My Chase Mortgage could be a lower-cost choice than carrying a steadiness and accruing curiosity in your buy.

It is much more price it to make the most of Chase Pay Over Time for those who’ve been focused for a no-fee supply. On this case, you may have extra time to repay your buy with out being charged a payment. The one downside on this state of affairs is that your credit score utilization could improve while you’re paying off your Pay Over Time plan.

An alternative choice to decide on if you wish to keep away from curiosity and charges is a 0% APR bank card. Many high cash-back bank cards supply an introductory interval from 12 to 18 months, the place you’ll be able to repay new purchases with a 0% APR (although a variable APR will apply to your steadiness as soon as that introductory interval is over).

For these actually giant purchases, a 0% APR card is perhaps the higher solution to go if you wish to use bank cards to finance. That mentioned, for those who’re unable to get accredited for a 0% APR card, Pay Over Time is a viable various.

Associated: Execs and cons of 0% APR bank cards

Backside line

Financing choices reminiscent of Chase Pay Over Time and My Chase Mortgage could be a respectable selection in a pinch as a result of they help you pay in your purchases over time with out accruing curiosity.

Nonetheless, work to keep away from needing them as a lot as attainable. Borrow responsibly and repay your debt throughout the allotted time to keep away from penalties and injury to your credit score rating.

Associated: This is the right way to consolidate and repay your debt