Cathay Pacific bank card overview

Cathay Pacific could also be a world-class airline, however its U.S. bank card falls flat. From a lackluster welcome supply to underwhelming perks, this card struggles to compete with the highest journey rewards bank cards. I would not advocate this card, even to loyal Cathay flyers. Card ranking*: ⭐

*Card ranking relies on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

Cathay Pacific is one among my favourite worldwide airways — I’ve flown it in each first and enterprise class and have persistently been impressed. Based mostly in Hong Kong, the service serves six U.S. cities with sturdy connectivity throughout Asia and the South Pacific.

However whereas the airline has a premium fame, its bank card would not maintain up. The Cathay World Elite Mastercard, issued by Synchrony Financial institution and carrying a $99 annual charge, was refreshed and reopened to new candidates in April 2025. It usually requires a credit score rating of 620 or greater.

Let’s get into why I imagine this card falls wanting the mark.

The data for the Cathay World Elite Mastercard has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Cathay Pacific bank card professionals and cons

| Professionals | Cons |

|---|---|

|

|

Cathay Pacific bank card welcome supply

The Cathay Pacific bank card is at the moment providing (a really precise) 38,000 bonus miles after spending $3,000 within the first 90 days of account opening.

Based on our Might 2025 valuations, this welcome bonus is value a paltry $494. If you wish to earn a stash of Cathay Pacific Asia Miles, you are higher off making use of for a basic journey rewards bank card from American Categorical, Bilt, Capital One or Citi and transferring your rewards to this system.

Synchrony Financial institution doesn’t publish software restrictions, so it’s onerous to foretell your probabilities of approval. Since there is not any approach to verify in case you prequalify, making use of will most definitely end in a onerous inquiry in your credit score report.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Cathay Pacific bank card advantages

Here is a rundown of the perks you get from the Cathay Pacific bank card:

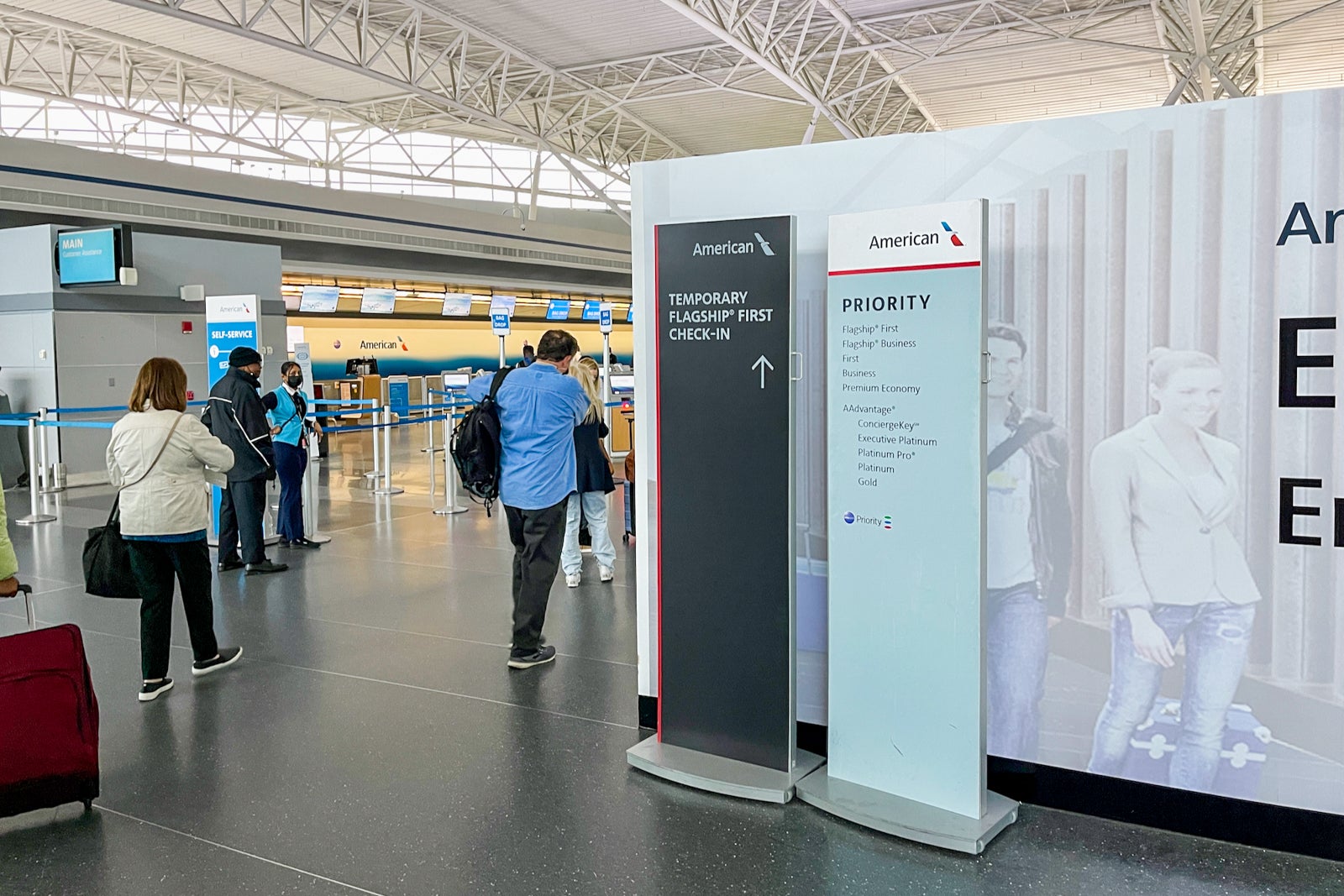

- Precedence check-in: You and your journey companions can verify in on the premium economic system check-in desk when flying Cathay Pacific.

- Precedence boarding: You — and solely you (no journey companions) — can board with the premium economic system group when flying Cathay Pacific; you have to current your bodily bank card to take action.

- World Elite Mastercard advantages: You will get pleasure from concierge entry and presents with manufacturers like Instacart (by means of August), Peacock (by means of December) and ShopRunner.

- No overseas transaction charges: You should use your card overseas with out accumulating additional fees (that is normal for many high journey rewards playing cards).

- Spend your approach to standing: Earn 10 standing factors for each $5,000 spent on the cardboard (as much as a most of 100 standing factors every calendar 12 months).

- Redemption low cost: Obtain 10% off automotive rental, expertise and lodge awards.

- Present and switch miles low cost: Get pleasure from 10% off of charges incurred when gifting or transferring miles to a different member.

These are poor advantages so far as an airline bank card is anxious. The very best airline bank cards supply lounge entry, companion certificates and useful methods to spend your approach to standing.

Whereas precedence check-in and boarding are helpful, you will solely get them with this card when a premium economic system cabin is working from the airport you are at (which is the case for all U.S. routes however just for about half of flights inside Asia).

The standing shortcut is meager. You’d have to spend $50,000 on the cardboard in a 12 months simply to get a 3rd of the way in which to Silver standing, which presents entry to Cathay Pacific business-class lounges, check-in and boarding.

Silver is equal to Oneworld Ruby standing; in case you’re going for Oneworld standing, I would advocate the extent above (Cathay Pacific Gold, which matches to Oneworld Sapphire) at a minimal. For that, you’d want 600 standing factors in a 12 months, so maxing out spending on this card would solely get you about 16% of the way in which; the remaining would have to be earned organically (by means of flying, procuring, and many others.).

This card’s phrases and situations state that it could take as much as six months for the standing factors to be mirrored in your account after they’re earned, so this card just isn’t a dependable approach to attain elite standing with the airline.

If standing is high precedence for you, a greater various is the Qatar Airways Privilege Membership Visa Infinite Credit score Card (with a $499 annual charge), which presents Oneworld Sapphire standing for the primary 12 months.

Lastly, the redemption low cost for automotive leases, experiences and motels — which, in contrast to Delta Air Traces’ 15% award flight low cost, doesn’t apply to flights — is not very helpful as a result of redeeming your Asia Miles for nonflight redemptions presents poor worth.

The data for the Qatar Airways Privilege Membership Visa Infinite Credit score Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Incomes miles on the Cathay Pacific bank card

As with most airline cobranded playing cards, you will earn essentially the most bonus miles when spending immediately with the airline. You will earn:

- 3 miles per greenback spent on Cathay Pacific and Hong Kong Categorical* flights and inflight purchases

- 2 factors per greenback spent on eating (together with eligible supply companies)

- 1 level per greenback spent on all the things else

*Hong Kong Categorical is Cathay Pacific’s low-cost subsidiary, working completely on intra-Asian routes.

Based mostly on our Might 2025 valuations, you will obtain a 3.9% return on flight purchases. Evaluate that to the over 6% return I get when utilizing my Chase Sapphire Reserve® (see charges and charges) for flight purchases (3 factors per greenback), together with that card’s sturdy journey protections, and it is easy to see why the Cathay Pacific card falls quick.

The two.6% return on eating pales compared to our high suggestion for a eating card, the American Categorical® Gold Card, which earns 8% on this class†, in keeping with our valuations.

†Earns 4 factors per greenback spent on eating at eating places worldwide (on as much as $50,000 in purchases per calendar 12 months, then 1 level per greenback spent for the remainder of the calendar 12 months).

In abstract, this card doesn’t pack a punch within the incomes division.

Redeeming miles on the Cathay Pacific bank card

Cathay Pacific is a member of the Oneworld alliance, so you’ll be able to redeem your miles with carriers akin to American Airways and British Airways, in addition to a number of nonalliance companions like Air Canada, LATAM and Lufthansa.

Nonetheless, the Asia Miles program is obscure. Should you’re new to it, try our full information to Asia Miles for all this system’s nuances and nitty-gritty particulars.

Should you assume redeeming Asia Miles is the best-value approach to fly in premium cabins with Cathay Pacific, assume once more. For instance, a one-way first-class flight from Los Angeles to Hong Kong requires 125,000 Asia Miles or 110,000 American Airways AAdvantage miles — and the taxes by means of AAdvantage are lower than 1 / 4 of these when reserving with Asia Miles.

Nonetheless, whereas reserving Cathay Pacific flights by means of American or Alaska Airways can supply higher worth, the airline releases extra award availability in its premium cabins to its personal members. I booked the flight above in January 2025 and had to make use of Asia Miles as a result of it wasn’t accessible by means of American or Alaska.

So, in case you discover an itinerary you want, my recommendation is to name Asia Miles at 833-933-2244 to place the award on maintain for as much as 72 hours. Should you want extra Cathay miles to cowl the fee, convert one among these transferable rewards currencies to Asia Miles (that are much more beneficial throughout a switch bonus promotion):

Lastly, you’ll be able to redeem Asia Miles for automotive leases, experiences and motels, in addition to lounge entry — however none of those choices are beneficial.

Which playing cards compete with the Cathay Pacific bank card?

On condition that Asia Miles companions with all the main transferable rewards packages apart from Chase, my recommendation is to get one of many following playing cards as an alternative:

For extra choices, see our full checklist of the greatest airline bank cards.

Associated: Why transferable factors and miles are value greater than different rewards

Is the Cathay Pacific bank card value it?

The Cathay World Elite Mastercard is the one U.S.-issued bank card that means that you can earn Asia Miles and standing factors immediately. Nonetheless, even frequent Cathay Pacific flyers may have hassle getting substantial worth from this card. My recommendation is to get a basic journey rewards bank card and switch your rewards to Asia Miles as an alternative.

Backside line

Cathay Pacific soars within the sky, however its bank card barely lifts off. Regardless of North America being its most profitable market outdoors Asia, the airline has failed to supply a compelling product for U.S. shoppers.

With a poor welcome bonus, disappointing journey perks and a sluggish path to elite standing, I might hesitate to advocate the Cathay Pacific bank card to even frequent Cathay Pacific flyers.

If you want to make use of miles to fly Cathay Pacific (in addition to get pleasure from lounge entry throughout your journey), I would counsel getting a basic journey rewards bank card and transferring your rewards to both Asia Miles or one other Oneworld loyalty program.

Associated: How to decide on an airline bank card

For charges and charges of the Amex Platinum, click on right here.