Transferable bank card rewards are particularly precious due to the numerous methods you may redeem them. You is perhaps conversant in rewards like Chase Final Rewards factors and American Categorical Membership Rewards factors. However, one other transferable reward foreign money that may provide important worth to some vacationers is Capital One miles.

Capital One miles are interesting for a number of causes. First, a number of Capital One playing cards earn a minimum of 2 miles per greenback on all purchases. Second, it is easy to get a minimum of 1 cent per Capital One mile if you redeem. And third, it is attainable to get considerably greater than 1 cent per mile for those who use Capital One’s switch companions.

So, this is all the things you want to find out about Capital One miles.

What are Capital One miles?

Capital One miles are the rewards you earn with choose Capital One playing cards, together with the Capital One Enterprise Rewards Credit score Card and Capital One Spark Miles for Enterprise.

You’ll be able to redeem these miles in some ways, together with by transferring to pick airline and lodge loyalty applications, redeeming for journey booked via the Capital One journey portal and redeeming to cowl latest journey purchases.

Associated: Why the Capital One Enterprise Rewards bank card nonetheless has a spot in our wallets

Easy methods to earn Capital One miles

You’ll be able to earn Capital One miles via choose bank cards. Specifically, most Capital One bank cards provide an preliminary sign-up bonus if you open a brand new card and meet the required spending necessities to earn the bonus. You will additionally earn miles on most purchases, and a few playing cards even provide anniversary bonus miles every year you renew your card.

Though Capital One presents many alternative bank cards, the Capital One playing cards that earn transferable miles are these within the Enterprise and Spark Miles households. Here is a fast have a look at a few of these playing cards and their present welcome presents:

- Capital One Enterprise X Rewards Credit score Card ($395 annual payment): Earn 75,000 bonus miles if you spend $4,000 on purchases within the first three months from account opening.

- Capital One Enterprise Rewards Credit score Card ($95 annual payment): Earn 75,000 bonus miles after spending $4,000 on purchases inside the first three months of account opening, plus a $250 Capital One Journey credit score within the first cardholder 12 months.

- Capital One VentureOne Rewards Credit score Card (No annual payment): Earn 20,000 bonus miles when you spend $500 on purchases inside the first three months from account opening.

- Capital One Enterprise X Enterprise ($395 annual payment): Earn 150,000 bonus miles if you spend $30,000 within the first three months.

- Capital One Spark Miles for Enterprise ($0 introductory annual payment for the primary 12 months, then $95 after): Earn a one-time bonus of fifty,000 miles when you spend $4,500 on purchases inside the first three months of account opening.

Day by day E-newsletter

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

The present limited-time welcome provide on the Capital One Enterprise Rewards Credit score Card is value mentioning. In comparison with the usual provide often accessible on this card, it presents an extra $250 Capital One Journey credit score within the first cardholder 12 months.

You’ll be able to convert Capital One money again into miles if in case you have one of many above playing cards. So, if in case you have a Capital One card just like the Capital One Savor Money Rewards Credit score Card that earns cash-back rewards, you may convert your cash-back rewards into Capital One miles for those who even have a card that earns Capital One miles.

Associated: The perfect time to use for these in style Capital One bank cards based mostly on provide historical past

Capital One switch companions

Capital One companions with a number of airline and lodge loyalty applications. You’ll be able to switch Capital One miles to those companion applications after which redeem via these loyalty applications.

Here is a have a look at the present Capital One switch companions and the usual switch ratios:

- Accor Stay Limitless: 2:1 switch ratio

- Aeromexico Rewards: 1:1 switch ratio

- Air Canada Aeroplan: 1:1 switch ratio

- Air France-KLM Flying Blue: 1:1 switch ratio

- Avianca LifeMiles: 1:1 switch ratio

- British Airways Government Membership: 1:1 switch ratio

- Cathay Asia Miles: 1:1 switch ratio

- Selection Privileges: 1:1 switch ratio

- Emirates Skywards: 1:1 switch ratio

- Etihad Airways Visitor: 1:1 switch ratio

- EVA Airways Infinity MileageLands: 4:3 switch ratio

- Finnair Plus: 1:1 switch ratio

- JetBlue TrueBlue: 5:3 switch ratio

- Qantas Frequent Flyer: 1:1 switch ratio

- Singapore Airways KrisFlyer: 1:1 switch ratio

- TAP Air Portugal Miles&Go: 1:1 switch ratio

- Turkish Airways Miles&Smiles: 1:1 switch ratio

- Virgin Crimson: 1:1 switch ratio

- Wyndham Rewards: 1:1 switch ratio

Switch bonuses might often allow you to switch Capital One miles to a number of companion applications at an elevated fee. However keep in mind that transfers are one-way: Transferring rewards again to Capital One miles is nearly at all times inconceivable as soon as you’ve got transferred them to a loyalty program.

Associated: Why transferable factors and miles are value greater than different rewards

Easy methods to redeem Capital One miles

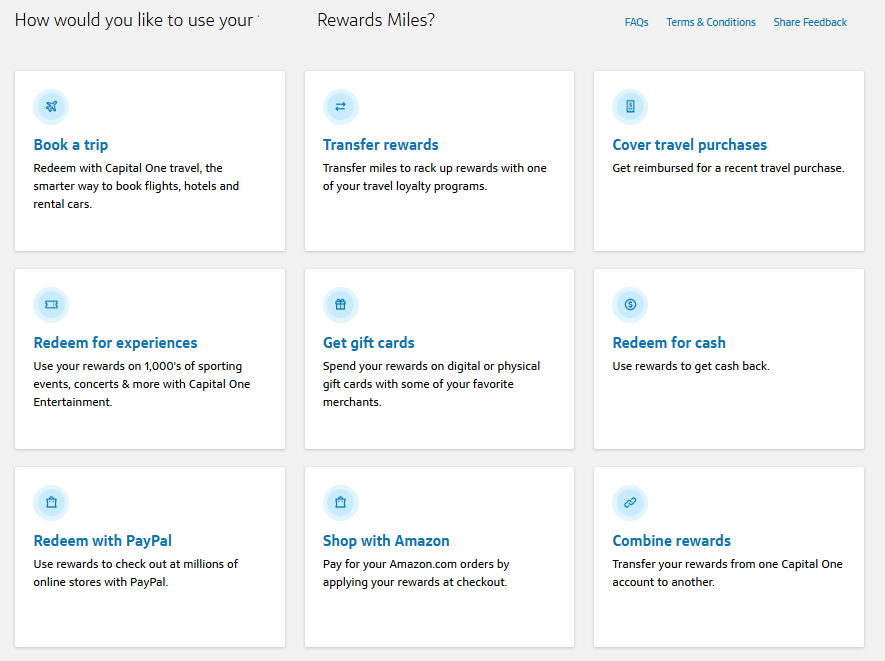

You will see a number of choices for redeeming Capital One miles in your on-line account.

You will sometimes get the very best worth if you switch your miles to airline and lodge companions. However, it’s also possible to get first rate worth when reserving via the Capital One journey portal or redeeming miles to offset latest journey purchases. Listed below are your choices and the redemption worth every ought to present.

Redeem with airline and lodge companions

As talked about above, you will sometimes get the very best worth out of your miles if you switch them to airline and lodge companions by clicking “Switch rewards.” Within the earlier part, I listed the Capital One switch companions and the ratios at which you’ll be able to switch Capital One miles to every companion.

Primarily based on TPG’s February 2025 valuations, you may anticipate to get 1.85 cents per Capital One mile if you switch to airline and lodge companions after which redeem via these applications. Nonetheless, the precise worth you get will rely upon which switch companions you utilize and the forms of awards you e-book with these companions. See our story on maximizing Capital One miles for some suggestions.

Associated: Easy methods to switch Capital One miles to airline and lodge companions

E book via the Capital One journey portal

You may as well redeem miles at a fee of 1 cent per mile when reserving flights, inns and rental vehicles via the Capital One journey portal.

Nonetheless, for those who e-book paid journey via the Capital One journey portal along with your Capital One card that earns transferable miles, you may earn 5 or 10 miles per greenback relying in your card and the kind of journey you buy. As such, I like to recommend reserving paid charges as a substitute of redeeming miles if you e-book journey via the Capital One journey portal.

Even if you wish to redeem Capital One miles to your flight, lodge or automotive rental reserving, you will often be higher off utilizing miles to cowl latest journey purchases as a substitute of redeeming when reserving via the journey portal.

Associated: Do you have to switch Capital One miles to companions or redeem straight for journey?

Cowl journey purchases

You’ll be able to redeem Capital One miles to cowl latest journey purchases made along with your card. Capital One says eligible journey purchases often embrace these you make from “airways, inns, rail traces, automotive rental companies, limousine companies, bus traces, cruise traces, taxi cabs, journey brokers and time shares.” Nonetheless, whether or not a selected buy is eligible is dependent upon the service provider class code hooked up to the acquisition.

You will see any eligible purchases — that are journey purchases posted to your account within the final 90 days — listed in your on-line account if you click on “Cowl journey purchases.” You should utilize miles to cowl the complete buy or simply a part of it. Both manner, your miles are value 1 cent every if you redeem them to cowl latest journey purchases.

Associated: Capital One Enterprise Rewards vs. Capital One Enterprise X: Value the additional $300 in annual charges?

Different methods to redeem Capital One miles

As you may need observed within the screenshot above, cardholders have a number of different choices for redeeming Capital One miles. Most of those different redemption choices provide decrease redemption values, so we do not typically suggest utilizing them. However this is an outline of your different redemption choices:

- Redeem for experiences: You’ll be able to redeem miles for sports activities, music, comedy and theater tickets via Capital One Leisure, often at a redemption fee of 0.8 cents per mile.

- Get reward playing cards: You’ll be able to redeem miles for reward playing cards, often at a redemption fee of 0.8 cents per mile.

- Redeem for money: You’ll be able to request an announcement credit score or a examine to your handle at a redemption fee of 0.5 cents per mile.

- Redeem with PayPal: You’ll be able to apply miles when testing with PayPal at a redemption fee of 0.8 cents per mile.

- Store with Amazon: You’ll be able to apply miles at checkout to your Amazon orders at a redemption fee of 0.8 cents per mile.

Earlier within the article, we mentioned a number of methods to redeem Capital One miles for a minimum of 1 cent every. So, there’ll hardly ever be a purpose to redeem Capital One miles for something lower than 1 cent every.

Backside line

When touring abroad, I usually use the Capital One Enterprise X Rewards Credit score Card as my on a regular basis spending card. It does not cost overseas transaction charges, and I do know I will earn a minimum of 2 miles per greenback on all purchases. I hardly ever have points utilizing it. However, I additionally typically discover it helpful to have entry to Capital One miles when reserving award flights. So, I am at all times pleased to earn extra Capital One miles on my on a regular basis purchases.

Now that you know the way to earn and redeem Capital One miles, I anticipate you might also perceive their worth — particularly for those who switch your miles to airline or lodge companions.