Some bank card functions supply instantaneous approval, which is nice. However what’s even higher than that’s getting instantaneous entry to your new bank card.

Immediate entry to your new card quantity allows you to begin engaged on spending necessities to earn that card’s welcome bonus. In any case, the clock on welcome bonuses begins the day your account is authorized, not once you obtain your card within the mail and activate it.

It is also an awesome function in the event you’re making use of for a card with an introductory 0% annual share price supply, which you would possibly want in the event you’re financing a big buy within the close to future.

Which means getting instantaneous entry to your new bank card could present one to 2 weeks of further time to work towards its bonus.

Let us take a look at numerous bank card issuers to see which of them supply instantaneous card numbers upon approval.

Our prime picks for playing cards with instantaneous card numbers

An instantaneous card quantity permits you to begin utilizing your new card instantly. This supplies further time to work on incomes the cardboard’s welcome bonus.

Within the case of store-brand bank cards, you additionally could obtain a reduction in your purchases, starting as quickly as you begin utilizing the cardboard. It is necessary to notice that some issuers, like Chase, will help you add your card to a digital pockets however not give an instantaneous card quantity.

Whereas there are too many playing cards to checklist that provide instantaneous card numbers or entry, listed below are seven of our prime picks.

| Card | Welcome supply | Annual charge | Earnings price | Greatest for | Degree of instantaneous card entry |

|---|---|---|---|---|---|

| The Platinum Card® from American Specific | Earn 80,000 bonus factors after spending $8,000 on purchases inside the first six months of card membership.

Nevertheless, it’s possible you’ll be focused for a better welcome supply by way of the CardMatch instrument. Gives are topic to vary at any time and will not be essentially out there to everybody.

|

$695 (see charges and charges) |

|

Premium lounge entry and life-style advantages (enrollment required for choose advantages) | It supplies entry to the total card quantity and the power so as to add to digital wallets. |

| American Specific® Gold Card | Earn 60,000 bonus factors after spending $6,000 on purchases inside the first six months of card membership.

Nevertheless, it’s possible you’ll be focused for a better welcome supply by way of the CardMatch instrument. Gives are topic to vary at any time and will not be essentially out there to everybody.

|

$325 (see charges and charges) |

|

Eating at eating places worldwide and procuring at U.S. supermarkets | It supplies entry to the total card quantity and the power so as to add to digital wallets. |

| Capital One Enterprise X Credit score Card | Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening. | $395 |

|

Easy miles incomes and lounge entry | Eligible authorized cardholders can obtain instantaneous entry by way of the Capital One app and add their card to a digital pockets. |

| Capital One Enterprise Rewards Credit score Card | Earn 75,000 bonus miles after spending $4,000 on purchases inside the first three months from account opening.

Moreover, you may obtain a $250 Capital One Journey credit score to make use of throughout your first cardholder 12 months upon account opening. |

$95 |

|

Journey rewards for a modest annual charge | Eligible authorized cardholders can obtain instantaneous entry by way of the Capital One app and add their card to a digital pockets. |

| Chase Sapphire Most popular® Card (see charges and charges) | Earn 100,000 bonus factors after spending $5,000 on purchases within the first three months from account opening. | $95 |

|

Journey rewards with quite a lot of bonus classes | It supplies the power so as to add your card to digital wallets with Spend Immediately. |

| Chase Sapphire Reserve® (see charges and charges) | Earn 60,000 bonus factors after spending $5,000 on purchases within the first three months from account opening. | $595 |

Factors for journey purchases are earned after utilizing the $300 annual journey credit score |

Premium journey rewards | It supplies the power so as to add your card to digital wallets with Spend Immediately. |

| Bilt Mastercard®* | None | $0 (see charges and charges) |

|

Incomes factors on lease | It offers instantaneous entry to the cardboard quantity and the power so as to add to digital wallets. |

*TPG founder Brian Kelly is a Bilt adviser and investor.

Every day Publication

Reward your inbox with the TPG Every day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

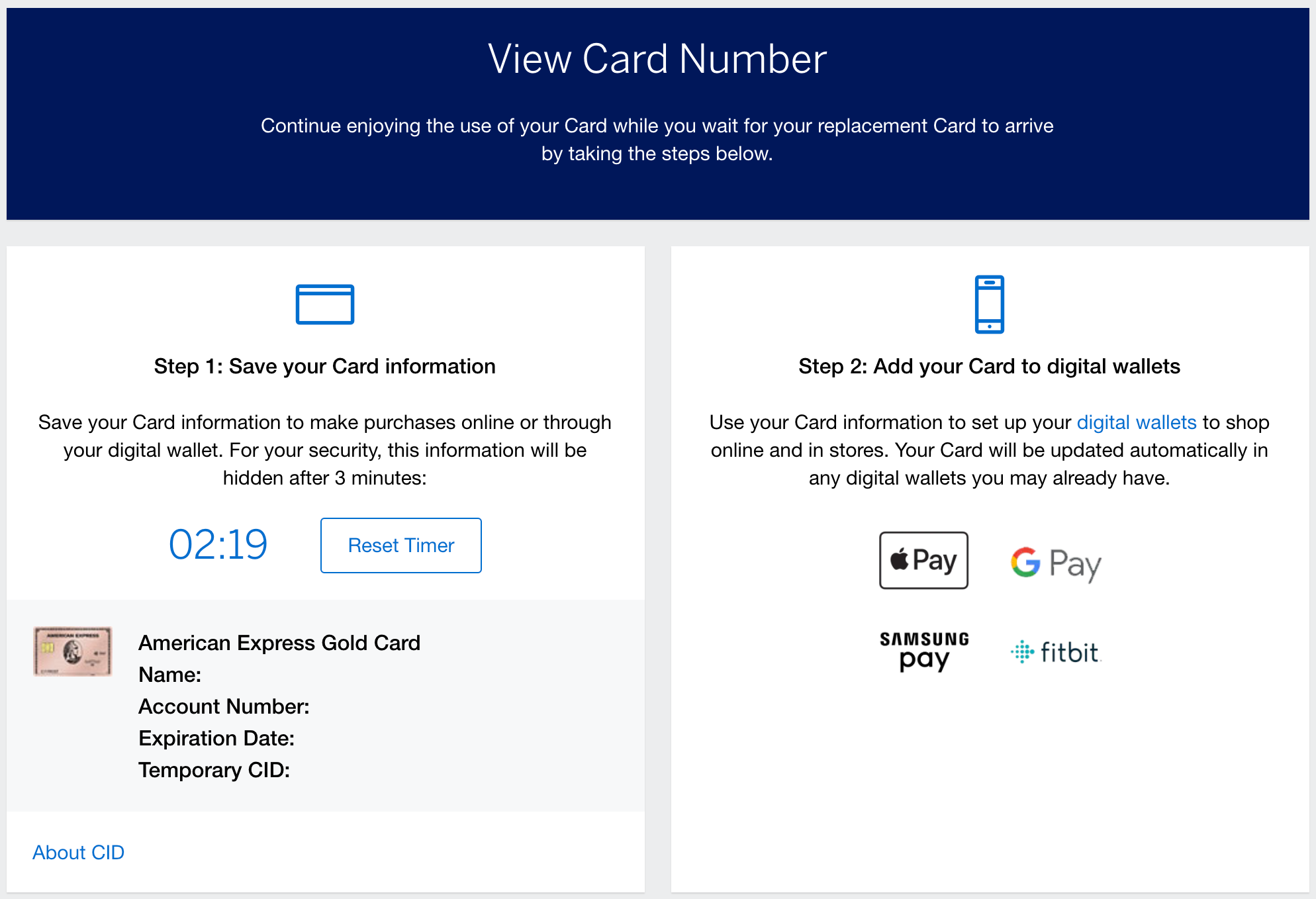

American Specific

American Specific supplies your new account quantity instantly after approval of your on-line utility, assuming your id may be verified. Beforehand, you needed to take a screenshot or write down your card quantity because you could not view the quantity once more. Nevertheless, some readers have obtained emails from Amex that allowed them to view the moment card quantity once more upon request.

The moment card quantity would be the identical because the bodily card you may get within the mail, however the four-digit card identification quantity on the entrance of the cardboard will likely be totally different. Due to that, you would possibly need to keep away from utilizing this card for recurring funds.

Notice that instantaneous card numbers for some cobranded playing cards could solely be used with the cobranded firm (for instance, Hilton or Marriott).

Along with instantaneous numbers for brand new cardmembers, Amex offers present cardmembers entry to their card info when ordering alternative playing cards.

Associated: Selecting the most effective American Specific card for you

Even in the event you’re not involved in getting your card quantity instantly, you must nonetheless request it when prompted by the system. All Amex private and enterprise playing cards supply instantaneous card numbers apart from the Amazon Enterprise Card and the Amazon Enterprise Prime Card.

The knowledge for the Amazon Enterprise and Amazon Enterprise Prime playing cards have been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

A few of our prime picks embody:

The knowledge for the Hilton Amex Aspire card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: The facility of the Amex Trifecta

Financial institution of America

The one Financial institution of America card that persistently presents an instantaneous card quantity is the Alaska Airways Visa Signature® bank card.

Sometimes, these with Financial institution of America checking accounts could obtain a focused promotion providing an instantaneous card quantity for playing cards just like the Financial institution of America® Premium Rewards® bank card; nevertheless, this isn’t normal apply.

The Alaska Airways Visa Signature card presents a beneficiant welcome bonus and among the most precious airline miles round. You will additionally get a free checked bag and precedence boarding in the event you use the cardboard to pay to your flight.

To study extra, learn our full overview of the Alaska Airways Visa Signature card.

Associated: The very best Financial institution of America bank cards

Barclays

Barclays by no means presents instantaneous card numbers. Nevertheless, you will have entry to your card’s spending restrict (with out gaining access to the cardboard quantity itself) in the event you apply for a Barclays-issued card whereas making a reservation.

Examples embody the Frontier Airways World Mastercard®, Holland America Line Rewards Visa® Card and JetBlue Card. For those who apply for and get authorized for these playing cards whereas making a reservation, you might be able to pay to your journey with the brand new card; you will not be capable of use the cardboard for purchases elsewhere, although.

The knowledge for the Frontier Mastercard, Holland America Visa and JetBlue playing cards has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Capital One

It might be attainable to make use of your Capital One card quantity immediately, however not everybody may have this chance. You have to be an present account holder and use the Capital One cell app to entry an instantaneous account quantity.

Notice that this differs from the digital card numbers provided by Capital One.

A few of our prime picks for Capital One playing cards providing instantaneous card numbers to eligible candidates are:

Associated: Capital One Enterprise vs Enterprise Rewards

Cardless

Cardless focuses on cobranded bank cards that you should use with no need the bodily card, immediately upon account approval and all through the lifetime of the cardboard. By means of the Cardless app, you possibly can entry these cobranded playing cards and may even get a brand new card quantity instantly within the app in case your card is ever compromised.

Cardless supplies cobranded bank cards for manufacturers like Simon Property Group, Avianca and LATAM Airways.

Chase

It’s attainable to make use of fashionable Chase playing cards — just like the Chase Sapphire Most popular, United℠ Explorer Card (see charges and charges) and World of Hyatt Credit score Card (see charges and charges) — immediately upon account approval by including these playing cards to a digital pockets by means of Spend Immediately.

It is necessary to notice that this doesn’t embody a method to entry an instantaneous card quantity, however a method to immediately add your card to a digital pockets.

Listed below are the steps to arrange Spend Immediately.

- Open the Chase app.

- Go to your card account.

- Navigate to account providers, then choose digital wallets.

- Then, select what cell pockets you need to add your card to. Comply with these steps, and you ought to be good to go to make use of your card at retailers that settle for digital wallets.

Nevertheless, the issuer notes that there are a number of playing cards you can’t use immediately, together with Credit cards, Amazon playing cards and enterprise playing cards.

Associated: The very best Chase playing cards

Citi

Citi presents instantaneous card numbers in case your utility is authorized immediately and your id is verified. Nevertheless, notice that you will have only one alternative to view this quantity, so be sure you write it down.

Plus, instantaneous bank card numbers will not be out there on small-business or American Airways bank cards, in line with a Citi spokesperson. Some readers have reported not having the choice to get an instantaneous card quantity with playing cards just like the Citi Double Money® Card (see charges and charges)

In case your bank card utility is authorized immediately, you possibly can click on on “Get Card Quantity At present” to entry your new card’s digital quantity. Verification could also be required to entry your instantaneous card quantity.

When you see a inexperienced examine mark, click on on “See Card Abstract” to view your short-term card quantity and card verification worth quantity. Nevertheless, you will not have entry to your card’s full spending restrict till you obtain the bodily card.

Nevertheless, just a few playing cards sometimes enable you entry to your short-term card quantity. These embody:

A caveat right here is that you could solely make purchases by way of instantaneous entry at AT&T and Costco with the AT&T Factors Plus and Costco Wherever Visa, respectively. Immediate entry purchases will not be out there at different retailers with these playing cards.

The knowledge for the AT&T Factors Plus Card and Citi Customized Money has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: The very best Citi bank cards

Uncover

Uncover typically offers you an instantaneous determination on whether or not you’ve got been authorized for a bank card. After this determination, if eligible, you possibly can obtain a digital card quantity to make use of on-line or add to a digital pockets.

The Uncover it® Money Again Credit score Card is our prime decide. It’s a good card for novices, providing an infinite money again match within the first 12 months and rotating 5% quarterly cash-back classes.

The knowledge for the Uncover it Money Again card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Goldman Sachs

Goldman Sachs allows you to use the Apple Card immediately with Apple Pay after account approval. Having a bodily card is totally non-compulsory.

The Apple Card is a strong choice because it has no annual charge and earns at the very least 2% again on all purchases when paying with Apple Pay. Plus, cash-back rewards can be found proper after every buy.

The knowledge for the Apple Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

SoFi

SoFi’s bank cards supply instantaneous entry to a digital card, with bodily playing cards arriving within the mail inside 10 enterprise days. These playing cards embody:

- SoFi Limitless Credit score Card

- SoFi On a regular basis Money Rewards Credit score Card

- SoFi Necessities Credit score Card

The primary two choices are nice money again choices. The SoFi Limitless presents limitless 2% money again on all purchases. In the meantime, the SoFi On a regular basis presents as much as 3% bonus money again in quite a lot of classes, together with eating, grocery shops and on-line grocery supply.

The knowledge for the SoFi Limitless Credit score Card, SoFi On a regular basis Money Rewards Credit score Card and SoFi Necessities Credit score Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: The very best 2% cash-back bank cards

Synchrony

There are two playing cards from Synchrony that you should use instantly upon approval. Nevertheless, you may solely be capable of use them immediately inside digital wallets or inside their respective apps: PayPal (for the PayPal Cashback Mastercard®) and Venmo (for the Venmo Credit score Card).

You will want to attend to your card to reach within the mail for purchases with different retailers.

The knowledge for the PayPal Mastercard and Venmo Credit score Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

US Financial institution

U.S. Financial institution sometimes solely presents instantaneous card numbers to shopper cardholders who’ve verified identities and a banking historical past with them. U.S. Financial institution has some wonderful cash-back card choices.

Some good choices to think about are:

The knowledge for the U.S. Financial institution Altitude Go and U.S. Financial institution Altitude Join Visa Signature Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Wells Fargo

Whereas most Wells Fargo-issued playing cards do not supply instantaneous card numbers, the Bilt Mastercard is an exception and has no annual charge (see charges and charges). The Bilt Mastercard is in a class of its personal on account of its unmatched skill to earn bonus factors on lease (as much as 100,000 every calendar 12 months; use the cardboard 5 instances every assertion interval to earn factors) with out incurring further transaction charges (see charges and charges).

You will even have instantaneous entry to your card quantity within the Bilt Rewards app.

To study extra, learn our full overview of the Bilt Mastercard.

FAQs

What’s a bank card instantaneous approval, and the way does it work?

As quickly as you apply for a bank card, your utility is processed by a pc. You will sometimes obtain one among three responses: speedy approval, some type of “pending” standing or denial.

Receiving instantaneous approval would not assure that you can start utilizing your card instantly. For those who obtain instantaneous approval, it’s possible you’ll be introduced with the choice to view your card quantity straight away; in any other case, you may often want to attend till your bodily card arrives within the mail earlier than you possibly can start utilizing it.

How lengthy does it take for me to get my new bank card?

It may possibly take 5 to 10 enterprise days to get a brand new bank card after approval. Nevertheless, that time-frame can range relying on the cardboard and issuer. As an illustration, American Specific makes use of in a single day transport for the Amex Platinum. Some issuers supply expedited transport on request, however there is no assure. Chances are you’ll must pay when requesting expedited transport.

Backside line

Some issuers supply expedited transport to your new card. Typically, although, you may have to attend roughly per week to your new card to reach within the mail. Having instantaneous entry to your new card quantity could make a giant distinction, particularly if you wish to begin working towards assembly the minimal spend requirement to obtain a welcome bonus as quickly as attainable.

For those who’re in speedy want of a brand new bank card, contemplate one of many choices above.

Associated: Need live performance presale entry? Do not be loyal to 1 financial institution

For Capital One merchandise listed on this web page, among the advantages could also be offered by Visa® or Mastercard® and should range by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.

For charges and charges of the Amex Platinum card, click on right here.

For charges and charges of the Amex Gold card, click on right here.

For charges and charges of the Bilt Mastercard, click on right here.

For rewards and advantages of the Bilt Mastercard, click on right here.