In a yr when the tech sector grappled with mass layoffs, unstable chip demand, and the frenzied race to scale AI infrastructure, one firm surged forward because the Fortune 500’s largest climber: Tremendous Micro Laptop. The San Jose–based mostly IT {hardware} producer posted explosive progress, leaping 206 spots—greater than some other firm on this yr’s checklist—to land at No. 292.

Tremendous Micro greater than doubled its income to $14.99 billion, a 110% year-over-year enhance, and led its business in one-year revenue progress, incomes $1.15 billion.

The corporate’s rise is essentially on account of its strategic place on the intersection of AI, cloud computing, and knowledge middle infrastructure, three of the fastest-growing areas in know-how immediately.

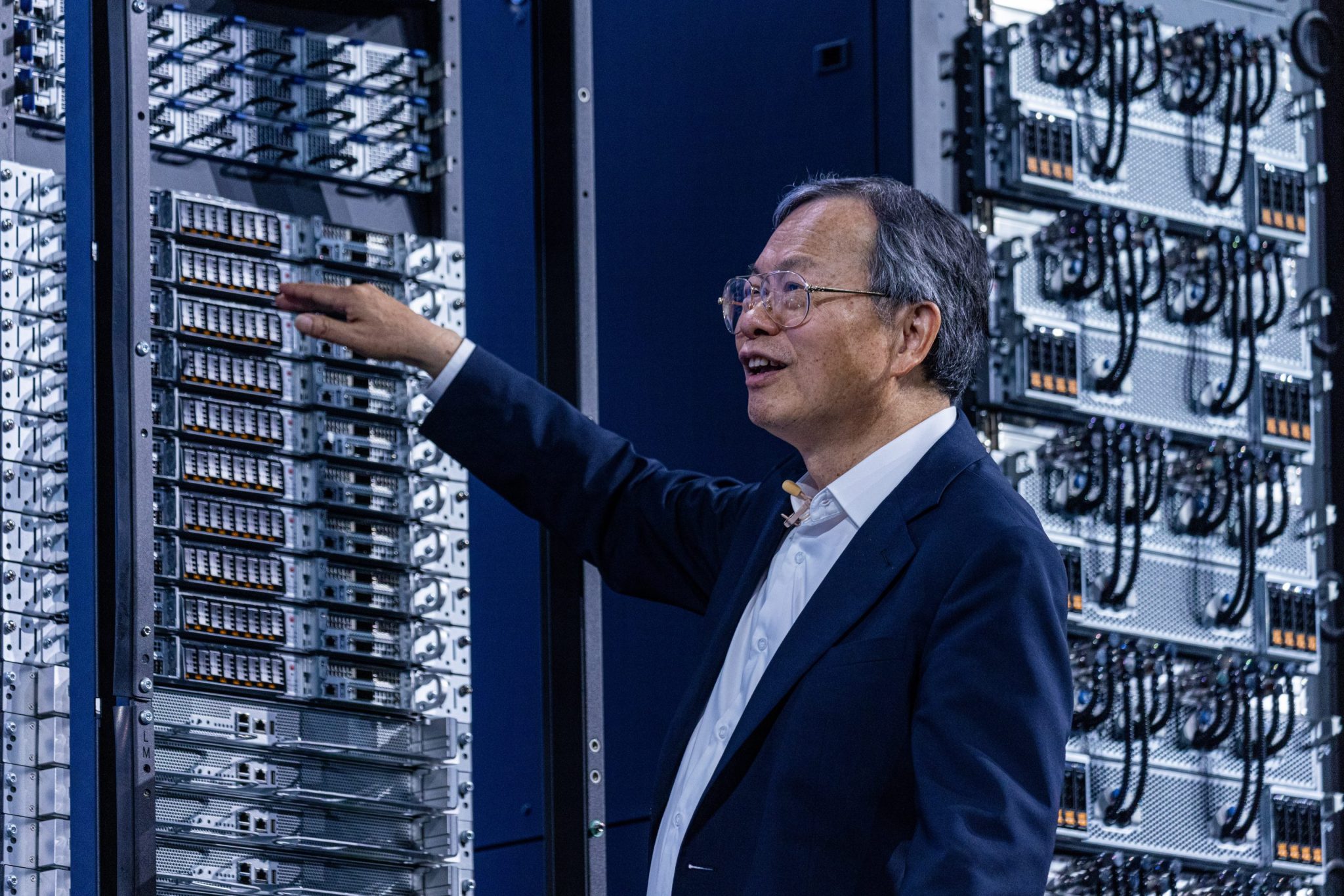

On the middle of its technique is cofounder and CEO Charles Liang, who has emphasised vertical integration, with the corporate designing, testing, and assembling its merchandise in-house. Liang says the corporate is laser-focused on innovation, together with early-to-market compatibility with Nvidia chips and customizable server {hardware} constructed to deal with numerous, high-performance workloads. That strategy has positioned Tremendous Micro to make the most of hovering demand for AI-ready infrastructure. Tremendous Micro has shipped greater than 1.3 million server and storage nodes, which give processing energy and handle knowledge for machines, and its methods now energy lots of the world’s knowledge facilities.

By way of shut partnerships with Nvidia and Intel, Tremendous Micro has change into a most well-liked vendor for corporations constructing AI-optimized environments. Not too long ago, it was chosen by Elon Musk’s xAI crew to help the event of a 750,000-square-foot knowledge middle in Memphis, a serious sign of the corporate’s rising affect.

Liang has spoken publicly about Tremendous Micro’s shut alignment with Nvidia’s product street map, which permits the corporate to rapidly combine new applied sciences.

“No matter Nvidia develops, we just about sync up with them,” he advised CRN in 2024. “And that’s one more reason why, at any time when they’ve a brand new product out, we’ve got a brand new product accessible faster than our rivals do.”

As demand for AI accelerates, Tremendous Micro plans to develop its server manufacturing capability in america. The corporate can be investing in inexperienced computing, branding its methods as energy-efficient alternate options in a sector beneath growing scrutiny for environmental influence.

Traders have taken discover. Tremendous Micro’s market capitalization is approaching $24 billion, reflecting elevated confidence in its trajectory. Nonetheless, the corporate’s rise has not come with out controversy.

In 2018, Nasdaq delisted the corporate for failing to file its monetary stories on time. It was re-listed in 2020 following a settlement with the SEC. In August 2024, the corporate confronted renewed scrutiny after Hindenburg Analysis revealed a report alleging questionable accounting practices and undisclosed third-party transactions.

Quickly after, the corporate missed a number of regulatory submitting deadlines, and audit agency EY resigned. Tremendous Micro and Liang are actually dealing with a number of lawsuits and lively investigations by each the SEC and the Division of Justice. The corporate has mentioned it’s cooperating with authorities.

The corporate mentioned that by February it had introduced its monetary reporting updated, handed a new unbiased audit, and carried out management adjustments. It has employed a brand new normal counsel and is actively looking for a brand new chief monetary officer.

Regardless of reporting third-quarter income under expectations in early Might, Tremendous Micro reiterated its rising confidence in assembly full-year progress targets, with Liang assuring traders that demand for AI infrastructure stays sturdy.

“We’re investing in individuals, processes, and methods to scale our basis, advancing our management in liquid cooling know-how, and delivering Knowledge Middle Constructing Block Options to attain and surpass our income targets,” an organization spokesperson advised Fortune in an emailed assertion.

This story was initially featured on Fortune.com