There is no higher feeling on the earth of factors and miles than utilizing your hard-earned rewards to e book a premium cabin redemption or a dream trip to an unique tropical resort.

However reserving premium journey with factors and miles may be time-consuming and sometimes requires persistence, flexibility and, above all, reserving far prematurely of your precise journey dates.

Nonetheless, there are occasions when utilizing factors and miles on the final minute can present outsize financial savings. Just lately, I needed to attend a good friend’s marriage ceremony out of state, and touring with my household meant paying an exorbitant sum of money for last-minute tickets.

Fortunately, I used to be ready to make use of factors and miles to e book my flights. This is how I saved myself over $3,000 on my last-minute journey — and some recommendations on how you can do the identical if you end up in an analogous scenario.

How I booked a last-minute flight utilizing factors and miles

There are occasions whenever you’ll must buy airfare final minute. It may very well be for a joyous event, similar to a shock engagement occasion or commencement, or for extra critical issues, such because the passing of a cherished one. Regardless, these trying to e book last-minute are on the mercy of airways. Subsequently, you are extra more likely to pay an arm and a leg to fly.

Airfare inside two weeks of your meant departure date generally is often extra expensive; nevertheless, as you shut in in your departure date, the worth tends to skyrocket. Simply know that in case you have airline miles or a journey bank card that earns transferable factors, you might be able to spare your self the monetary burden of a last-minute ticket.

Associated: One of the best time to e book flights for the most affordable airfare

I acquired a cellphone name from a great good friend explaining a mix-up along with his marriage ceremony invitation and realized that the marriage in Texas, which was printed on the cardboard to happen the next week, was truly in T-minus 72 hours. With our friendship going again over 15 years, there was no means I may miss the marriage, however I knew last-minute flights can be astronomical.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

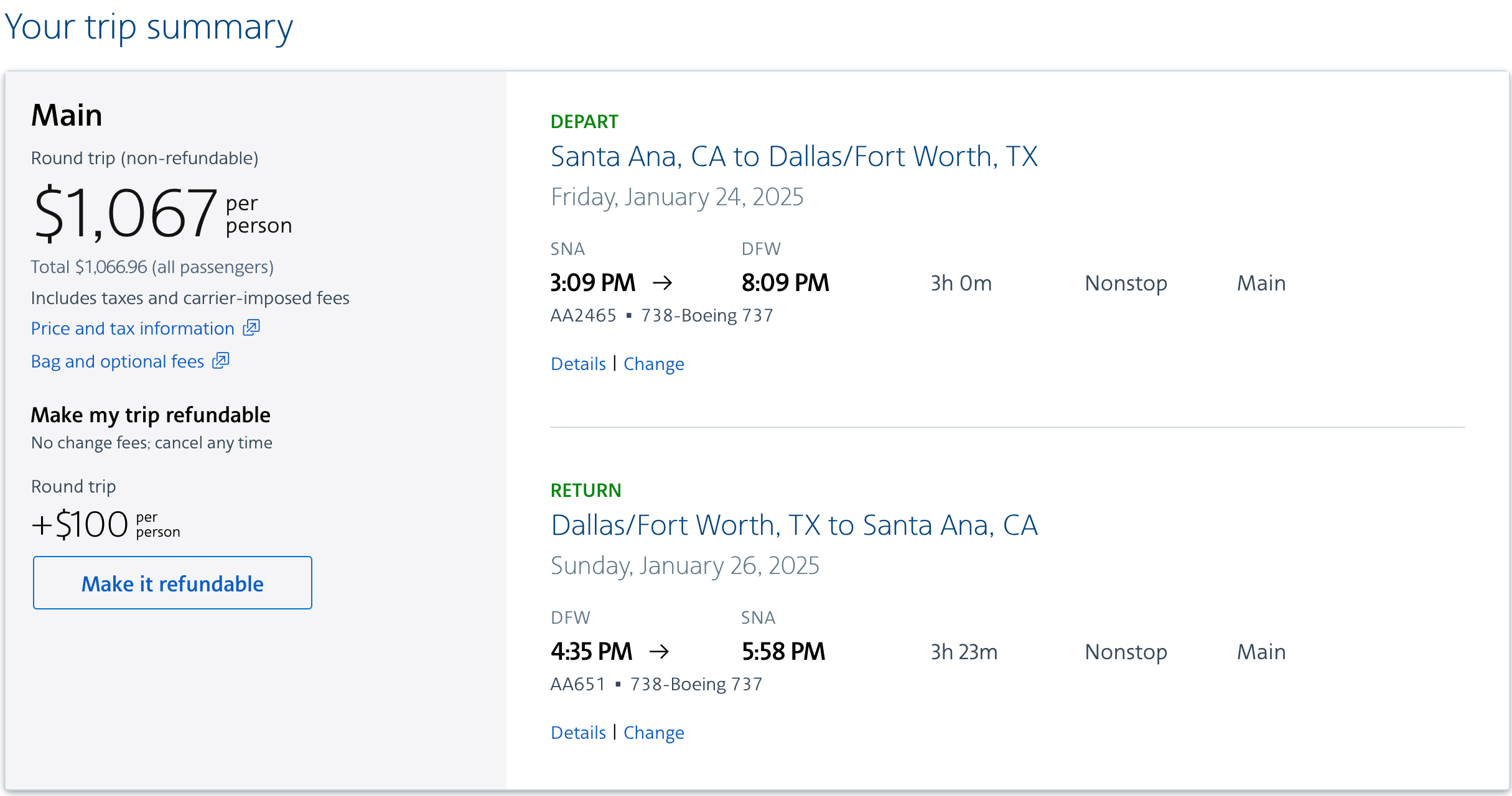

Spherical-trip airfare from my native California airport to Dallas Fort Value Worldwide Airport (DFW) hovered over $1,000 per particular person. Touring with my spouse and son meant I might need to fork over $3,000, along with different journey bills similar to lodging and a rental automobile.

My favourite facet concerning the world of factors and miles is that there is a whole ecosystem set as much as assist folks journey — another, so to talk.

As my cellphone name wrapped up, I started brainstorming methods to beat this financial problem. Understanding that Dallas is a significant American Airways hub, I seemed to e book award seats on AA. To assist me with my award flight search, I used a reasonably new device, PointsPath, which proved extraordinarily helpful.

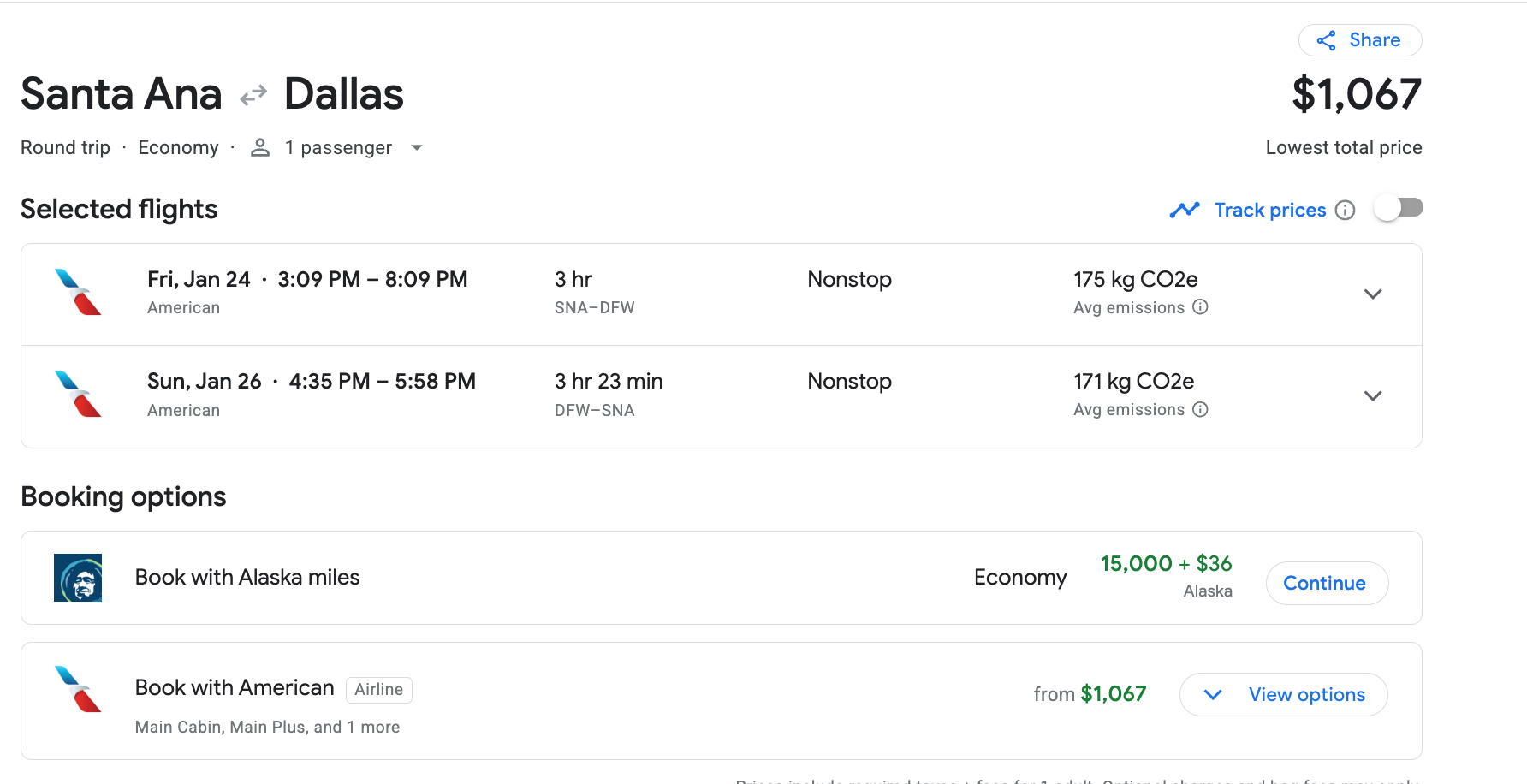

PointsPath is a Google Chrome extension that routinely searches for award ticket availability when utilizing Google Flights and shows the price of a redemption ticket alongside the money worth.

Associated: These 12 apps and web sites make award redemptions simpler to search out

Serving to me shortly cut back the trouble of trying to find award availability throughout numerous applications, PointsPath nudged me to e book an American Airways award ticket utilizing Alaska Airways Mileage Plan.

Since Alaska and American Airways are each a part of Oneworld alliance, I discovered American Airways award flights bookable by way of Mileage Plan. Try our information for data on how you can e book home American flights with associate airways.

After looking out Alaska Airways, I discovered round-trip financial system flights on American Airways for 15,000 Mileage Plan miles per particular person and fewer than $50 in taxes and costs. Compared, American Airways AAdvantage was charging 40,000 miles round-trip for a similar itinerary.

Significance of transferable bank card factors

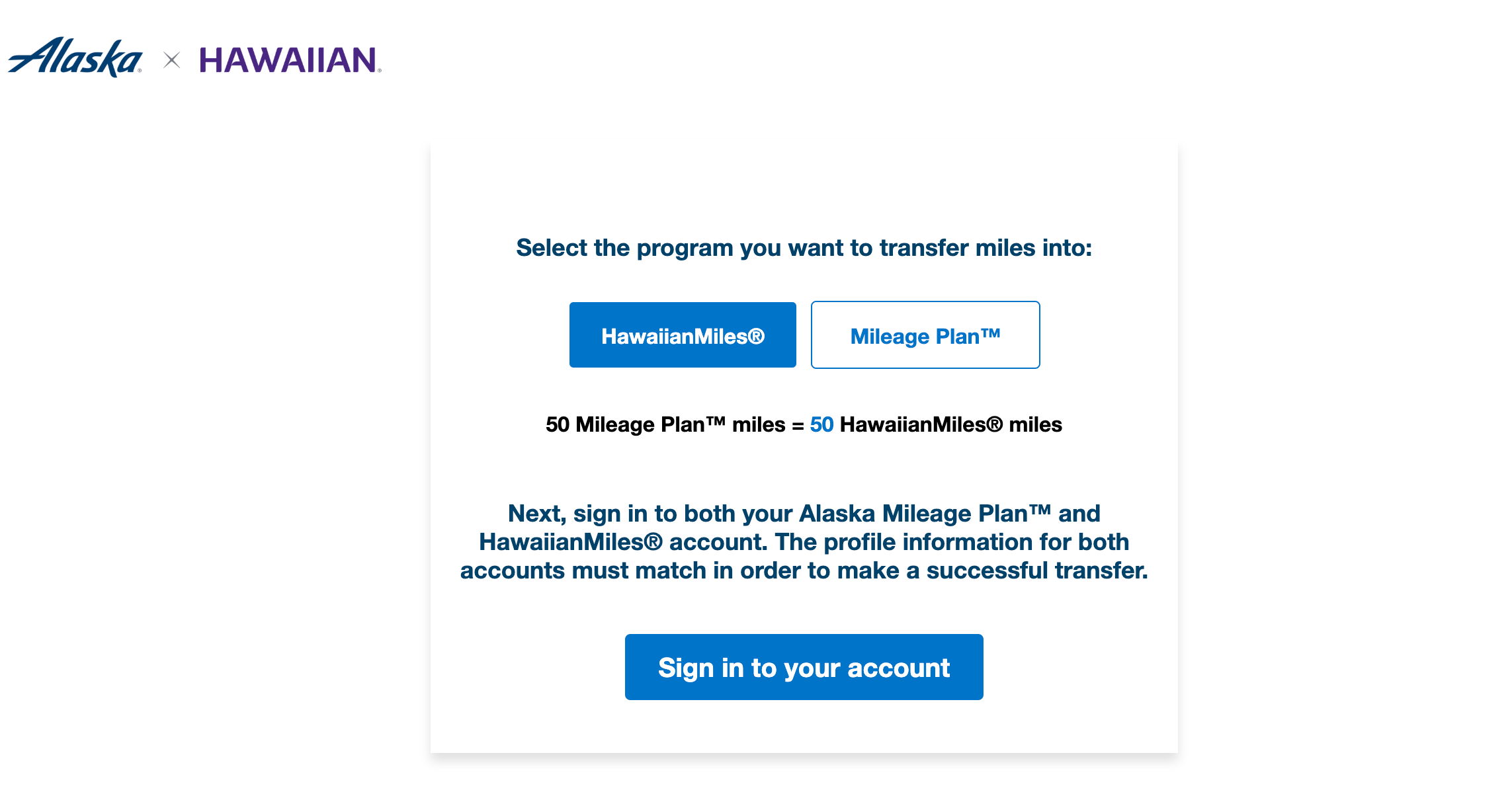

The primary challenge with the flights I discovered is that I don’t have any Alaska miles or an Alaska Airways bank card, such because the Alaska Airways Visa Signature® bank card. All of my Oneworld flights are credited to AAdvantage. Fortunate for me, Alaska Airways and Hawaiian Airways went by way of a merger final 12 months, and whereas their loyalty applications nonetheless stay separate, for now, every airline permits the switch of miles between the 2 accounts.

That is the place having transferable bank card factors comes into play. The one bank card that transfers factors on to Alaska Airways Mileage Plan is the Bilt Mastercard® (see charges and costs). Although I don’t have that card, I shortly considered a work-around to make use of. TPG Brian Kelly is a Bilt advisor and investor.

As a holder of The Platinum Card® from American Categorical, I’m able to switch American Categorical Membership Rewards factors to HawaiianMiles at a fee of 1:1. From there, I can immediately switch Hawaiian miles to Mileage Plan.

Be aware that Amex does cost a payment — as much as $99 per transaction — to switch factors to home companions (JetBlue, Hawaiian and Delta).

Remember the fact that Amex has hinted that HawaiianMiles will ultimately be eliminated as a switch associate later this 12 months following the merger with Alaska. So, in case you’re trying to reap the benefits of this switch choice, accomplish that sooner moderately than later.

Having a card that earns transferable reward factors, particularly the Amex Platinum, proved to be a lifesaver.

I additionally produce other reward playing cards that earn Chase Final Rewards factors and Citi ThankYou Reward factors. I believe it is best to have a mess of playing cards to assist broaden the listing of airline and lodge switch associate loyalty applications I can make the most of.

Holding one or a number of playing cards that earn totally different transferable factors will help you widen your redemption choices with entry to totally different switch companions. It is also helpful as a result of issuers often run switch bonuses, which will help you maximize your redemptions by decreasing the variety of factors you might want to switch to e book your journey.

Associated: How (and why) it’s best to earn transferable bank card factors

Backside line

And not using a bank card that earns transferable factors, I might’ve been out over $3,000. It was solely due to factors and miles that I used to be capable of attend my good friend’s marriage ceremony with my household. In any other case, the sky-high price of a last-minute flight would have proved an actual deterrent.

This expertise additional confirmed what I imagine: Redeeming factors and miles will help facilitate journey, and having transferable factors is the best (and smartest) option to go about it.

My recommendation is to not put all your eggs in a single basket; add one or a number of transferable points-earning bank cards to your pockets, alongside any money again or airline-cobranded bank cards. You by no means know whenever you’ll want the pliability that such playing cards present.

Associated: Greatest reward bank cards

See Bilt Mastercard charges and costs right here.

See Bilt Mastercard rewards and advantages right here.