Avelo Airways is taking an axe to one in every of its core guarantees. Efficient Friday, the almost four-year-old ultra-low-cost provider will institute change and cancellation charges for its flights.

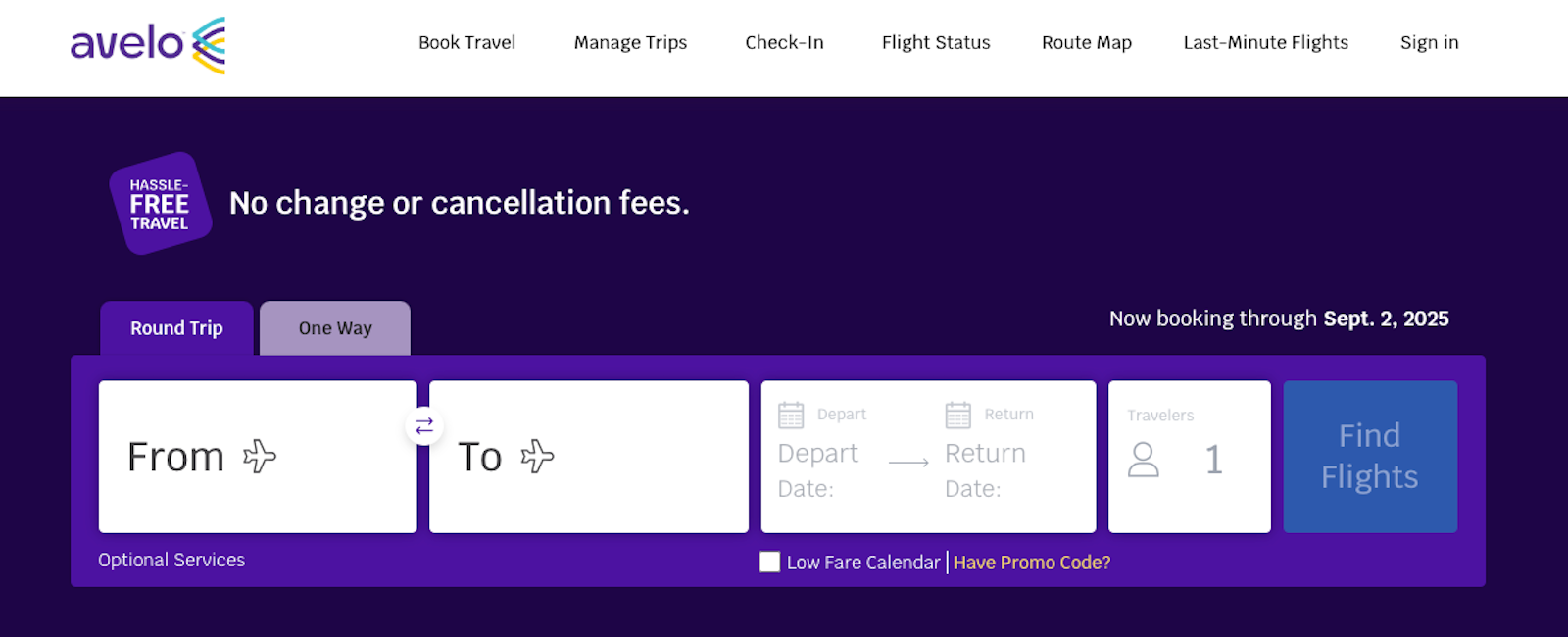

The transfer will finish a “hassle-free journey” promise that is been a central tenet of the airline’s branding. Till this week, it was frequent to discover a banner studying “No change or cancellation charges” proper on the prime of the homepage for Avelo’s web site.

The transfer is a part of an effort to spice up funds for the younger airline and deter what it says are expensive last-minute cancellations on the a part of vacationers.

There’s additionally a key — and cheap — caveat that may permit vacationers to keep up loads of flexibility of their Avelo travels: a $5 flex go that buys clients “free” ticket adjustments and cancellations.

Avelo’s adjustments come because the provider, for the primary time, revealed to TPG that it’s deep into plotting its first loyalty program, together with a cobranded bank card. Each are anticipated to launch over the approaching months.

This is what to know in regards to the adjustments you will see at Avelo this week, all through the spring and later in 2025.

Professional ideas: 11 main errors individuals make with journey rewards bank cards

Does Avelo have change charges?

In a transfer vacationers will seemingly bemoan, Avelo plans to implement change or cancellation charges starting on Friday, March 7.

Itinerary adjustments or cancellations can be free two months or farther forward of departure, however then will climb nearer to journey day.

Each day Publication

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Whereas some airways have traditionally employed flat charges for adjustments, and others a extra dynamic pricing mannequin, Avelo is taking a barely completely different strategy. A buyer’s change or cancellation charge can be charged as a proportion of what they paid — each for his or her base fare and for add-on purchases like luggage and seats.

Avelo change charges

This is how the pricing will work for Avelo cancellations and adjustments, efficient March 7:

| Timeframe | Payment |

|---|---|

| 60 days or extra previous to departure | No change charge |

| 8 to 60 days previous to departure | 25% of itinerary worth |

| 1 to 7 days previous to departure | 50% of itinerary worth |

| Lower than sooner or later previous to departure | 75% of itinerary worth |

So, as an instance you paid $45 for a one-way flight from New Haven to Orlando, plus $90 in bag and seat charges, for a complete of $135.

Should you determined, three days earlier than your journey, that you just wanted to cancel or make an itinerary change, you’d get a visit credit score from Avelo for 50% of what you paid — or $67.50, on this case.

Had you made the change three hours earlier than your flight, you’d solely obtain $33.75, 1 / 4 of what you paid.

Nonetheless, there is a means you’ll be able to skirt the danger of a change or cancellation charge.

Choose a seat: First look inside and the place to take a seat on Avelo’s Boeing 737-800

AveloFlex: $5 for ‘free’ adjustments

Avelo on Friday will even launch a brand new add-on possibility it is calling “AveloFlex.”

For $5, you’ll be able to primarily purchase your self the flexibility to make “free” ticket adjustments or cancellations if an issue arises.

It’s going to value you $5 per individual, per phase, so for those who had two vacationers making a visit that included a connecting flight (nonetheless unusual on Avelo), you’d pay $10 per traveler, for a complete of $20.

Whereas it is only one extra add-on to the price range airline expertise that already consists of loads, it is a pretty nominal value to keep away from the danger of a a lot bigger charge if an issue comes up — and fewer than you’d seemingly pay for a full journey insurance coverage coverage.

Chopping down on spoiling stock

Nonetheless, including change and cancellation charges is prone to be a disappointing transfer for purchasers, the provider’s chief business officer, Brian Davis, famous in a memo to employees considered by TPG.

The transfer was easy economics, Davis mentioned, since Avelo operates a lot of its routes only a few occasions per week — which means that it sees empty seats as a monetary legal responsibility.

“Once we provide changeability to all clients on a regular basis, there is a significant value to that, as a result of there’s some quantity of people that wait till the final minute after which cancel, and we’re left with a seat we will not resell,” Davis instructed TPG in an interview this week. “To the shoppers who actually worth flexibility, we wish to proceed to make that out there to them, as properly, with a transparent selection and a nominal value level.”

Avelo’s transfer towards change charges comes simply weeks after Spirit Airways did the identical on its most elementary fares — a transfer that got here after it and Frontier Airways took their largest strides away from such charges in sweeping strikes final 12 months.

And whereas the most important U.S. airways have long-since ditched change charges on full-fare financial system tickets, loads of restrictions stay for many of the giant carriers’ fundamental financial system fares.

“There was a motion instantly post-COVID away from change charges,” Davis famous. “However that has considerably moved again, significantly throughout the bottom value level type of fare that we’d view as our competitors throughout the completely different carriers.”

Avelo loyalty program is coming quickly

Whereas clients aren’t prone to have a good time Avelo’s transfer this week, they might be extra eager on different huge adjustments within the works on the provider, which launched operations in the course of the coronavirus pandemic in 2021.

The airline is weeks away from saying its first loyalty program, Davis confirmed. And Avelo just lately reached a tentative settlement with an issuer to launch a cobranded bank card program later this 12 months.

It is a huge shift for the airline: As just lately as late-summer 2024, Avelo executives had instructed me that discuss a loyalty program had not reached any form of superior stage — this, as fellow startup provider Breeze launched a card final 12 months.

However now, Avelo is “actively” constructing a program, Davis mentioned, with plans to announce particulars inside weeks.

Learn extra: Getting began with factors, miles and bank cards to journey

What ought to clients anticipate?

What kind of perks will this system provide?

“It is actually not a frequent flyer program,” Davis mentioned, leaving little greater than breadcrumbs.

“We take into consideration this because the low-frequency traveler who — worth is de facto essential to them,” he defined. “This is a chance [to be] part of our membership, a cardholder, and all 12 months lengthy whenever you’re shopping for your gasoline and your groceries and also you’re partaking in your day-to-day actions, you are incomes a financial institution of worth that’s tremendous highly effective and thrilling for you then to daydream with your loved ones in regards to the subsequent trip you could take.”

About these change charges …

Do not be stunned if Avelo makes use of its new change charges to create one thing of a marketplace for its loyalty program (and maybe its bank card), both.

“We would definitely think about flexibility can be one of many advantages,” Davis mentioned.

We must always be aware, Avelo already has a restricted partnership with Capital One that provides a number of advantages to vacationers — however the upcoming loyalty and card applications ought to go properly past that.

Finances airways intention for piece of pie

How completely different may an Avelo loyalty and card program look from its rivals? We’ll be eagerly awaiting the rollout.

Finances airways have leaned extra closely into loyalty applications and cobranded bank cards in latest months, aiming to assert even a small piece of a profitable pie that is propelled income for lots of the bigger carriers.

Frontier Airways just lately introduced its cobranded bank card purposes had spiked by 25% after the provider introduced plans for first-class seats and a companion go for high-level Frontier Miles elite standing members, launching later this 12 months.

Associated studying: