Once I discovered the annual payment for my Delta SkyMiles® Reserve American Specific Card was rising a full $100 (from $550 to $650; see charges and costs), I confronted a tricky resolution — was this premium journey card nonetheless value protecting?

New cardmembers can earn 60,000 bonus miles after spending $5,000 in eligible purchases within the first six months of card membership. TPG’s August 2024 valuations peg that bonus at $690.

I made a decision to maintain my Delta Amex Reserve this 12 months to check the worth of its new advantages. Whereas I am nonetheless determining one of the best ways to take full benefit of every perk, the month-to-month Resy (a web based restaurant reservation service) profit has been surprisingly easy to earn. So easy, in truth, that I just lately earned the assertion credit score with out even realizing it.

This is how.

Associated: Do you might have a Delta Amex card? Listed here are 9 issues it is advisable to do

Playing cards that earn Resy assertion credit

It isn’t usually {that a} card makes it this simple to make use of its perks, however that is precisely what occurred to me final month. Earlier than I clarify precisely how this occurred, let’s take a look at the record of assertion credit for different playing cards that earn a Resy credit score.

The complete lineup of Delta and Amex cobranded playing cards acquired annual payment bumps and altered perks earlier this 12 months, as did the American Specific® Gold Card. I’ll solely concentrate on the playing cards with the identical assertion credit as my Delta Reserve Amex.

This is a better take a look at the annual and month-to-month assertion credit:

- Delta Stays (Delta’s resort journey portal) for pay as you go resorts and trip leases

- Resy for eligible purchases at Resy eating places within the U.S.*

- Choose U.S. ride-hailing companies like Uber, Lyft, Revel, Curb and Alto*

Every day Publication

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

*Enrollment is required for choose advantages; phrases apply.

The quantity you can obtain for these assertion credit varies by card. These are the playing cards which can be eligible to obtain all three of those assertion credit:

In case you have one in every of these 5 playing cards, you should use the listed assertion credit to offset the annual payment if you understand how to make use of them. TPG has a must-read information that will help you maximize these credit, so I will not repeat that right here. As an alternative, let’s get again to my shock credit score.

Incomes the month-to-month Resy assertion credit score

With my Delta Reserve Amex, I stand up to $240 yearly (as much as $20 month-to-month) in assertion credit once I dine at an eligible restaurant within the U.S. that participates within the Resy reservations system and pay with my Delta Reserve Amex. Chances are you’ll be questioning how a perk that includes eating at particular eating places was capable of shock me, however it did.

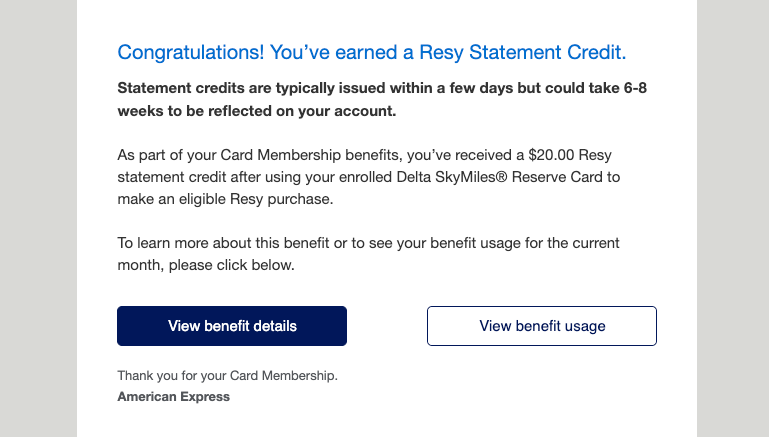

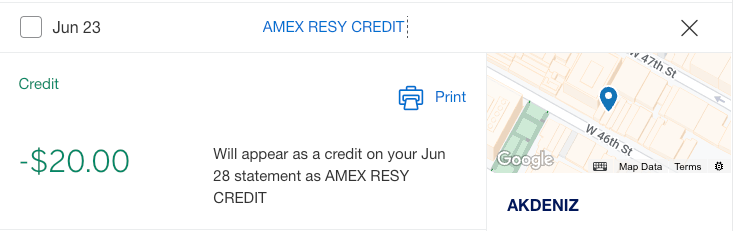

That is as a result of you do not have to make a reservation by way of Resy to earn the credit score; you solely need to pay your invoice utilizing an eligible card. I acquired an electronic mail alerting me that I had earned a $20 Resy assertion credit score, although I had no recollection of eating at a taking part restaurant.

My husband was out of city then, so the one eating out I had been doing was hitting the McDonald’s drive-thru to get Blissful Meals for the youngsters. As a lot as my youngsters love a fast and low-cost meal from McDonald’s, I knew that could not have triggered the credit score. (McDonald’s has an superior rewards program, although.)

Fortunately, Amex makes figuring out which cost triggered the Resy credit score simple. I logged in to my account and located the restaurant’s identify was listed within the $20 credit score transaction. The shock meal was one my husband had eaten whereas he was in New York Metropolis. Thriller solved!

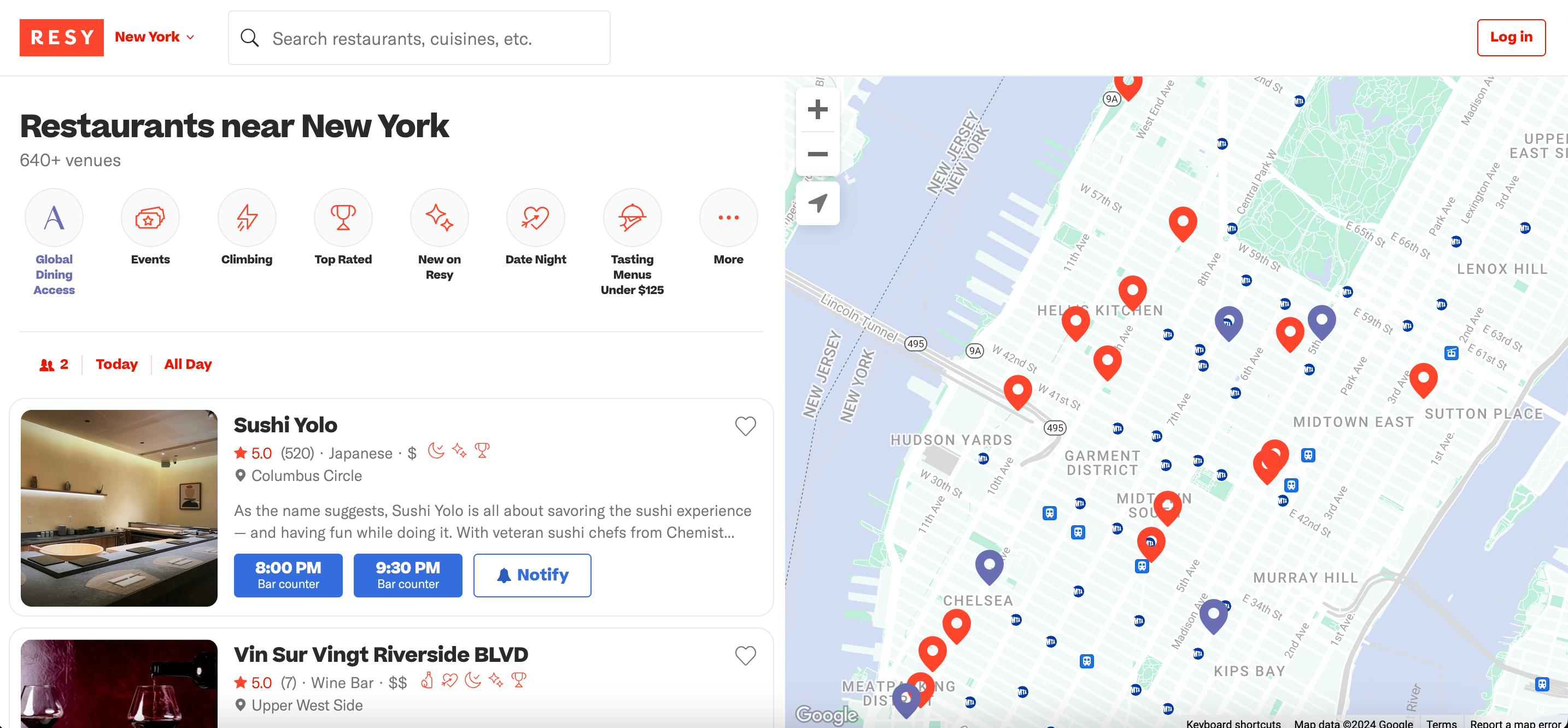

New York has an extended record of Resy-affiliated eating places. When you dine in New York or one other metropolitan space, you might additionally obtain a shock assertion credit score utilizing your eligible Amex card to pay on your meal.

We do not have as many taking part eating places in my hometown, so I’ve to plan extra rigorously to make use of my month-to-month Resy credit score. My technique thus far includes reviewing the record of eating places at the start of the month as a reminder to cease by one for dinner or drinks in some unspecified time in the future. Or, if I’ve a visit developing, I will take a look at eating places at my vacation spot and add one to the itinerary.

Discovering Resy-affiliated eating places is straightforward. You should utilize the Resy web site or app to seek for close by eating places and both make a reservation or go to as a walk-in. Simply keep in mind to pay the invoice along with your eligible Amex card.

Associated: Why the Delta SkyMiles Reserve card is the most effective card I’ve added to my pockets up to now 12 months

Different real-world examples

TPG senior editorial director Nick Ewen additionally has the Delta Reserve Amex, and he is been in a position to make use of the Resy credit score in just a few methods. In March, he loved a $20 assertion credit score at a restaurant on Restaurant Row in New York Metropolis, and he additionally used it to offset a part of a current brunch in South Florida along with his household.

He even bought a bodily present card at a neighborhood Resy institution for a pal’s birthday, triggering the $20 assertion credit score.

TPG senior director of product administration Gabe Travers is often the reservation maker amongst his pals, so he has a reasonably good psychological Rolodex of what is on Resy — and what’s not.

“Between residence and journey, we often eat at a Resy restaurant a minimum of as soon as a month. It does take somewhat bit of coaching to recollect to drag out my Delta Reserve Amex, because it is not often the place I put my eating spending (that is often my American Specific® Gold Card) — however the brand new month-to-month assertion credit assist offset the upper Delta Amex annual charges,” he mentioned.

Like Nick, Gabe has additionally discovered that he can earn the month-to-month assertion credit score by buying restaurant present playing cards.

“Considered one of my favourite native Resy eating places that makes use of Toast as its point-of-sale system additionally sells present playing cards on its web site that additionally course of by way of Toast,” he mentioned. “In my expertise, these appear to set off the assertion credit score because it’s the identical restaurant, similar cost — then I can save up for a fair nicer night time out.”

We have seen different anecdotal proof {that a} present card buy will usually set off the assertion credit score, however your mileage might range primarily based on how the restaurant expenses your card.

Backside line

Used each month, the Resy assertion credit score may be value as much as $240 per 12 months. Mixed with as much as $120 in annual ride-hailing assertion credit and the Delta Stays assertion credit score value as much as $200, that is $560 per 12 months in financial savings, which falls solely $90 wanting my Delta Reserve Amex’s $650 annual payment. Enrollment required for choose advantages.

Once I issue within the card’s different advantages, like an annual companion certificates, Delta Sky Membership lounge entry* and free checked luggage, I can simply squeeze $650 in worth from this card. If you’re contemplating including a Delta Amex to your pockets, you may get much more worth within the first 12 months while you earn the introductory welcome provide.

*Starting Feb.1, 2025, entry will probably be restricted to fifteen visits per 12 months.

To study extra, learn our full assessment of the Delta Reserve Amex.

Apply right here: Delta SkyMiles Reserve American Specific Card

Associated: Is the Delta Reserve Amex definitely worth the annual payment?

For charges and costs of the Delta Reserve Amex, click on right here.

For charges and costs of the Delta Platinum Amex, click on right here.

For charges and costs of the Delta Platinum Enterprise Amex, click on right here.

For charges and costs of the Delta Reserve Enterprise Amex, click on right here.