Do you know that you could pay the annual payment in your United bank card utilizing your airline miles? It is referred to as “Pay Your self Again” — however I am not speaking about utilizing your Chase Final Rewards factors with the Chase Pay Your self Again program.

As a substitute, you possibly can pay your card’s annual payment with common United Airways MileagePlus miles.

Do not feel dangerous in the event you weren’t conscious of this characteristic or the small print surrounding it. The web site that homes this info will not be extensively publicized and does not present a lot in the best way of particulars.

I am going to stroll you thru find out how to pay your United bank card’s annual payment utilizing United miles.

Playing cards eligible for this characteristic

United gives a number of cobranded bank cards, together with the next:

The data for the United Membership and United Membership Enterprise Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

*This card is discontinued and not accepting new candidates.

Any United card with an annual payment is eligible to take part on this supply — together with ones which can be not accessible to new candidates. That is nice information for anybody feeling on the fence about their card’s annual payment this 12 months.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: No saver house, no downside: How one can unlock extra award availability with United

How one can pay your card’s annual payment with United Airways miles

There’s a web site outlining this feature: decisions.unitedmileageplus.com. It mentions that you should utilize miles to repay your annual payment, however sadly, it says you could name the quantity on the again of your card to begin the method.

Furthermore, the phrases on the backside of the web page have a couple of essential factors it is best to word:

- This characteristic is barely accessible after you could have paid your annual payment inside the final 90 days, which means you will have to pay the payment first after which use United miles as a reimbursement after the actual fact.

- Redemption values aren’t revealed and might change at any time. Proper now, the worth is 1.5 cents per mile (extra on that under).

- The assertion credit score will seem in your account inside three enterprise days, and you will see the reimbursement and use of miles in your billing assertion inside one or two billing cycles.

- Reimbursement of your annual payment utilizing miles doesn’t depend as a cost to fulfill your minimal cost due that month, so guarantee any minimal funds are nonetheless met.

There are a couple of methods to get began. You possibly can name the quantity on the again of your United bank card as a primary technique. Bear in mind to pay that payment first and then request to make use of your United miles as a reimbursement.

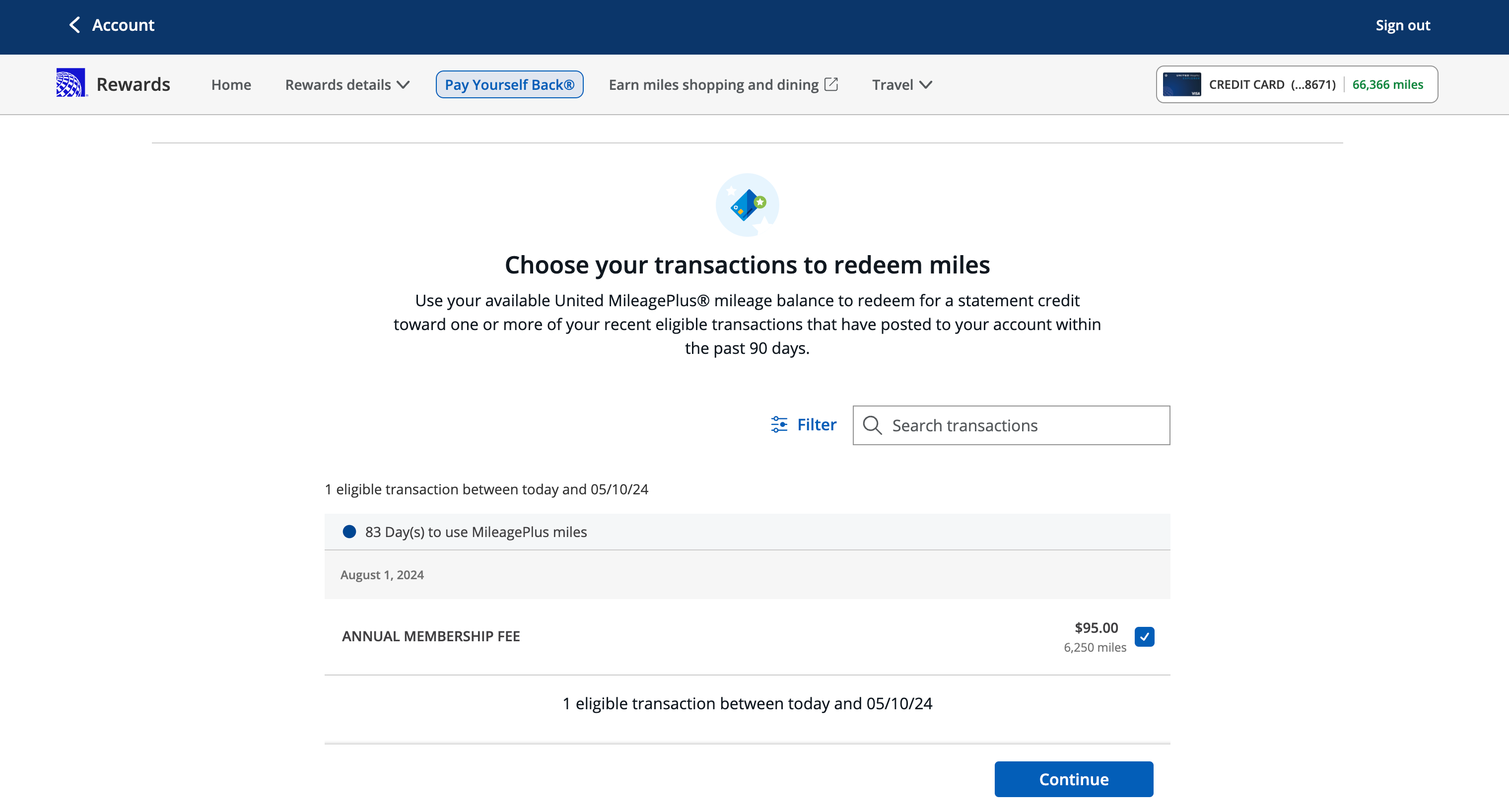

There are two different methods to pay your annual payment with miles. This web site outlines find out how to redeem your miles in opposition to your annual payment on-line. It is a quite simple course of so long as you observe the instructions.

Lastly, you possibly can full this course of within the Chase app. Log in to the app and choose your United card. Then go to the Rewards and Advantages part and choose Pay Your self Again.

Associated: United Premier standing: What it’s and find out how to earn it

What it prices

How a lot does it price? Or, to rephrase this query, what number of miles will you want?

Since you’ll pay the annual payment and search reimbursement together with your miles, let’s take a look at the price by way of what number of United miles you will finally use to reimburse your self after paying the annual payment in your United bank card.

Whereas the MileagePlus Decisions web page states, “Redemption values could also be modified at any time,” we have seen no change within the redemption charge for over two years now. You should utilize your United Miles at 1.5 cents apiece in opposition to your card’s annual payment.

Regardless of this, on-line boards present that some cardholders have acquired focused e mail gives to make use of United miles as excessive as 1.75 cents apiece in opposition to their card’s annual payment.

TPG August 2024 valuations peg United Miles at 1.35 cents every. Thus, this redemption is above the typical worth for United miles. On the face of it, that appears like a reasonably whole lot.

That stated, in the event you routinely redeem your miles for first—and business-class awards, you’re possible getting greater than 1.5 cents every in worth out of your United miles. On this state of affairs, you is perhaps hesitant to make use of your miles on this method.

General, although, this can be a honest use of United miles when contemplating your entire redemption choices, however it will likely be as much as you to resolve whether or not it really works for you.

Listed here are roughly what number of miles you possibly can count on to pay based mostly in your card’s annual payment (take into account that these can change at any time):

- United Enterprise Card ($0 introductory annual payment for the primary 12 months, then $99): 6,600 miles

- United Membership Enterprise Card ($450 annual payment): 30,000 miles

- United Membership Card ($450 annual payment): 30,000 miles

- United Membership Infinite Card ($525 annual payment): 35,000 miles

- United Explorer Card ($0 introductory annual payment for the primary 12 months, then $95): 6,334 miles

- United Quest Card ($250 annual payment): 16,667 miles

Is paying your United Card annual payment with United miles value it?

Whether or not this course of is value it depends upon the variety of miles it is going to price, the kinds of redemptions you sometimes do with United and what number of miles you could have accessible. Keep in mind that you should pay your card’s annual payment upfront.

In case the assertion credit score out of your miles redemption does not submit in time, it is best to nonetheless have the money accessible to pay your card’s annual payment.

Except you routinely guide first- and business-class award tickets with United, protecting your card’s annual payment with United miles is an effective way to make use of your further miles. TPG senior editorial director Nick Ewen has the United Explorer Card; he is contemplating this feature, as his annual payment simply got here due on Aug. 1.

“I have been disenchanted by the rash of latest devaluations from United,” he says. “Our information exhibits that MileagePlus miles are value 1.35 cents as of our August 2024 valuations, however I regularly see them decrease — even with my reductions as a cardmember. Utilizing 6,250 miles for my $95 annual payment is definitely 1.52 cents per mile. Or, put one other method, I am utilizing 6,250 for a pair of one-time United Membership passes, free checked baggage and a World Entry or TSA PreCheck assertion credit score each 4 years. That is not a foul choice.”

Backside line

Utilizing United miles to offset your bank card’s annual payment is an fascinating choice. Not everybody will discover worth in it, relying on how you like to make use of your miles, what worth you assign to them and even what number of are in your account proper now.

And since there’s not a lot info on-line about this feature, you’ll have by no means even thought of it. That stated, I’m an enormous fan of choices, particularly once you get first rate worth from a redemption.

In case you’re fascinated about utilizing your United miles to reimburse your card’s annual payment, name the quantity on the again of your card or go to the Chase app or web site to get began.

To be taught extra, learn our information on the finest United playing cards.

Associated: 6 of our favourite under-the-radar bank card perks

/cdn.vox-cdn.com/uploads/chorus_asset/file/25543000/247200_Asus_ROG_Ally_X_ReviewDSC02361.jpg?w=150&resize=150,150&ssl=1)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25784211/247333_EOY_Package_Check_In_CVirginia_HULU_DISNEY.jpg?w=150&resize=150,150&ssl=1)