JPMorgan Chase for years understated the danger it posed to the monetary system, based on a whistleblower who claimed that America’s largest financial institution made billions of {dollars} by violating guidelines established to guard the worldwide economic system from disaster.

In a 35-page letter despatched to JPMorgan Chase’s board audit committee, the whistleblower, a former JPMorgan Chase banker, alleged the agency “misrepresented” a number of indicators used to evaluate its complexity by the Federal Reserve by partaking in a course of referred to as “netting,” which is prohibited below Fed guidelines and worldwide requirements. This apply made the financial institution seem much less advanced, permitting the agency to carry much less capital in reserve — in impact eroding the monetary buffer meant to guard in opposition to future shocks.

Although the apply violates worldwide requirements, the Federal Reserve allowed JPMorgan Chase and different massive U.S. banks to proceed it, based on one other banker aware of the matter.

Sen. Elizabeth Warren, the highest Democrat on the Senate Banking Committee, mentioned she was deeply involved that the Federal Reserve “could also be turning a blind eye as JPMorgan and different Wall Avenue banks prepare dinner their books and skim off of funds meant to forestall a worldwide financial collapse.”

“Inconsistent and lax financial institution supervision has crashed our economic system earlier than,” she instructed the Worldwide Consortium of Investigative Journalists and The Bureau of Investigative Journalism.

“[Federal Reserve Chair Jerome] Powell owes the American individuals an evidence for permitting CEOs to control their monetary experiences to allow them to pay themselves and their rich traders extra in govt compensation and buybacks.”

The whistleblower claimed that JPMorgan Chase was in a position to difficulty a further $75 billion to $100 billion in loans by understating its complexity. They calculated that this might have allowed JPMorgan Chase to generate a further $2 billion in internet earnings in a single 12 months alone.

Former policymakers warned that the dearth of correct enforcement of the principles established within the wake of the 2008 monetary disaster — after which taxpayers footed the invoice for colossal authorities bailouts to stabilize the worldwide economic system — might go away massive U.S. banks with out the required capital readily available within the occasion of one other disaster.

“If [U.S. banks] don’t have sufficient capital for occasions after they expertise monetary stress, that’s placing their home economies at larger threat as a result of it’s eroding their capability to soak up losses,” mentioned Graham Steele, a former assistant secretary for monetary establishments on the U.S. Treasury Division. “It additionally imposes dangers to the worldwide monetary system. They are going to unfold threat and contagion as a result of these are international monetary establishments and international markets.”

In August 2023, the whistleblower wrote within the letter to JPMorgan Chase’s board audit committee, which oversees the agency’s monetary reporting, that the financial institution had been misreporting complexity indicators since 2016. The whistleblower claimed they’d raised the difficulty internally in 2018 and that they had been finally retaliated in opposition to and laid off in 2022. In response to the letter, they filed whistleblower complaints with the Federal Reserve and the Securities and Trade Fee in 2022 and briefed each businesses on the matter that 12 months.

The indications are a part of the Federal Reserve’s quarterly systemic threat report, which the U.S. regulator makes use of to calculate the danger posed by the eight largest American banks to the worldwide monetary system. The Federal Reserve makes use of the info within the report back to calculate the extra capital every financial institution should maintain above the minimal necessities set by U.S. legislation, which is called the capital surcharge. The banks that pose a larger threat to the monetary system are required to carry bigger capital reserves.

A JPMorgan Chase spokesperson didn’t reply a query from ICIJ and TBIJ about whether or not the whistleblower’s description of how the agency reported these indicators was correct. The spokesperson mentioned in an announcement that the financial institution totally complies with all capital rules, and that the financial institution’s methodology “is totally clear to our regulators.”

The Basel Accord, a world set of banking requirements, additionally prohibits netting in reporting these complexity indicators. The framework is just not legally binding, however the members of the worldwide committee that units these requirements — which incorporates the Federal Reserve and different U.S. establishments — have agreed to totally implement them of their jurisdictions.

A Federal Reserve spokesperson didn’t reply a query by ICIJ and TBIJ about whether or not the regulator allowed banks to report the complexity indicators in the way in which described by the whistleblower. As a substitute, the spokesperson pointed to the general greater quantities of extra capital that enormous U.S. banks should maintain compared to European counterparts, and the advisory nature of the worldwide banking requirements.

“Evaluating how U.S. and European banks calculate their capital surcharge exposures is just not a correct comparability,” the spokesperson mentioned. “The most important and most advanced U.S. banks are required below Fed guidelines to have considerably greater capital surcharges than their worldwide counterparts and considerably greater capital surcharges than specified below the non-binding Basel Accord.”

‘Our smartest individuals’

Within the aftermath of the 2008 monetary disaster, banking regulators throughout the globe agreed to a algorithm designed to strengthen oversight and regulation of banks. These new guidelines tried to make sure that banks saved sufficient capital readily available to outlive one other disaster on their very own with out counting on a big taxpayer bailout, as occurred in the US in 2008.

The executives of the biggest U.S. banks, in the meantime, have made no secret that they think about how the U.S. has applied these guidelines a roadblock to larger earnings.

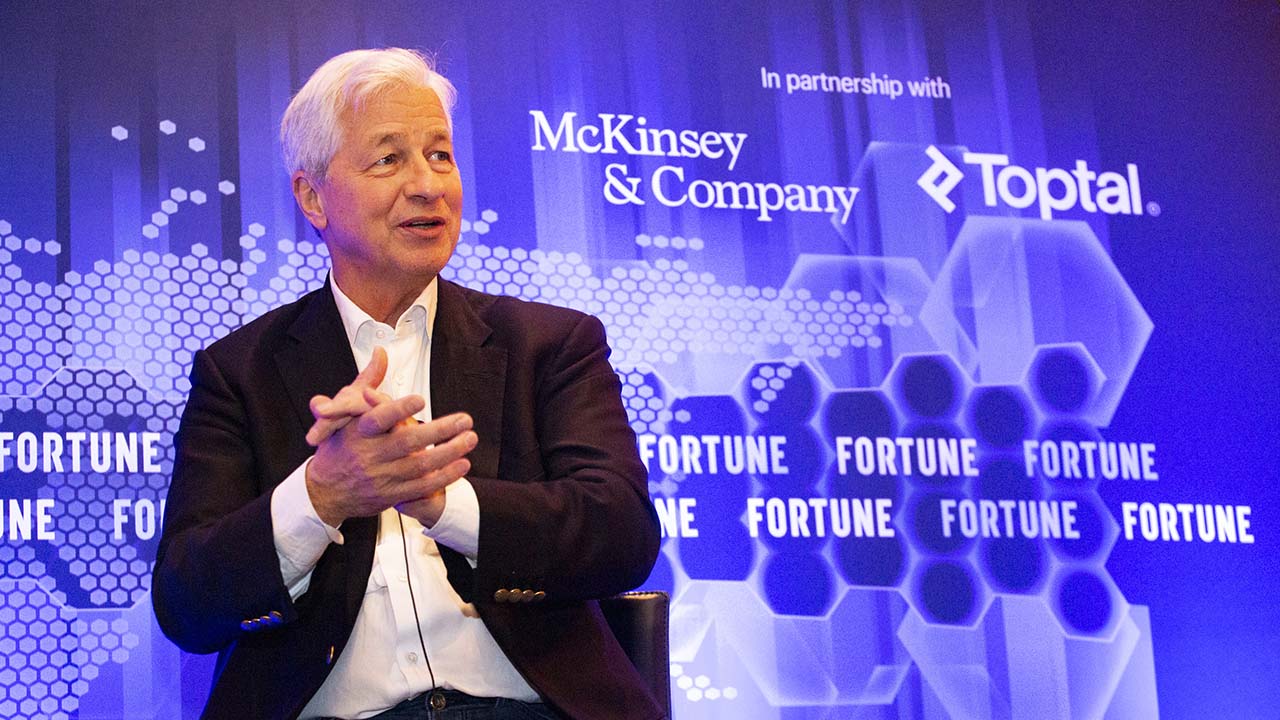

JPMorgan Chase CEO Jamie Dimon mentioned beforehand the financial institution was working laborious to attenuate the capital it was compelled to carry — property that would in any other case be loaned out, disbursed to shareholders as a dividend, or awarded to executives within the type of annual bonuses. “We’ve bought our smartest individuals determining each angle to scale back capital necessities for JPMorgan,” Dimon mentioned in 2023.

A spokesperson for the Monetary Providers Discussion board, which represents the biggest U.S. banks, mentioned that the quantity of capital these banks maintain has tripled to almost $1 trillion over the previous 15 years, and that the group has urged the Fed to evaluate U.S. capital necessities “that are greater than worldwide requirements and have elevated as a result of financial progress and inflation unrelated to systemic threat.”

The complexity indicators described by the whistleblower represent a considerable a part of a financial institution’s complete international systemic threat rating. A discount to the financial institution’s rating on these indicators might subsequently have a tangible impact on its capital necessities.

The complexity indicators additionally require banks to report their total buying and selling volumes. Massive banks usually maintain each lengthy positions, which enhance in worth when the property recognize, and quick positions that decline in worth if the property recognize. If the banks internet, or offset, their lengthy and quick positions, their buying and selling quantity will look smaller.

A financial institution that holds lengthy and quick positions in a single safety, for instance, might need zero internet publicity — however it could be extra advanced than a financial institution with no positions in that safety. For that motive, Federal Reserve guidelines and worldwide requirements require banks to report the lengthy place and particularly prohibit netting quick and lengthy positions.

The whistleblower included of their letter what they alleged was an outline of JPMorgan Chase’s methodology for reporting these indicators. It described a apply dubbed “inner operational elimination,” which the agency asserted didn’t represent netting. The whistleblower contended that this coverage was functionally the identical as netting and derided the interpretation as “nonsensical.”

One other former JPMorgan Chase banker, who has since moved to a different massive U.S. financial institution, mentioned different banks topic to the capital surcharge have adopted comparable insurance policies to JPMorgan Chase in reporting these indicators.

It’s deeply unlucky that [the Federal Reserve] would permit the banks to get away with violating very clear home and worldwide requirements, however much more stunning to do it in a means that’s so opaque — former U.S. Treasury official Graham Steele

Requested if the banks had sought approval for that interpretation from the Federal Reserve, the banker mentioned: “U.S. corporations are type of discouraged from making the regulators their interpretive workplaces. Supervisors anticipate the banks to have experience, to do their work after which it’s topic to evaluate. It’s much less asking for permission up entrance and extra of doing the interpretations and being topic to being instructed that they’re improper.”

Steele, the previous Treasury official, mentioned the Fed’s failure to implement its personal guidelines was regarding, and will probably benefit some U.S. banks over others if all banks weren’t made conscious of its place on the similar time. “It’s deeply unlucky that [the Federal Reserve] would permit the banks to get away with violating very clear home and worldwide requirements, however much more stunning to do it in a means that’s so opaque,” he mentioned.

Gaming the principles

Former policymakers and economists crucial of the Federal Reserve instructed ICIJ and TBIJ that the U.S. regulator’s strategy on this difficulty matches inside a bigger sample of caving to banks’ need for much less regulation, and will undermine worldwide coordination on banking requirements.

The banking business waged a lobbying blitz in 2023 and 2024 in opposition to proposed guidelines, dubbed the “Basel Endgame,” that might enhance capital necessities for the biggest U.S. banks. Lobbyists for the banks paid to place up billboards opposing the brand new guidelines alongside main highways and Washington’s Reagan Nationwide Airport, and even aired advertisements throughout Sunday Evening Soccer warning that the principles would enhance prices for working-class Individuals.

In September, the banking business scored a significant victory when the Fed dramatically revised its plan, proposing a 9% enhance for big U.S. banks as an alternative of the 19% enhance it had proposed in summer season 2023. The Fed’s vice chairman for banking supervision, Michael Barr, additionally introduced in January that he would step down from his place after advisers to President Donald Trump mulled an effort to demote him. Barr had come below assault by Republicans within the Senate partially for his function in pushing for greater capital necessities.

By deviating from worldwide requirements, critics additionally mentioned the Fed had made it tougher to make sure a degree enjoying subject amongst banks throughout the globe.

“No particular person nation will need to penalize its personal massive banks,” mentioned David Aikman, a professor of finance at King’s Faculty London. “They’ll solely signal as much as these guidelines in the event that they assume everyone else is making use of the principles faithfully.”

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832866/STK048_XBOX_2_C.jpg?w=150&resize=150,150&ssl=1)