The Citi® / AAdvantage® Platinum Choose® World Elite Mastercard® is a strong choice for American Airways vacationers on the lookout for their first checked bag free on home flights.

You’ll be able to spend towards Million Miler standing and construct up your AAdvantage mileage steadiness on your subsequent journey. If you happen to’re contemplating making use of for the Citi / AAdvantage Platinum Choose, chances are you’ll be unsure whether or not you’ve gotten a excessive sufficient credit score rating to be authorized. This is what you need to know.

The data for the Citi / AAdvantage Platinum Choose World Elite Mastercard has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

What credit score rating qualifies for approval?

Citi would not publish particular credit score scores wanted to be accepted for its playing cards. In spite of everything, your credit score rating is only one of many issues issuers have in mind when deciding whether or not to approve a client for a card.

However you will typically want a good credit score rating of at the least 670 or greater to be authorized for a rewards bank card just like the Citi / AAdvantage Platinum Choose Mastercard. That mentioned, it is doable to get denied in case your rating is excessive, even when different facets of your credit score portfolio could also be interesting to the issuer.

Associated: How do credit score scores work?

What’s the Citi / AAdvantage Platinum Choose?

The Citi / AAdvantage Platinum Choose is a cobranded American Airways bank card issued by Citi. This bank card can simply be well worth the $99 annual charge (waived for the primary 12 months) even in the event you solely fly American Airways domestically just a few occasions per 12 months.

It’s because by merely having this card you and as much as 4 companions touring with you on the identical reservation get your first checked bag free on home American Airways itineraries.

You may additionally earn 2 miles per greenback spent at gasoline stations, eating places and on eligible American Airways purchases.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: Citi’s present AAdvantage bank card provides: Every little thing it’s worthwhile to know

What number of card accounts can I’ve open?

Citi doesn’t appear to restrict the variety of bank cards you possibly can have open. Nevertheless, it does appear to have a most credit score line that it’s prepared to increase throughout all your Citi playing cards.

So, you probably have at the least one different Citi bank card and are not authorized for a brand new card, chances are you’ll wish to name Citi’s reconsideration line to see if shifting some credit score from one in every of your present playing cards will will let you open the brand new card.

Associated: What number of bank cards ought to I’ve?

Who’s eligible for a welcome bonus?

You will not be eligible to earn a welcome bonus on the Citi / AAdvantage Platinum Choose Mastercard in the event you’ve acquired a welcome bonus for the cardboard throughout the final 48 months.

Particularly, the pricing and data part on the applying web page for this card notes:

American Airways AAdvantage® bonus miles will not be obtainable you probably have acquired a brand new account bonus for a Citi® / AAdvantage® Platinum Choose® account up to now 48 months or in the event you transformed one other Citi bank card account on which you earned a brand new account bonus within the final 48 months right into a Citi® / AAdvantage® Platinum Choose® account.

Associated: What it’s worthwhile to find out about incomes one other American Airways card welcome bonus

Methods to examine your credit score rating

There are various methods to examine your credit score rating at no cost. For instance, many bank cards allow you to examine your FICO rating for free of charge to you. It is a good suggestion to trace the development of your rating over time, particularly in the event you’re working to enhance your credit score rating.

Nevertheless it’s necessary to appreciate that you do not have only one credit score rating. As a substitute, there are totally different calculation strategies, comparable to FICO Rating and VantageScore, and totally different credit score reporting businesses, comparable to TransUnion and Experian.

Your credit score rating will fluctuate primarily based on the calculation methodology and credit score reporting company that’s used.

Associated: 6 issues to do to enhance your credit score

Components that have an effect on your credit score rating

As soon as you realize your credit score rating vary, chances are you’ll marvel what elements have an effect on your credit score rating. There are just a few formulation for calculating your credit score rating, however not one of the actual calculations are public.

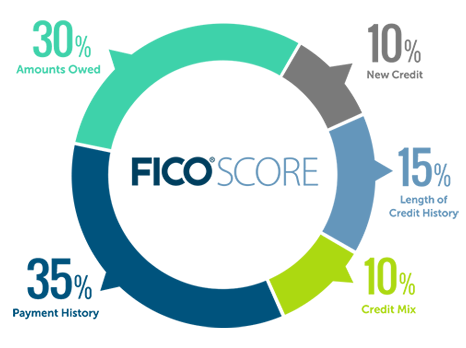

This being mentioned, FICO is comparatively clear concerning the various factors they assess and the way a lot weight every is given:

- Fee historical past (35%): Whether or not you have paid previous credit score accounts on time

- Quantities owed (30%): The relative dimension of your present debt and the ratio of your present debt to your obtainable credit score

- Size of credit score historical past (15%): How lengthy your credit score accounts have been established (together with the age of your oldest account, the age of your latest account and the common age of all of your accounts), how lengthy sure credit score accounts have been established and the way lengthy it has been because you used sure accounts

- New credit score (10%): The variety of accounts you have opened lately

- Credit score combine (10%): The variety of various kinds of credit score accounts you’ve gotten. This contains bank cards, retail accounts, installment loans, finance firm accounts and mortgage loans

Associated: 4 widespread credit score rating myths

What to do in the event you get rejected

In case your software is rejected, you will get a letter within the mail that states why Citi turned down your software. Relying on the explanations given for the rejection, chances are you’ll wish to use this data to enhance your credit score rating earlier than making use of once more.

Or, in the event you consider you possibly can present extra data which may result in approval of your software, you possibly can name Citi’s reconsideration line at 1-800-695-5171 and make your case.

You may wish to clarify that you just lately utilized for the Citi / AAdvantage Platinum Choose World Elite Mastercard, have been shocked to see that your software was rejected and ask to talk to somebody about getting that call reconsidered.

As soon as the agent pulls up your software, be ready to current a compelling argument for why Citi ought to approve your software.

Associated: 5 issues to examine earlier than making use of on your subsequent bank card

How lengthy to attend earlier than making use of once more

It is best to keep away from making use of once more for a Citi card till you have addressed the explanations Citi gave for rejecting you.

However, if you wish to apply once more or apply for a special Citi card, the consensus is you could solely apply for one Citi card (private or enterprise) each eight days and not more than two playing cards in a 65-day window.

Associated: The final word information to bank card software restrictions

Do you get lounge entry?

No, you don’t get lounge entry as a cardholder of the Citi / AAdvantage Platinum Choose Mastercard.

If you happen to’re on the lookout for Admirals Membership entry when flying American Airways, you need to contemplate the $595 annual charge Citi® / AAdvantage® Government World Elite Mastercard® (see charges and costs).

This card gives full membership entry privileges to Admirals Membership lounges for the first cardholder.

Associated: Greatest bank cards for airport lounge entry

Do you get a free checked bag?

As a Citi / AAdvantage Platinum Choose cardholder, you and as much as 4 companions touring with you on the identical reservation will every get a primary checked bag free on home itineraries marketed by American Airways and operated by American Airways or American Eagle.

To reap the benefits of this profit, your bank card account have to be open at the least seven days earlier than journey, and the reservation should embody the first bank card member’s American Airways AAdvantage quantity at the least seven days earlier than journey. Obese and oversize charges nonetheless apply.

Associated: Methods to keep away from checked baggage charges on main home airways

Backside line

There is no single greatest bank card for American Airways flyers. As a substitute, the greatest card for you is dependent upon what you are on the lookout for in a card. The Citi / AAdvantage Platinum Choose and AAdvantage® Aviator® Purple World Elite Mastercard are each good choices for American Airways vacationers who fly with the airline ceaselessly sufficient to get at the least $99 of worth from the cardboard’s checked bag allowance on home American Airways itineraries.

The data for the AAdvantage Aviator Purple card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

These playing cards have totally different incomes charges and advantages, so that you simply must determine which card’s advantages you like.

Be taught extra: Citi / AAdvantage Platinum Choose World Elite Mastercard full evaluation

/cdn.vox-cdn.com/uploads/chorus_asset/file/25530683/Screenshot_2024_07_14_at_6.17.45_PM.png?w=150&resize=150,150&ssl=1)