There are a lot of causes to ask for a credit score restrict enhance. For instance, you might spend as much as your bank card’s restrict continuously. Or, you might be trying to decrease your credit score utilization to enhance your credit score rating and get a brand new rewards bank card.

No matter why you need to enhance your credit score restrict, you might be questioning when the appropriate time is.

This is all the things you could know.

What’s a credit score restrict?

Your credit score restrict is the utmost quantity of credit score your monetary establishment is keen to increase to you on a specific credit score line. In different phrases, your credit score restrict is the very best steadiness you may carry in your bank card at any given time — though you might be able to spend over your credit score restrict in some conditions.

The monetary establishment will usually set your credit score restrict while you apply for a brand new bank card. Your credit score restrict is predicated on a number of features of your credit score historical past, together with your earnings, credit score rating and general monetary scenario. The issuer needs to offer you a restrict that minimizes your threat of default whereas additionally providing you with sufficient spending energy to really use your card continuously.

When are you able to request a credit score restrict enhance?

Your bank card issuer units your credit score restrict while you apply in your bank card. Some issuers require you to carry a card for a minimal period of time earlier than requesting a credit score restrict enhance. Some issuers have insurance policies concerning how continuously you may request a credit score restrict enhance.

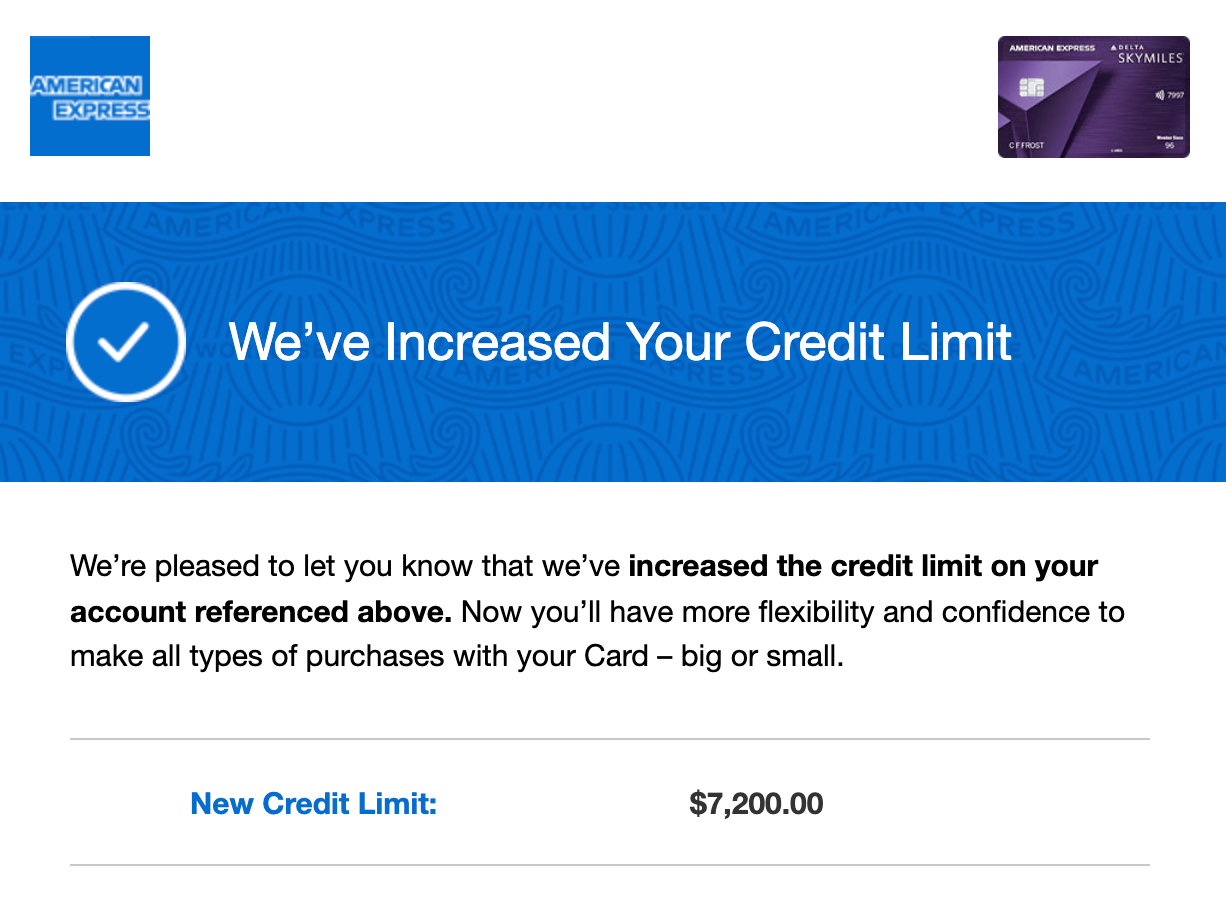

For instance, you probably have an American Categorical card, you may request a credit score restrict enhance as soon as your account has been open for no less than 60 days.

And, you probably have a Capital One card, you usually aren’t eligible for a credit score line enhance in the event you opened your account “inside the previous a number of months.” After that time, you might request a credit score line enhance anytime you want, however Capital One usually does not change an account’s credit score line extra typically than each six months.

Different issuers, reminiscent of Chase, have insurance policies concerning once they’ll enhance your credit score line, however these insurance policies aren’t publicly accessible, so it is best to name customer support to debate your accessible choices.

Each day E-newsletter

Reward your inbox with the TPG Each day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Citi permits cardholders to request a credit score line enhance on-line or by way of the cell software each six months. TPG bank card author Danyal Ahmed requests credit score line will increase on a number of Citi-issued bank cards each six months and is often given a modest enhance between $1,200 and $2,800 almost each time.

Some bank card issuers might routinely enhance your credit score restrict in the event you’ve used it responsibly for a sure period of time. And, within the case of some secured bank cards, the issuer might even transfer you from a secured credit score line to an unsecured credit score line.

Associated: The 6 finest bank cards with the very best credit score limits

When is it sensible to ask for a credit score restrict enhance?

Monetary establishments think about your present earnings, credit score rating and general monetary well being when deciding whether or not to extend your credit score restrict. So, you will have a greater likelihood of success in the event you ask for a credit score restrict enhance when these elements have improved.

Specifically, you might have success asking for a credit score restrict enhance when a number of of the next have occurred:

- You’ve got obtained a increase or began a brand new job that will increase your annual family earnings.

- Your credit score rating has improved considerably.

- You’ve got paid off excellent debt.

- You’ve got been utilizing the cardboard responsibly and have not utilized for another credit score just lately.

When is it dangerous to ask for a credit score restrict enhance?

When customers face monetary difficulties, banks typically reduce credit score limits. In consequence, you often will not need to ask for a credit score restrict enhance quickly after any of the next have occurred:

- You’ve got misplaced your job or obtained a pay reduce that decreases your annual family earnings.

- Your credit score rating has decreased.

- You are at or near your credit score restrict.

- You’ve got just lately missed a cost or submitted a cost late.

- You might have latest inquires in your credit score report for brand new credit score strains, reminiscent of loans or different bank cards.

Associated: The way to verify your credit score rating at no cost

How lengthy does it take to extend your credit score restrict?

Requesting a credit score restrict enhance is often fast and simple. Some issuers even enable you to take action on-line. However even in the event you can apply for a credit score restrict enhance on-line, you will need to name the quantity on the again of your card you probably have any questions. For instance, in case you are trying to keep away from a onerous credit score pull, you might need to name to find out if there’s a decrease credit score restrict enhance which you could receive with solely a mushy credit score pull.

Whether or not you request a credit score restrict enhance on-line or over the cellphone, you might obtain a response in as little as 30 seconds or might have to attend as much as 30 days. Much like a bank card software, some requests might be permitted rapidly by the issuer’s algorithms, whereas others would require extra info or overview by a human.

How a lot of a credit score restrict enhance must you ask for?

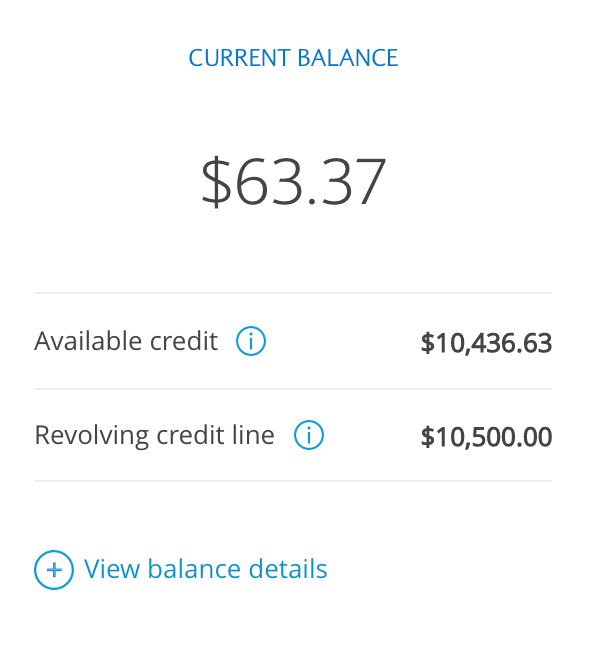

There are a number of features to contemplate when deciding how a lot of a credit score restrict enhance to request. For instance, you will usually need to maintain your credit score utilization between 20% and 30% of your accessible credit score. So, you might need to ask for a credit score restrict enhance that may help you stay beneath 30% credit score utilization as you use your bank card for on a regular basis spending.

If you wish to keep away from a tough pull to your credit score, you might ask your issuer if you may get a comparatively small credit score restrict enhance with solely a mushy credit score pull. In spite of everything, approving small credit score restrict will increase is simpler, as these are much less dangerous for the issuer.

However you probably have a specific buy in thoughts or purpose why you are in search of a selected credit score restrict enhance, it is price asking for one within the quantity that you simply want. Primarily based in your creditworthiness, your issuer could also be keen to approve your request.

Does getting a credit score restrict enhance have an effect on your credit score rating?

Getting a credit score restrict enhance can have an effect on your credit score rating in two main methods:

- Decrease credit score utilization: Credit score utilization accounts for about 30% of your FICO rating. You’ll be able to decrease your credit score utilization by growing the quantity of credit score you could have entry to. So, getting a credit score restrict enhance can positively have an effect on this side of your credit score rating.

- A tough pull in your credit score report: New credit score accounts for about 10% of your FICO rating. So, while you apply for a brand new line of credit score — together with some credit score line enhance requests — your credit score rating might lower by 5 to 10 factors for a number of months.

As such, a credit score restrict enhance request might briefly decrease your credit score rating. However even when your request is not permitted, the long-term impression might be minimal.

Associated: 7 issues to grasp about credit score earlier than making use of for a brand new card

Backside line

It is necessary to accurately time your request for a better credit score restrict. In spite of everything, you need to make the request when the issuer has a compelling purpose to say sure. For those who observe the steerage on this article, you might be able to snag a credit score restrict enhance on a number of of your playing cards.