The Factors Man has been reporting on bank cards since 2010, serving to you maximize purchases for future journey. However factors and miles are a comparatively new providing within the grand scheme of the historical past of bank cards.

Whereas bank cards have not all the time appeared the way in which that they do now, credit score has been a key monetary instrument serving to folks buy items and companies for 1000’s of years. From historical civilizations to the trendy day, credit score has been a sustaining driver of economies and one that can proceed to evolve effectively into the long run.

Historical bank cards

While you consider “bank cards,” you in all probability think about them to be a contemporary monetary innovation. Nonetheless, the idea of a bank card dates again to historical occasions. Credit score has been round for nearly so long as cash itself.

The Mesopotamian and Harappan civilizations used clay tablets to trace their commerce and transactions, very like modern-day bank cards. In keeping with Jonathan Mark Kenoyer, an archaeologist and professor of anthropology on the College of Wisconsin-Madison, earthen tablets bore seals from the 2 civilizations and had been used out of necessity. The quantity of products being traded between them was so massive that paying with bodily cash would have been too cumbersome.

Later, within the Babylonian empire, a few of the first written guidelines concerning strains of credit score appeared within the Code of Hammurabi. These strains of credit score labored extra like modern-day loans relatively than bank cards. Curiously sufficient, most of the guidelines round delinquencies and fraud are nonetheless mirrored in fashionable bank card protections and laws.

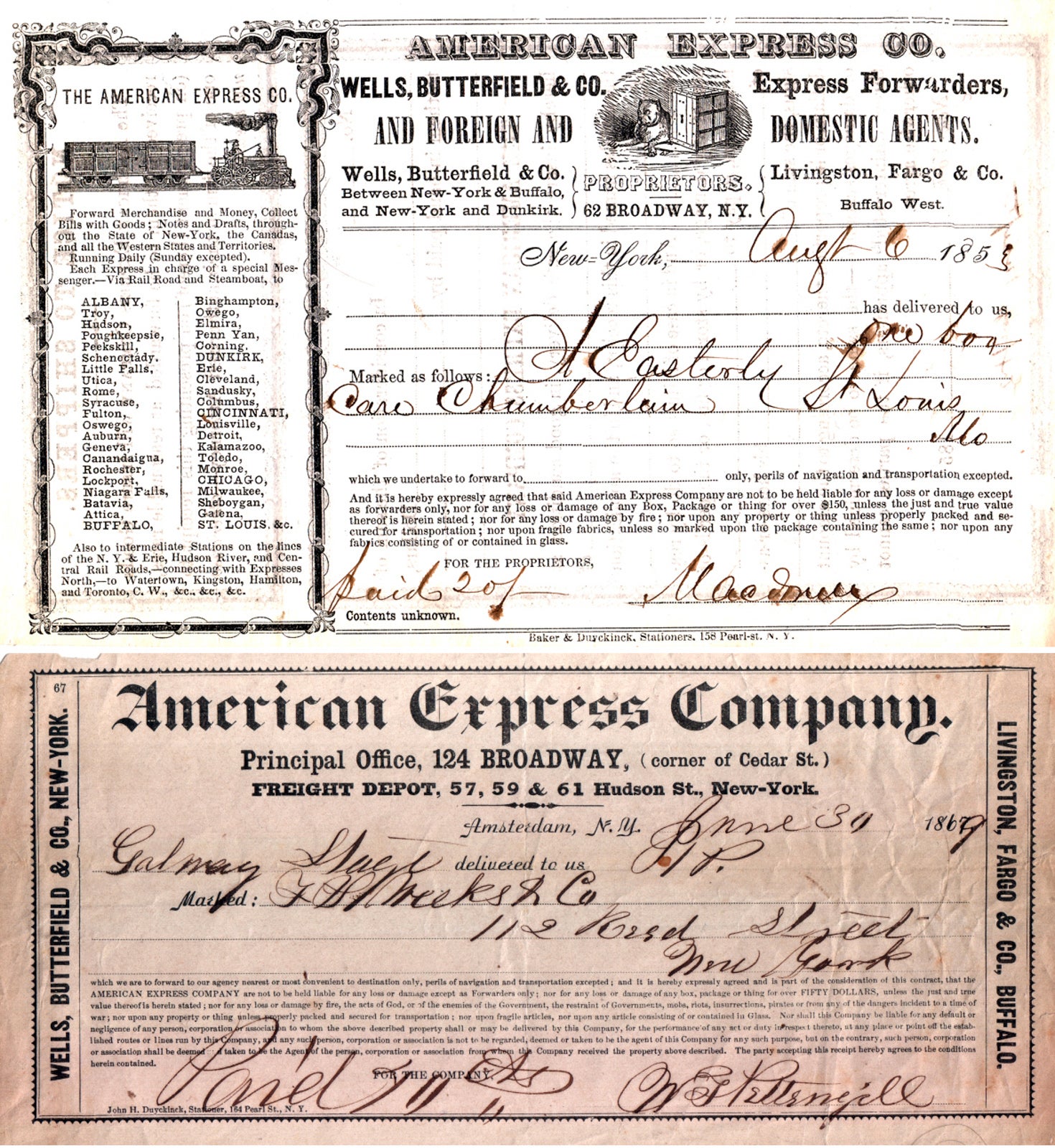

The 1800s: Cost cash and the start of American Specific

It is solely becoming that card large American Specific ought to be an vital a part of the monetary trade’s historical past. American Specific was the product of a merger amongst three firms — Wells & Co.; Livingston, Fargo & Co.; and Wells, Butterfield & Co. — on March 18, 1850. Since then, the corporate has develop into a globally built-in funds firm that reported $72.7 billion in income in 2024.

By 1865, the corporate boasted greater than 900 workplaces in 10 states. That very same yr, American Specific launched the primary cost coin. These had been primarily issued by department shops and displayed a buyer’s identification quantity and a picture related with the service provider.

In the meantime, in 1868, the corporate merged with Retailers Union Specific Co. to develop into American Retailers Union Specific Co. 5 years later, it took on the identify American Specific Co.

Additionally within the nineteenth century, American Specific created its first cash orders and traveler’s checks (establishments within the U.Okay. are credited with creating the primary variations of those two monetary devices within the late 18th century). In 1895, Amex’s first European workplace opened in Paris, with expansions to England and Germany occurring by 1898.

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

1900-1940: Shopper’s plates and the primary journey rewards bank card

The interval between 1900 and 1940 noticed a rise in credit score as a fee kind. Many department shops and gasoline stations started providing shopper’s plates to common clients. These metallic plates had been just like fashionable bank cards, measuring 2 1/2 by 1 1/4 inches and containing clients’ names and billing addresses.

Retailers stored shopper’s plates in-store and used them to generate receipts and observe the quantity every buyer owed.

The primary airline bank card

The primary journey bank card that appears extra like right now’s fashions debuted in 1934 when American Airways launched the Air Journey Card. The cardboard contained a novel quantity tied to every buyer’s account — identical to modern-day bank cards.

The Air Journey Card was legitimate for American Airways purchases. Ultimately, 17 different airways started accepting it as a fee kind for airfare. Rather than incomes factors on flights, cardholders obtained a 15% low cost on airfare purchases charged to the cardboard.

How does that stack up in opposition to the modern-day Citi® / AAdvantage® Platinum Choose® World Elite Mastercard®? If you happen to charged a $500 fare to the Air Journey Card, you’d have earned a $75 low cost. In the meantime, charging $500 in American Airways airfare to the Citi AAdvantage Platinum card earns 1,000 miles, which, in keeping with TPG’s November 2024 valuations, are value $16.

Whereas the Air Journey Card from 1934 was extra rewarding on airfare purchases, it did not supply a sign-up bonus or earn rewards on nonairfare purchases. In that regard, we’re significantly better off right now.

The knowledge for the Citi/AAdvantage Platinum Choose card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

Associated: The very best airline bank cards

The Fifties: Diners Membership introduces the primary cost card

The Diners Membership Card, launched in 1950, was the primary multipurpose cost card that buyers may use at varied retailers. Legend has it that it was created by a businessman named Frank McNamara, who forgot his pockets whereas eating out in New York Metropolis and resolved by no means to face the identical embarrassment once more. A yr later, he returned to that very same restaurant and paid with the primary cardboard Diners Membership Card. The story is apocryphal, however McNamara did certainly co-found the primary fashionable cost card.

Initially, the Diners Membership Card was legitimate at a couple of dozen eating places in New York and had round 200 cardholders. The corporate made cash by charging clients an annual charge of $3 and eating places a 7% transaction charge. By 1953, the Diners Membership Card was accepted within the U.Okay., Canada, Cuba and Mexico.

1958 was a monumental yr for the Diners Membership Card. The corporate had its first TV advert as a sponsor of the New York Giants. Diners Membership then entered the journey market, partnering with journey companies in main cities that accepted the cardboard for the acquisition of airline, steamship (the jet age was simply beginning!) and cruise tickets.

American Specific and Financial institution of America be a part of the competitors

In the meantime, American Specific launched its first cost card within the U.S. and Canada. At first, the cardboard was purple cardboard, however by 1959 it had develop into the inexperienced plastic card we all know right now.

That very same yr, Financial institution of America launched what grew to become the primary nationally licensed bank card program, BankAmericard. The cardboard was legitimate at quite a lot of retailers and pioneered the 25-day grace interval and installment funds. Following fast adoption and development, this system expanded across the globe and finally grew to become referred to as Visa.

Additionally within the late Fifties, Chase and lots of different banks began bank card packages, however most rapidly failed. By 1959, Diners Membership reached one million cardholders and was listed on the New York Inventory Alternate.

The Sixties: The expansion of the bank card trade

The Sixties had been a watershed decade for the bank card trade.

Following the launch of the BankAmericard in California, virtually one million BankAmericards had been in circulation by the top of 1960. Simply six years later, Financial institution of America started licensing it as the primary general-purpose bank card throughout the nation. By June 1966, 61,000 retailers throughout 42 states accepted the BankAmericard.

Citi and American Specific additionally launched new playing cards throughout this time. First Nationwide Metropolis Financial institution (now Citi) started issuing the “Every thing Card.” In the meantime, Amex established its first company card program for business clients in 1966. First Nationwide Metropolis Financial institution would finally be a part of a brand new affiliation of banks — the Interbank Card Affiliation — to launch Mastercard.

The Fact in Lending Act

In response to the increase of bank card accounts, the Fact in Lending Act was enacted in 1968. The Federal Reserve Board applied this set of laws within the hopes of defending customers as they handled collectors. Most notably, the TILA requires card issuers to reveal sure data earlier than issuing a shopper a bank card, together with the annual share fee and costs related to the cardboard account.

The identical yr the TILA went into impact, the Interbank Card Affiliation shaped partnerships with banks from all over the world. Within the following decade, the ICA would revamp its model to Mastercard.

From 1966 till 1970, greater than 100 million bank cards had been produced and mailed, unsolicited, to clients the banks had deemed creditworthy — a far cry from the generally stringent utility course of of the present bank card panorama. Not surprisingly, this mass distribution invited a wave of white-collar crime, privateness considerations and legislative debates.

By 1970, the follow of issuing unsolicited bank cards had been banned. Issuers may solely ship out utility requests — a follow that has continued in full power ever since, as mailboxes stuffed with utility solicitations can attest.

Lastly, in 1969, IBM developed magnetic-stripe expertise, which might play a big position within the evolution of bank card tech as a complete within the Seventies and past.

The Seventies: Bank cards evolve

The Seventies had been a decade of improved regulation, technological advances and rebranding of some bank card networks into names that we acknowledge right now. Now, let’s think about every of those three developments in barely extra element.

Regulation

Till the Seventies, many bank card issuers would merely mail bank cards to customers whether or not they had requested them or not. Of us had been left to destroy or mail again the playing cards they did not need. The Unsolicited Credit score Card Act of 1970 stopped the unsolicited distribution of bank cards issued by oil firms, retailers and most different collectors — however widespread carriers and banks had been each exempted because of jurisdiction points.

The Seventies noticed varied different bank card laws, together with the:

- Honest Credit score Reporting Act (1970) to make sure the accuracy and equity of credit score reporting in addition to require shopper reporting companies to undertake cheap procedures akin to shopper entry to their credit score studies.

- Equal Credit score Alternative Act (1974) to ban lending discrimination based mostly on intercourse or marital standing. This act was amended in 1976 to additionally prohibit lending discrimination based mostly on race, faith, nationwide origin, age, the receipt of public help revenue or exercising one’s rights below sure shopper safety legal guidelines.

- Honest Credit score Billing Act (1974) to guard customers from unfair credit score billing practices and supply a pathway for customers to dispute prices from bank card issuers.

- Honest Debt Assortment Practices Act (1977) to eradicate abusive debt assortment practices by debt collectors and to advertise constant state motion to guard customers in opposition to debt assortment abuses.

Associated: Why a bank card is a wiser alternative than a debit card

Technological advances

In 1971, IBM partnered with the banking and airline industries to develop a world normal for magnetic-stripe bank cards. This is able to quickly permit cardholders to use their bank cards worldwide. Likewise, all through the Seventies, varied bank card networks applied digital authorization programs, which may then facilitate using digital clearing and settlement programs; for instance, Nationwide BankAmericard debuted this expertise in 1973.

Rebranding

First, BankAmericard rebranded to Visa in 1976; then, the Interbank Card Affiliation grew to become Mastercard in 1979. Each bank card networks rebranded to facilitate worldwide development and acceptance.

The Nineteen Eighties: The journey loyalty increase

Within the Nineteen Eighties, the monetary companies trade boomed, making it a aggressive time for bank card issuers as they launched new merchandise. The ’80s additionally ushered within the period of journey loyalty packages as we all know them right now, together with frequent flyer, resort and automobile rental rewards packages.

American Specific, Visa, and Mastercard all launched premium bank card merchandise within the early-to-mid-Nineteen Eighties. Amex already appealed to a extra prosperous buyer base, and the 1984 debut of The Platinum Card® from American Specific solidified this notion. On the time, the cardboard carried a $250 annual charge and provided 24-hour concierge service, journey insurance coverage, and entry to non-public golf equipment all over the world. Adjusted for inflation, the annual charge can be $630 — barely lower than the $695 you’d pay right now (see charges and costs).

Whereas most bank cards up up to now had been aspirational merchandise geared toward premium clients, Uncover bucked this pattern in 1983 by introducing the no-annual-fee Uncover Card by Sears, Roebuck and Co. The cardboard was extensively promoted in an advert in the course of the 1985 Tremendous Bowl.

The mid-to-late Nineteen Eighties additionally noticed the launch of affinity and cobranded bank cards. In 1986, Continental Airways teamed up with Marine Midland Financial institution (now a part of HSBC) on the Continental TravelBank Gold MasterCard, and American Airways partnered on a card with Citi a yr later.

Lastly, the mid-Nineteen Eighties noticed the primary bank card rewards program, Diners Membership Rewards.

The Nineteen Eighties was an enormous decade for card issuers and customers alike. These new merchandise and loyalty packages set the tone for the following a long time and for the present iteration of playing cards, factors, and miles that we all know and love right now.

The Nineteen Nineties: Bank cards get high-tech (and high-end)

The Nineteen Nineties noticed two of the largest modifications to the world of bank card rewards: the packages we use to redeem our miles and the bodily playing cards themselves. Amex kicked off the last decade by launching Membership Miles in 1991, the precursor to right now’s massively in style Membership Rewards program.

You’ll be able to inform how a lot has modified by wanting on the unique seven Amex switch companions, solely two of that are nonetheless in enterprise: Delta Air Strains and Southwest Airways. Continental, Northwest Airways, Pan Am, Halfway Airways, and MGM Grand Air are all gone. Whereas this system has modified rather a lot through the years, Amex struck gold with the thought of transferable factors. These days, a number of different main issuers have adopted go well with in some kind or one other.

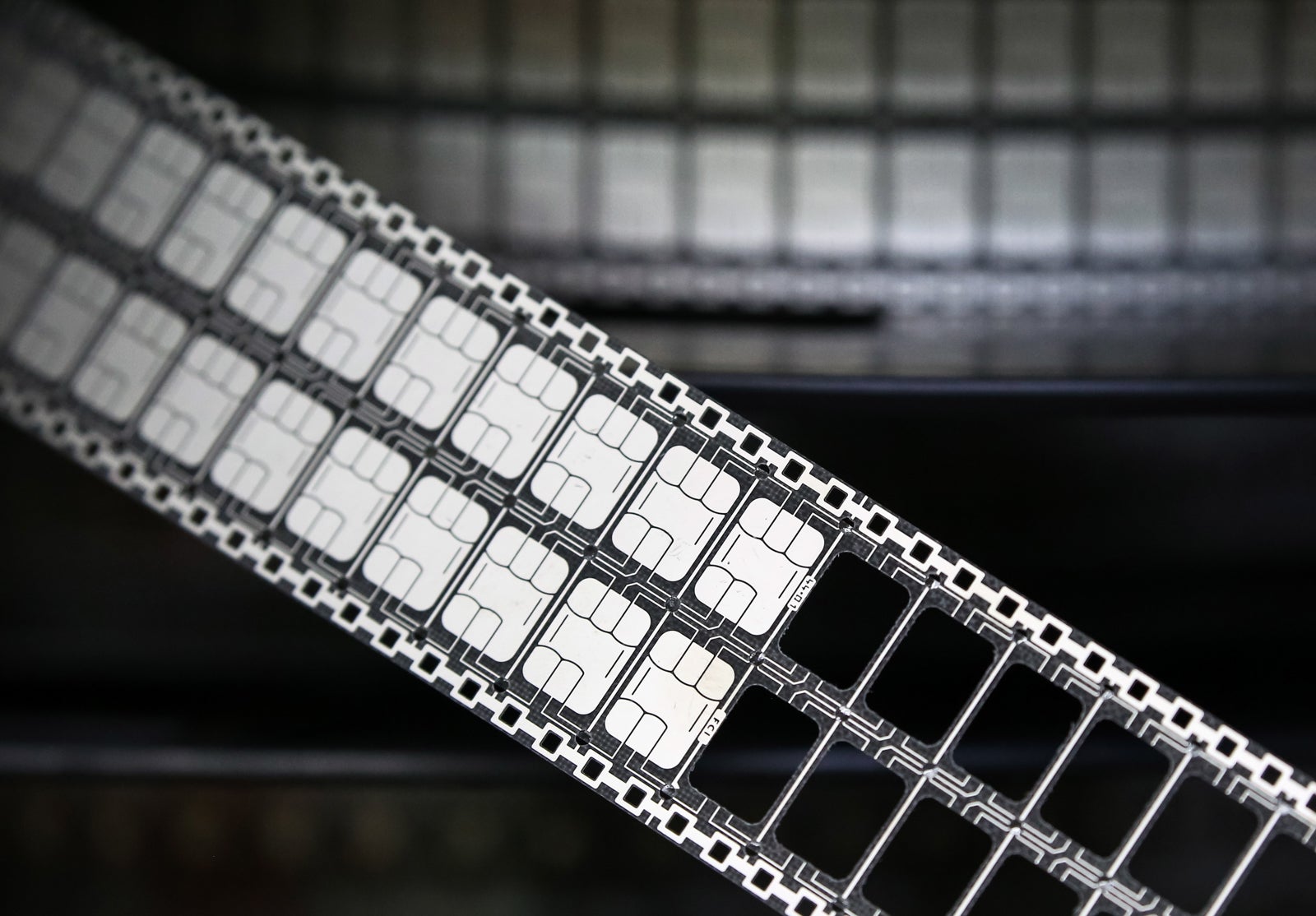

Combating fraud with EMV expertise

As bank cards continued to achieve reputation all over the world, fraud grew to become a bigger concern. EMV chip expertise — the “EMV” stands for Europay, Mastercard, and Visa — debuted in Europe within the mid-90s. This expertise, which has since develop into commonplace on bank cards, creates a novel transaction code for every buy to assist mitigate the danger of fraud. Whereas most playing cards proceed to supply the normal magnetic stripe on the again, many fee processors insist that you just use your card’s chip as a substitute of swiping.

The Black Card hits the market

Constructing on the success of its premium Platinum Card and Membership Miles program, Amex acknowledged a possibility to additional phase the premium bank card market. The corporate started concentrating on ultrawealthy and high-spending companies and people.

The unique Amex Centurion Card was launched within the late ’90s. In keeping with an city legend, we might have Jerry Seinfeld to thank for it. We tried to substantiate this, however he was possible certainly one of a number of purchasers. The invitation-only Centurion Card has remained extremely secretive, however TPG was capable of gather some intel on the perks Centurion cardholders get pleasure from — and what they pay for the privilege.

The 2000s: The competitors grows

Within the 2000s, competitors amongst issuers intensified, forcing banks to step up their recreation and make bank cards extra rewarding than ever. Throughout this time, issuers launched utterly new rewards packages, bonus spending classes, distinctive card advantages, and all-time-high welcome bonuses.

Rewards packages shifted to be extra travel-specific. Lots of the greatest card issuers launched airline and resort switch companions. Some even made journey advantages like automated elite standing and complimentary entrance into airport lounges extra accessible.

By the early 2000s, American Specific Membership Rewards, Chase Final Rewards and Citi ThankYou Rewards every provided over a dozen airline and resort companions. All three issuers additionally provided a number of bank cards, starting from fundamental to premium. Capital One adopted go well with shortly after.

The 2010s: The golden age of bank cards

The 2010s marked the start of the golden age of bank cards. Citi made a splash in 2011 by introducing the Citi Premier® Card — now the Citi Strata Premier℠ Card (see charges and costs) — and the Citi Status® Card. However what actually shook up the trade was the launch of the Chase Sapphire Reserve® in 2016. It debuted with a whopping 100,000-point sign-up bonus (now 60,000 bonus factors after you spend $4,000 on purchases within the first three months from account opening). On the time, it earned 3 Final Rewards factors per greenback spent on journey and eating and provided a versatile $300 annual journey credit score in addition to different perks. The response was overwhelmingly optimistic — to the purpose that Chase briefly ran out of the metallic used to make the playing cards.

The knowledge for the Citi Status Card and Citi Premier Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

In sum, the 2010s had been a decade marked by the debut of many new playing cards available on the market, as issuers tried to one-up one another with higher welcome provides and incomes charges. Coupled with the golden age of air journey — with passenger numbers hovering in 2019 — the bank card and journey industries had been sure that it could solely go up from there.

The 2020s: Pandemic period and past

Then, the coronavirus pandemic hit. By mid-March 2020, almost all journey had come to an entire cease. For a lot of, this meant their journey rewards playing cards had been going straight to their sock drawers — and cash-back playing cards grew to become king.

Whereas issuers tried to adapt — including helpful assertion credit to encourage cardholders to maintain spending whereas staying at dwelling — many individuals downgraded or outright canceled their playing cards. Issuers even lower credit score limits to mitigate monetary threat. 2020 was a difficult yr for everybody.

It wasn’t all dangerous information, although. Expertise additionally advanced. Earlier than the coronavirus pandemic, virtually all bank cards had an embedded sensible chip for larger safety. Then, the pandemic really sped up the implementation of contactless funds nationwide. Whereas Google pioneered the thought of digital wallets with the launch of Google Pay, each Apple Pay and Samsung Pay began to develop into in style choices as customers more and more turned to digital wallets.

The rebound in journey after this era has been astounding, and right now, we’re seeing demand for journey as robust as ever. There continues to be heavy demand for premium cabins on airways, a lot in order that it is powerful to seek out availability because of much less seat availability and extra folks vying for a redemption.

There have additionally been some modifications within the bank card panorama, with extra issuer-based lounges provided. For instance, in 2023, Capital One opened a lounge at Denver Worldwide Airport (DEN), and in 2024, a Capital One Touchdown debuted at Ronald Reagan Washington Nationwide Airport (DCA). Likewise, each Chase and American Specific have expanded their lounge footprints, with Chase Sapphire lounges opening in Phoenix Sky Harbor Worldwide Airport (PHX) and San Diego Worldwide Airport (SAN) and a brand new Centurion Lounge in Hartsfield-Jackson Atlanta Worldwide Airport (ATL).

Bank card issuers proceed to compete for extra customers, and several other playing cards have seen refreshes of their advantages and incomes charges and, after all, will increase in annual charges. The American Specific® Gold Card was refreshed to incorporate new assertion credit, spending caps, and a rise within the annual charge. Capital One discontinued the favored legacy Capital One Savor Money Rewards Credit score Card, and the Capital One SavorOne Money Rewards Credit score Card was rebranded because the Capital One Savor Money Rewards Credit score Card. Moreover, the cobranded Hilton bank cards issued by American Specific noticed vital modifications, such because the Hilton Honors American Specific Surpass® Card and the top-tier Hilton Honors American Specific Aspire Card.

The knowledge for the Hilton Honors Aspire Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or offered by the cardboard issuer.

With an increasing number of people making use of for bank cards for elevated perks and advantages, we proceed to see a trimming or elimination of advantages which were longstanding. Simply this yr alone, a number of premium bank cards misplaced entry to Precedence Cross eating places, together with the Chase Sapphire Reserve and the Capital One Enterprise X Enterprise.

We are able to speculate that to be able to curb overcrowding in lounges, bank cards might begin to lower their beneficiant visitor insurance policies, such because the Capital One Enterprise X Rewards Credit score Card, which provides cardholders and approved customers the flexibility to convey as much as two visitors for no further charge. American Specific now limits visitors to Centurion Lounges for The Platinum Card from American Specific cardmembers — now requiring that they spend no less than $75,000 on eligible purchases on their card inside a calendar yr to qualify for complimentary visitor entry for as much as two visitors per go to. As well as, Delta SkyMiles® Reserve American Specific Card and Delta SkyMiles® Reserve Enterprise American Specific Card cardmembers have a cap on Sky Membership lounge visits as a method to fight lounge overcrowding.

The bank card trade is understood for one factor: remaining resilient regardless of occasions of change. As we glance forward, we will anticipate card rebrands and new card unveilings that can possible include elevated annual charges and maybe even fewer priceless advantages and beneficiant welcome provides.

Backside line

Over the previous century, bank cards have superior tremendously. In 2022, 82% of People carried no less than one bank card, making credit score a necessary a part of private finance and of collaborating in our financial system. With so many developments, it will likely be attention-grabbing to see how expertise continues to form the trade.

Fairly quickly, we might ditch our beloved plastic and metallic playing cards altogether, as bank card expertise will present improved smartphone integration. Whereas playing cards might look completely different, the TPG group is optimistic that the long run will convey even higher rewards and worth for purchasers.

Associated: The very best bank cards

For charges and costs of the Amex Platinum card, click on right here.