Whether or not you have been pregaming for Cyber Monday by compiling a want record of discounted gadgets (responsible as charged) or are simply looking to see what strikes your fancy, it is best to contemplate placing your bank cards to work that will help you maximize these purchases.

That features including on any further reductions or rebates you possibly can, incomes further rewards or money again wherever potential after which paying with the appropriate bank card.

This information will enable you strategize your bank card recreation to optimize your buy energy this Cyber Monday and rating some killer offers.

Greatest playing cards for Cyber Monday buying at main retailers

The place you are buying might dictate which bank card it is best to use. That is since you may earn bonus rewards primarily based on the kind of retailer you are buying at and the way it reviews to your bank card. For particulars on that idea, see the next:

In case you’re buying at main retailers comparable to Goal, Walmart, Greatest Purchase or Amazon this Cyber Monday, listed below are the bank cards it is best to think about using to maximise your earnings on every greenback you spend.

Uncover it Money Again Credit score Card

If rotating quarterly classes feels like music to your ears, the Uncover it® Money Again Credit score Card could be for you.

Annual charge: $0

Present welcome bonus: None, however Uncover will match the money again you earn throughout your first cardmember yr.

Each day Publication

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Incomes construction: Earn 5% again on rotating classes every quarter, permitting you to earn 5% on as much as $1,500 spent on the altering record of retailers (you will must enroll to activate your bonus earnings every quarter). Throughout the fourth quarter of 2024, the bonus classes are Amazon.com and Goal.

Why we prefer it: With the ability to earn 5% again on Cyber Monday purchases is incredible. However this will get even higher when you’re a brand new cardholder this yr. Uncover will match the money again you earn on the finish of your first yr — not unhealthy in any respect for a no-annual-fee bank card.

The details about the Uncover it® Money Again card has been collected independently by TPG. The cardboard particulars on this web page haven’t been supplied by or reviewed by the issuer.

Be taught extra: Uncover it® Money Again

Chase Freedom Flex

The Chase Freedom Flex® is a incredible card for these new to the bank card world.

Annual charge: $0

Present welcome bonus: Earn a $200 bonus after spending $500 on purchases inside three months from account opening.

Incomes construction: Earn 5% again on rotating quarterly classes (as much as $1,500 in mixed spending every quarter; activation required), 5% again on journey bought by way of Chase Journey℠, 5% again on Lyft (by way of March 2025), 3% again on eating at eating places (together with takeout and eligible supply companies), 3% again on drugstore purchases and 1% again on different purchases.

Why we prefer it: Just like the Uncover it® Money Again card, the Chase Freedom Flex earns 5% again on rotating classes every quarter (on as much as $1,500 in mixed spending, then 1% again after that; activation is required to activate the bonus earnings). From October to December 2024, these classes embrace PayPal, McDonald’s, pet shops/veterinary companies and choose charity companies.

PayPal is an particularly helpful bonus class for Cyber Monday as a result of thousands and thousands of outlets settle for PayPal at on-line checkout — simply be sure your PayPal account has your Chase Freedom Flex set because the default fee technique.

The actual energy of this card comes once you maintain one other bank card that earns Chase Final Rewards factors, as you’d be capable to mix your cash-back earnings with factors and double their worth in line with TPG’s November 2024 valuations.

To study extra, see our full overview of the Chase Freedom Flex.

Apply right here: Chase Freedom Flex

Prime Visa

If in case you have a Prime membership, it’s essential to contemplate the Prime Visa this vacation season.

Annual charge: $0, however a Prime membership is required

Present welcome bonus: Get a $200 Amazon present card immediately upon account approval, solely for Prime members.

Incomes construction: Earn 5% money again on Amazon and Entire Meals purchases. Cardholders additionally earn 2% again at eating places, fuel stations and transit (together with ride-hailing) and 1% again on all different eligible purchases. Moreover, earn 10% again or extra on a rotating choice of gadgets and classes on Amazon.com. Notice that these incomes charges require an eligible Amazon Prime membership.

Why we prefer it: It is arduous to beat the Amazon Prime Visa Card once you’re buying at Amazon. In case you’re planning on spending most of your Cyber Monday price range with the e-retailer, it is a nice card to make use of to maximise these purchases.

To study extra, see our full overview of the Prime Visa.

Apply right here: Prime Visa

Goal Circle Card

Goal is a well-liked retailer at any time of the yr, not to mention Black Friday and Cyber Monday. In case you’re a Goal fan, contemplate the Goal Circle™ Mastercard.

Annual charge: $0

Present welcome bonus: Get $50 off a future qualifying buy from Goal when that buy is $50 or extra. This provide is legitimate as quickly as your account is accredited.

Incomes charges: Get a 5% low cost on all eligible Goal purchases in-store and on-line.

Why we prefer it: In contrast to different playing cards on this record, this card gives an instantaneous low cost in your purchases. Getting a 5% low cost on Goal purchases, each in-store and on-line, can prevent a reasonably penny. Plus, cardholders get 5% off at Starbucks areas inside Goal.

Different advantages embrace 30 further days for returns and free transport on most Goal on-line purchases with out having to fulfill the same old $35 minimal. Understand that this card is obtainable as both a debit or bank card. The debit model can usually make extra sense because it will not add to your 5/24 rely with Chase or create a tough pull in your credit score report.

The details about the Goal Circle Mastercard has been collected independently by TPG. The cardboard particulars on this web page haven’t been supplied by or reviewed by the issuer.

Be taught extra: Goal Circle Mastercard

Greatest playing cards for Cyber Monday buying at smaller retailers

Smaller retailers and on-line boutiques might not fall into bigger bonus classes, so flat-rate rewards bank cards are usually the most effective choices for these purchases. There may be an exception, although, which we’ll spotlight under.

The Platinum Card from American Specific

In case you’re out there for a premium card with quite a few advantages, contemplate The Platinum Card® from American Specific.

Annual charge: $695 (see charges and costs)

Present welcome bonus: Earn 80,000 bonus factors after spending $8,000 on purchases within the first six months of cardmembership.

TPG’s November 2024 valuations peg this bonus at a whopping $1,600. Nonetheless, you could be eligible for a fair larger welcome provide by way of the CardMatch software. Presents can change at any time, and never everybody can be given the identical gives.

Incomes charges: Earn 5 factors per greenback on flights booked straight with lodges or by way of American Specific Journey (on as much as $500,000 of those purchases per calendar yr, then 1 level per greenback), 5 factors per greenback on pay as you go lodges booked by way of American Specific Journey and 1 level per greenback on different purchases.

Why we prefer it: This luxurious journey rewards card comes with a colossal annual charge to match the eye-popping variety of advantages it gives, however this vacation buying season could be the very best time to use for the Amex Platinum.

In case you’re anticipating 1000’s of {dollars} in spending throughout Cyber Monday and thru the tip of the yr, your vacation buying may put a big dent into the spending requirement to earn the welcome bonus.

It is also price checking your Amex Presents to see when you’re focused for any rebates or bonus factors when buying at small companies.

To study extra, see our full overview of the Amex Platinum Card.

Apply right here: The Platinum Card from American Specific

Chase Freedom Limitless

The Chase Freedom Limitless® is one other common product from Chase that is price your consideration for Cyber Monday.

Annual charge: $0

Present welcome bonus: Earn a further 1.5% money again on all the things you purchase (on as much as $20,000 spent within the first yr), price as much as $300 money again.

Incomes charges: Earn 5% again on journey bought by way of Chase Journey℠, 5% again on Lyft (by way of March 2025), 3% again on drugstore purchases, 3% again on eating (together with takeout and eligible supply companies) and 1.5% money again on all purchases with none incomes limits.

Why we prefer it: Some purchases do not fall into bonus classes like grocery shops or fuel stations. For all of those different purchases, it is best to use a card that earns effectively on on a regular basis spending.

The Freedom Limitless earns 1.5% again on all spending with these “different purchases.” As with the Freedom Flex coated above, the actual energy of this card comes once you maintain one other bank card that earns Chase Final Rewards factors, as you’d be capable to mix your cash-back earnings with factors and double their worth in line with TPG’s November 2024 valuations.

To study extra, see our full overview of the Chase Freedom Limitless.

Apply right here: Chase Freedom Limitless

Capital One Enterprise Rewards Credit score Card

In case you’re in search of a strong mid-tier card, contemplate the Capital One Enterprise Rewards Credit score Card.

Annual charge: $95 (see charges and costs)

Present welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases throughout the first three months of account opening. TPG’s November 2024 valuations place this bonus at $1,338.

Incomes charges: Earn 5 miles per greenback on lodges, trip leases and rental vehicles booked by way of Capital One Journey and earn 2 miles per greenback on all different purchases.

Why we prefer it: You may earn 2 miles per greenback when buying in shops or on-line throughout Black Friday and Cyber Monday, so that is most likely one in every of your finest bank cards for these purchases — irrespective of which retailer it’s.

Capital One miles are price 1.85 cents every primarily based on TPG’s valuations, that means you will earn a 3.7% return on spending. You can even search for Capital One Presents to supply more money again (extra on that under).

To study extra, see our full overview of the Capital One Enterprise Rewards card.

Apply right here: Capital One Enterprise Rewards

Citi Double Money Card

These in search of a card with a really primary earnings construction will respect the Citi Double Money® Card (see charges and costs).

Annual charge: $0

Present welcome bonus: Earn $200 money again after spending $1,500 on purchases within the first six months of account opening.

Incomes charges: Earn 2 factors on each greenback spent, as follows: Earn 1% money again when making your buy, and a further 1% once you pay your invoice.

Why we prefer it: If in case you have the Citi Double Money and no different Citi bank cards, you possibly can redeem your rewards for journey or for money again. The actual energy of this card comes when you’ve got a ThankYou point-earning card just like the Citi Strata Premier® Card (which has a $95 annual charge, see charges and costs) and may mix your rewards to entry all of Citi’s resort and airline companions for wonderful redemption values.

To study extra, see our full overview of the Citi Double Money.

Apply right here: Citi Double Money Card

Greatest playing cards for Cyber Monday buying when you’re reserving future journey

Quite a few airline and resort manufacturers provide Black Friday and Cyber Monday journey offers yearly. In case you resolve to make the most of any of those promotions, make sure you use the appropriate journey bank card.

Capital One Enterprise X Rewards Credit score Card

If a premium card feels like match for you however you do not need to fork over a number of hundred {dollars} for one, contemplate the Capital One Enterprise X Rewards Credit score Card.

Annual charge: $395 (see charges and costs)

Present welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases inside three months of account opening. TPG’s November 2024 valuations peg this bonus at $1,388.

Incomes charges: Earn 10 miles per greenback on lodges and rental vehicles booked by way of Capital One Journey, 5 miles per greenback on flights and trip leases booked by way of Capital One Journey and a couple of miles per greenback on all different purchases.

Why we prefer it: The incomes charge of two miles per greenback on on a regular basis purchases mirrors the incomes charge of the Enterprise Rewards card mentioned above. The place the Enterprise X card shines is once you’re reserving by way of Capital One Journey.

In case you discover a fantastic deal on a flight or resort and ebook by way of this portal, you will earn further rewards. Even higher: cardholders obtain $300 in credit yearly for journey booked by way of Capital One Journey annually, which might go a good distance towards masking your journey prices.

Cardholders even have entry to Capital One Lounges, Plaza Premium lounges and Precedence Move lounges at quite a few airports around the globe and get 10,000 bonus miles on every account anniversary — plus quite a few journey protections in case one thing goes fallacious in your vacation.

To study extra, see our full overview of the Capital One Enterprise X.

Apply right here: Capital One Enterprise X Rewards Credit score Card

Chase Sapphire Reserve

Rounding out the trio of prime premium playing cards is the Chase Sapphire Reserve®.

Annual charge: $550

Present welcome bonus: Earn 60,000 factors after spending $4,000 on purchases within the first three months from account opening.

Incomes charges: Earn 10 factors per greenback on lodges and automobile leases bought by way of Chase Journey℠ and 5 factors per greenback on flights booked by way of this portal. You may additionally earn 10 factors per greenback on Chase Eating and on Lyft rides (Lyft by way of March 2025).

Cardholders additionally earn 3 factors per greenback on journey, 3 factors per greenback on eating (together with takeout and eligible supply companies) and 1 level per greenback on different purchases. Notice that the bonus-earning charges on journey purchases do not apply to purchases coated by your journey credit score (see under).

Why we prefer it: What counts as journey on the Sapphire Reserve is outlined very broadly, and cardholders have as much as $300 in journey credit to make use of annually. This may be a good way to scale back or eradicate journey spending throughout Cyber Monday offers.

You may additionally take pleasure in perks with Lyft (by way of March 2025) and entry to lounges from Chase Sapphire and Precedence Move as soon as it is time to take your journey. And if one thing goes fallacious throughout your journey, you will have best-in-class journey protections.

To study extra, see our full overview of the Chase Sapphire Reserve.

Apply right here: Chase Sapphire Reserve

Cobranded airline and resort playing cards

Think about using your cobranded playing cards once you ebook journey offers straight. Many airline and resort bank cards provide best-in-class incomes charges on model purchases whereas providing perks like computerized elite standing, free checked baggage and extra.

Whereas we do not counsel utilizing your cobranded playing cards on on a regular basis purchases from retailers like Goal and Amazon, you should use your particular cobranded playing cards once you ebook offers to maximise Cyber Monday purchases with the related airline or resort group.

Associated: When does it make sense to spend on a cobranded bank card?

Different ideas for maximizing purchases

You’ll be able to add much more rebates and rewards on prime of utilizing the most effective bank cards for Cyber Monday purchases. In case you play your playing cards proper (pun supposed), you possibly can triple-dip when buying on-line.

Buying portals

Along with maximizing purchases on Cyber Monday by utilizing the most effective bank cards for the retailers you store with, be sure you’re additionally profiting from on-line buying portals. Whenever you use buying portals on your Cyber Monday buying, you possibly can double- and even triple-dip your rewards earnings on prime of what you will already save with Cyber Monday offers.

We particularly love utilizing the Rakuten Chrome extension and checking CashbackMonitor.com to see which portals give the most effective return at particular retailers. Plus, many of the main U.S. airways have their very own buying portals the place offers abound.

Associated: Your information to maximizing buying portals on your on-line purchases

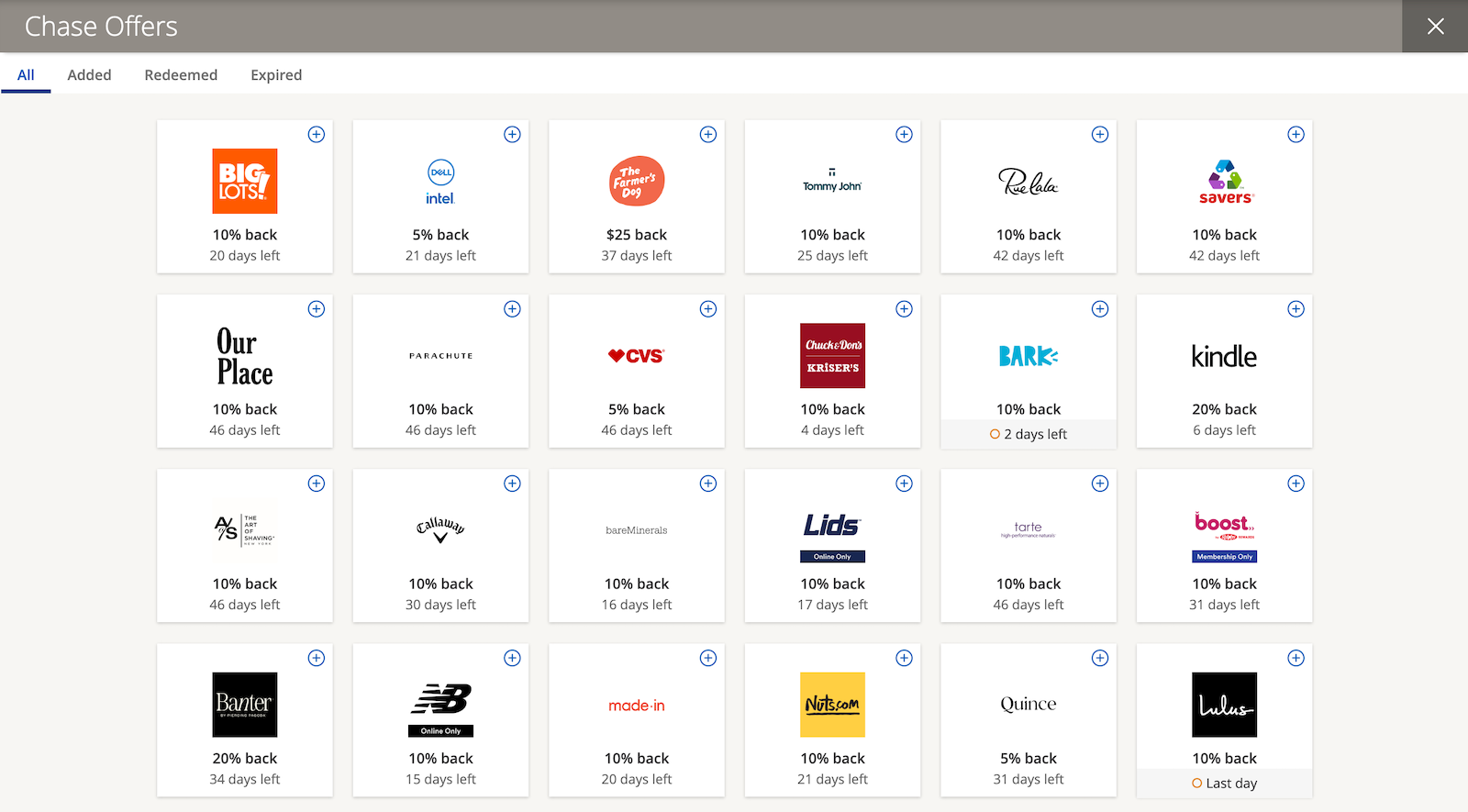

Presents out of your bank card issuer

Your bank card issuer might provide a program with rebates that operate like coupons or different gives to earn bonus rewards. These gives are focused, that means what you see on one bank card could also be completely totally different from what’s out there on one other bank card.

Nonetheless, it is best to positively verify your Amex Presents, BankAmeriDeals, Capital One Presents, Chase Presents and Citi Service provider Presents.

These gives are focused and in addition change recurrently, so it is price checking your gives recurrently. A number of further clicks to make use of a portal or add a proposal to your bank card earlier than making a purchase order can result in massive financial savings or a giant pile of additional rewards.

Backside line

To get the most effective deal potential this Cyber Monday, use the appropriate bank card. With doubtlessly tons of (or 1000’s) of {dollars} in spending over the following month, you will need to be sure you earn these bonus factors, miles and money again that may assist enhance your balances as you head into 2025.

It is also a good time to join a brand new bank card and put your vacation buying on that card so you possibly can earn a fantastic welcome bonus. See right here for the most effective bank card bonus gives presently out there.

Apply right here: Chase Freedom Flex

Apply right here: Amex Platinum Card

Apply right here: Chase Freedom Limitless

Apply right here: Capital One Enterprise Rewards

Apply right here: Citi Double Money

Apply right here: Capital One Enterprise X

Apply right here: Chase Sapphire Reserve

Associated: The right way to maximize buying portals for Black Friday and vacation offers

For charges and costs of the Amex Platinum Card, click on right here.

For Capital One merchandise listed on this web page, among the advantages could also be supplied by Visa® or Mastercard® and will fluctuate by product. See the respective Information to Advantages for particulars, as phrases and exclusions apply.