Generally life occurs, and it may possibly get you off observe financially.

You possibly can have a monetary plan, funds and ample financial savings. Nonetheless, it will not be sufficient so that you can keep away from lacking funds and letting your accounts go delinquent.

Bank card delinquency is not something new, so let’s take a more in-depth have a look at what precisely it’s — and how one can keep away from it.

What’s bank card delinquency?

In a 2023 FICO Report, 11% of U.S. adults admitted to having missed a bank card fee. These late or missed invoice funds start the method of bank card delinquency.

Delinquency does not imply that you have not paid your stability in full; it merely means you did not make the required minimal fee. Nonetheless, at TPG, we all the time advocate paying in full to keep away from curiosity in your stability. That is one in all TPG’s commandments of bank card rewards.

A 2023 Philadelphia Federal Reserve report confirmed that bank card delinquency is at an all-time excessive.

The rising charges could counsel bank card firms are working with extra dangerous debtors — and that was even earlier than the coronavirus pandemic. Due to this, some banks could lower credit score limits for cardholders and be cautious when accepting new cardholders.

Failure to pay payments on time can lead to bank card suspensions, revocations, or perhaps a charge-off; moreover, you may be assessed late penalties and costs on delinquent accounts.

Let’s go over what all of which means by strolling by the times and months after lacking a fee.

Every day E-newsletter

Reward your inbox with the TPG Every day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

The start levels of card delinquency

In the event you miss a fee deadline, normally inside 30 days, little occurs to your account. Your bank card firm could situation a late fee charge, but when you’ll be able to get your account present inside this time interval, this unfavourable mark shouldn’t even present up in your credit score report. Moreover, should you aren’t a repeat offender in the case of lacking funds, your financial institution could waive a late fee charge should you ask properly.

After the 30-day mark of a missed fee, your account will seemingly be reported to all three credit score bureaus as delinquent. Which means it normally takes two consecutive missed funds for delinquency to begin to severely affect you. Shoppers get a little bit of a buffer earlier than coping with vital repercussions.

The creditor may briefly droop or pause your account and cease authorizing purchases for fee.

The center levels of card delinquency

After a number of months in delinquency (normally three to 4 months late), bank card firms are prone to drop the hammer and fully droop your account and require sure actions to reverse a suspension.

In the event you’re coping with extenuating circumstances comparable to a job loss, or different monetary hardship, you possibly can contact your card issuer about potential customized compensation choices. Banks could also be extra keen to work with you, particularly should you’re going by tough financial occasions.

Apart from working with the issuer immediately, you might additionally work with a nonprofit credit score counselor who could possibly assist create a debt administration plan. Remember the counselor has to work with you and the creditor and be agreed upon by each events.

The later levels of card delinquency

Ultimately, your card can be revoked and you may by no means use it once more, even should you make a fee in full. This normally occurs across the four- to five-month mark.

In the event you nonetheless have not made progress in your account to deliver it updated, the bank card issuer could conduct a “cost off” as the ultimate stage of delinquency. This sometimes happens after six months late.

From an accounting perspective, this merely means the issuer has recategorized the debt from an asset to a loss. Nonetheless, a charge-off has critical implications in your credit score, and you’ll nonetheless have to pay again your stability in full.

Associated: An entire information to bank card debt

The results of delinquency in your credit score

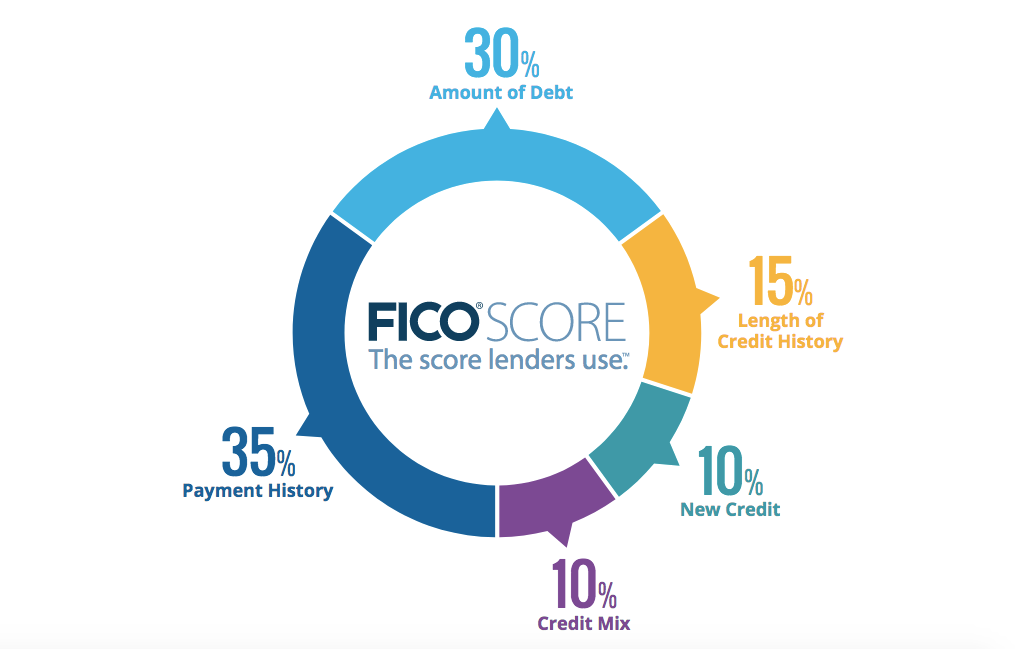

Now that we have mentioned what delinquency is, how badly does it have an effect on your credit score? The credit score rating components of fee historical past and quantity owed are most affected if you miss funds.

Fee historical past

Not paying your payments on time impacts your fee historical past, which makes up 35% of your FICO rating.

Quantity owed

Subsequent, a bank card revocation (that is when the issuer closes your account) can negatively affect your credit score utilization ratio. With much less general obtainable credit score, your utilization ratio will increase. “Quantity owed” is about 30% of your credit score rating, so this additionally can be negatively affected.

Cost-off

Lastly, a bank card charge-off will stay in your credit score report for as much as seven years. The precise affect in your credit score rating varies, however a charge-off has the potential to significantly have an effect on your monetary future.

How one can keep away from bank card delinquency (and a charge-off)

Make all funds on time. Making no less than a minimal fee in your card’s invoice each month will keep away from delinquency. One technique to do that is by organising autopay. It will preserve you from forgetting a few stability fully.

Do not spend in your card. This might sound the obvious, however should you’re susceptible to lacking a fee, do not proceed spending on the cardboard.

Name your bank card firm should you’re struggling. Card firms could also be keen to work with you for prolonged fee choices or different methods to assist preserve your stability present.

Associated: The largest components that affect your credit score rating

Backside line

There is a huge distinction between one late fee by a number of days and a delinquent account that goes unpaid for months. The excellent news is that there are methods to get again in good standing along with your card issuer earlier than issues begin turning ugly.

In fact, it is easy for late funds — plus the curiosity in your revolving stability and different charges — to rapidly add up. It may well snowball uncontrolled. That is why it is essential to not solely deliver your accounts present as quickly as doable but additionally to attempt to keep away from stepping into the state of affairs within the first place.

Nonetheless, it is typically unavoidable, particularly for these in monetary hardship. Data is energy, although, and with the following tips, you will know what to look out for and what to do to keep away from delinquency.

Associated: Bank cards 101: The newbie’s information