These massive welcome bonuses that may include new bank cards after you hit a spending threshold can actually speed up you to a terrific trip courtesy of your factors and miles. However, after you get previous that glitzy purpose so as to add a brand new bank card to your pockets, there’s extra that rewards playing cards can do for you and your loved ones’s backside line.

The truth is, there’s one useful card profit that is saved me greater than $1,000 through the years. It is also rapidly resolved some conditions that would positively have developed into massive time-sucking complications.

Prolonged guarantee safety is a type of typically neglected advantages out there with sure bank cards that has saved me extra instances than as soon as. It should not be an neglected perk as it might put a reimbursement in your pockets rapidly and simply when one thing goes improper with an merchandise you charged to the cardboard.

You will not discover it on each bank card, however it’s a profit you will discover on a huge number of American Categorical playing cards (phrases apply).* On this article, I will share the time one American Categorical card helped hold cash in my household’s pocket, this time to the tune of $120.

*Eligibility and profit ranges differ by card. Phrases, circumstances and limitations apply. Go to americanexpress.com/benefitsguide for particulars. Insurance policies are underwritten by AMEX Assurance Firm.

Associated: Your full information to buying protections on American Categorical playing cards

The day the vacuum died

A couple of years in the past, we bought a cordless vacuum cleaner from Amazon for $119.99. The vacuum labored effective for a handful of months, however in December, it stopped working utterly.

Underneath regular circumstances, this could have gotten me fairly sizzling underneath the collar since I hate losing money on issues that rapidly break. On high of that, I haven’t got time to chase down some endless customer support loop on the off likelihood of possibly getting a refund.

Fortunately, a couple of minutes of labor with American Categorical solved the difficulty earlier than it grew to become an issue.

Each day E-newsletter

Reward your inbox with the TPG Each day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

Associated: The perfect American Categorical playing cards

Submitting an prolonged guarantee declare

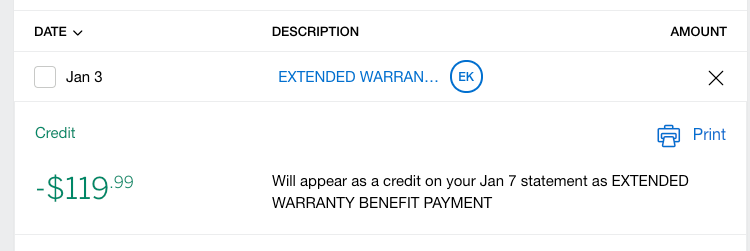

In early January, I opened an prolonged guarantee* declare with American Categorical for the not too long ago departed vacuum. I bought the vacuum cleaner utilizing my Hilton Honors American Categorical Aspire Card, which turned out to be an excellent resolution when it rapidly broke.

I did not should submit any footage of the damaged vacuum or different documentation past finishing a easy type on the American Categorical web site. The subsequent morning, on a Sunday no much less, I acquired an electronic mail from American Categorical with a letter hooked up stating my declare had been accredited for the total quantity of my buy.

Positive sufficient, the credit score appeared on my account shortly after, and we had been in a position to buy a alternative vacuum with out taking a monetary hit.

What number of instances have you ever heard a narrative from somebody who bought an merchandise from Amazon or one other on-line retailer and ended up having to throw it within the trash just a few months later? I’ve to surprise what number of of these people had a bank card of their pockets that may have protected their buy, and so they did not even realize it.

The data for the Hilton Honors American Categorical Aspire Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: How American Categorical’ prolonged guarantee saved me $150 — and an enormous headache

Not my first buy safety rodeo

This is not my first optimistic expertise with American Categorical’ prolonged guarantee protection.

American Categorical’ prolonged guarantee program* saved me a ton of cash three years after I bought a TV. Some time again, I bought a brand-new flat-screen TV from Costco utilizing The Platinum Card® from American Categorical to the tune of $1,200.

I’ve held that card in my pockets for a decade, ever since my days within the navy. It stays in my pockets now as a result of it proves its price 12 months after 12 months.

Three years of blissful and irritating Sundays watching my beloved Atlanta Falcons had been interrupted when the tv all of a sudden stopped working. I referred to as a tv restore firm, solely to have them inform me the TV was dead-dead and, in fact, we had been simply past the producer’s included guarantee.

Fortunately, I held on to the acquisition receipt. I submitted the report from the restore firm together with my receipt to Amex, and so they credited me the whole buy quantity, together with taxes.

The Amex guarantee* had picked up for one further 12 months when the built-in guarantee dropped off. It did not take lengthy for me to buy the alternative tv and get again to the necessary enterprise of rooting for the Falcons and Georgia Bulldogs from the sofa.

This form of safety does not cowl you on each form of buy or in perpetuity. Typically, American Categorical steps in when different guarantee choices will not cowl you as much as a sure size of time — on this case, one 12 months past the included guarantee.

So, should you’re coated by a “satisfaction assure” or built-in guarantee from a retailer or producer, you will most likely have to pursue that first. Amex additionally will not cowl you for dwell vegetation, software program, present playing cards, jewellery and a handful of different objects. Moreover, you will have to file your declare inside 30 days of the incident.

Prolonged guarantee safety on the Amex Platinum can cowl claims of as much as $10,000 per merchandise and as much as $50,000 in a calendar 12 months inside 5 years of your buy date. You’ll be able to see the total listing of Amex playing cards that supply numerous methods to guard your purchases right here.

It is secure to say that the varied protections American Categorical gives additionally make them a terrific alternative for vacation buying or any time you’ve got a giant expense.

In case you are out there for a card like this, know that new Amex Platinum cardmembers can at the moment earn 80,000 factors after spending $8,000 on purchases on the cardboard within the first six months of cardmembership.

Some folks have focused welcome gives of as much as 150,000 bonus factors out there to them by way of CardMatch (supply topic to alter at any time, and never everybody can be focused for a similar supply).

Backside line

These two claims saved me over $1,400 in chilly onerous money.

To place it one other method, that is the identical as over two years of annual charges on my beloved American Categorical Platinum Card (see charges and costs), and that is earlier than you contemplate all the opposite perks that card has to supply.

I obtained a bit fortunate holding on to that Costco TV receipt for 3 years. I extremely advocate selecting an electronic mail receipt from any native retailer whenever you buy big-ticket objects. That method, you may simply search your electronic mail for the receipt when issues go haywire.

Do not go away your self excessive and dry on massive purchases. Be sure to’re getting all the worth you may out of these bank cards you carry round in your pockets each day.

To study extra, take a look at our full assessment of the Amex Platinum.

Apply right here: Amex Platinum

Associated: 4 the explanation why the Amex Platinum would be the superb card for Delta flyers

For charges and costs of the Amex Platinum, click on right here.