Alaska Airways Visa Signature bank card overview

The Alaska Airways Visa Signature® bank card is without doubt one of the greatest playing cards for incomes Alaska miles. Even in case you do not stay on the West Coast, Alaska Airways miles are useful since you need to use them to e-book flights on Oneworld accomplice airways, together with Cathay Pacific, Japan Airways, Qantas and American Airways. You may additionally get a free checked bag and precedence boarding in case you use the cardboard to pay to your flight. Card Score*: ⭐⭐⭐⭐

*Card ranking is predicated on the opinion of TPG’s editors and isn’t influenced by the cardboard issuer.

Making use of for the private Alaska Airways Visa bank card and the Alaska Airways Visa® Enterprise card are your predominant choices for simply incomes an enormous chunk of Alaska Airways Mileage Plan miles.

Alaska miles may be laborious to earn provided that they solely accomplice with two rewards currencies — simply Marriott Bonvoy and Bilt Rewards. Due to this fact, in case you’re loyal to the airline and need precedence boarding and checked baggage allowances, or you might have an excellent cause to accrue Alaska miles for journey on Alaska Airways or its companions, this card is value contemplating.

With the approval of Alaska’s merger with Hawaiian Airways, there will likely be extra incomes and redemption alternatives when flying to the Hawaiian Islands and past.

Plus, Alaska Airways introduced an overhaul to its Alaska Airways Mileage Plan program for 2025, which can present extra methods to earn elite standing when not flying — together with incentives for spending on its bank card.

The beneficial credit score rating for this product is 670 or above, and it additionally has a $95 annual payment.

So, let’s examine if the private card is an efficient match for you.

Alaska Airways Visa execs and cons

| Execs | Cons |

|---|---|

|

Alaska Airways Visa welcome provide

New candidates for the Alaska Airways Visa Signature® bank card can earn 60,000 bonus miles plus Alaska’s well-known companion fare ($99 fare plus taxes and charges from $23) after spending $3,000 or extra on purchases inside the first 90 days from account opening.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

TPG’s October 2024 valuations place Alaska miles at 1.45 cents apiece, making 60,000 miles value a strong $870. You may additionally earn a companion fare ticket, which is a strong profit that can be utilized to significantly save for a second traveler.

This is without doubt one of the greatest provides that the Alaska Airways Visa ever has, so I like to recommend making use of now if this card is in your radar and you realize you’ll be able to make the most of that companion certificates.

Alaska Airways Visa advantages

This card provides a number of advantages that make it a fantastic alternative in case you continuously fly Alaska Airways.

With a $95 annual payment, this card gives elitelike perks with out Alaska Airways MVP elite standing. Cardholders get one piece of free checked baggage for themselves and as much as six different passengers on the identical reservation once they pay with the cardboard, saving $35 per individual every approach on checked baggage.

You may additionally get pleasure from Alaska-related reductions, together with 20% again on Alaska Airways inflight purchases.

Plus, beginning Jan. 1, 2025, cardholders will be capable to earn 1 EQM towards elite standing qualification for each $3 spent on the cardboard, as much as a complete of 30,000 EQMs annually on certified purchases.

Which means $60,000 charged on the Alaska Airways Visa earns 20,000 EQMs, which might earn MVP standing and get you midway to MVP Gold simply with card spending.

Suppose you fly Alaska with a good friend or member of the family on paid fares at the very least yearly. In that case, this card’s most profitable ongoing profit is more likely to be the annual companion fare, which you will earn yearly in your account anniversary in case you’ve spent $6,000 or extra inside the prior anniversary yr — although you will additionally get one as half of the present welcome bonus.

For extra data on the companion ticket and tips on how to get probably the most worth out of it, see our ideas for maximizing the Alaska Airways Visa Companion Fare.

This card additionally has no international transaction charges, so you need to use the cardboard wherever across the globe with out incurring further fees. As well as, you may get $100 off an annual Alaska Lounge+ membership whenever you pay with this card. Alaska lounges are a number of the greatest home lounges and are recognized for his or her fluffy and golden brown pancakes.

Incomes miles on the Alaska Airways Visa

With the Alaska Airways Visa card, you will earn 3 miles per greenback on eligible Alaska Airways purchases, 2 miles per greenback on gasoline, native transit, electrical automobile charging stations, ride-hailing, cable and choose streaming companies and 1 mile per greenback on all different eligible purchases.

As well as, if in case you have an eligible Financial institution of America account, you will get pleasure from a ten% bonus on all miles earned — boosting your efficient incomes charges on these purchases even increased.

When you continuously journey on Alaska Airways for work or pleasure and need to construct up your Mileage Plan stability, this card is an apparent alternative for airline purchases.

It is best to doubtless use one other journey bank card for non-Alaska purchases since you are able to do higher than the cardboard’s incomes charges on all different purchases.

Nevertheless, in case you actually need to rack up Alaska miles for accomplice award flights, then that recommendation could not apply since Alaska miles are useful and difficult to get in any other case with out flying Alaska.

Associated: Capitalize on Alaska-Hawaiian merger

Redeeming miles on the Alaska Airways Visa

Alaska’s Mileage Plan shifted to a distance-based mannequin in March 2024. Some redemptions are cheaper, however a few of this system’s candy spots require extra miles than they beforehand did.

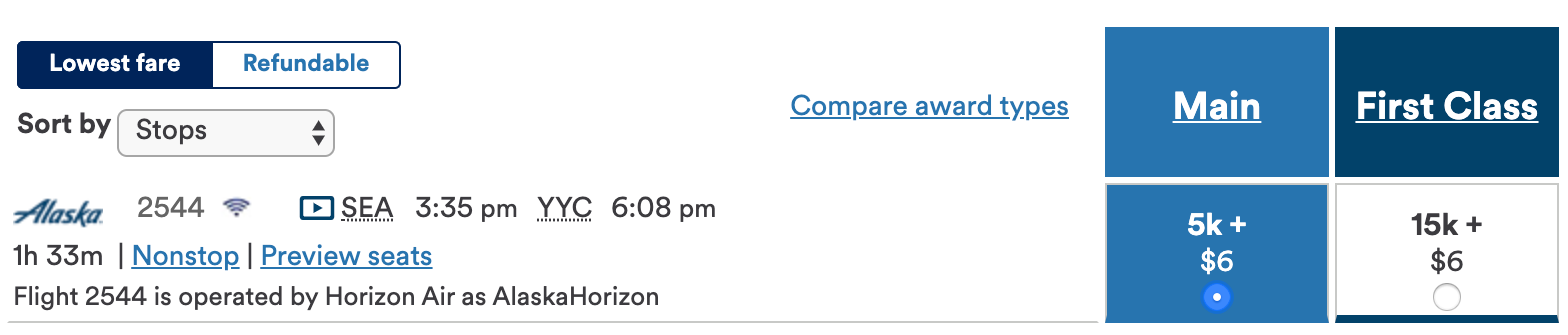

Brief-haul Alaska awards (akin to Seattle to San Francisco) begin at simply 5,000 Alaska miles every approach. Many longer flights (akin to Seattle to New York Metropolis) are 12,500 miles in economic system.

If you need top notch, it is usually 40,000 miles on longer home flights however can begin as little as 15,000 miles every approach on shorter flights. If you wish to head to Hawaii, these awards begin at 15,000 miles every approach in economic system and 40,000 every approach in top notch.

Alaska’s companions will even cowl your travels throughout a lot of the globe. These companions embrace British Airways, Cathay Pacific and Qantas. When redeeming by way of Alaska, you will not essentially get the bottom mileage reserving fee for all of those companions (relying on the route).

However you’ll be able to construct some nice itineraries by profiting from Alaska’s allowance of one free stopover on one-way award tickets.

A few of TPG bank cards editor Emily Thompson‘s favourite methods to maximize Alaska Airways redemptions embrace reserving Cathay Pacific top notch from the U.S. to Asia from 70,000 miles one-way, Japan Airways top notch one-way from the U.S. to Asia beginning at 70,000 miles and Fiji Airways from the U.S. to Fiji one-way in enterprise class from 55,000 miles.

You would even fly to Australia on Fiji Airways and add in a free stopover in Fiji for a similar 55,000 miles in enterprise class.

However you do not have to lap the planet to maximise Alaska miles. Reserving awards across the U.S. and Canada from simply 5,000 Alaska miles every approach can be a fairly nice deal.

Which playing cards compete with the Alaska Airways Visa?

The most important downside of the Alaska Visa is that the miles are in a selected airline loyalty program. In consequence, they’re extra restricted than different currencies since you’ll be able to solely use them on Alaska and its companions.

Listed below are a number of nice playing cards for incomes transferable rewards in case you’re not in particular want of Alaska miles:

- If you wish to earn Chase factors: Go for the Chase Sapphire Most well-liked® Card, one of many prime mid-tier journey playing cards available on the market. It provides beneficiant point-earning alternatives, akin to 3 factors per greenback on eating and choose streaming companies. These useful factors may be transferred to airline and lodge companions or redeemed straight for journey at a fee of 1.25 cents per level by way of Chase Journey℠. To be taught extra, learn our full evaluate of the Sapphire Most well-liked.

- When you’re after Capital One miles: The Capital One Enterprise Rewards Credit score Card combines fixed-value redemptions with 15-plus airline and lodge switch companions. With its affordable annual payment (see charges and charges) and enticing rewards on on a regular basis spending, this card is a useful asset value holding onto. To be taught extra, learn our full evaluate of the Enterprise Rewards.

- If you need entry to all kinds of switch companions: The American Specific® Inexperienced Card grants entry to Amex’s 21 lodge and airline switch companions. American Specific has extra switch companions than most different main issuers, so this card is an effective way to diversify your factors. You may additionally get pleasure from different advantages, like an as much as $199 annual assertion credit score every calendar yr for a Clear Plus membership, for a $150 annual payment. To be taught extra, learn our full evaluate of the Amex Inexperienced.

For extra choices, take a look at our full listing of the greatest journey bank cards.

The knowledge for the American Specific Inexperienced Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Associated: Chase Sapphire Most well-liked vs. Capital One Enterprise Rewards Credit score Card

Is the Alaska Airways Visa value it?

I imagine the Alaska Airways Visa is a superb alternative in case you’re an Alaska loyalist or need to diversify your factors and miles portfolio with useful Alaska miles. Due to a good incomes fee for Alaska Airways purchases and the dear annual companion ticket, the cardboard’s low $95 annual payment pales compared to the advantages.

Backside line

When you’re a devoted Alaska Airways buyer or want to broaden your factors and miles assortment, the Alaska Airways Visa is a superb possibility. Even those that do not continuously fly the airline or its companions can get strong worth from the annual companion ticket, which is why I positively advocate contemplating this card.

Apply right here: Alaska Airways Visa Signature

Associated: How to decide on an airline bank card

/cdn.vox-cdn.com/uploads/chorus_asset/file/25362061/STK_414_AI_CHATBOT_R2_CVirginia_D.jpg?w=150&resize=150,150&ssl=1)