There’s little or no that we dislike extra right here at TPG than pointless charges — together with international transaction charges.

You might have observed that whenever you use some bank cards overseas (or on an internet site not hosted within the U.S.), an extra charge will get tacked on to every buy.

Let’s talk about what these charges are and how one can keep away from them sooner or later.

What Is a international transaction charge?

Overseas transaction charges are charged on sure playing cards whenever you make a purchase order that goes by way of an abroad financial institution to course of the transaction. While you make a transaction whereas touring or by way of a international web site, banks could must convert the acquisition into U.S. {dollars}. On some bank cards, issuers will then move the conversion price onto customers.

How a lot are international transaction charges?

Visa and Mastercard cost a 1% charge to banks for processing purchases made overseas, and lots of U.S. issuers tack on an extra 1-2% charge. The usual international transaction charge tends to be round 3%. Nevertheless, Capital One and Uncover are distinctive in having zero international transaction charges throughout all their bank cards.

| Card issuer | Commonplace international transaction charge |

|---|---|

| American Categorical international transaction charge | 2.7% |

| Financial institution of America international transaction charge | 3% |

| Barclays international transaction charge | 2.99% |

| Capital One international transaction charge | None |

| Chase international transaction charge | 3% |

| Citi international transaction charge | 3% |

| Uncover international transaction charge | None |

| U.S. Financial institution international transaction charge | 3% |

| Wells Fargo international transaction charge | 3% |

Which playing cards haven’t any international transaction charges?

A lot of the prime journey bank cards do not cost international transaction charges. Actually, it is uncommon for a card that gives journey rewards and perks to cost any international transaction charges. Whereas some issuers cost international transaction charges of round 3% on a few of their merchandise, it’s best to contemplate Capital One or Uncover playing cards since they do not cost international transaction charges on any of their playing cards.

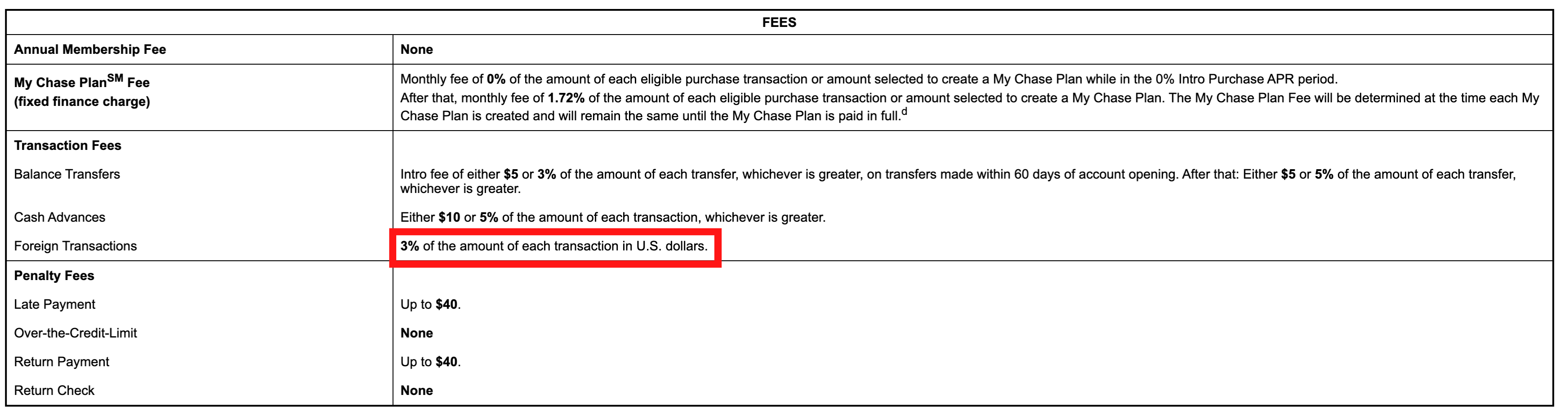

Card issuers are required to offer potential and current prospects entry to charges and charges related to a bank card, together with international transaction charges. Verify the phrases and situations of your bank card to see whether or not or not your card (or the cardboard you are contemplating making use of for) fees international transaction charges.

When wanting on the charges and charges desk, you possibly can sometimes discover the international transaction charge listed explicitly below a charges part.

Overseas transaction charges vs. ATM charges

One other kind of charge it’s possible you’ll hear about whenever you journey is a international ATM charge. Whereas the 2 charges can apply when touring exterior the U.S., they don’t seem to be synonymous.

Day by day Publication

Reward your inbox with the TPG Day by day e-newsletter

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

A international ATM charge is charged whenever you withdraw money from an ATM out of the country. Some banks waive this charge, particularly if you happen to use an ATM that falls inside a particular community of banks.

Moreover, you may be on the hook for added charges whenever you use an ATM overseas, together with a flat charge out of your financial institution for utilizing an ATM not affiliated with the financial institution (which is often $5), a international foreign money conversion charge (which generally falls in keeping with international transaction charges at 3%) and extra charges charged by the proprietor of the particular ATM you employ.

That is one cause we suggest paying with a bank card wherever attainable. However in some locations, money remains to be king and you will have to have a sport plan for avoiding a majority of these charges — or issue them into your price range.

Associated: Methods to avoid wasting on abroad ATM withdrawals

Easy methods to keep away from international transaction charges

Use a card with no international transaction charges

The best approach to keep away from international transaction charges is to make use of a card that does not cost them. TPG has a often up to date information on the prime bank cards with no international transaction charges that may assist you determine the most effective playing cards to make use of to your journeys.

Sadly, cash-back playing cards such because the Chase Freedom Limitless® and the Blue Money Most well-liked® Card from American Categorical (see charges and charges) are likely to cost international transaction charges.

Keep away from ‘dynamic foreign money conversion’

When utilizing a card terminal overseas, it’s possible you’ll be prompted to pay within the native foreign money or in U.S. {dollars}. You must all the time select the native foreign money.

Dynamic foreign money conversion is a sneaky manner that banks encourage you to pay in your house foreign money (U.S. {dollars}) whereas overseas. Nevertheless, they’re going to normally provide you with a poor conversion price, so it is best to pay in euros, pesos or whichever is the native foreign money.

Associated: I fell for dynamic foreign money conversion — reader mistake story

Pay with money

In fact, you may additionally keep away from international transaction charges by paying with money. However these purchases will not earn you any rewards, and withdrawing money overseas could also be topic to pesky charges.

Backside line

The excellent news is that international transaction charges are a lot much less frequent throughout prime bank cards than they was once. Hopefully, the business as an entire is shifting away from charging prospects a majority of these charges. Till then, test your bank card’s phrases and situations to know if you happen to’ll be on the hook for a charge whenever you’re touring and plan your card utilization accordingly.

To keep away from international transaction charges, select a prime journey rewards card or one from Capital One or Uncover. Additionally, all the time pay within the native foreign money moderately than U.S. {dollars} to keep away from poor conversion charges.

Associated: Greatest journey rewards playing cards

For charges and charges of the Blue Money Most well-liked card, click on right here.