The Chase Sapphire Most popular® Card (see charges and costs) was one of many first rewards playing cards I ever bought, and it stays a staple in my pockets. For years, I’ve used it to earn invaluable transferable factors on journey, eating and groceries.

If you have not utilized for the Sapphire Most popular but, now is a superb time to take action. This card is providing probably the most profitable welcome bonuses we have seen in years: 100,000 Final Rewards factors after spending $5,000 on purchases within the first three months from account opening. That is price a whopping $2,050 based mostly on our April 2025 valuations.

Should you simply bought your Chase Sapphire Most popular, be sure you take these steps to get essentially the most out of this implausible card from day one.

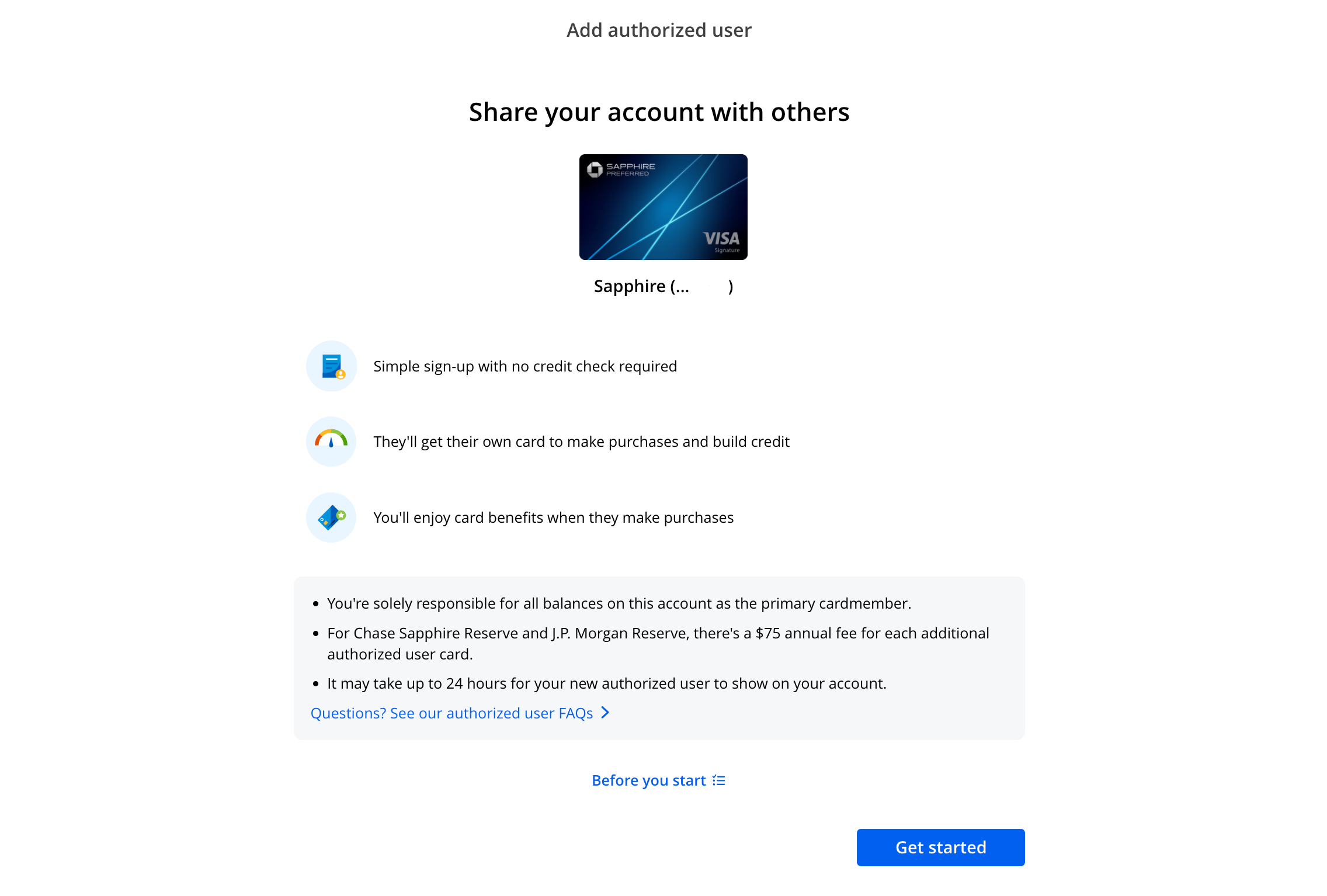

Add a certified consumer

Having a certified consumer in your Sapphire Most popular account allows you to earn factors sooner — and thus attain the welcome bonus sooner. Your approved consumer’s purchases will depend towards your welcome bonus, however being a certified consumer will not preclude them from incomes a welcome bonus on their very own Sapphire Most popular sooner or later.

This additionally allows you to switch your Final Rewards factors to one in all Chase’s airline or lodge associate packages within the title of 1 family member who can be a certified consumer in your card. Plus, approved customers can profit from the Sapphire Most popular’s journey safety advantages after they e book journey with their card.

The method so as to add a certified consumer on-line is straightforward and free and takes lower than a minute. Signal into your Chase account, click on on “Extra” subsequent to your card, then click on “Account providers” and “Licensed customers.”

Spouses and companions are apparent candidates for approved customers, however they don’t seem to be the one ones to contemplate. TPG staffers have added mother and father and trusted buddies as approved customers to achieve welcome bonuses sooner, and including your baby as a certified consumer is an effective way to assist them construct credit score.

Simply keep in mind that while you add a certified consumer, you are accountable for paying off any purchases they make on their card.

Associated: The bank cards with the best worth for approved customers

Every day E-newsletter

Reward your inbox with the TPG Every day e-newsletter

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

Set it as your default card for journey

The Chase Sapphire Most popular is a card to make use of for journey purchases for 2 primary causes:

Chase defines journey very broadly, so it covers every part from airways, resorts and timeshares to automotive leases, cruises, journey businesses and campgrounds. It additionally contains extra day-to-day transportation like buses, tolls and parking.

When you have any subscriptions that fall into this class, like a toll move or month-to-month parking charges, set your new Sapphire Most popular as your default fee technique.

The identical goes in your rental automotive accounts, permitting you to reap the benefits of the cardboard’s major rental automotive protection.

Plus, Lyft extends particular advantages (by September 30, 2027) to Sapphire Most popular Card holders, so you should definitely add your card to your Lyft account.

Ebook a lodge keep

Your new card additionally provides you entry to Chase Journey℠, the issuer’s on-line journey portal.

You will earn 5 Final Rewards factors per greenback spent on issues like resorts and automotive leases booked by the portal — a return of over 10% based mostly on TPG’s valuations.

Moreover, your first lodge reserving after every account anniversary will set off the cardboard’s annual $50 lodge credit score.

I’ve discovered this credit score very useful for brief stays at boutique and unbiased resorts; I am utilizing this 12 months’s credit score for a weekend journey to a buddy’s marriage ceremony.

Add your card to supply apps and eating packages

Whereas the Chase Sapphire Most popular could also be billed as a journey card, it is also a standout card for eating. It earns 3 Final Rewards factors per greenback spent on eating, together with eligible supply providers, takeout and eating out, in addition to on-line grocery orders.

Plus, because of Chase’s partnership with DoorDash, Sapphire Most popular Card holders can enroll to obtain a complimentary DashPass membership for no less than a 12 months (activate by December 31, 2027). I like this perk as a result of I can get monetary savings on each order with DashPass — with out paying the $96 annual DashPass payment.

As quickly as you may have your Sapphire Most popular Card in hand (or get a digital card quantity), set it because the default fee technique in your DoorDash account and activate your complimentary DashPass membership. You must also add it to different takeout and supply providers, in addition to your on-line grocery accounts, to maximise rewards on these purchases.

And should you take part in any eating rewards packages, you should definitely add your Sapphire Most popular to those accounts. I like double-dipping on rewards this manner — I can stack incomes Chase factors and airline or lodge factors on the similar time.

Associated: Greatest eating bank cards

Set it to pay in your streaming providers

A lesser-known perk of the Chase Sapphire Most popular is that it earns 3 Final Rewards factors per greenback spent on choose streaming providers.

Consequently, you may wish to set your new card as your default fee technique for subscriptions with providers equivalent to Disney+, Hulu, Netflix, Peacock and Spotify. You may see which retailers qualify for bonus factors at Chase’s rewards class web page.

Associated: Bank cards that prevent cash on streaming subscriptions

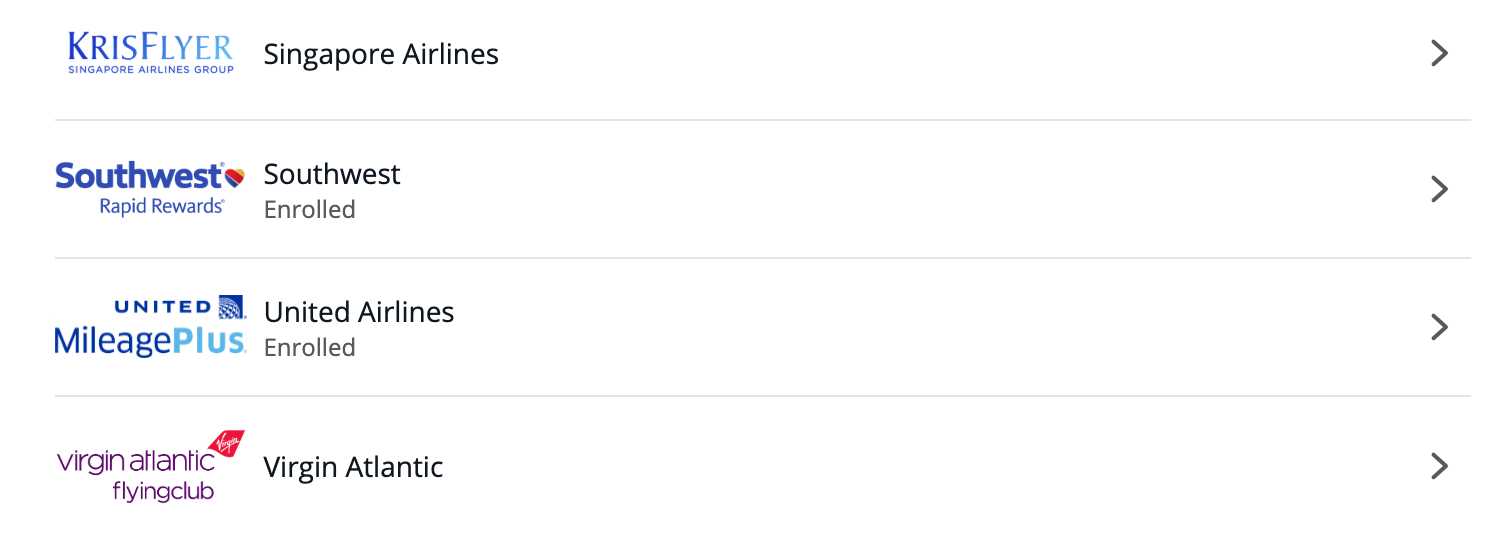

Hyperlink your loyalty accounts

Whereas the Chase Sapphire Most popular allows you to redeem your Final Rewards factors at a flat charge of 1.25 cents every by Chase Journey, you possibly can typically get way more worth by redeeming them with one in all Chase’s 14 airline and lodge companions.

We typically advocate ready to switch your Chase factors till you have confirmed award availability with the airline or lodge. Once you’re able to switch, you don’t need something to decelerate the method — in any other case, that luxurious lodge room or first-class seat you may have your eye on may very well be snapped up earlier than the switch completes.

Most Chase Final Rewards transfers occur virtually immediately, however they’ll take longer in case your associate loyalty account is comparatively new. That is why we advocate registering for loyalty accounts with Chase’s companions and linking them to your Chase account now — even should you do not plan to switch factors anytime quickly.

As an example, since my dwelling airport is a United Airways and Southwest Airways hub, I knew I might finally use these switch companions. I clicked by Chase’s website like I might to switch factors and linked my loyalty account numbers. Now my account says “Enrolled,” that means I am able to switch to those airways.

Associated: Why transferable factors and miles are price greater than different rewards

Full the Chase quartet

When the time is best for you to get your subsequent card, including a Chase card that enhances your Sapphire Most popular may also help you construct your Final Rewards stability even sooner.

Our favourite playing cards to pair with the Chase Sapphire Most popular embrace:

Nonetheless, when planning your bank card technique, hold Chase’s 5/24 rule in thoughts. The issuer will not approve you for a brand new card should you’ve opened 5 or extra bank cards (from any financial institution) within the final two years.

Associated: The last word information to the very best bank card mixtures

Backside line

There is a purpose why the Chase Sapphire Most popular stays a TPG favourite 12 months after 12 months. Briefly, it is a wonderful earner with tons of perks and an inexpensive annual payment.

Comply with the steps above to begin maximizing the cardboard straight away, and you may see your Chase Final Rewards stability take off. To make sure you nab these bonus factors as a part of the welcome supply, take a look at our suggestions for incomes a welcome bonus.

Associated: Chase Sapphire Most popular advantages you may not find out about