Lately, most of us know a factor or two about avoiding scams. We scoff at emails from overseas princes soliciting Western Union cash transfers — if the messages even make it by our spam filters, in fact — and even our telephones can detect if an incoming name from an unknown quantity is probably going spam, telemarketing or a rip-off name.

But scams and schemes have additionally turn into extra subtle — they usually’re on the rise. A number of years in the past, it took me a number of minutes to appreciate the Chinese language-speaking caller on the opposite finish wasn’t really calling from FedEx with a package deal from my mom in Taiwan. And after I Google “pay automotive registration on-line,” the primary few hyperlinks do not go to my county tax workplace web site; all of them go to third-party businesses wanting to “assist” me pay my dues for a beneficiant payment.

Should you’ve fallen prey to a rip-off recently, do not be embarrassed: You are not alone.

“Id theft will not be a type of issues that ‘occurs to another person,'” Michael Bruemmer, Experian’s VP of client safety, informed TPG.

The Federal Commerce Fee obtained greater than 2.6 million rip-off stories in 2023 alone. In line with the FTC, imposter scams are on the high of the fraud report checklist, accounting for greater than $2.7 billion stolen from customers.

One scheme concentrating on vacationers, particularly, is the International Entry enrollment rip-off. The Higher Enterprise Bureau reported the company’s ScamTracker web site had obtained a number of accounts of “deceptive web sites that idiot folks into handing over cash and delicate private data.”

Associated: There is a new solution to skip the wait to your International Entry interview

How the International Entry rip-off works

You seek for the International Entry software on-line, based on the BBB, and the official U.S. Customs and Border Safety web site seems — as does one other web site that is constructed particularly to mimic the official web page.

Should you comply with that imposter hyperlink, you are dropped at a third-party firm that gives to finish all of the requisite paperwork in your behalf — simply present your private data, resembling your full title, passport quantity and residential tackle. You may be prompted to pay the usual $120 authorities payment, plus a further payment for the service.

Every day Publication

Reward your inbox with the TPG Every day publication

Be part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s specialists

What’s simply occurred? In line with the BBB, “scammers have tricked you into paying extra cash to finish the shape on the official authorities web site. Additionally, they now have entry to your private data and bank card particulars.”

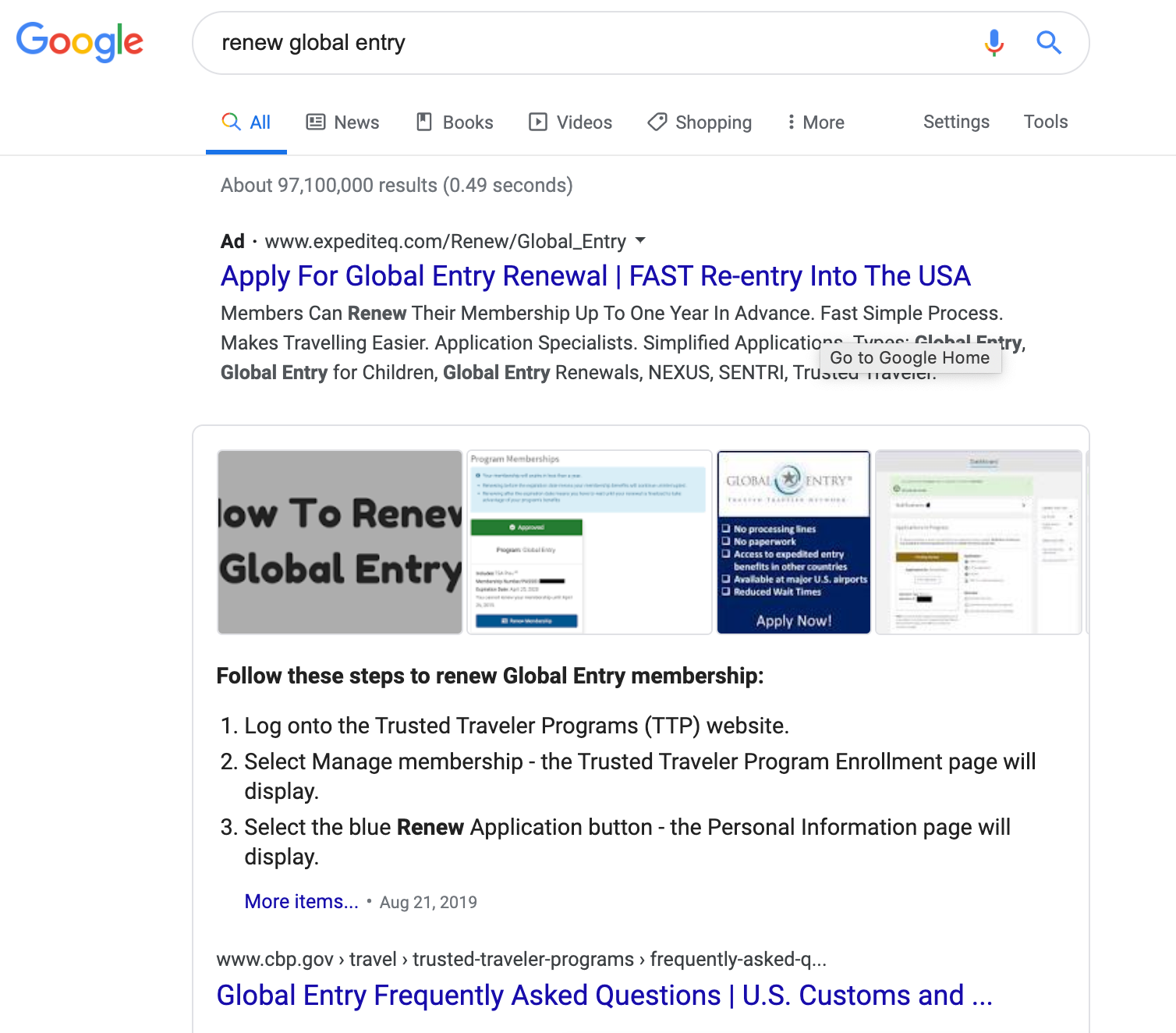

Curious, I examined this Google seek for myself. Listed here are my outcomes for “renew International Entry“:

You may see that the Google search field reveals me a preview of the steps I have to take, straight from the official CBP web site. The very first hyperlink on the high, nevertheless, goes to an advert for a third-party web site with all the appropriate buzzwords.

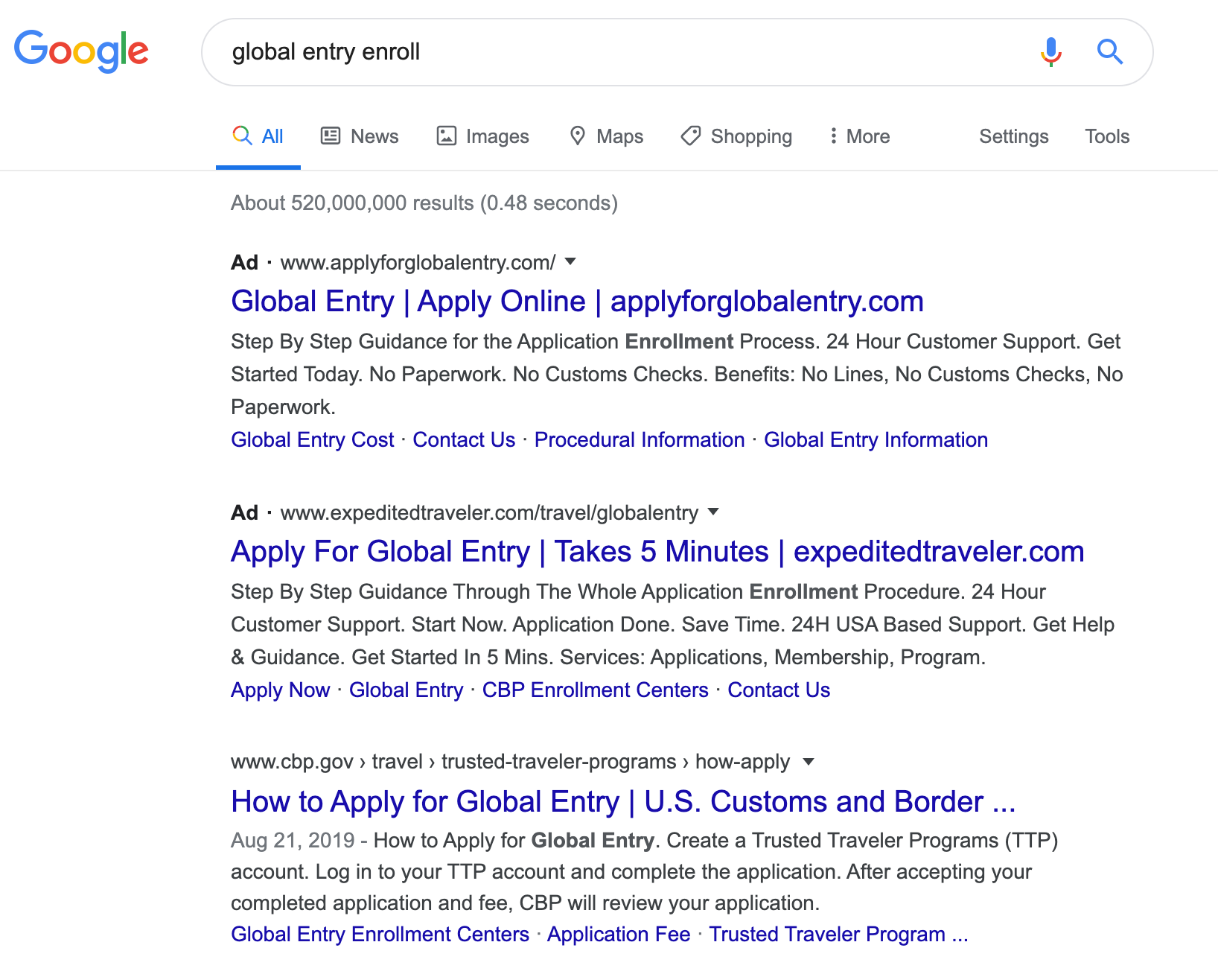

In incognito mode, which does not take into consideration the a whole bunch of journey websites I search day-after-day, the official CPB web page below “International Entry enroll” seems even decrease down the web page beneath two adverts with very legitimate-sounding URLs:

However none of those firms are CBP-approved.

CBoarding Group did a little bit of sleuthing and found that the listed tackle for one in every of these so-called “expediting businesses” really went to a shady-looking warehouse in Houston, based on Google Maps.

“There’s solely one Trusted Traveler Packages web site,” a CBP spokesperson informed TPG. “Third-party firms that cost charges to course of Trusted Traveler Program purposes aren’t endorsed by, related to or affiliated in any means with U.S. Customs and Border Safety or the U.S. authorities.”

Associated: Easy steps to keep away from bank card fraud

What to do when you’ve been scammed

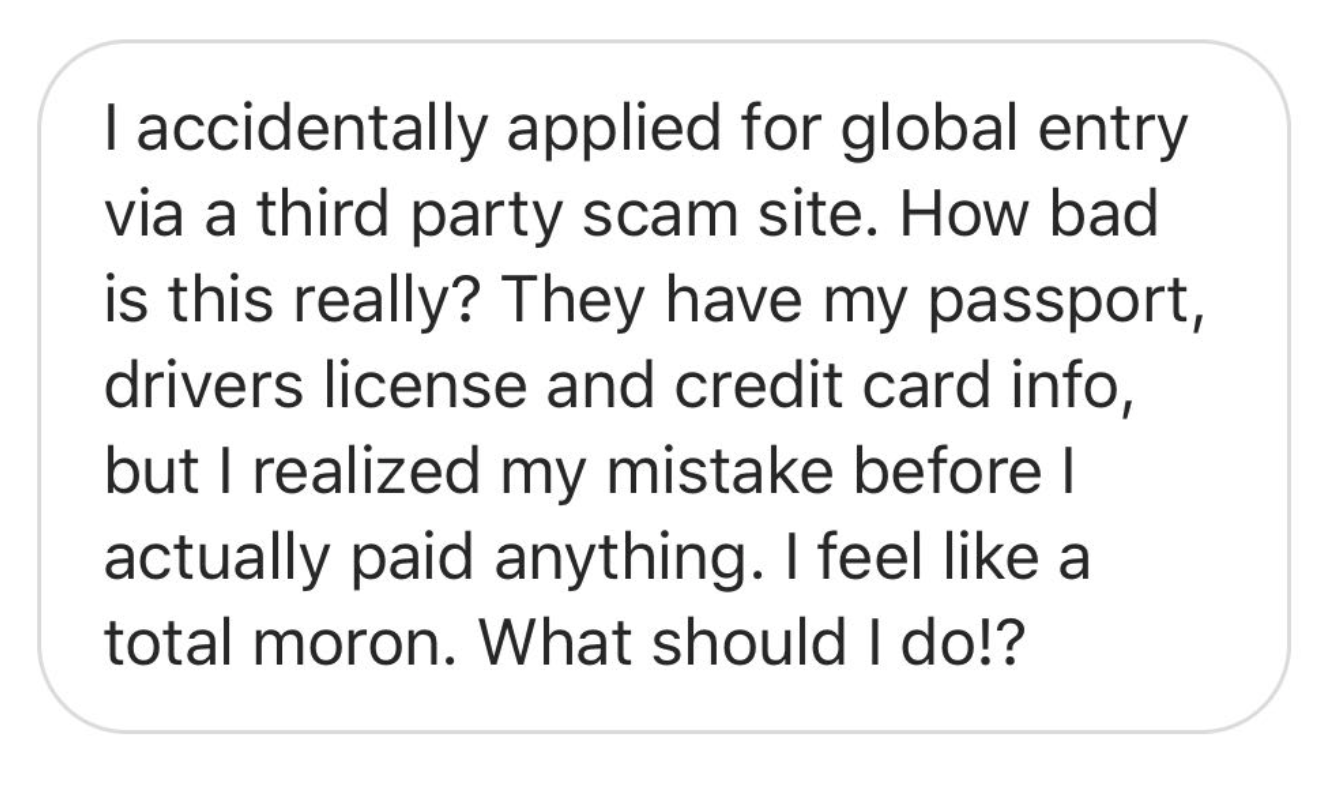

A reader reached out to TPG for steering after falling prey to at least one such web site, questioning what subsequent steps they need to take to keep away from having their private and monetary data additional compromised.

“How unhealthy is that this, actually?” the reader requested, explaining how they’d utilized for International Entry by a third-party web site.

Sadly, it is at all times unhealthy information when your bank card particulars, dwelling tackle and private data resembling full title, date of delivery, driver’s license quantity and passport data have all been compromised.

“You have got simply opened up the gateway to turning into a sufferer of identification crime,” mentioned Eva Velasquez, president and CEO of Id Theft Useful resource Middle, who suggests folks resembling this TPG reader act rapidly in the event that they by accident give out private data on a suspicious web site.

Even when nothing occurs to your information instantly, it is no enjoyable discovering out the onerous means that unscrupulous strangers have a lot entry to your non-public data. “A passport within the fallacious arms may result in varied types of fraud,” safety consciousness knowledgeable and Safr.Me CEO Robert Siciliano informed TPG.

And simply because information breaches are broadly prevalent does not imply the dangers are mitigated in any means. “Recovering from identification theft generally is a lengthy and irritating battle,” mentioned Michael Bruemmer, Experian’s VP of client safety. “Many individuals assume it might solely occur as soon as, or that dangers fluctuate. On the contrary, identification theft typically carries with it lifelong penalties.”

The excellent news? A number of easy security steps can cut back the danger of identification theft and assist present victims monitor for doable fraud. Victims can do harm management by reporting monetary and identification paperwork stolen, conserving an in depth eye on bodily safety at their houses and subscribing to on-line information stories.

Safety specialists recommend taking sure following steps when your private data is compromised.

Report your bank card as stolen

Block any subsequent transactions and request a brand new card with completely different numbers. (In case you have a bank card with a “pause” button, it is a good time to make use of that function.)

Lock down your credit score file

Safe your credit score file with all three main client credit score bureaus till your card has been reissued. (Be aware {that a} credit score lock will not be the identical factor as a credit score freeze, which takes longer to carry than a brief lock.)

Join on-line notifications

Subscribe to textual content or e-mail alerts so that you’re warned every time your bank card is used for a transaction. Monitor your credit score stories for suspicious exercise, and instantly report something out of the peculiar. And if your private home tackle has been compromised, a great safety system will assist provide you with peace of thoughts, particularly when you go along with a system that syncs along with your telephone or sends digital alerts.

Monitor your e-mail

In case your e-mail tackle was compromised, keep alert for varied types of phishing emails, and keep away from clicking any suspicious hyperlinks.

Report the rip-off

After you’ve got taken steps to safe and monitor your private and monetary data, report the fraudulent firm to the BBB ScamTracker web site and to the FTC’s devoted identification theft web site.

Associated: What is the distinction between bank card fraud and identification theft?

Backside line

Should you really feel unsure about managing the method your self, you may name on the specialists for assist. Advisers on the Id Theft Useful resource Middle supply free steering over the telephone, Velasquez mentioned, “together with who it is advisable to name [and] what it is advisable to say. [They] will make it easier to create an motion plan that’s greatest for you.”

Finally, the perfect safety in opposition to future scams is a robust, proactive method.

“Customers ought to concentrate on the true threat, particularly as the danger will increase, and do what they will to cut back their vulnerability,” Bruemmer informed TPG. “Taking steps to safeguard private, delicate data can shield in opposition to identification theft and maintaining a tally of one’s monetary accounts can mitigate and even cease fraud.”

The one factor you do not need to do, based on Bruemmer? Get overwhelmed and faux nothing has occurred. “Doing nothing solely makes it simpler for thieves to say much more victims.”